$1751 SNAP Benefits: Let’s talk honestly about $1751 SNAP benefits in January 2026 — a figure that’s buzzing across headlines, social media, and community centers. What’s the real story behind it? Is everyone getting that much? Who qualifies for the full amount? When do the payments hit, and what are the new rules in 2026? This article explains all that in plain English, combining expertise with real-life examples, backed by hard data from reliable government sources. Whether you’re new to SNAP or you’ve been navigating the system for years, this guide is here to help — with a professional, grounded take that’s easy enough for anyone to understand.

Table of Contents

$1751 SNAP Benefits

The idea that “everyone is getting $1,751” in January 2026 is misleading — but some families definitely will, especially those with large households and very little income. The new year brings important rule changes that affect work requirements, food purchase rules, and benefit access. Knowing how your income, expenses, and household details affect your SNAP eligibility is key to maximizing your benefits. SNAP remains one of the most powerful tools to combat hunger, reduce food insecurity, and stabilize families — and staying informed is your best defense against confusion, delay, or underpayment.

| Topic | Details / Stats |

|---|---|

| Program Name | Supplemental Nutrition Assistance Program (SNAP) |

| Overseen By | USDA – Food and Nutrition Service (FNS) |

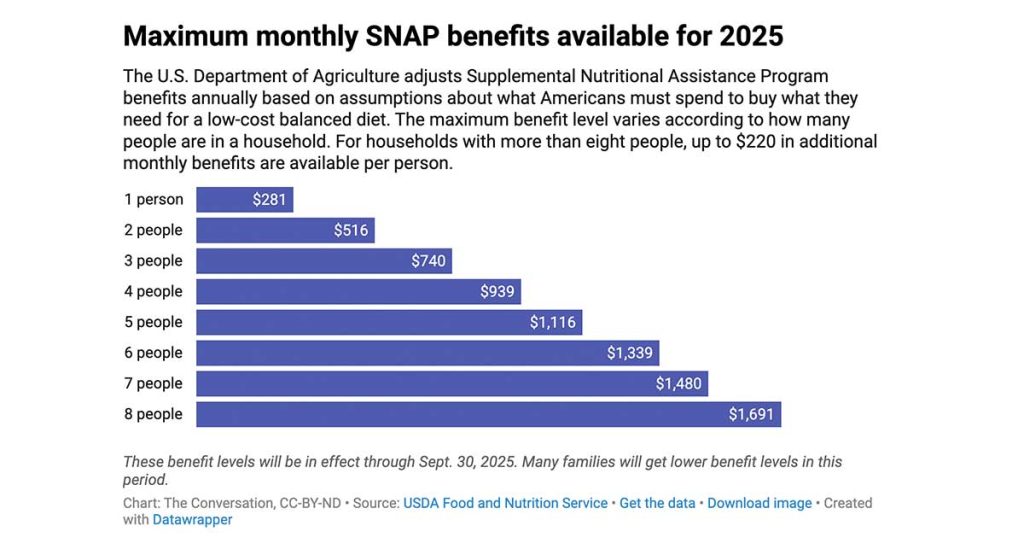

| Max Monthly Allotment (2026) | Up to $1,751+ for large households with no income |

| Average Monthly SNAP Benefit (2024) | ~$347 per household |

| New in 2026 | Expanded work rules, food purchase limits in some states, income adjustments |

| Income Limit Example (Family of 4) | ~$3,483 gross / ~$2,680 net (approx.) |

| Payment Dates | Vary by state — typically Jan 1–20 |

| SNAP Official Website | www.fns.usda.gov/snap |

What Is SNAP?

SNAP stands for the Supplemental Nutrition Assistance Program, formerly known as food stamps. It’s a federal program run by the U.S. Department of Agriculture (USDA) that helps low-income households afford groceries. Benefits are delivered monthly through an EBT (Electronic Benefit Transfer) card, which works like a debit card at approved food retailers.

As of 2024, over 42 million people — nearly 1 in 8 Americans — received SNAP benefits, making it the largest nutrition program in the country. SNAP helps families bridge the gap between paychecks and pantry needs, especially as grocery costs continue to climb.

What Does the $1751 SNAP Benefits Actually Mean?

The $1,751 monthly SNAP benefit is not a guaranteed amount — it’s the maximum possible benefit a household might receive. This figure generally applies to large families (7-8 members) in the 48 contiguous U.S. states and D.C., and only if they have little to no net income.

In reality, most families receive significantly less because of how SNAP calculates benefit amounts. Here’s how it works:

- Each household size has a maximum allotment.

- Your net income (after deductions) is used to determine how much SNAP you get.

- The USDA subtracts 30% of your net monthly income from the maximum allotment to determine your final benefit.

So, the closer your net income is to $0, the closer your monthly SNAP benefit gets to that $1,751 max.

Real-World Example

Let’s break it down:

Family of 8

- USDA max allotment (2026): ~$1,751

- Net income: $0

- Benefit received: Full $1,751

Same family with income:

- Net income: $800/month

- 30% of net income = $240

- Final SNAP benefit = $1,751 – $240 = $1,511/month

That’s why it’s critical to report all allowable deductions — like rent, childcare, and medical expenses — to keep your net income as low as possible for SNAP calculations.

SNAP Income Limits for 2026

Income is a major eligibility factor. Households must pass gross and net income tests, which vary based on household size. Here are estimated 2026 limits for most states (excluding Alaska and Hawaii, which have higher thresholds):

Gross Monthly Income Limits (before deductions):

- 1 person: ~$1,696

- 2 people: ~$2,292

- 3 people: ~$2,888

- 4 people: ~$3,483

- 5 people: ~$4,079

- 6 people: ~$4,675

- 7 people: ~$5,271

- 8 people: ~$5,867

- Each additional person: +$596

Net Monthly Income Limits (after deductions):

- 1 person: ~$1,305

- 2 people: ~$1,763

- 3 people: ~$2,221

- 4 people: ~$2,680

- 5 people: ~$3,138

- 6 people: ~$3,596

- 7 people: ~$4,055

- 8 people: ~$4,513

- Each additional person: +$459

If you have elderly or disabled members, only the net income test applies. Households also must meet resource limits, generally $2,750 or $4,250 (with elderly/disabled members).

2026 SNAP Policy Changes You Should Know

Expanded Work Requirements

A key update for 2026 is the broadening of work requirements. Under the new rules:

- Able-bodied adults aged 18 to 54 without dependents must work, volunteer, or train at least 80 hours/month.

- Failure to meet the requirement may result in losing SNAP after 3 months in a 36-month period.

- Exemptions still apply: people with disabilities, seniors, caregivers, and pregnant women are generally not subject to this rule.

State-Level Food Purchase Restrictions

Another new twist in 2026: some states have started restricting “junk food” from being purchased with SNAP.

Items some states may now ban include:

- Sugary sodas

- Candy

- Energy drinks

- Ice cream or bakery desserts

These rules are state-specific, approved via waivers from USDA, and intended to promote healthier eating among SNAP recipients.

Higher Income Thresholds

The USDA updates income limits each year based on inflation. In 2026, limits have increased slightly, expanding eligibility to more working families who may have previously been on the cusp.

SNAP Payment Dates for January 2026

Every state manages its own SNAP distribution schedule. Here’s what you need to know:

- Most states issue benefits between Jan 1–10

- Some stretch it out through the 20th or even later

- Your payment date is often based on:

- The last digit of your case number

- Your Social Security Number

- Your last name or birthdate

Example:

- Florida issues benefits between Jan 1–28 based on case number.

- California’s EBT deposits fall between Jan 1–10.

- New York splits its schedule by region (NYC vs. rest of state).

To find your exact date, check with your state SNAP agency or visit your EBT portal.

What $1751 SNAP Benefits Can and Cannot Buy?

You can use SNAP benefits to buy:

- Fruits, vegetables, meat, fish, poultry

- Bread, cereal, rice, pasta

- Dairy products

- Seeds or plants to grow food at home

But SNAP cannot be used for:

- Alcohol, tobacco

- Hot foods/prepared meals (like deli counters or fast food)

- Vitamins, supplements

- Pet food or non-food items (like soap or paper towels)

In 2026, some states may also limit “junk food” — check with your local office to see if candy, soda, or chips are restricted where you live.

How to Apply for $1751 SNAP Benefits?

If you think you’re eligible, don’t wait — applying is easier than ever.

Step-by-step guide:

- Visit your state’s SNAP website (Google “[your state] SNAP”).

- Fill out the online application.

- Submit required documents: ID, pay stubs, rent receipts, utility bills.

- Complete a short phone or in-person interview.

- Wait for approval (typically 30 days or less).

- If approved, receive your EBT card by mail.

Most states offer online portals to check status, upload documents, and recertify benefits.

Who Qualifies for the Maximum $1751 SNAP Benefits?

To get the full amount (or close), you must:

- Have a large household (6–8 members or more)

- Show very little or zero net income after deductions

- Live in a state that follows standard SNAP rules (no caps or adjustments)

- Provide complete and verified documentation on time

Families with no income, lots of deductible expenses (like high rent), and multiple children tend to qualify for the highest benefits.

SNAP’s Toughest Rules Yet: How They Could Cost You Benefits

New York Social Security Schedule: Exact December 2025 Payment Dates

Florida SNAP Benefits Return to Regular Schedule — Check Your December Deposit Date