January 2026 Social Security Checks: January 2026 Social Security Checks are a top concern for retirees, disability recipients, and low-income households as the new year kicks off with changes to deposit dates and benefit amounts. Whether you’re a retiree budgeting your bills or a caregiver helping a loved one plan ahead, understanding when the checks arrive and what changes in 2026 is crucial. This guide offers everything you need to know: payment dates, cost-of-living adjustments (COLA), benefit breakdowns, SSI rules, and what you can do to make your money go further.

Table of Contents

January 2026 Social Security Checks

January 2026 Social Security Checks come with a slightly new rhythm — early deposits, a 2.8% increase in benefits, and important planning notes. Whether you receive retirement, disability, survivors, or SSI benefits, knowing the exact date your check arrives is vital to budgeting and living well. With inflation still looming, every dollar counts. Knowing how COLA works, when to expect your payment, and how to access tools like my Social Security gives you the power to stay ahead. Plan wisely, check your payment dates, and don’t hesitate to contact SSA if something seems off.

| Topic | Details |

|---|---|

| COLA Increase | 2.8% COLA in 2026. Average retiree gains ~$56/month. |

| SSI January Payment | Deposited Dec. 31, 2025 due to New Year’s Day holiday. |

| Social Security Special Case Payments | Jan. 2, 2026 for those who filed before May 1997 or receive both SS and SSI. |

| Standard Payments | Based on birthday: Jan. 14 (1st–10th), Jan. 21 (11th–20th), Jan. 28 (21st–31st). |

| February SSI Paid Early | Deposited Jan. 30, 2026 as Feb. 1 is a weekend. |

| Online Access | https://www.ssa.gov/myaccount |

What Is Social Security and SSI?

Social Security benefits come from the Federal Insurance Contributions Act (FICA) taxes deducted from most paychecks. These funds support:

- Retirement benefits for workers age 62+

- Disability benefits for those unable to work

- Survivor benefits for widows, widowers, and dependent children

- Supplemental Security Income (SSI) for low-income individuals who are elderly or disabled

While Social Security is earned through work credits, SSI is needs-based, and eligibility depends on income, assets, and age/disability status.

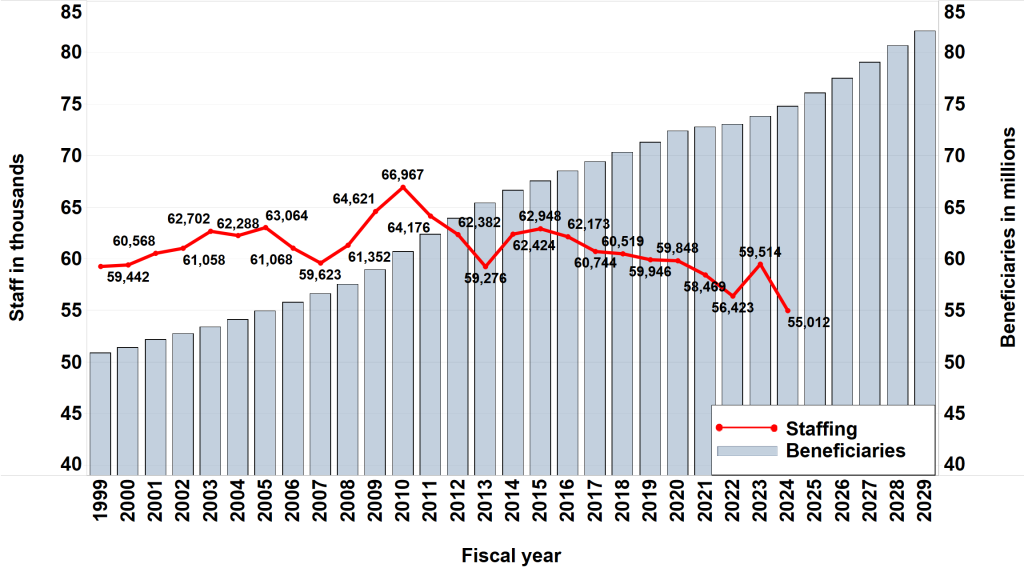

In 2025, more than 71 million Americans received Social Security or SSI benefits, according to the SSA’s annual report. That number continues to rise as more Baby Boomers retire.

What’s New in 2026: 2.8% COLA Increase

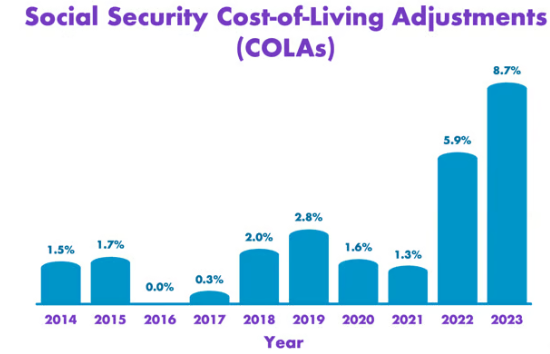

One of the most important annual adjustments to benefits is the Cost-of-Living Adjustment (COLA). Based on inflation measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), COLA helps protect buying power.

For 2026, the COLA is 2.8%. That means monthly checks are increasing as follows:

- Average retired worker: From ~$2,015 to ~$2,071

- SSI Individual (max): From $967 to ~$994

- SSI Couple (max): From $1,453 to ~$1,491

- Max SS benefit at age 70: ~$5,251/month

Even though the increase is smaller than the 5.9% and 8.7% COLAs of 2022 and 2023, respectively, it still provides some cushion against rising costs.

January 2026 Social Security Checks Schedule

Let’s break down how the payment schedule works, especially with holidays in play:

December 31, 2025 – SSI for January 2026

SSI is always paid on the 1st of the month, except when that day falls on a weekend or federal holiday. Since Jan. 1, 2026 is New Year’s Day, payments go out Wednesday, Dec. 31, 2025.

This means you’ll receive your January SSI a day early.

January 2, 2026 – Social Security for Early Filers

Social Security beneficiaries who:

- Began receiving benefits before May 1997, or

- Receive both SSI and Social Security

will receive their January benefit on Friday, Jan. 2, 2026.

This avoids overlapping SSI and SS deposits on the same day, making it easier for recipients to distinguish between their two payments.

Standard Social Security Payment Schedule (Based on Birthdate)

If you started receiving benefits after May 1997, your payment is issued based on your birthdate:

| Birthdate Range | Payment Date (Wednesday) |

|---|---|

| 1st–10th | January 14, 2026 |

| 11th–20th | January 21, 2026 |

| 21st–31st | January 28, 2026 |

Note: If your scheduled date falls on a holiday, SSA shifts the payment to the prior business day.

January 30, 2026 – SSI for February 2026

Because February 1, 2026 falls on a Sunday, the February SSI payment will be issued early on Friday, January 30.

This early release of funds is common throughout the year when the 1st falls on a weekend.

How Will You Get Paid?

Social Security no longer sends paper checks. Instead, recipients receive benefits through:

- Direct Deposit to a checking or savings account

- Direct Express® Debit Card, a prepaid card backed by the U.S. Treasury

Direct deposit is fast, secure, and typically arrives on the morning of your payment date — though it can take until the end of the day depending on your bank.

Tax Considerations for 2026

Many Social Security recipients don’t realize their benefits may be subject to federal income tax depending on total income.

For 2026:

- If you file individual and your income exceeds $25,000, up to 50% of your benefits may be taxable.

- If your income exceeds $34,000, up to 85% may be taxable.

- For joint filers, those limits rise to $32,000 and $44,000.

Note: These income thresholds are not adjusted for inflation, meaning more recipients become subject to taxation each year.

Tip: You can elect voluntary tax withholding via Form W-4V, found here: SSA.gov W-4V Form

Why January 2026 Social Security Checks Dates Matter?

Here’s how knowing your payment date helps:

- Prevent Overdraft Fees: Knowing when money comes in helps avoid late bills or bounced checks.

- Budget Accurately: Especially important for fixed-income seniors managing housing, utilities, and prescriptions.

- Plan for Annual Deductions: Medicare Part B premiums are deducted directly from Social Security for most — knowing the date helps track your net benefit.

Smart Planning Tips for 2026

- Set Up SSA Online Access

Use your my Social Security account to track payments, download tax forms, and update direct deposit:

https://www.ssa.gov/myaccount - Create a Monthly Budget

Plan your expenses around the exact deposit date. Tools like Mint, YNAB, or even a spreadsheet can help you allocate rent, food, healthcare, and other essentials. - Check for State Supplements (SSP)

Some states add a supplement to SSI. Contact your local social services agency or check SSA.gov’s state page. - Re-verify Eligibility Annually

For SSI recipients, the SSA may request annual redetermination forms. Always report changes in income or household status.

The Future of Social Security: What You Should Know

With more Americans retiring every year, concerns over Social Security trust fund solvency are growing.

- The Old-Age and Survivors Insurance (OASI) trust fund is projected to be depleted by 2034, per the 2025 Trustees Report.

- Without legislative action, benefits could be reduced to ~77% of scheduled payments.

While cuts are not guaranteed, Congress may eventually raise taxes, increase full retirement age, or reduce future benefits.

Stay informed and consider building supplemental retirement savings through IRAs, 401(k)s, or other sources.

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Big changes are coming to Social Security in 2026: 5 important updates

Working While Receiving Social Security – 2026 Rule Changes That May Affect Monthly Payments

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!

Big changes are coming to Social Security in 2026: 5 important updates

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026