Social Security Check at $1,850: If you’re receiving a Social Security check at $1,850, you’re not alone—and you’re probably wondering what that payment will look like in 2026. With inflation still affecting everyday costs like groceries, gas, rent, and healthcare, many Americans are paying close attention to how much their monthly Social Security payment could increase in 2026 and whether that increase will truly help in real life. In 2026, Social Security benefits are set to rise due to a 2.8% Cost-of-Living Adjustment (COLA) announced by the Social Security Administration. This adjustment is designed to help benefits keep pace with inflation. On paper, that sounds like good news—and it is—but the real story lies in how much of that increase actually ends up in your pocket after Medicare premiums and possible taxes.

This article breaks everything down in plain, everyday language, with enough depth and professional insight to be useful for financial planners, caregivers, and anyone preparing for retirement. By the end, you’ll know exactly what to expect, how to plan ahead, and what extra details most articles don’t tell you.

Table of Contents

Social Security Check at $1,850

For someone receiving a Social Security check at $1,850, the 2026 COLA of 2.8% raises the gross monthly benefit to about $1,901.80. But after higher Medicare Part B premiums and possible taxes, the real increase most people see is closer to $30–$40 per month. While not dramatic, this adjustment still plays a vital role in helping millions of Americans manage rising costs. Understanding the details—and planning around them—makes all the difference.

| Topic | What Changes in 2026 |

|---|---|

| 2026 Social Security COLA | 2.8% increase |

| $1,850 Monthly Benefit | Increases to ~$1,901.80 (gross) |

| Medicare Part B Premium | Rises to $202.90/month |

| Estimated Net Increase | ~$30–$40/month after Part B |

| When Increase Starts | January 2026 payments |

| Affected Groups | Retirees, SSDI, survivors, SSI |

Understanding the 2026 COLA: Why It Exists and How It’s Calculated

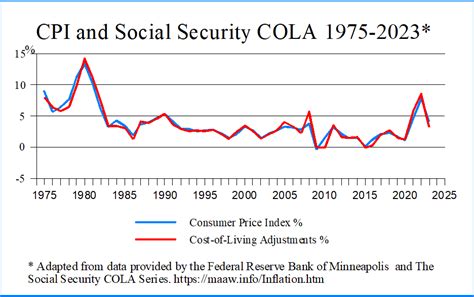

The Cost-of-Living Adjustment (COLA) exists to protect Social Security recipients from losing buying power as prices rise. Each year, the SSA looks at inflation data—specifically the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)—to determine whether benefits need to increase.

For 2026, inflation levels triggered a 2.8% COLA. While that’s lower than some recent years with higher inflation spikes, it still represents a meaningful adjustment for millions of Americans living on fixed incomes.

What’s important to understand is this:

COLA is not a raise—it’s an inflation adjustment. Its purpose is to help you maintain the same standard of living, not to improve it.

What a 2.8% COLA Means for Social Security Check at $1,850?

Let’s talk real numbers.

- Current monthly benefit: $1,850

- 2026 COLA: 2.8%

- New gross monthly benefit: approximately $1,901.80

That’s an increase of about $51–$52 per month, or roughly $624 per year, before any deductions.

This increase applies automatically. You don’t need to apply, call, or fill out paperwork. If you’re already receiving benefits, the adjustment happens on its own through the SSA system.

Why Your Take‑Home Increase Is Smaller Than the Headline Number?

This is where many people feel confused—or even disappointed.

Medicare Part B Premiums: The Biggest Factor

Most Social Security recipients are also enrolled in Medicare, and Medicare Part B premiums are usually deducted directly from Social Security payments.

For 2026, the standard Medicare Part B premium increases to $202.90 per month, up from $185. That’s a $17.90 increase.

The premium is set by the Centers for Medicare & Medicaid Services, not the SSA—but it directly affects your Social Security check.

So while your benefit goes up by about $52:

- Minus ~$18 for Medicare Part B

- Leaves ~$34 in additional monthly income

This explains why many retirees say, “My Social Security went up, but it doesn’t feel like it.”

The “Hold Harmless” Rule: What It Is and Why It Matters

There’s an important protection called the hold harmless provision. It prevents Medicare Part B premiums from increasing by more than your Social Security COLA in certain cases.

However, this protection does not apply to everyone.

You may not be protected if:

- You are a new Medicare enrollee

- You pay higher premiums due to income (IRMAA)

- Your premiums are not deducted from Social Security

For those individuals, Medicare increases can exceed the COLA, meaning your net Social Security payment could stay flat—or even go down.

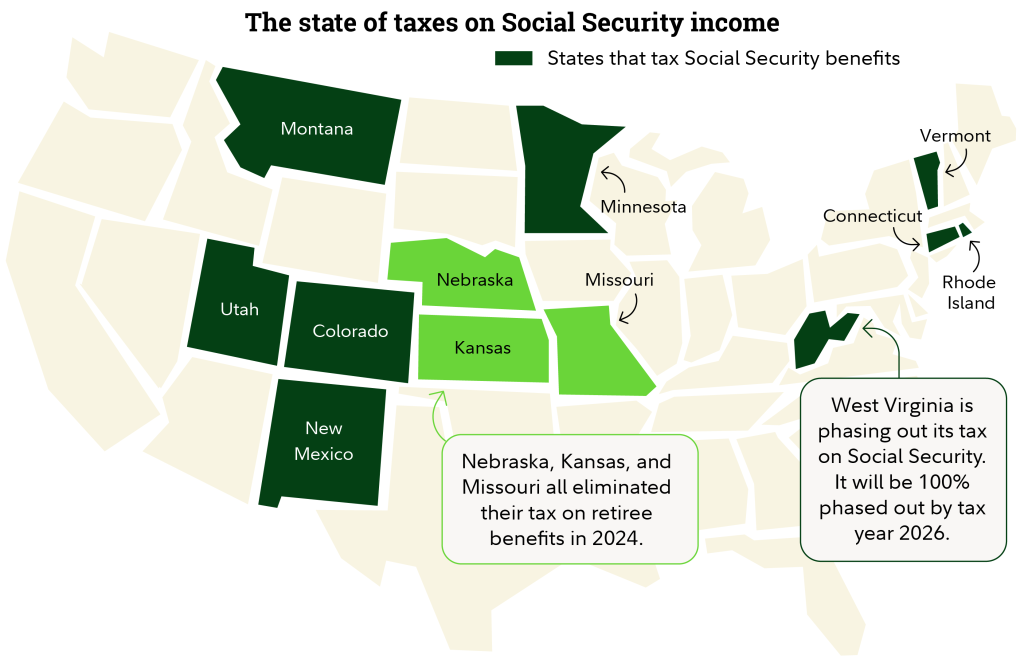

Taxes on Social Security: Another Quiet Reduction

Depending on your total income, Social Security benefits may be partially taxable at the federal level.

Here’s how it works in simple terms:

- If your combined income exceeds $25,000 (single) or $32,000 (married filing jointly), up to 50% of your benefits may be taxable.

- Above $34,000 (single) or $44,000 (joint), up to 85% of benefits may be taxable.

Combined income includes:

- Adjusted gross income

- Nontaxable interest

- Half of your Social Security benefits

Taxes aren’t automatically withheld unless you request it, but they still apply when you file your return.

When You’ll See the Higher Social Security Payment

Most beneficiaries will see the COLA increase starting with January 2026 payments. The exact payment date depends on your birth date:

- Birthdays 1–10: Second Wednesday

- Birthdays 11–20: Third Wednesday

- Birthdays 21–31: Fourth Wednesday

SSI recipients typically see the increase slightly earlier, often in late December.

How the 2026 Increase Affects Different Types of Beneficiaries

Retired Workers

Receive the full 2.8% COLA applied to their benefit amount.

Social Security Disability Insurance (SSDI)

SSDI recipients receive the same COLA percentage as retirees.

Survivor Benefits

Widows, widowers, and dependents also receive the 2.8% adjustment.

Supplemental Security Income (SSI)

SSI payments increase as well, though benefit amounts differ due to income and asset limits.

Why COLA Still May Not Keep Up With Real‑World Costs

One of the biggest criticisms of the current COLA formula is that it doesn’t fully reflect how seniors actually spend money.

Healthcare, prescription drugs, housing, and insurance often rise faster than the CPI-W index used to calculate COLA. Over time, this creates a slow erosion of purchasing power—especially for older retirees.

This is why even a COLA increase can feel underwhelming at the grocery store or pharmacy.

Practical Planning Tips for 2026

1. Review Your Medicare Coverage

Check whether a Medicare Advantage or Medigap plan could reduce out‑of‑pocket costs.

2. Budget Using Net Income, Not Gross

Always plan based on what hits your bank account after premiums and taxes.

3. Prepare for Healthcare Inflation

Assume healthcare costs will rise faster than your Social Security benefit.

4. Monitor Income Thresholds

Even small withdrawals from retirement accounts can push you into higher tax or Medicare premium brackets.

5. Use Official Tools

Your “my Social Security” account on ssa.gov shows personalized benefit details and updates.

Big changes are coming to Social Security in 2026: 5 important updates

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!