VA Benefits Increase 2026: The 2026 VA benefits increase is official, and for over 5.6 million American veterans receiving disability compensation, it means larger monthly checks starting January 1, 2026. Thanks to a 2.8% Cost-of-Living Adjustment (COLA), these tax-free benefits are rising in sync with inflation, keeping pace with rising costs in housing, groceries, gas, and healthcare. From seasoned Vietnam vets to recently retired post-9/11 service members, this increase ensures your hard-earned benefits hold their value. And yes — the change is automatic. No forms. No phone calls. No stress. This article will break down what this increase means for you, how much more you’ll receive, how to verify your new benefits, and what else you need to know to protect and potentially increase your payments in 2026.

Table of Contents

VA Benefits Increase 2026

The 2026 VA benefits increase reflects a continued commitment to our nation’s veterans. Whether you served in Korea, Iraq, Afghanistan, or here at home, this raise ensures your benefits grow alongside inflation — preserving your purchasing power and dignity. With a 2.8% increase across all ratings and categories, this annual COLA protects your monthly income and affirms a promise: You served your country — and your country still has your back. If you’re unsure about your current rating, need assistance with claims, or just want to verify your payment, the tools are in your hands.

| Key Detail | 2026 Update |

|---|---|

| COLA Increase | 2.8% |

| Effective Date | January 1, 2026 |

| Applies To | Disability Compensation, SMC, VA pensions |

| 100% Disability Pay Increase | ~$104.67/month |

| 10% Disability Pay Increase | ~$4.80/month |

| Dependent Payments Increase | Yes |

| Special Monthly Compensation (SMC) | Yes, COLA-adjusted |

| How to Confirm | VA.gov, MyVA app, Bank statement |

| Contact VA | 1-800-827-1000 |

Why Do VA Benefits Increase Annually?

Veterans’ disability payments are protected against inflation by law. Each year, Congress authorizes an increase in VA benefits that matches the Social Security COLA, which is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — a federal measure of inflation maintained by the Bureau of Labor Statistics.

If the cost of food, rent, or fuel rises, VA benefits increase to maintain the purchasing power of disabled veterans and their families. The Veterans’ Compensation Cost-of-Living Adjustment Act of 2025 was passed to approve this year’s COLA — a routine but crucial piece of legislation.

A Closer Look at VA Benefits Increase 2026

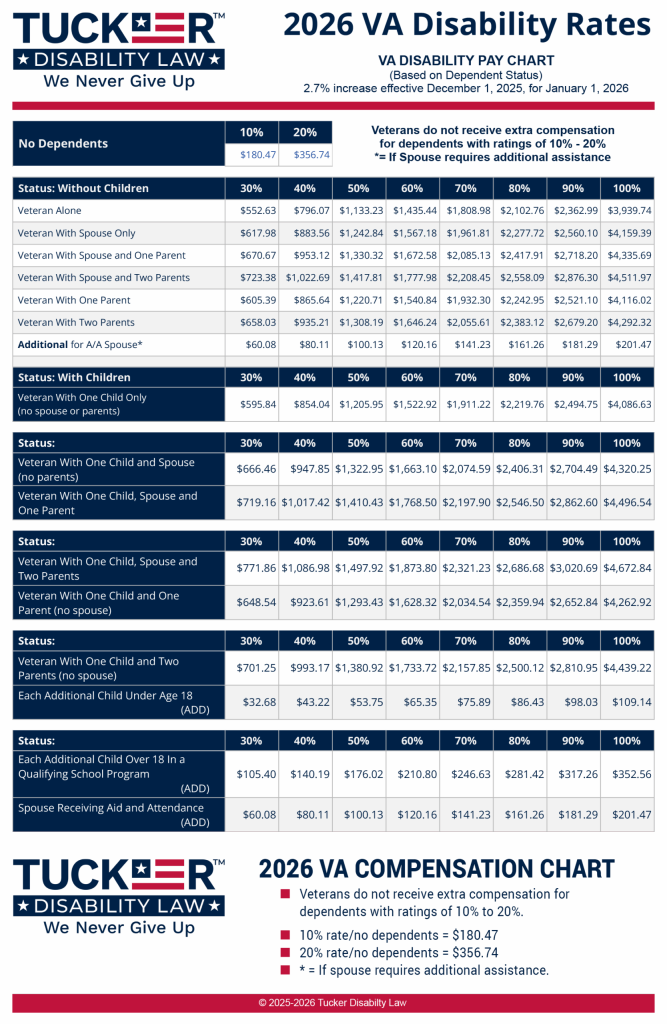

Here’s a breakdown of monthly compensation rates for veterans without dependents:

| Disability Rating | 2025 Rate | 2026 Rate (+2.8%) |

|---|---|---|

| 10% | $171.23 | $176.03 |

| 20% | $338.49 | $347.97 |

| 30% | $524.31 | $538.00 |

| 40% | $755.28 | $776.41 |

| 50% | $1,075.16 | $1,105.27 |

| 60% | $1,361.88 | $1,400.02 |

| 70% | $1,716.28 | $1,764.34 |

| 80% | $1,995.01 | $2,050.91 |

| 90% | $2,241.91 | $2,304.68 |

| 100% | $3,737.85 | $3,842.52 |

Note: These figures are base compensation rates for single veterans with no dependents. The addition of a spouse, child(ren), or dependent parent(s) increases monthly payments.

Disability With Dependents — Full Family Picture

Let’s take a look at examples for a veteran rated 100% disabled with dependents:

| Family Situation | 2025 Rate | 2026 Rate |

|---|---|---|

| Veteran Only | $3,737.85 | $3,842.52 |

| Veteran + Spouse | $3,946.25 | $4,056.75 |

| Veteran + Spouse + 1 Child | $4,135.25 | $4,251.04 |

| Veteran + Spouse + 2 Children | $4,257.45 | $4,376.67 |

| Veteran + 2 Parents | $4,001.45 | $4,113.45 |

These adjustments are vital for families managing monthly essentials and long-term care expenses.

Understanding Special Monthly Compensation (SMC)

Veterans with serious conditions — such as amputations, paralysis, or need for home care — may qualify for Special Monthly Compensation (SMC). This benefit provides additional payments beyond the base disability rating.

SMC categories range from K to R2 and cover scenarios like:

- Loss of use of hands or feet

- Loss of sight or hearing

- Aid and attendance (help with daily tasks)

Just like regular disability pay, SMC rates increased by 2.8% in 2026. Veterans with conditions requiring full-time assistance can receive over $9,000/month with dependents and higher-level SMCs.

When Will You See the Money?

The COLA increase took effect on December 1, 2025, but you’ll see the change reflected in your January 2026 payments — typically deposited around January 1–3, depending on your bank.

Real-World Scenario: Monthly Impact

Let’s say Samantha, a 70% disabled veteran with one child and a spouse, received around $1,857.93/month in 2025. With the 2.8% increase, her new payment is:

- $1,910.92/month — an increase of $52.99/month, or $635.88/year.

That’s enough to cover a full week of groceries for a family, several tankfuls of gas, or 2–3 co-pays for prescriptions. These increases may seem modest — but over 12 months, they add up significantly.

How to Confirm Your New VA Payments?

To verify your updated benefits:

- Log in to VA.gov

- Use your DS Logon, ID.me, or Login.gov

- Click “Disability” then “View your payment history”

- Check your Bank Account

- Compare your January 2026 deposit to December 2025

- Download the MyVA App

- View payment details and manage your info

- Call VA Directly

- 1-800-827-1000 (Monday to Friday, 8 AM to 9 PM ET)

Financial Planning Tip: What to Do With the Extra Cash

Even a small monthly increase can make a strategic impact when used wisely:

- Emergency Fund: Use the bump to build a safety cushion.

- VA Home Loan Payments: Apply extra funds to pay down principal.

- Veteran Savings Accounts: Consider using credit unions offering veteran-focused savings plans.

- Debt Repayment: Knock out high-interest debt faster.

- Invest: For those able, stash the increase in a Roth IRA or Treasury Bonds.

Can You File for a Higher Rating in 2026?

Yes — and you should if your condition has worsened.

Signs you may need a reevaluation:

- New or worsening symptoms

- Increased medication or surgeries

- Impact on employment or daily life

- Mental health decline (depression, PTSD, etc.)

You’ll need to file VA Form 21-526EZ, available through VA.gov, and submit medical evidence.

Important: You can also appeal past ratings if you believe they were unfair or miscalculated.

Legislative Context: Who Made This Happen?

The Veterans’ Compensation Cost-of-Living Adjustment Act of 2025, signed by Congress, authorized the 2.8% raise. This act is typically bipartisan, passed each fall to ensure veterans receive the same COLA as Social Security beneficiaries.

Protect Yourself: Avoid Scams

Veterans are frequently targeted by scammers posing as VA officials. Be wary of:

- Emails or texts asking for your VA login or bank info

- Calls offering to “unlock” your COLA for a fee

- Fake disability consultants charging upfront

The VA will NEVER ask for personal info over text or charge for COLA increases.

VA Confirms 2026 Disability Compensation Increases; How Much Will You Receive?

VA Disability Benefits January 2026 – Updated Payment Levels, Deposit Dates, and Eligibility

When is the January 2026 Florida TCA Payment made? Check Eligibility