$2,000 IRS Check Is Coming: You might’ve seen it on TikTok, Facebook, or even in a group chat: “The IRS is sending out a $2,000 check to every American this December!”

Sounds exciting, right? Especially during the holiday season when budgets are tight and inflation is still in the air. But here’s the real deal — and this article is going to give it to you straight, in a way that’s easy to understand and full of trustworthy, fact-based info.

Table of Contents

$2,000 IRS Check Is Coming

Despite what viral posts and inbox rumors may say, there is no official $2,000 IRS check coming to every American in December 2025. There’s no federal law passed, no IRS deposit schedule, and no blanket stimulus program approved at this time. What is happening:

- Refunds based on individual tax filings

- Credits like EITC and Child Tax Credit

- Possible catch-up payments if you missed past rebates

| Topic | What’s True | Official Source / Fact |

|---|---|---|

| $2,000 IRS check for all Americans | No federal program approved | Official IRS newsroom: https://www.irs.gov/newsroom/news-releases-for-current-month |

| Recent IRS payments | Some past rebates & missed refunds sent | IRS Economic Impact Payments archive |

| Trump’s “Tariff Dividend” | Political idea, not passed into law | News fact-checks and IRS denial statements |

| Online rumors | Fueled by viral posts and clickbait | IRS scam alert system |

| IRS tax credits & refunds | Still ongoing if eligible | IRS.gov “Get My Refund” and online account |

The Origin of the $2,000 IRS Check Is Coming Rumor

Let’s be honest — Americans have been through a lot financially over the last five years.

Between the pandemic, job losses, stimulus checks, inflation, interest rate hikes, and a rollercoaster stock market, it’s no surprise folks are eager for some extra help.

That’s why it only took one viral video or post to light the fire. People started saying things like:

- “There’s a December 2025 stimulus drop coming!”

- “Check your bank, the IRS is depositing $2,000!”

- “Trump approved another payment!”

Sounds good, but the truth? There’s no official federal $2,000 check scheduled or funded.

None of these claims are backed by IRS publications, White House releases, or Congressional bills.

What’s Actually Happening With IRS Payments?

Here’s what’s real:

1. IRS Refunds and Past Credits

You can absolutely still get money from the IRS — but only if:

- You filed taxes and are due a refund

- You’re eligible for credits like the Earned Income Tax Credit (EITC) or Child Tax Credit

- You missed claiming a previous stimulus check (from 2020–2021) and now qualify via the Recovery Rebate Credit

These refunds or credits can sometimes hit $1,000–$2,000 or more, but again — it depends on your personal tax situation, not some new stimulus.

2. Recovery Rebate Credit Refunds Still Being Processed

If you never claimed your third-round stimulus check (the $1,400 one from 2021), the IRS has continued processing late claims into 2025. That’s real money — but not new money.

Why Are $2,000 IRS Check Rumors So Believable?

This isn’t just about politics or fake news. It’s a perfect storm of human psychology, digital algorithms, and economic pain:

Social Media Algorithms

Platforms push content that goes viral — and what’s more clickable than “FREE MONEY”? Especially when the headline says “IRS confirms” or “breaking stimulus news.”

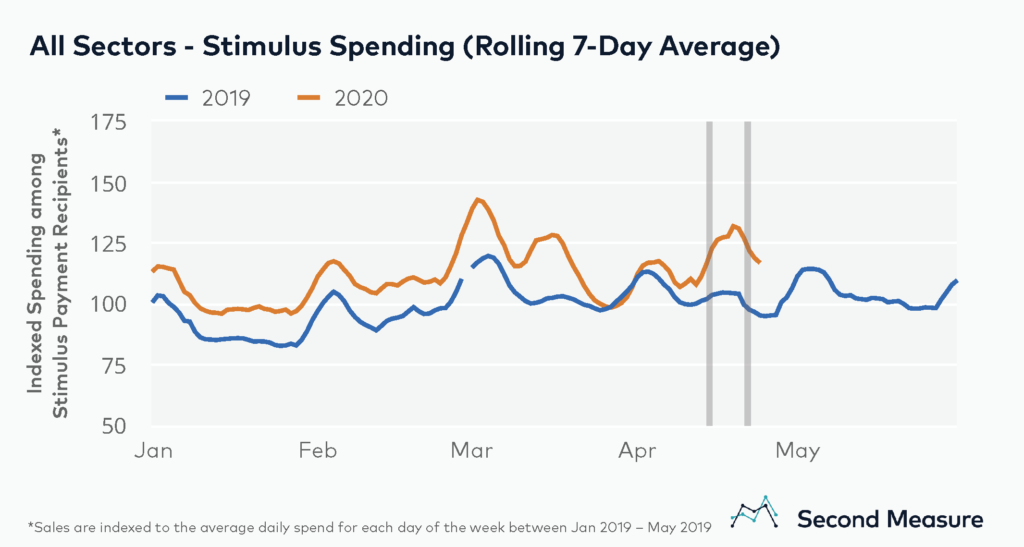

Past Stimulus Checks

We’ve seen real checks before. Three rounds of stimulus checks went out during COVID-19. So people naturally assume more might be coming — especially with an election year looming.

Political Proposals Sound Like Promises

Former President Trump and others have discussed creating a “Tariff Dividend” — using tariff revenues to give households a $2,000 check.

The media picked up on the soundbite, and suddenly folks assumed it was signed into law.

But again — it’s not law, not funded, and not administered by the IRS.

How the IRS Handles Real Payments?

When the IRS sends payments, it’s done with official procedures, timelines, and mass communication.

You’ll see:

- Clear language on IRS.gov

- Emails or letters only if you’re registered

- Taxpayer updates with FAQs and verification tools

- Consistent reporting across mainstream, verified news

What you won’t see is a random TikTok user leaking “secret info” about stimulus checks.

What Is the “Tariff Dividend” and Why It’s Confusing People?

The phrase “Tariff Dividend” is catchy. Trump proposed using tariff revenue collected from foreign countries — especially China — to send direct checks to American households.

Here’s the breakdown:

- The idea is real — it’s part of campaign conversations.

- But it has no legal basis yet.

- There’s no Congressional support or budget passed.

- The IRS cannot act on campaign promises — only on passed laws.

What Might You Actually Receive from the IRS?

Even though there’s no new $2,000 check, some Americans could see that kind of money deposited. How? Through:

- Annual tax refunds

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education Credits

- Missed 2021 stimulus claims (Recovery Rebate)

So yes — you might get money. But it’s based on your own income, family status, and tax filing.

For example:

- A single parent with 2 kids making $38,000/year could see a refund of $3,000–$5,000

- A young worker who overpaid payroll taxes might get $800–$2,000

How to Check Your $2,000 IRS Check Status (Step by Step)

Here’s what you should do to see if you have money coming from the IRS:

Step 1: Log Into IRS.gov

Use the “View Your Account” feature to check past refunds, upcoming payments, and account balances.

Step 2: Use the “Get My Payment” Tool

If any past rebates or credits are owed, this tool shows status updates.

Step 3: File or Amend Your Return

If you missed a credit or refund (such as for 2021), you can amend your tax return within 3 years to claim it.

Step 4: Don’t Trust Unofficial Sites

Avoid entering your Social Security number or bank info on non-IRS websites claiming to “verify” your stimulus eligibility.

How to Tell a Real IRS Payment From a Scam?

With the $2,000 check rumor trending, scammers are flooding inboxes and texts with fake promises.

Here’s what to remember:

The IRS Will NEVER:

- Ask you to click a link to “claim payment”

- Text you for your SSN

- Ask for a “release fee”

- Threaten you with jail for not responding

Real IRS communication is:

- Mailed via USPS

- Only emailed after IRS account setup

- Available to verify at IRS.gov

The Economic & Political Climate Around the Rumor

Inflation, rising rent, and uncertainty have made people hopeful. Politicians know that — and voters respond to headlines promising economic relief.

But legally, any such plan must:

- Be written into a bill

- Be passed by both chambers of Congress

- Be signed into law by the President

- Be funded by the Treasury

- Be administered by the IRS with detailed rules

None of that has happened for a $2,000 check.

What to Do If You’re Hoping for IRS Help?

If you were counting on this rumor being true, here’s some solid advice:

1. Don’t Bank on Unconfirmed Payments

Plan your finances based on confirmed tax credits or refunds only.

2. File Early and Accurately

Early filers tend to get refunds faster. Don’t wait for April if you’re owed money.

3. Set Up an Online IRS Account

You’ll get real-time updates and secure access to transcripts and records.

4. Track Proposed Legislation

If Congress ever introduces an actual stimulus bill, you’ll find it on congress.gov — not Facebook.

Illinois expands property tax relief for seniors: Check eligibility and application

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!

Alaska’s $1,000 Payments: Check Eligibility Criteria and Official Payment Date