Social Security Eligibility Income 2026: If you’re asking, “How much do I need to make in 2026 to qualify for Social Security?” you’re not alone — and you’re asking the right question. Whether you’re just getting your feet wet in the job market, nearing retirement, or trying to help a parent understand their benefits, this is the kind of info everyone working in the U.S. should know. This article walks you through what counts, how much income you need, and how to make sense of the Social Security system — clearly, accurately, and with a friendly voice. We’ll cover earnings thresholds, common mistakes, benefits for different groups, and what changes to expect in 2026. Stick around — you’ll leave smarter and more prepared.

Table of Contents

Social Security Eligibility Income 2026

In 2026, the income you need to qualify for Social Security is clear: $1,890 per credit, up to 4 credits a year. That’s $7,560 in total to check the box for one year. Over time, if you build up 40 credits, you unlock access to Social Security retirement benefits that may become a crucial part of your financial security. Whether you’re 18 or 68, the best time to start planning is now.

| Topic | 2026 Data |

|---|---|

| Work Credit Earnings Requirement | $1,890 per credit |

| Maximum Credits Per Year | 4 credits |

| Total Earnings to Earn 4 Credits | $7,560 |

| Credits Required for Retirement Benefits | 40 credits (≈10 years of work) |

| Social Security Taxable Earnings Cap | $184,500 |

| Earnings Limit (Under Full Retirement Age) | $24,480 |

| Earnings Limit (Year You Reach FRA) | $65,160 |

| Full Retirement Age for Workers Born 1960+ | 67 |

| Official Source | Social Security Administration – 2026 Fact Sheet |

Understanding Social Security Eligibility Income: Why It Matters in 2026

Social Security is the bedrock of retirement income for over 67 million Americans, covering retirees, people with disabilities, survivors, and even dependent children. Funded by payroll taxes under FICA (Federal Insurance Contributions Act), nearly every working American contributes — and benefits — from it.

The money you earn today helps pay current beneficiaries. Later, your benefits will be funded by younger workers. It’s a cycle — but one you only benefit from if you earn enough to qualify.

This means you need to understand the eligibility requirements, how much income qualifies, and how that income translates into work credits.

What Are Social Security Work Credits?

The Basics

You earn work credits based on how much you make each year. These credits are the building blocks of Social Security eligibility.

In 2026:

- You earn 1 credit for every $1,890 in covered earnings.

- You can earn up to 4 credits per year, no matter how much more you make.

- Therefore, $7,560 is enough to earn all 4 credits in 2026.

You need 40 credits (roughly 10 years of work) to qualify for Social Security retirement benefits based on your own earnings record.

Historical Comparison

| Year | Earnings Per Credit | Total to Earn 4 Credits |

|---|---|---|

| 2024 | $1,730 | $6,920 |

| 2025 | $1,770 | $7,080 |

| 2026 | $1,890 | $7,560 |

This increase reflects rising wages and the annual Cost-of-Living Adjustment (COLA).

Social Security Eligibility Income 2026: Who Needs These Credits?

Retirement Benefits

Most people focus on retirement, which requires 40 credits. Once you have them, you’re eligible — even if you stop working decades before claiming.

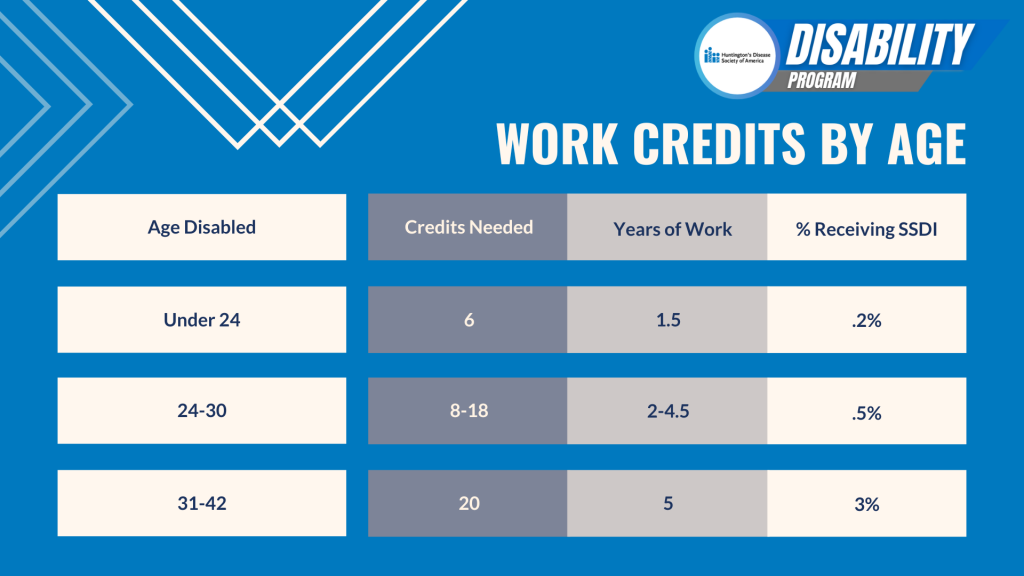

Disability Benefits (SSDI)

Credits needed for disability vary by age. A 25-year-old may only need 6 credits, while a 45-year-old may need 20.

Survivors’ Benefits

Spouses and dependent children may receive survivors’ benefits if the deceased had enough credits — even if they weren’t yet retired.

No-Credit? No Problem… Maybe

If you don’t have 40 credits, you might still qualify based on a spouse’s record, or get SSI (Supplemental Security Income) if your income and resources are limited.

Working While Receiving Benefits: 2026 Income Limits

Planning to collect benefits while still working? Here’s what you need to know:

Before Full Retirement Age (FRA)

If you’re under your FRA, your benefits may be temporarily reduced:

- 2026 limit: $24,480.

- For every $2 you earn over that, $1 is withheld from your benefits.

Year You Reach FRA

The limit increases:

- 2026 limit: $65,160.

- For every $3 you earn above that, $1 is withheld until your FRA month.

After Full Retirement Age

- No limit. You can work and earn as much as you want without benefit reduction.

Any withheld benefits due to earnings are not lost — they’re added back to your checks later, adjusted for age and timing.

What Income Counts for Social Security?

Only earned income counts:

- Wages

- Tips

- Self-employment income

Doesn’t count:

- Pensions

- Rental income

- Dividends or capital gains

- Veterans benefits or public assistance

Self-employed workers must report income properly and pay both halves of the Social Security tax (12.4%) to get credit.

Taxable Maximum: How Much of Your Income Counts?

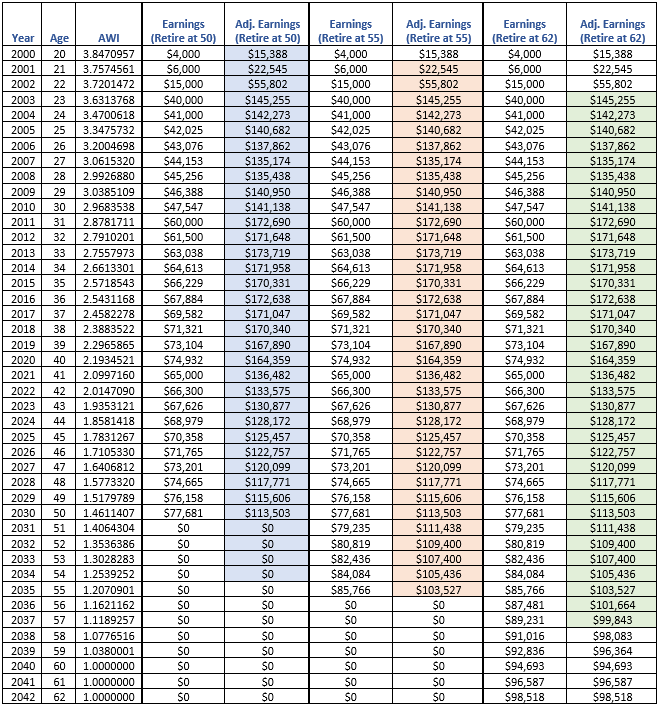

In 2026, the maximum taxable earnings subject to Social Security taxes is $184,500. Any income above that won’t increase your Social Security benefit and is not taxed by the SSA.

If you earn less, your benefit is calculated using your highest 35 years of income, adjusted for inflation.

Planning for Different Life Stages

High School & College Students

That part-time summer job? It counts. If you make over $1,890, you’ve got your first credit. It’s never too early to start building toward 40.

Mid-Career Professionals

Check your earnings history at ssa.gov. Make sure your employer is reporting your wages correctly.

Near-Retirees

Understand your FRA and the impact of early vs. delayed retirement. Waiting past your FRA increases your monthly benefit.

Top Social Security Myths (Debunked)

“Social Security will run out before I retire.”

False. Even if trust funds are depleted by 2034 (projected), payroll taxes will still cover ~77% of scheduled benefits unless Congress acts.

“I lose benefits if I keep working.”

False. Benefits may be temporarily reduced if you’re under FRA and earn too much, but you’ll be repaid later via higher monthly checks.

“I need to work for 40 years.”

False. You need 40 credits, which equals about 10 years of work, not 40. However, working longer can boost your benefit by replacing low-earning years.

Impact of Delayed Retirement and Early Claiming

- Claiming at 62 (earliest age): Benefits reduced by ~30%.

- Claiming at FRA (66–67): Full benefits.

- Claiming at 70: Receive delayed retirement credits, boosting your benefit by up to 8% per year beyond FRA.

How to Track and Plan?

Create a “my Social Security” Account

This secure account gives you access to:

- Your earnings history

- Estimated future benefits

- Statements

- Ability to apply for benefits online

Review Annually

Check your account each year — mistakes in wage reporting can delay or reduce benefits.

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

Checklist: Steps to Take in 2026

- Earn at least $7,560 to get all 4 credits.

- Check your Social Security account.

- Confirm your earnings are recorded accurately.

- Understand your FRA and income limits if claiming early.

- Maximize your benefit by working longer or delaying retirement.