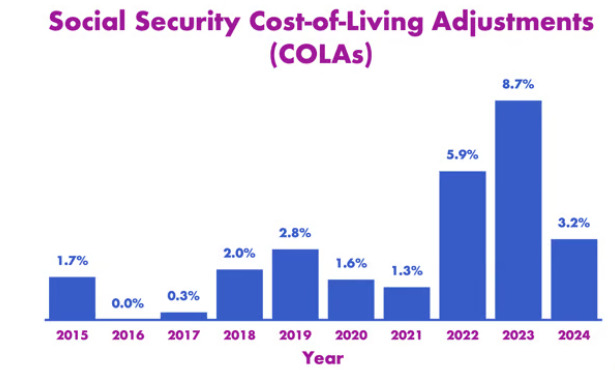

Social Security Increases by State: If you’re retired or planning to retire soon, you’re probably wondering how far your Social Security check will stretch in 2026. Well, here’s the scoop: thanks to a 2.8% Cost-of-Living Adjustment (COLA), everyone receiving Social Security benefits will see a boost. But not all states are created equal when it comes to how much more money you’ll actually take home. In this guide, we’ll break down the “Social Security Increases by State 2026”, focusing on the five states where retirees will see the biggest gains. Whether you’re a retiree, future retiree, financial pro, or just curious, this article has you covered with easy-to-digest info, useful tips, verified stats, and added insights you won’t want to miss.

Table of Contents

Social Security Increases by State

The 2026 Social Security COLA increase is good news, especially for retirees in states like Connecticut, New Jersey, and New Hampshire. While everyone gets a 2.8% raise, those in high-benefit states will see bigger checks. Now’s a great time to review your financial plan and consider whether your state is the best fit for your retirement. With smart planning, even a modest increase can make a big difference. Whether you’re just starting to think about retirement or already enjoying it, take this opportunity to optimize your income and protect your future. Stay informed, stay prepared, and make the most of your benefits.

| State | Average Monthly Social Security Benefit (2025) | 2026 Projected Increase (2.8%) | New Average Monthly Benefit |

|---|---|---|---|

| Connecticut | $2,167 | $60.66 | $2,227.66 |

| New Jersey | $2,163 | $60.57 | $2,223.57 |

| New Hampshire | $2,147 | $60.11 | $2,207.11 |

| Delaware | $2,141 | $59.95 | $2,200.95 |

| Maryland | $2,106 | $58.96 | $2,164.96 |

Understanding the 2026 Social Security COLA Increase

The Cost-of-Living Adjustment (COLA) is an annual tweak Uncle Sam makes to keep up with inflation. Think of it like a raise to help your benefit keep pace with the rising costs of gas, groceries, and everything in between.

The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When the CPI-W rises, so does your benefit. For 2026, the official COLA has been set at 2.8%, based on inflation trends throughout 2025.

What Does This Mean in Dollars?

- National average benefit in 2025: $1,860/month

- Projected 2026 increase (2.8%): +$52/month

- New average in 2026: ~$1,912/month

That’s around $624 more per year in your pocket. Not too shabby.

While this may not sound like a windfall, for seniors living on fixed incomes, even a small boost can provide a cushion against rising healthcare costs, food prices, and energy bills.

Why the Social Security Increases Varies by State?

Here’s the deal: everyone gets the same 2.8% increase, but the actual dollar amount depends on what you were already receiving. That varies based on your earnings history.

If you worked high-paying jobs for most of your career, your monthly Social Security check is going to be higher. And if you live in a state where people tend to have higher lifetime earnings, the average benefit in that state will be bigger.

Factors That Influence Higher Benefits:

- Longer work histories with steady income

- Delayed retirement (waiting until full retirement age or later)

- Higher-paying jobs, especially in professional, technical, or government fields

- Statewide income trends, since higher earnings lead to larger contributions to Social Security

The Five States With the Biggest Social Security Increases in 2026

1. Connecticut

- Average Benefit: $2,167

- Increase: $60.66/month

- Why It Ranks High: Connecticut consistently ranks among the top states for average income. Many retirees here worked in finance, education, or healthcare.

- State Taxes: Connecticut does tax Social Security if your income exceeds certain thresholds.

- Example: A retired couple earning above $100,000 total may see some of their Social Security taxed.

2. New Jersey

- Average Benefit: $2,163

- Increase: $60.57/month

- Why It Ranks High: The Garden State is home to many corporate headquarters and government jobs, leading to high average earnings.

- Tax Policy: Social Security benefits are not taxed, and there’s a generous retirement income exclusion.

- Extra Tip: Property taxes are high, but income-related perks help balance that.

3. New Hampshire

- Average Benefit: $2,147

- Increase: $60.11/month

- Why It Ranks High: NH has no state income tax and a growing retiree population with solid work histories.

- Tax Benefits: Zero income tax and no tax on retirement income.

- Living Factor: Cost of living is moderate, making the most of your benefit.

4. Delaware

- Average Benefit: $2,141

- Increase: $59.95/month

- Why It Ranks High: Delaware’s location near major metro areas means many retirees had high-paying jobs in neighboring states.

- Retiree-Friendly: Social Security is exempt from state tax, and there are no sales taxes.

- Healthcare Access: Excellent access to hospitals and medical care for older adults.

5. Maryland

- Average Benefit: $2,106

- Increase: $58.96/month

- Why It Ranks High: High federal employment, defense contracting, and professional services lead to strong lifetime earnings.

- Tax Info: Maryland is phasing out taxes on Social Security depending on income and age.

- Extra Point: Strong public transportation and community resources make retirement easier.

BONUS: States With Smaller Gains (But Still Valuable!)

Not every state sees big dollar increases, but a boost is still a boost. States with lower cost-of-living often have smaller monthly benefits but also offer better spending power.

- Mississippi: Lower average benefits, but very low cost of living

- Arkansas: Modest payouts, but favorable tax treatment

- West Virginia: Small increases, but housing and healthcare are affordable

Takeaway: Even with smaller dollar gains, your money might go further in these states.

Practical Retirement Planning Tips for 2026

Review Your Benefit Statement

Log into SSA.gov/myaccount to check your estimated benefits. Make sure your earnings history is accurate – any missing years or errors could reduce your payments.

Factor in State Taxes

A higher benefit isn’t as helpful if your state takes a bite out of it. Compare state tax policies on Social Security, pensions, and other retirement income.

Use the Extra Wisely

The extra $600+ per year may not change your lifestyle, but it can go a long way toward:

- Emergency funds

- Medical co-pays or prescription drug costs

- Utility bills or groceries

- Travel or holiday expenses

Consider a Part-Time Job

Working in retirement is becoming more common. Just be aware that if you’re under full retirement age, your benefits may be temporarily reduced if you earn over a set limit ($22,320 in 2024; likely higher in 2026).

Meet With a Retirement Planner

An experienced advisor can help you:

- Strategize your withdrawal rates

- Manage tax liability

- Create a long-term income plan that fits your goals

The Big Picture: Social Security and Inflation

Although the 2.8% COLA is good news, it’s worth noting that actual inflation may be higher in certain areas like healthcare or housing. Social Security isn’t always keeping pace with these sector-specific increases.

Also, COLA is tied to the CPI-W, which may not reflect the spending habits of retirees as accurately as the CPI-E (Consumer Price Index for the Elderly) would. Some advocacy groups continue to push for CPI-E to become the new standard, as it places more weight on medical expenses.

2026 COLA Benefit Plans: Check Updated Cost-of-Living Adjustments Rules

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

Social Security Benefits January 2026: How Much Will Your Payments Increase?