2 ETFs to Buy and Hold Forever: If you’re looking to invest your money wisely, grow your wealth, and sleep well at night, let’s talk about two simple, powerful funds: the best ETFs to buy and hold forever. Whether you’re starting with $1,000 or building a long-term retirement nest egg, these Exchange-Traded Funds (ETFs) are designed to take the stress out of investing while delivering solid long-term returns. In this article, we’ll explore why these ETFs are excellent for investors of all levels, how they work, and what makes them true forever funds. You’ll walk away with a clear plan that doesn’t require a finance degree to follow.

Table of Contents

2 ETFs to Buy and Hold Forever

If you want long-term wealth without the stress of picking stocks or timing the market, VOO and VT are your two best friends. Whether you’re a beginner or a seasoned investor, these ETFs offer a simple, low-cost, powerful way to grow your money over time. And yes — you can start with just $1,000. Stick with the plan. Stay in the game. Let time and compound growth work their magic.

| Feature | Vanguard S&P 500 ETF (VOO) | Vanguard Total World Stock ETF (VT) |

|---|---|---|

| What it tracks | S&P 500 – 500 top U.S. companies | Global stock market (9,000+ companies) |

| Expense ratio | 0.03% (Vanguard) | 0.06% |

| Dividend yield | ~1.1% | ~1.8% |

| Diversification | U.S. large-cap only | Global (U.S. + international) |

| Ideal for | U.S.-focused growth | One-fund global exposure |

| Longevity | High – billions in assets | High – global core strategy |

What’s an ETF, and Why Should You Care?

An Exchange-Traded Fund (ETF) is like a shopping cart filled with hundreds or even thousands of stocks. When you buy a share of an ETF, you’re getting a slice of every company in the basket. This diversification helps reduce your risk while exposing you to market-wide growth.

Instead of betting on one company, like Apple or Amazon, you’re betting on the entire market. ETFs are known for being low-cost, tax-efficient, and easy to trade. Think of them as starter packs for long-term investors — built for simplicity and long-term success.

A Brief History: Index Investing and the Power of Simplicity

The idea of investing in the entire market — instead of picking individual stocks — was popularized by John C. Bogle, the founder of Vanguard. In 1975, Bogle launched the first index fund to give investors broad exposure with minimal fees. Since then, index ETFs like VOO and VT have become favorites among legendary investors like Warren Buffett, who once said:

“A low-cost S&P 500 index fund is the best investment most Americans can make.”

This strategy works because most actively managed funds don’t beat the market over time. According to the latest SPIVA report, over 85% of U.S. active fund managers underperformed the S&P 500 over the past 10 years

ETF #1: Vanguard S&P 500 ETF (VOO)

What It Is

VOO tracks the S&P 500 Index, which includes 500 of the largest and most profitable publicly traded companies in the U.S. You’re getting exposure to giants like:

- Apple

- Microsoft

- Amazon

- Johnson & Johnson

- Tesla

These companies power the U.S. economy and have historically produced double-digit returns over long time periods.

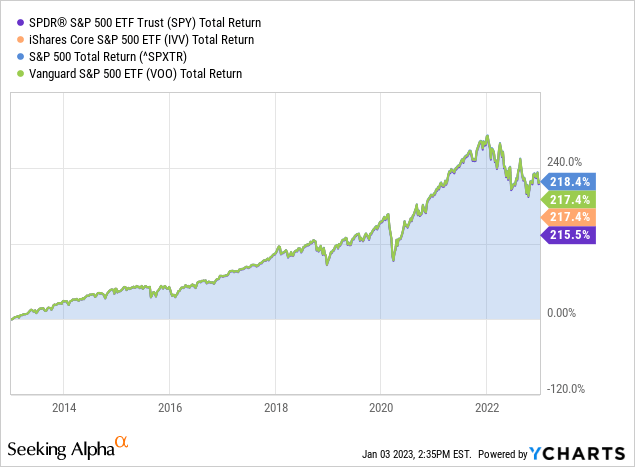

Why VOO Belongs in Your Portfolio

- Expense Ratio: Ultra-low at 0.03%

- High Liquidity: Easy to buy and sell

- Strong Historical Performance: The S&P 500 returned an average of ~10% annually over the last 50 years

Who Should Consider VOO?

- Investors focused on U.S. economic growth

- Anyone building a core portfolio with large-cap exposure

- Long-term investors who want to minimize costs and stay diversified

ETF #2: Vanguard Total World Stock ETF (VT)

What It Is

VT is a one-stop global solution. It includes companies from over 70 countries, with more than 9,000 stocks from developed and emerging markets. You get exposure to:

- U.S. tech (like VOO)

- European giants (e.g., Nestlé, SAP)

- Emerging market leaders (e.g., Alibaba, Infosys)

Why VT Is a “Forever Fund”

- Truly Global Diversification — All major economies included

- Passive Indexing — No guesswork needed

- Low Fees: 0.06% expense ratio is still way below average

VT is ideal for folks who don’t want to research multiple ETFs. With just one fund, you’ve got exposure to almost every publicly traded company on Earth.

2 ETFs to Buy and Hold Forever: How to Invest $1,000 Wisely

So, you’ve got your thousand bucks ready to roll. Here’s how you can put it to work.

Option 1: Invest All in One ETF

If you’re looking for simplicity:

- All in VOO: Focused U.S. growth strategy

- All in VT: Global diversification with a one-click solution

Option 2: Split the Investment

Go 50/50 or 70/30 between the two. This gives you a balance of U.S. strength and global exposure.

Option 3: Use Dollar-Cost Averaging

Instead of dropping the full $1,000 at once, you could invest $250 every month for 4 months. This method, called Dollar-Cost Averaging (DCA), helps reduce the impact of market volatility and avoids buying at a peak.

Staying Invested: Behavioral Tips for Long-Term Success

Investing is as much about behavior as it is about numbers. Here’s how to stay grounded:

- Ignore daily market noise — Watch less CNBC, read fewer headlines.

- Zoom out on the chart — 10+ year charts look much smoother than 1-week charts.

- Reinvest dividends — This adds fuel to your compounding engine.

- Don’t check your portfolio daily — Think decades, not days.

Behavioral finance experts agree: emotional investors lose money. Stick to your plan, automate your investments, and let time do the heavy lifting.

What About Portfolio Rebalancing?

If you’re investing in more than one fund, you’ll want to rebalance once a year. For example, if you go 60% VOO and 40% VT, those percentages will drift as the market moves. Rebalancing resets your allocations — selling high, buying low — without guessing the market.

Most robo-advisors do this automatically, but if you’re DIY-ing it, set a calendar reminder once a year.

Who Should NOT Invest in These ETFs?

As great as these ETFs are, they’re not for everyone.

- People who need cash soon: If you need money in the next 3 years, don’t put it in stocks.

- Short-term traders: These funds are long-term plays, not quick flips.

- Folks with high debt: Pay off high-interest debt first before investing aggressively.