Get $325 in Cash From Wells Fargo: In an age where every dollar counts, savvy Americans are looking for smarter ways to make quick, easy money — and one opportunity that’s catching attention nationwide is the Wells Fargo $325 cash bonus offer. It’s promoted as “No Loans, No Sweepstakes”, and that’s no joke. This isn’t some giveaway based on luck or taking on debt. It’s real, easy money — if you meet just one simple requirement. New customers who open an eligible Wells Fargo Everyday Checking account and receive at least $1,000 in qualifying direct deposits within 90 days can walk away with a $325 cash bonus. Whether you’re a working professional, a student starting your financial journey, or someone simply hunting for a solid sign-up bonus, this opportunity has wide appeal. But don’t let its simplicity fool you — understanding the fine print, planning ahead, and executing correctly are critical if you want to claim this bonus without hiccups.

Table of Contents

Get $325 in Cash From Wells Fargo

The Wells Fargo $325 checking bonus offer is a golden opportunity — simple, real cash for setting up your direct deposit in a new account. As long as you follow the requirements, avoid common pitfalls, and handle the tax side, this bonus can be a quick and easy win. Whether you’re looking to make the most of your banking options, fund an emergency savings account, or just get a little extra breathing room, this offer delivers — no loans, no sweepstakes, no strings (well, not many). Just read the fine print, act on time, and you’re good to go.

| Item | Details |

|---|---|

| Bonus Amount | $325 cash |

| Bank | Wells Fargo |

| Requirement | Receive $1,000+ in qualifying direct deposits within 90 days |

| Offer Deadline | Jan. 14, 2026 (subject to change) |

| Bonus Paid | Within 30 days after meeting requirements |

| Monthly Account Fee | $15 (waivable) |

| Account Type | Wells Fargo Everyday Checking |

| Eligible for New Customers Only? | Yes |

| Official Offer Page | Wells Fargo Bonus Offer |

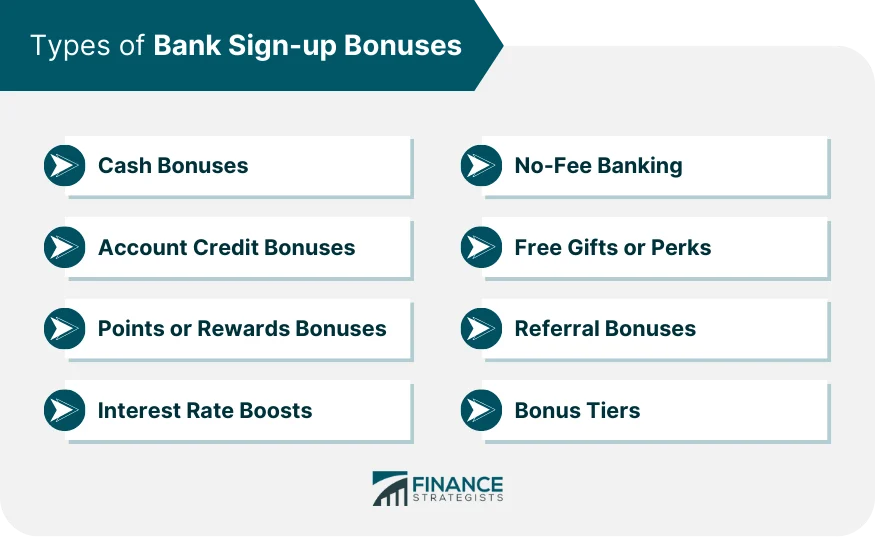

Why Banks Offer These Bonuses — And Why It’s Not Too Good to Be True

You might be asking: Why would a big bank hand out $325 for free? The answer is simple: customer acquisition.

Banks spend billions of dollars every year attracting new customers. A cash bonus is a marketing cost, not a handout. It’s cheaper for Wells Fargo to give you $325 than to pay for a month-long national ad campaign that might not lead to a new account.

In fact, according to a study by Cornerstone Advisors, 65% of U.S. banks now offer some form of sign-up incentive to compete with online banks and neobanks. As a result, consumers who shop wisely can walk away with hundreds — even thousands — of dollars per year by moving their accounts strategically.

What Qualifies as a “Direct Deposit”?

The most crucial piece of this bonus offer is the $1,000 in “qualifying direct deposits.” But what exactly qualifies?

Accepted Direct Deposits:

- Employer payroll via ACH (automatic clearing house)

- Government benefits such as Social Security or disability payments

- Military pay

- Retirement income, pension, or annuity via ACH

What Does NOT Qualify:

- Cash deposits made at ATMs or branches

- Zelle or peer-to-peer transfers

- PayPal/Venmo transfers

- Mobile check deposits

- Internal transfers from other Wells Fargo or external accounts

So, if you’re planning to manually move $1,000 from your other account to Wells Fargo, don’t do it — that won’t count. The deposit must be electronically pushed through a formal direct deposit system.

Step-by-Step: How to Get $325 in Cash From Wells Fargo

Step 1: Open a Wells Fargo Everyday Checking Account

Head to the official Wells Fargo bonus page and begin your application. You must use this page or enter the provided bonus code during application to be eligible. A $25 minimum opening deposit is typically required.

Step 2: Set Up Direct Deposit with Your Employer or Income Source

Log into your employer’s payroll portal and input your new Wells Fargo routing and account number. If you’re self-employed or freelance, talk to clients or platforms that offer ACH payment options.

Make sure you hit the $1,000 threshold within 90 days of opening your account.

Step 3: Wait for the Bonus to Post

Wells Fargo generally pays the $325 bonus within 30 days of meeting the requirement, as long as the account remains open and in good standing.

Real-Life Example: How an Average American Used This Bonus

Let’s take James, a 29-year-old delivery driver from Ohio. He switched his paycheck to Wells Fargo’s Everyday Checking account after hearing about the offer from a friend. In just two pay cycles, James hit the $1,000 mark. A few weeks later, $325 was deposited into his account. He then used that bonus to pay down a credit card bill.

This story isn’t rare — millions of Americans take advantage of bank offers every year. But many also miss out because they make a small mistake, like using non-qualifying transfers or closing their account early.

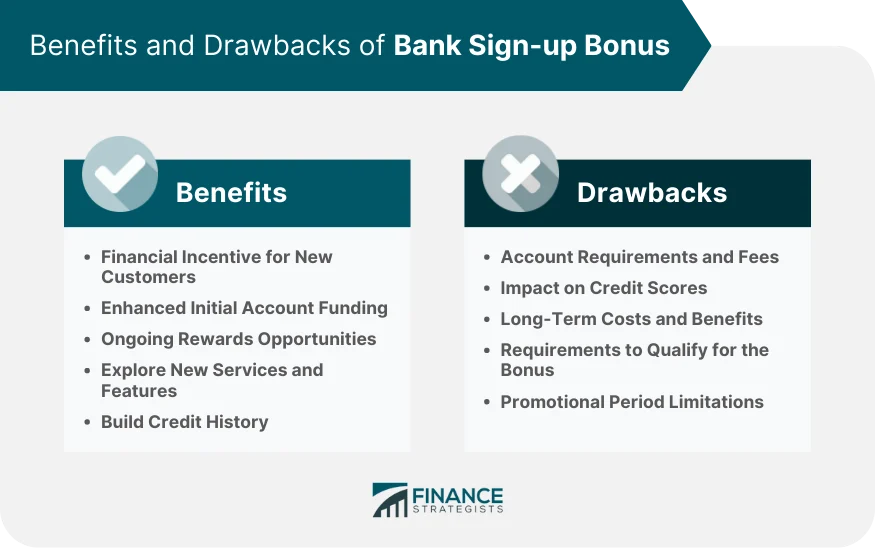

Fee Traps and How to Avoid Them

The Wells Fargo Everyday Checking account does come with a $15 monthly fee, but here’s how you can dodge it:

Ways to Waive the Monthly Fee:

- Maintain a $500 minimum daily balance

- Set up $500+ in qualifying direct deposits per month

- Link a Wells Fargo Campus ATM or Campus Debit Card

- Be aged 17-24

If none of these apply to you, the fee could chip away at your bonus — so make sure you meet at least one of these waiver criteria.

Is $325 in Cash From Wells Fargo Taxable?

Yes — and this often surprises people.

The IRS considers bonuses like this to be “interest income,” and Wells Fargo will send you a 1099-INT form if you earn $10 or more. That means you’re legally obligated to report the bonus as taxable income when filing your taxes.

According to the IRS, the average tax rate on bonus interest ranges between 10%–24% depending on your income bracket. For a $325 bonus, that’s about $33 to $78 in taxes owed, which still leaves you with a net gain of over $240.

How This Offer Compares to Other Banks?

Here’s how Wells Fargo’s $325 bonus stacks up to similar bank offers:

| Bank | Bonus | Deposit Requirement | Deadline |

|---|---|---|---|

| Wells Fargo | $325 | $1,000 direct deposit in 90 days | Jan 14, 2026 |

| Chase Total Checking | $300 | $500 direct deposit in 90 days | Ongoing |

| Citi Checking | Up to $2,000 | Up to $300,000 deposit | Limited Time |

| SoFi Checking | $250 | $5,000+ direct deposit | Ongoing |

Wells Fargo’s offer stands out because of its low direct deposit requirement relative to the bonus size — making it one of the best “easy win” offers for most Americans.

Who Should Consider $325 in Cash From Wells Fargo Offer?

This deal isn’t right for everyone. Here’s a quick breakdown:

Good Fit For:

- Employees with predictable paychecks

- Gig workers who can receive ACH transfers

- College students and recent grads looking to build banking history

- People looking to switch from high-fee banks

Not Ideal For:

- Those without access to direct deposit

- Freelancers paid only via PayPal or check

- People with limited access to Wells Fargo branches (although online access is available)

Common Mistakes to Avoid

- Missing the bonus code: Always use the official link to apply or confirm the code is applied at checkout.

- Sending funds via Zelle or PayPal: These don’t qualify.

- Closing the account too early: Keep the account open until the bonus posts and for a reasonable period afterward.

- Ignoring the monthly fee: Make sure you meet the waiver criteria to avoid eroding your bonus.

Wells Fargo Settlement Payouts: How Much Could Be Coming to You?

Wells Fargo $325 Cash Offer – Meet This One Requirement to Get the Bonus, No Loans or Sweepstakes

Wells Fargo $33 Million Settlement: How Eligible Customers Can Claim Their Payout