Social Security Boost by State 2026: The Social Security Boost by State 2026 is one of the most talked-about topics in the world of retirement, personal finance, and government benefits this year. And for good reason. In 2026, Social Security recipients will enjoy a 2.8% increase in their monthly checks, thanks to the official cost-of-living adjustment (COLA) announced by the Social Security Administration (SSA). But here’s where it gets even more interesting: While every American receiving Social Security gets this percentage increase, the real money — the actual dollar amount — varies by state. In fact, beneficiaries in five U.S. states stand to gain up to $2,000 more in total benefits throughout the year. Let’s break this all down — what it means, why it matters, and how you can make the most of it.

Table of Contents

Social Security Boost by State 2026

The Social Security Boost by State in 2026 is a win for millions of Americans. Thanks to the 2.8% COLA, the average monthly check is rising to $2,071, and retirees in states like Connecticut, New Jersey, New Hampshire, Delaware, and Maryland are poised to see up to $2,000 more in total benefits this year. But don’t let the headlines fool you. Rising healthcare costs, regional expenses, and tax implications all affect your real-world spending power. The key? Use this moment to reassess your budget, tighten your financial strategy, and look ahead — not just at the next check, but at your long-term peace of mind.

| Topic | Details |

|---|---|

| 2026 COLA | 2.8% increase in Social Security benefits |

| Average 2026 Benefit | $2,071 per month after COLA |

| Top 5 States for Higher Dollar Gains | Connecticut, New Jersey, New Hampshire, Delaware, Maryland |

| Annual Boost in These States | Up to $2,000 or more over the year |

| Applies To | Retirees, Disabled (SSDI), Survivors, SSI recipients |

| SSA Official Website | https://www.ssa.gov/cola |

What Is the 2026 Social Security COLA?

Each year, the U.S. government assesses how much prices have gone up due to inflation — that’s the rising cost of goods and services like food, gas, and rent. When inflation increases, Social Security payments are adjusted upward so retirees and others don’t lose buying power. That adjustment is known as the Cost-of-Living Adjustment (COLA).

For 2026, COLA is officially set at 2.8%, which means:

- If you received $2,000/month in 2025, your new monthly check in 2026 is $2,056.

- Over a full year, that’s an additional $672.

This increase helps protect people on fixed incomes — especially retirees — from being left behind by the rising cost of everyday essentials.

Why Some States Will See Bigger Gains Than Others?

Let’s make something clear: the COLA increase is uniform across the U.S. — everyone gets the same percentage increase. But the total dollar amount you receive depends on your current Social Security benefit.

And guess what determines your benefit? Your lifetime earnings, which are typically higher in states with:

- High-paying industries (finance, tech, medical)

- Strong wage growth

- Higher education levels

As a result, folks living in some states start with higher average Social Security checks, and the same 2.8% increase amounts to more dollars.

Top 5 States Getting the Social Security Boost by State 2026

According to expert analysis from The Motley Fool and Nasdaq, the following five states are expected to see the highest dollar gains from the 2026 COLA:

1. Connecticut

- Among the top states for average earnings

- 2025 average monthly benefit: ~$2,250

- 2026 COLA impact: +$63/month → ~$756/year

2. New Jersey

- Home to many high-income earners and retirees

- 2025 benefit: ~$2,220

- Estimated annual boost: ~$730

3. New Hampshire

- Higher-than-average retirement income

- Benefits rise by ~$60/month → ~$720/year

4. Delaware

- One of the smaller states but with strong benefit levels

- Increase expected to be ~$700/year

5. Maryland

- A highly educated, high-income workforce

- Strong historical benefit base means ~$750 or more yearly boost

For comparison, some lower-income states such as Mississippi or West Virginia may see annual gains closer to $500–$600, even with the same 2.8% percentage increase.

Real-Life Example: What a Social Security Boost by State 2026 Looks Like

Let’s say you live in Connecticut and currently receive $2,400/month in Social Security.

- After a 2.8% bump: You now receive $2,467/month

- That’s an increase of $67/month

- Over 12 months, that’s $804 more

- Add in potential state-level benefits or tax breaks, and it could total close to $2,000 in extra value, especially when compounding COLA and cost-saving programs

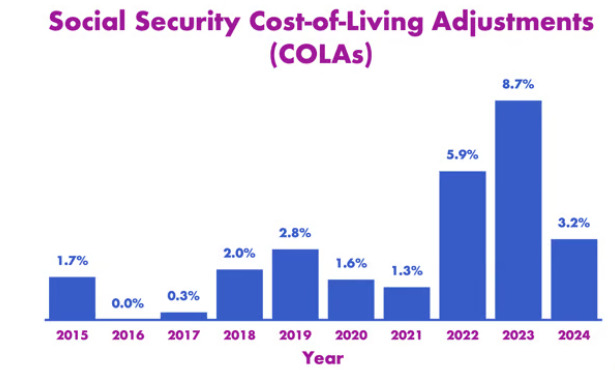

Historical COLA Trends – How 2026 Compares

| Year | COLA % |

|---|---|

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% (highest in 40 years) |

| 2024 | 3.2% |

| 2025 | 2.4% |

| 2026 | 2.8% |

As you can see, the 2026 COLA is modest but healthy, especially following several years of economic ups and downs.

Who Gets the Boost?

This increase applies automatically to:

- Retired workers

- Disabled workers (SSDI)

- Survivors (widows, widowers, children)

- Supplemental Security Income (SSI) recipients

No need to apply or submit paperwork. The increase will appear in your January 2026 check.

Regional Cost of Living Still Plays a Role

Even if you live in one of the five high-benefit states, remember that these states also tend to have a higher cost of living. For example:

- Connecticut: 31% above the U.S. average

- New Jersey: 27% above average

- Maryland: 20% above average

So while your checks may be bigger, your grocery bills, utilities, and housing may be too.

How Medicare Costs May Offset Some of the Gains?

It’s not all sunshine and rainbows. Medicare Part B premiums are also rising in 2026, and those premiums are often deducted directly from your Social Security check.

- 2026 projected Part B premium: $202.90/month (up from $174.70 in 2025)

- For some, that may eat up ~30% or more of the monthly COLA increase

So while you’ll see a raise, the net amount you feel in your pocket may be smaller.

What About Taxes?

Yes, your Social Security benefits may be taxable — especially if you have other income from a pension, 401(k), or job.

- Up to 85% of your benefits can be subject to federal income tax

- Some states (like Connecticut and New Jersey) also tax Social Security, though many exempt lower-income retirees

Tip: Consider working with a tax professional to minimize your liability or adjust withholdings.

Practical Financial Tips for Beneficiaries in 2026

1. Log In to Your SSA Account:

Check your updated benefit amounts and track deductions at ssa.gov/myaccount.

2. Adjust Your Budget:

Use the extra funds to pay down debt, cover rising healthcare, or add to emergency savings.

3. Don’t Rely Solely on COLA:

Treat COLA as a bonus — not a long-term strategy. Inflation may still outpace it in some years.

4. Consider State-Level Programs:

Some states offer property tax relief, food assistance, and energy rebates for seniors. Search your state’s Department of Aging website.

5. Review Retirement Projections:

Recalculate how long your savings will last with this updated benefit using calculators from Fidelity or Vanguard.

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules