Michigan Unemployment Benefits: If you’ve ever lost your job, you know how scary that can feel. One minute you’re working, the next you’re figuring out how to pay rent, feed the kids, and keep the lights on. In 2026, Michigan Unemployment Benefits are getting a serious upgrade to help make those times less stressful. Starting January 1, 2026, new unemployment claims in Michigan will offer higher weekly payments, better support for families, and more responsive systems — all part of a much-needed reform aimed at giving Michigan workers a fair shot when they fall on hard times. This guide breaks everything down in plain English: what’s changing, who qualifies, how to apply, and what it all means for your paycheck and peace of mind.

Table of Contents

Michigan Unemployment Benefits

The 2026 changes to Michigan unemployment benefits reflect a smarter, more compassionate approach to job loss. With higher weekly payments, better family support, and modern job search expectations, it’s a leap forward in economic fairness. This isn’t just about handing out cash — it’s about giving people the breathing room to get back on their feet, explore new paths, and reclaim their livelihoods with dignity. If you’ve never filed before, or if you’re unsure about what you qualify for, take a few minutes to explore your options. Whether you need a short-term boost or longer-term retraining, Michigan’s resources are finally meeting the moment.

| Key Info | Details (2026) |

|---|---|

| Max Weekly Benefit | $530/week (up from $446 in 2025) |

| Increase Amount | +$84 from previous year |

| Dependent Allowance | $19.33 per dependent (up from $12.66) |

| Max Dependents Allowed | 5 dependents |

| Max Weekly Payout (With Dependents) | $626.65 ($530 + $96.65) |

| Effective Date | January 1, 2026 |

| Claim Duration | Up to 26 weeks |

| Job Search Requirements | Minimum of 3 work search activities/week |

| Official Info | Michigan.gov/leo |

Why This Change Matters: Economic & Legal Context

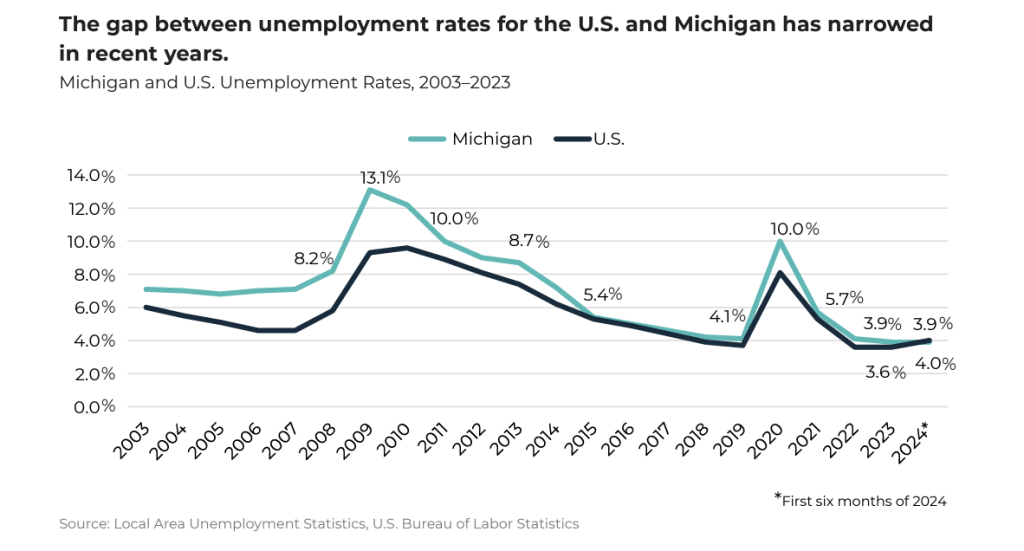

Michigan’s economy has shifted dramatically over the past two decades. The cost of living has climbed, industries have evolved, and temporary layoffs are increasingly common in fields like manufacturing, healthcare, and tech.

For years, Michigan lagged behind other states in unemployment compensation. The maximum weekly benefit had remained at $362 from 2002 to 2022, despite the average rent in Detroit and Grand Rapids skyrocketing by over 50% during the same time.

Thanks to Public Act 203 of 2022, Michigan is now catching up. The law introduced a phased increase in benefits to:

- Provide stronger financial support

- Modernize the Unemployment Insurance Agency (UIA)

- Reflect wage growth and inflation

Now in its second phase, the 2026 boost is part of a broader push to align unemployment systems with the modern labor market.

What Does $530 a Week Look Like in Practice?

Here’s a breakdown using real-world examples:

Example 1: Single Worker

- Kyle worked in retail and was laid off post-holidays.

- His earnings qualify him for the maximum benefit: $530/week

- No dependents, so that’s his full weekly payout.

Example 2: Parent with Dependents

- Alicia, a nurse’s aide, gets laid off due to budget cuts.

- She qualifies for the max + 2 dependents.

- Her weekly total: $530 + (2 x $19.33) = $568.66

- Over 26 weeks: $14,785.16

This amount gives families the breathing room to cover essentials like food, rent, and transportation while job hunting.

Michigan Unemployment Benefits Eligibility Criteria (Who Can Apply?)

To qualify for unemployment in Michigan, you must meet certain conditions:

Basic Requirements:

- Be unemployed through no fault of your own

- Earn sufficient wages in at least two of the last four quarters

- Be able, available, and actively seeking work

- Be legally authorized to work in the U.S.

Earnings Threshold:

Your earnings over the base period (first 4 of the last 5 completed quarters) must:

- Total at least $3,830, and

- Include at least one quarter with $1,871 or more (amounts adjusted annually)

For workers with irregular income, like seasonal workers or freelancers, benefits may still be available — but they’ll need to show documented income and meet alternative criteria.

How Michigan Unemployment Benefits Are Calculated?

Michigan uses a straightforward formula:

- Weekly Benefit Amount (WBA) = 4.1% of highest quarter wages

- Add $19.33 for each dependent (up to 5)

You’ll never receive more than $530 per week in base benefits, but the maximum with dependents is $626.65/week.

What About Gig Workers and Freelancers?

Traditional unemployment often excludes 1099 workers, independent contractors, and side-hustlers — unless they paid into the system voluntarily.

While federal pandemic-era programs like PUA (Pandemic Unemployment Assistance) filled that gap from 2020–2021, there’s currently no guarantee of similar options in 2026. However:

- Self-employed individuals who incorporated and paid UI taxes may qualify

- Some workforce programs offer retraining grants and financial aid

If you’re a gig worker, reach out to Michigan Works! or call UIA directly for tailored guidance.

How to Apply for Michigan Unemployment Benefits 2026?

Follow this 5-step process:

Step 1: Gather Your Docs

- Social Security Number

- Past employer names, addresses, and dates

- Bank account for direct deposit

Step 2: File a Claim

Apply online at Michigan.gov/UIA, or use the Michigan UIA Claimant Portal.

Step 3: Certify Weekly

Log in each week to confirm:

- You’re still unemployed

- You’re able and available to work

- You’ve completed your work search activities

Step 4: Record Your Job Search

As of mid-2026, Michigan requires 3 documented work search activities per week, such as:

- Submitting job applications

- Attending interviews

- Going to job fairs

- Participating in training or workshops

Failure to document could delay or deny benefits.

Step 5: Monitor Payments

Payments typically arrive via direct deposit within 48–72 hours after weekly certification.

For Employers: What You Need to Know

This isn’t just a worker-focused change. Employers should be aware of:

- Potential changes to state UI contribution rates

- New rules for layoff notifications and reporting

- Eligibility to use work-share programs to reduce hours instead of laying off staff

Employers are encouraged to:

- Review their UI accounts at miwam.unemployment.state.mi.us

- Stay current on tax rate notices

- Use Michigan Works! to help connect laid-off employees to new jobs or retraining programs

Common Mistakes to Avoid

Applying for unemployment isn’t hard, but it’s easy to mess up if you’re not careful:

- Missing the weekly certification deadline

- Failing to report part-time or freelance income

- Not keeping a record of job search activities

- Providing incomplete wage or employer information

To stay on track, set calendar reminders and keep a dedicated folder for all UI-related documents.

What If Your Claim Gets Denied?

Don’t panic. If your claim is denied, you’ll receive a written notice with the reason and instructions on how to appeal.

You’ll have 30 calendar days to file an appeal with the Michigan Office of Administrative Hearings and Rules (MOAHR).

It helps to:

- Submit supporting documents

- Get legal advice or free help from organizations like Michigan Legal Help

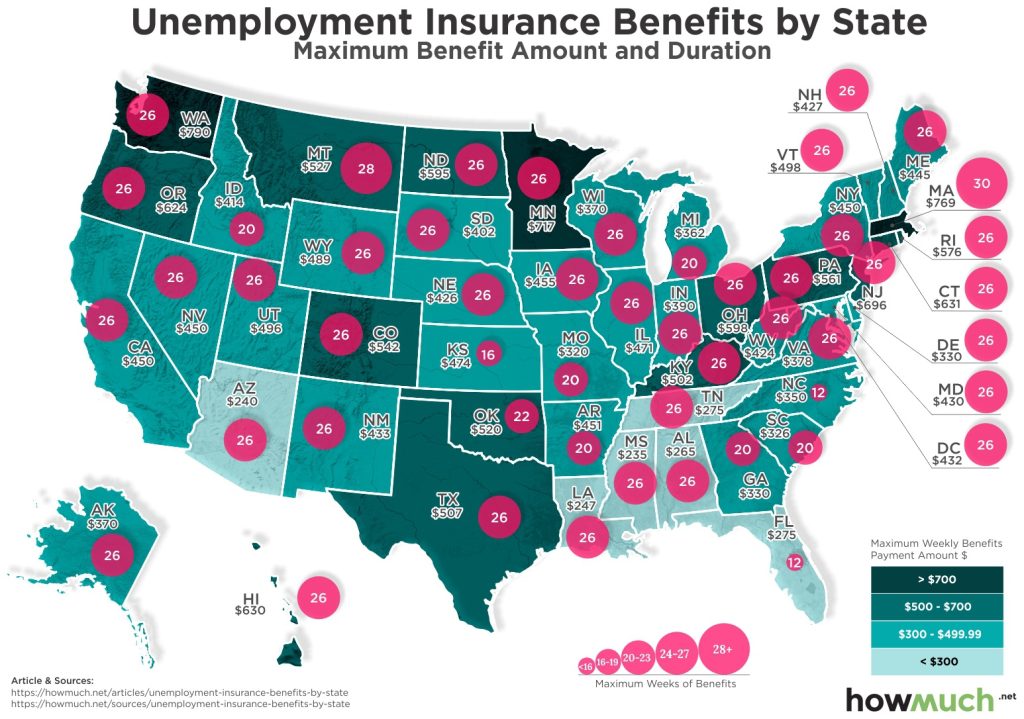

Michigan vs Other States in 2026

How does Michigan’s new rate stack up nationally?

| State | Max Weekly Benefit | Max Duration |

|---|---|---|

| Michigan | $530 (up to $626.65 w/ dependents) | 26 weeks |

| Illinois | $593 | 26 weeks |

| Ohio | $598 | 26 weeks |

| California | $450 | 26 weeks |

| Texas | $577 | 26 weeks |

While not the absolute highest, Michigan’s increased benefits and dependent support put it in the upper tier — and ahead of many states in terms of family-friendly policy.

San Diego Says Goodbye to Rock-Bottom Wages: New Minimum Wage Hike Coming January 2026!

VA Disability Benefits January 2026 – Updated Payment Levels, Deposit Dates, and Eligibility

New York raises overtime thresholds starting January 2026: Here’s how much