Social Security Fairness Act Update: The Social Security Fairness Act is finally the law of the land — a monumental win for millions of public workers and their families across the United States. If you’re a retired teacher, police officer, firefighter, or other public servant who paid their dues to this country, you’ve probably felt the sting of unfair Social Security rules. For years, two little-known policies — the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) — took a chunk out of your monthly retirement benefits. But not anymore.

As of January 2025, those cuts are gone, and the government is paying people back. In this guide, we’ll explain everything you need to know about when those back payments are rolling out, how much more you’ll receive monthly, and how to make sure you’re getting what you’re owed. Whether you’re just hearing about the Fairness Act or you’re waiting for your check, this article breaks it all down in plain English — the way we’d explain it to family at the kitchen table.

Table of Contents

Social Security Fairness Act Update

The Social Security Fairness Act is more than a policy win — it’s a long-overdue correction to a system that left too many behind. For millions of teachers, police officers, firefighters, and public workers, this new law means a fair shake in retirement. By eliminating the outdated WEP and GPO rules, the law ensures that your Social Security reflects what you truly earned — not what some outdated formula thinks you deserve. If you’re affected, you’ve either seen a one-time retroactive payment already or it’s on the way. Monthly checks have increased, and this money can make a serious difference — not just for bills, but for peace of mind. It’s a reminder that sometimes the system does listen. And this time, it finally paid back what was owed.

| Topic | What You Need to Know |

|---|---|

| Law Signed | January 5, 2025 — President signed the Social Security Fairness Act into law |

| Retroactive Payments Begin | Late February 2025 — SSA started one‑time back pay for eligible beneficiaries |

| New Monthly Benefits Begin | April 2025 payments — reflecting higher benefits earned in March 2025 |

| Effective Date | Rules no longer applied after December 2023 → benefits from January 2024 onward are recalculated |

| Who’s Affected | Public workers with non‑covered pensions; spouses & survivors previously reduced by GPO |

| Official SSA Page | https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html |

Understanding the Problem: WEP and GPO

To understand how big this change is, you’ve got to understand what people were up against.

The Windfall Elimination Provision (WEP) penalized workers who had a pension from a job that didn’t withhold Social Security taxes and also earned Social Security through other employment. The result? A confusing formula that reduced their Social Security checks by up to $500 a month or more, depending on earnings history.

The Government Pension Offset (GPO) was arguably even worse. It affected surviving spouses and those eligible for spousal benefits. If a person had a government pension and was also entitled to Social Security based on their spouse’s work history, the GPO could eliminate their entire spousal benefit, leaving many with no income from Social Security at all.

These rules disproportionately impacted women, minorities, and low-to-moderate income households, especially in states like California, Texas, Louisiana, Massachusetts, and Ohio, where many public sector jobs aren’t covered by Social Security.

The Game-Changer: What the Social Security Fairness Act Does

The Fairness Act fully repeals both WEP and GPO. This means:

- Social Security will no longer reduce your benefits if you have a non-covered pension.

- Surviving spouses and spousal benefits will no longer be offset by a government pension.

- Back payments will be issued for benefits lost starting January 2024.

- Monthly benefit increases began with payments sent in April 2025.

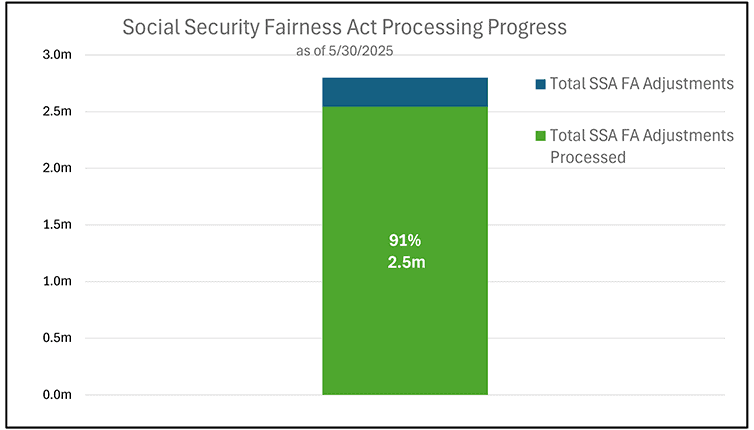

The impact is huge. Over 2.5 million Americans are expected to benefit directly, with billions in total owed in back payments and ongoing increases in monthly retirement income.

When Back Payments Begin?

One of the most pressing questions folks are asking is, “When do I get my back pay?”

The Social Security Administration (SSA) began issuing one-time retroactive payments in late February 2025. These payments cover the difference between what beneficiaries were paid under WEP/GPO and what they should have received without those provisions starting from January 2024.

Most people received their lump-sum payments by March 2025, though some more complex cases — like those with disputed earnings records, multiple pensions, or delayed applications — may take longer. The SSA has acknowledged there’s a backlog for cases requiring manual review, especially among older retirees and widows whose records span several decades.

What’s Changing in Social Security Fairness Act Update?

Starting with benefits earned in March 2025 (paid out in April), people began receiving higher monthly checks going forward.

The average monthly increase depends on how severely WEP or GPO affected your benefits. Here’s a ballpark idea:

- WEP Repeal: Most affected retirees saw their Social Security benefits increase by around $360 per month, though it could range from $100 to over $500.

- Spousal Benefits under GPO: Many spouses saw increases of $700 per month, with some exceeding $900.

- Survivor Benefits: Increases here can exceed $1,100 per month, especially for long-time widows who had large pensions offsetting their benefits entirely.

The most common recipients seeing boosts are retired teachers, law enforcement officers, corrections officers, postal workers, and their spouses or survivors.

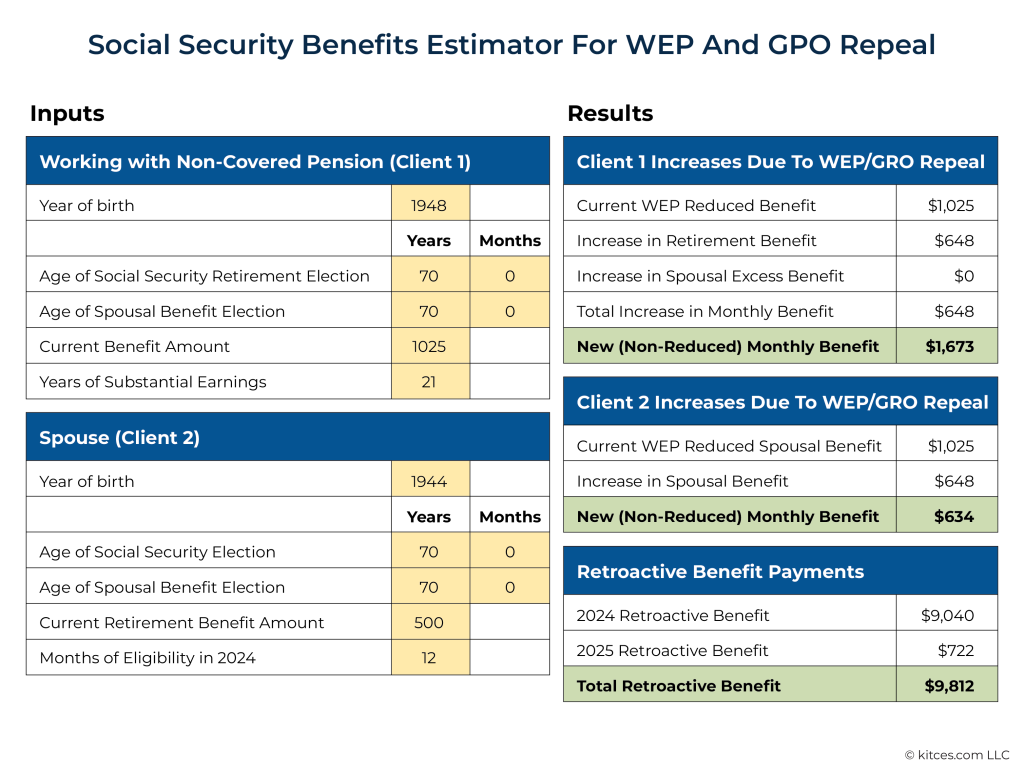

Real-Life Example

Let’s say Maria worked 30 years as a public school teacher in Texas, where her position didn’t pay into Social Security. She also worked 12 years in the private sector, qualifying her for a monthly Social Security check. But under WEP, her monthly benefit was reduced by $400.

Thanks to the Fairness Act, Maria:

- Received a retroactive payment for $400 × 15 months = $6,000

- Began receiving $400 more per month starting April 2025

Now her monthly budget includes more room for rent, groceries, or even helping out her grandkids.

What If You’re Not Yet Receiving Benefits?

This law also opens the door for people who previously didn’t apply for Social Security because WEP or GPO made it not worth the trouble.

If that’s you — maybe you figured the benefit would be too small, or maybe someone at your pension office told you to skip it — now’s the time to reconsider.

The SSA has confirmed that you can apply now and be evaluated under the new rules. If you qualify, you’ll receive:

- Retroactive payments going back to January 2024 (if eligible), and

- Full, unreduced benefits going forward

That’s a major opportunity — and it might be worth talking to a Social Security expert, union advisor, or benefits counselor.

Long-Term Financial Impact

For many families, these benefit increases won’t just improve quality of life today — they’ll change financial plans for decades. Here’s how:

For Retirees:

- Increases monthly income and reduces reliance on savings

- Helps stretch retirement accounts longer

- Improves eligibility for mortgages, refinancing, or senior housing

For Widows and Survivors:

- Provides stable income for surviving spouses

- Reduces financial stress during life transitions

- Restores income that was previously denied

For Professionals:

- Financial planners must adjust long-term cash flow models

- HR and benefits teams should revise retirement seminars and outreach

- Tax professionals should guide clients on how to handle lump sum income properly

Challenges in Implementation

No government rollout is without its bumps. Here’s what’s causing delays:

- SSA Backlogs: Due to staffing issues and old systems, some people’s payments are delayed — especially if their cases involve multiple pensions or missing records.

- Mailing Issues: People who moved or changed banks may experience trouble receiving notices or payments.

- Appeals & Disputes: Some individuals disagree with SSA’s calculations and have opened appeals, which will delay their full payment.

SSA has encouraged patience and recommended that people wait until after receiving their April or May 2025 benefit before calling — to allow time for processing.

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!