Social Security $1,850 Monthly Check: How the 2026 Update Changes This Benefit Amount is not just a headline—it’s a real concern for millions of Americans planning, living on, or advising others about retirement. Whether you’re already getting your check, waiting to claim, or just helping a family member navigate their benefits, the 2026 Social Security changes deserve your attention. If you’re earning around $1,850 a month in Social Security, this article gives you everything you need to know about how your benefit will change in 2026—including COLA increases, Medicare deductions, tax impacts, spousal options, and claiming strategies.

Table of Contents

Social Security $1,850 Monthly Check

In 2026, a 2.8% COLA will increase a $1,850 Social Security check to about $1,902/month. But rising Medicare premiums, taxation thresholds, and income limits could reduce net benefits. This guide breaks down the new changes, planning strategies, and financial tools every retiree should understand. Learn how to time your claims, avoid penalties, maximize spousal benefits, and protect your retirement income in the face of 2026’s Social Security updates.

| Topic | 2025 Amount | 2026 Change |

|---|---|---|

| COLA Increase | – | 2.8% |

| Your $1,850 Monthly Check | $1,850 | ~$1,902 |

| Medicare Part B Premium | $185 | $202.90 |

| Wage Cap for SS Tax | $176,100 | $184,500 |

| Earnings Limit (Under FRA) | $23,400 | $24,480 |

| SSI Max (Individual) | $967 | $994 |

| Spousal Benefit | Up to 50% | Unchanged |

Understanding the 2.8% COLA and Your New Check

The Cost-of-Living Adjustment (COLA) for 2026 is officially set at 2.8%, a response to inflation and rising costs across the country. This increase impacts more than 71 million Americans receiving Social Security or Supplemental Security Income (SSI).

If you currently receive $1,850/month, the 2.8% increase raises your check by approximately $52, bringing your new estimated monthly benefit to about $1,902—before deductions. This amount may seem modest, but it adds up to over $624 per year in additional income.

For seniors and disabled individuals living on a fixed income, even this small increase can go a long way when budgeting for rising expenses—especially on groceries, gas, and utilities.

Why Medicare Premiums Will Eat Into Your Raise?

Most retirees have Medicare Part B premiums automatically deducted from their Social Security check. In 2026, these premiums will rise significantly:

- 2025 Medicare Part B Premium: $185

- 2026 Medicare Part B Premium: $202.90

That’s a nearly $18/month increase that offsets part of your COLA. So, your net Social Security raise may be more like $34/month rather than the full $52.

Those with higher incomes will pay even more for Part B and Part D coverage. Medicare applies “Income-Related Monthly Adjustment Amounts” (IRMAA) for individuals earning more than $103,000 or couples over $206,000.

SSI and Disability (SSDI) Benefits Also Increase

The COLA also affects:

- SSI recipients, who’ll now receive up to $994/month (up from $967 in 2025).

- SSDI recipients, who’ll see an average monthly benefit rise from $1,537 to approximately $1,580.

These adjustments aim to protect America’s most vulnerable populations from the impact of inflation. However, with housing, medical, and food costs rising faster, many advocates argue the COLA is still too low.

Taxation of Social Security $1,850 Monthly Check

Here’s where many retirees are caught off-guard: Social Security benefits can be taxed—up to 85% at the federal level.

The basics:

- If you’re single and your combined income (AGI + nontaxable interest + half of Social Security) is over $25,000, up to 50% is taxable.

- Over $34,000? Up to 85% of your benefit may be taxed.

- For married couples, the thresholds are $32,000 and $44,000 respectively.

Pro Tip: Social Security thresholds haven’t changed in decades, which means even modest COLA increases can push retirees into higher tax brackets, especially if they also have IRAs, pensions, or investment income.

Some states also tax Social Security (like Colorado and Connecticut), but most—38 states—do not. Check your state laws carefully.

Social Security $1,850 Monthly Check Dates and Direct Deposit Only

When You’ll Be Paid:

Social Security is paid on a schedule based on your birthdate:

- 1st–10th birthday → Paid on 2nd Wednesday

- 11th–20th → 3rd Wednesday

- 21st–31st → 4th Wednesday

SSI benefits arrive on the 1st of each month, or the last business day before if the 1st falls on a weekend or holiday.

Paper Checks Ending

If you’re still getting paper checks, know that the SSA is phasing them out completely. You must use:

- Direct deposit to a checking or savings account

- Or the Direct Express debit card, used by over 4 million people.

This change improves security and reduces fraud—but if you haven’t switched, do so ASAP at ssa.gov.

Working While Collecting Social Security

Many folks collect benefits and still work. If you’re under full retirement age (FRA), there’s a limit:

- In 2026, you can earn up to $24,480/year ($2,040/month) without penalty.

- Earn above that, and $1 is withheld for every $2 you earn over the limit.

If you reach FRA in 2026, your limit rises to $65,160. After FRA? No earnings limit. So work all you want—your benefit is unaffected.

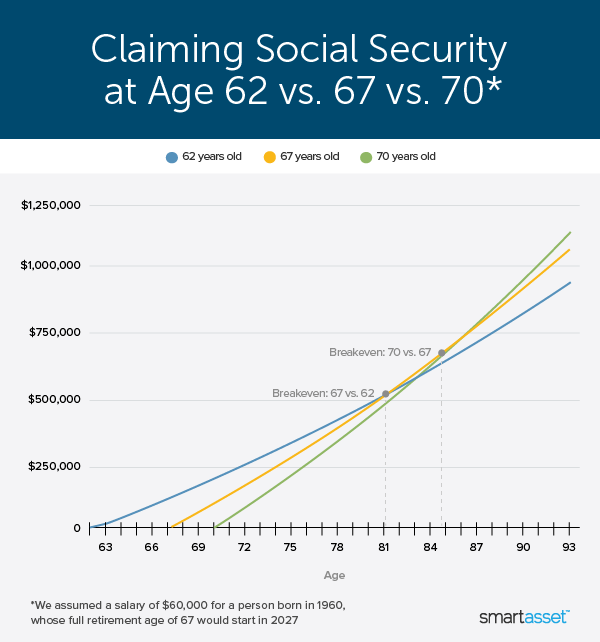

Delaying Social Security = Bigger Monthly Checks

Every month you delay claiming benefits past your full retirement age, your check grows by about two-thirds of 1%, or 8% per year, until age 70.

Here’s how it plays out:

- Claim at 62: ~30% reduction

- Claim at FRA (66–67): Full benefit

- Claim at 70: ~124% of full benefit

If your FRA benefit is $1,850/month, delaying to age 70 could raise that check to over $2,300/month—locked in for life, with future COLA increases based on the higher amount.

Spousal and Survivor Benefits: Smart Family Strategies

Social Security also supports spouses, ex-spouses, and survivors.

Spousal Benefits:

You may qualify for up to 50% of your spouse’s benefit—even if you never worked. You can claim:

- At age 62, with reduced benefits

- Or at full retirement age, for the full 50%

This is especially valuable for couples with uneven work histories.

Survivor Benefits:

Widows and widowers can claim survivor benefits as early as age 60 (or 50 if disabled). You may receive:

- Up to 100% of the deceased spouse’s benefit

- Or switch to your own higher benefit later

Coordinating survivor benefits and your own record can maximize household income over time.

Financial Planning Tips for 2026 and Beyond

To make the most of your Social Security in 2026:

- Use MySSA: Set up your free account at ssa.gov to view your statements, estimates, and benefit calculators.

- Work with a financial advisor to create a claiming strategy tailored to your tax bracket, health outlook, and income needs.

- Consider Roth conversions before claiming Social Security. They reduce future taxable income and help avoid IRMAA surcharges.

- Budget for healthcare, especially if you’ll be enrolling in Medicare. Deductibles, copays, and prescription costs rise yearly.

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Working While Receiving Social Security – 2026 Rule Changes That May Affect Monthly Payments

Big changes are coming to Social Security in 2026: 5 important updates