Minimum wage increase in 2026: Minimum Wage Increase 2026 is more than just a paycheck boost. It reflects how America is shifting its values around labor, compensation, and fairness. In 2026, over 20 states across the U.S. are hiking their minimum wages, with some reaching as high as $17.13 per hour. For workers, that means more take-home pay. For businesses? It’s a signal to review payroll, benefits, and hiring strategies. Whether you’re flipping burgers, stocking shelves, running a coffee shop, or managing HR at a growing startup — this wage increase impacts you. Let’s dive into everything you need to know: the states making changes, why it matters, how it affects you, and what the future holds.

Table of Contents

Minimum wage increase in 2026

The Minimum Wage Increase 2026 isn’t just a number — it’s a mirror of America’s shifting economic values. As wages climb in more than 20 states, workers get a shot at a fairer life, and employers face new responsibilities. Whether you’re earning, hiring, or advocating — this change affects you. Stay informed. Stay compliant. Stay human.

| State(s) | New Minimum Wage (2026) | Effective Date | Details |

|---|---|---|---|

| California | $16.90 | Jan 1, 2026 | Inflation-adjusted |

| New York | $17.00 NYC/LI | Jan 1, 2026 | $16 upstate |

| Florida | $15.00 | Sept 30, 2026 | Constitutional mandate |

| Washington | $17.13 | Jan 1, 2026 | Indexed to inflation |

| Nebraska | $15.00 | Jan 1, 2026 | Voter approved |

| Hawaii | $16.00 | Jan 1, 2026 | Significant jump |

| Full List → | See all changes → | Paycom |

The Bigger Picture: Why Minimum Wage Increase in 2026 Matters Now More Than Ever

Minimum wage isn’t just an economic number — it’s a statement of values. In a time when inflation is driving up food, rent, healthcare, and utilities, a stagnant wage means falling behind.

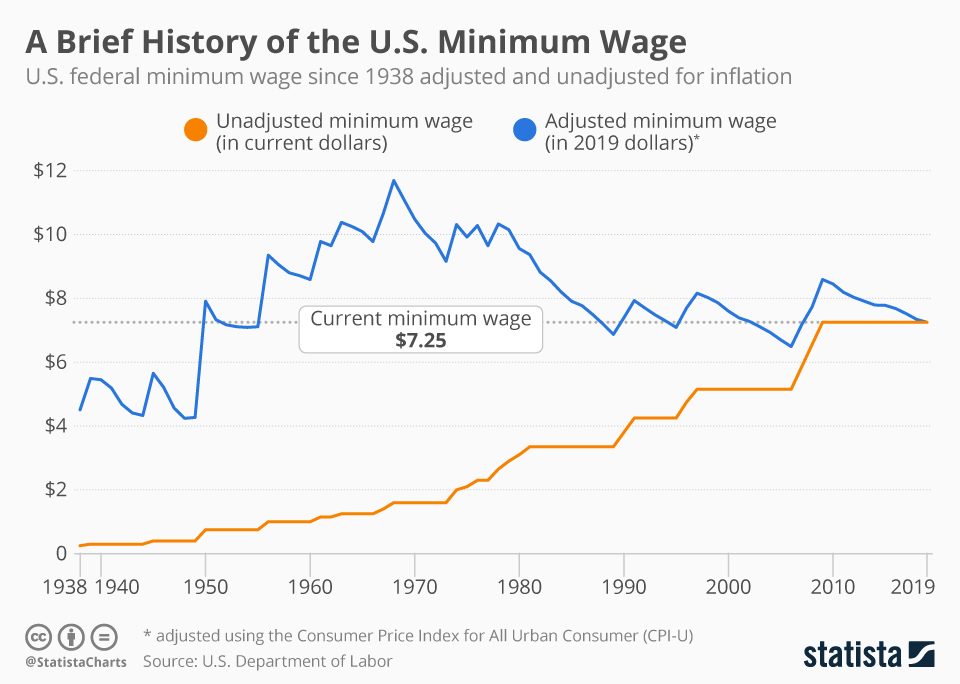

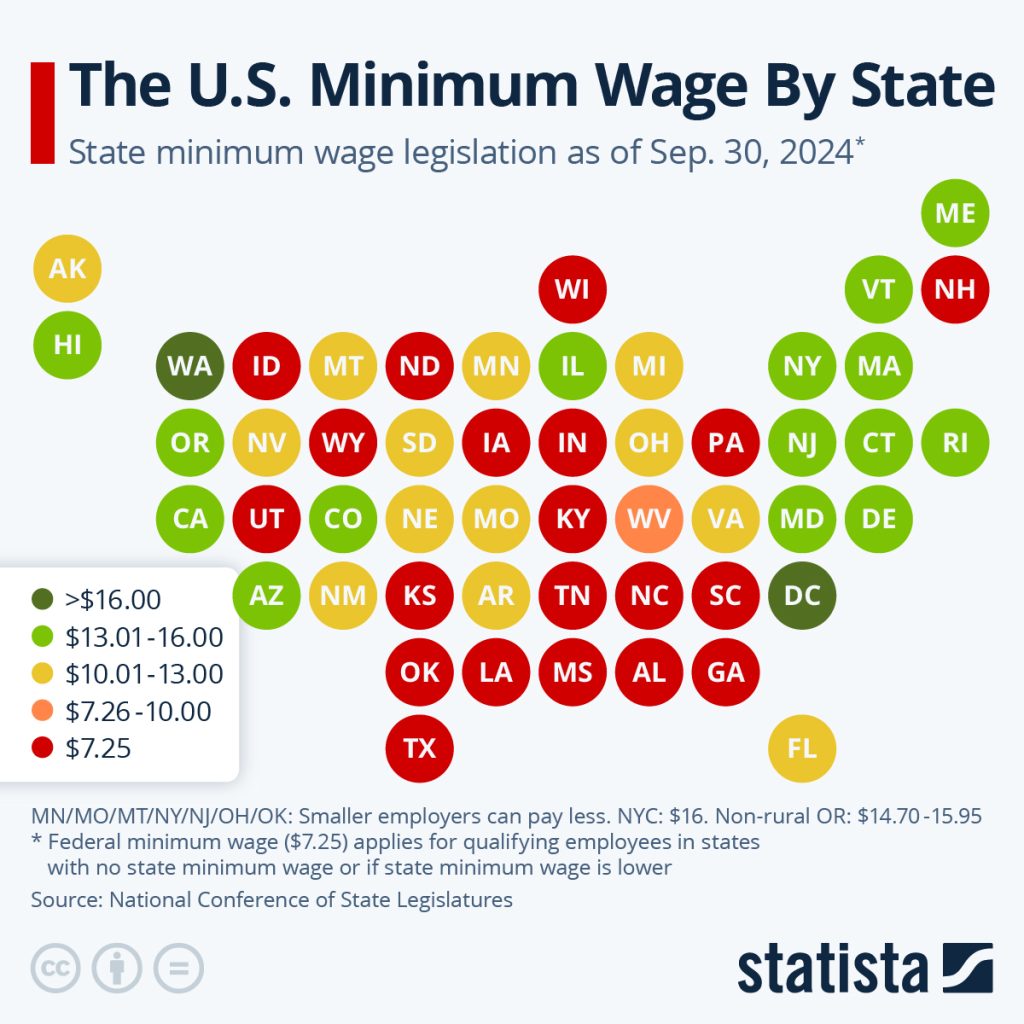

The federal minimum wage has been stuck at $7.25 since 2009, despite a nearly 40% rise in living costs. That’s why states have taken the lead. Through legislation and ballot measures, local governments are stepping up where Congress has not. These changes aren’t just numbers on paper. They’re shaping real lives — and sometimes, saving them.

How We Got Here: A Quick History of the Minimum Wage

The minimum wage in the U.S. was established in 1938 under the Fair Labor Standards Act (FLSA) at $0.25/hour. The goal? Protect workers from exploitation and poverty.

Here’s how it’s evolved:

- 1968: Minimum wage peaked in real value (adjusted for inflation)

- 2009: Last federal increase to $7.25/hour

- 2012: “Fight for $15” movement begins in New York

- 2020s: States and cities begin pushing past $15/hour

Today, over 30 states have a higher minimum wage than the federal level. Many adjust annually using CPI (Consumer Price Index) to keep up with inflation.

What’s Changing in minimum wage increase in 2026: State-by-State Overview

Here are notable state increases effective in 2026:

California: $16.90/hour

California continues its leadership with one of the highest base wages, plus a new $20/hour minimum for fast-food workers (starting in 2025). The state adjusts annually based on inflation.

New York: $17.00 in NYC, $16.00 upstate

Thanks to regional tiering, NYC and surrounding counties will move to $17.00, while the rest of the state hits $16. Annual increases are now indexed to inflation.

Florida: $15.00/hour on Sept 30

This is the final step in a series of $1-per-year raises, mandated by Amendment 2, which was passed by voters in 2020. After this, Florida will adjust annually using the CPI.

Washington: $17.13/hour

Washington’s wage law is tied to the CPI-W (Consumer Price Index for Urban Wage Earners), giving it the highest statewide minimum wage in the U.S.

Nebraska: $15.00/hour

Voters approved Initiative 433 in 2022. Wages will rise incrementally to $15 by 2026, with CPI-based adjustments beginning in 2027.

Hawaii: $16.00/hour

A sharp $2/hour jump from 2025 levels. Hawaii’s lawmakers responded to the state’s highest-in-the-nation cost of living.

Other states with notable increases:

- Connecticut: $16.94

- Colorado: $15.15

- New Jersey: $15.92

- Arizona: $15.15

- Rhode Island: $16.00

- Maine: $15.10

The Real-World Impact: What This Means for You

For Workers

- Higher Paychecks: If you’re in a state with increases, expect to see more in your bank account.

- Stronger Job Market Leverage: With more companies competing for workers, now’s a great time to renegotiate pay or switch jobs.

- Better Living Standards: Higher wages can mean fewer second jobs, less stress, and more time for family or school.

For Employers

- Payroll Planning is Crucial: Budgeting for wage increases is no longer optional — it’s law.

- Competitive Recruiting: Paying above the minimum can help you attract and retain talent in a tight labor market.

- Compliance Risks: Failing to update wages can result in fines, lawsuits, or worse — public backlash.

“We see wage increases as investments. We don’t just retain employees — we empower them.”

— Susan Takoda, COO of Riverbend Organics, Oregon

Minimum Wage vs. Cost of Living: Are Wages Keeping Up?

A common question: Is $15/hour enough?

Let’s compare how many hours someone on minimum wage must work to afford a one-bedroom apartment:

| City | Min Wage (2026) | Avg Rent (1BR) | Hours Needed/Month |

|---|---|---|---|

| Seattle, WA | $19.97 (city wage) | $2,100 | 105 |

| New York, NY | $17.00 | $2,300 | 135 |

| Miami, FL | $15.00 | $1,900 | 127 |

| Omaha, NE | $15.00 | $1,100 | 73 |

| Jackson, MS | $7.25 | $950 | 131 |

Even in states with higher wages, housing costs still stretch workers thin. That’s why many economists argue for paired wage and housing reforms.

Tipped Workers: A Complicated Picture

In many states, tipped workers earn a lower base wage — often between $2.13 and $6.98/hour — with the expectation that tips make up the difference.

For example:

- Florida’s tipped minimum wage will be $11.98 in 2026.

- California and Washington, however, do not allow a tip credit, meaning tipped workers must receive the full minimum wage before tips.

Workers should track their hours and pay closely, and file a complaint if they’re being underpaid. Employers must legally make up the difference if tips don’t reach the full wage.

Legal Considerations and Enforcement

Employers must:

- Display current wage posters in the workplace

- Update payroll systems by January 1 (or other effective dates)

- Keep accurate records of hours and wages

- Ensure tipped and youth workers receive compliant pay

Non-compliance may result in:

- State labor audits

- Penalties of up to $1,100 per violation

- Employee lawsuits or class actions

State agencies like the U.S. Department of Labor’s Wage and Hour Division regularly enforce these rules. Many also have anonymous reporting tools.

What’s Ahead: Future Proposals and Political Movements

- Federal Movement: Multiple bills propose raising the federal wage to $15 or more, but political gridlock remains.

- Ballot Initiatives: States like Pennsylvania, North Carolina, and Texas could see pushes toward wage hikes.

- Industry-Specific Minimums: Fast food, healthcare, and delivery sectors may see separate wage laws.

Automation is also accelerating, with some businesses shifting to kiosks, AI ordering, and robotics to manage rising labor costs — making workforce development and tech skills even more essential.

What Should You Do Right Now?

If You’re an Employee:

- Check your paycheck after Jan 1 (or Sept 30 in FL)

- Know your legal rights under state law

- Track your hours and tip earnings

- Ask your employer if you’re unsure

If You’re an Employer:

- Review your state and city wage laws

- Update payroll systems and HR software

- Train managers on wage compliance

- Budget for possible future increases

Maine increases minimum wage in 2026: Check the amount and date

New Montana Law Means Bigger Paychecks: Minimum Wage Hike Kicks In January 1, 2026

San Diego Says Goodbye to Rock-Bottom Wages: New Minimum Wage Hike Coming January 2026!