Maine increases minimum wage: When you hear the phrase Maine increases minimum wage in 2026, it’s not just another regulation — it’s a meaningful change that affects over 100,000 hardworking Mainers and thousands of employers across the state. Whether you’re pouring coffee in Portland, cleaning cabins up north, or running payroll for a mid-sized business, this wage hike is more than numbers — it’s about dignity, fairness, and keeping pace with real life. On January 1, 2026, Maine’s minimum wage increases to $15.10 per hour, with adjusted rates for tipped employees, salaried workers, and city-specific ordinances. This annual update reflects Maine’s unique policy of indexing wages to inflation — one of the most worker-conscious systems in the country.

Table of Contents

Maine increases minimum wage

Maine’s 2026 minimum wage increase to $15.10/hour reflects a growing national trend toward wage fairness, driven by voter mandates and economic data. This change will impact workers across sectors — including restaurant staff, farmers, retail clerks, and salaried employees — while providing clear expectations for businesses to follow. By tying wages to inflation, Maine has created a stable, transparent, and fair system that supports workers without political wrangling. Whether you’re earning a paycheck or signing them, these changes matter — and they reflect a future that values work and wages that keep up with life.

| Category | 2026 Value | Details / Source |

|---|---|---|

| State Minimum Wage | $15.10/hour | Applies statewide from Jan. 1, 2026 (maine.gov) |

| Tipped Minimum Wage | $7.55/hour | Must earn $15.10/hour total including tips |

| Salary Threshold | $871.16/week (~$45,300/year) | For overtime exemption classification |

| Portland City Minimum | $16.75/hour | Local ordinance supersedes state rate |

| First Time for Ag Workers | Full coverage | Agricultural workers included under wage law |

| Law Origin | 2016 Voter Initiative | Indexes wages to CPI-W inflation |

Why the Maine increases minimum wage — The Roots Behind the Change

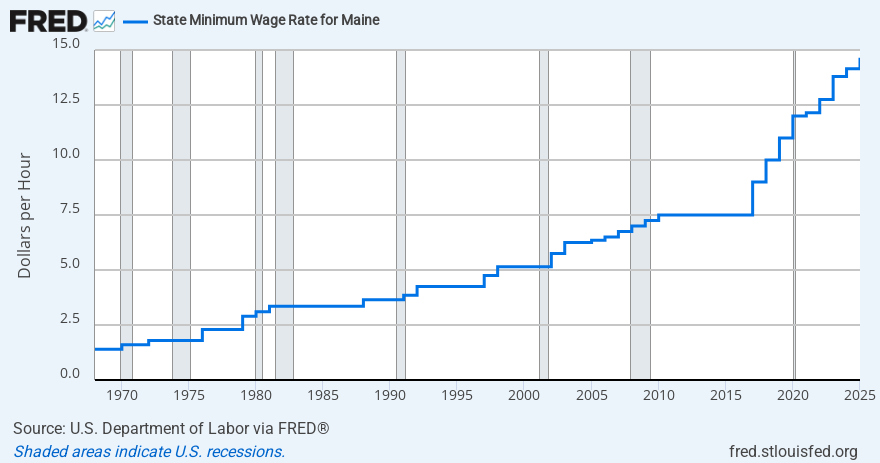

Let’s talk about why this change is happening. Back in 2016, Maine voters approved a ballot initiative that not only raised the minimum wage but locked in automatic increases based on inflation. That means the state doesn’t need to debate wage changes every year — it simply adjusts based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

This system is grounded in fairness. If the cost of groceries, gas, and housing goes up, so should the minimum wage. It’s about economic justice, not politics.

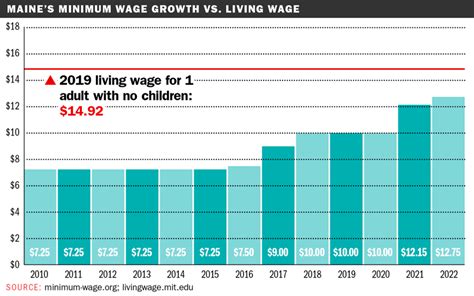

What sets Maine apart is that it was one of the first states in the U.S. to adopt a fully indexed model for its minimum wage. As of 2026, Maine’s rate will be more than double the federal minimum wage of $7.25/hour, which hasn’t changed since 2009. That shows leadership.

Detailed Breakdown of Maine increases minimum wage

Statewide Minimum Wage: $15.10/hour

This applies to all non-exempt, hourly workers who are not covered by a higher local ordinance. It’s a 3.1% increase from 2025’s $14.65/hour.

Whether you’re working in a grocery store, factory, hotel, or warehouse — this new baseline matters. And while it may sound modest to some, over a 40-hour week, that’s over $600 — a meaningful step for many working families.

Tipped Wage: $7.55/hour (Plus Tips to $15.10/hour)

Maine allows a tip credit, meaning employers can pay less in direct wages if tips make up the difference. But if tips don’t bring you to $15.10/hour, your boss has to make up the shortfall — that’s the law.

Employers are also legally required to keep accurate tip records. You can’t rely on “honor systems” or mental math. If the employer can’t prove you’re making enough with tips, they must pay you the difference out of pocket.

This system protects restaurant servers, hotel staff, bartenders, and delivery drivers — industries where abuse or misclassification can happen without safeguards.

Who’s Covered — And What’s New

Salaried (Exempt) Employees: $871.16/week Minimum

If you’re a salaried worker (and not eligible for overtime), your weekly salary must be at least $871.16 starting in 2026. That’s about $45,300 annually.

But salary isn’t everything — job duties also matter. Under both Maine and federal law (Fair Labor Standards Act), being exempt from overtime pay requires passing a duties test — not just hitting a number. That includes things like managing teams, using discretion, or holding specialized expertise.

Bottom line: just giving someone a salary doesn’t make them exempt.

Agricultural Workers Now Covered

This is historic — Maine’s 2026 wage rules now apply to farm workers, who were previously excluded. This change impacts seasonal laborers, migrant farmhands, and small local ag operations. These workers will now have access to wage protections for the first time — a long-overdue move toward equity.

What About Cities Like Portland?

Maine allows local municipalities to set their own, higher minimum wage if they choose. Portland leads the way.

Portland, Maine: $16.75/hour

This rate applies citywide. For tipped workers, the base wage is $8.38/hour, and the employer is still responsible for ensuring tips bring workers to at least $16.75/hour. If they don’t — the business must pay the difference.

Portland’s ordinance was passed by voters in 2020 and has adjusted annually since. It’s helped local workers in one of Maine’s highest-cost regions keep up with rising rents and living expenses.

Other cities like Rockland are following suit — raising wages locally depending on employer size and scope. Employers must always follow the highest applicable wage law — federal, state, or local.

How Maine increases minimum wage Impacts Different Industries?

The wage increase doesn’t hit every sector the same way. Here’s how it plays out across key industries:

Hospitality and Tourism

Lodges, resorts, restaurants, and bars must now plan for higher base wages and stricter tip compliance. These industries often run on seasonal labor, so this is a budgeting issue.

Retail

Big box stores and grocery chains already tend to pay above minimum wage, but small local shops may need to update their systems. Wage compression (where senior workers earn close to entry-level ones) can become a concern.

Manufacturing and Logistics

This sector sees ripple effects. Even if most jobs pay above the minimum, wage floors push up entry-level rates, creating pressure on mid-level roles and union negotiations.

Small Businesses

For small mom-and-pop businesses, the increase can feel challenging. However, many economists argue that minimum wage increases boost local economies — because low-wage earners tend to spend their paychecks locally.

Practical Compliance Tips for Employers

If you’re an employer in Maine, here’s a checklist to stay compliant:

- Update Payroll Systems

Adjust pay rates and schedules by December 31, 2025, to reflect the new rates. - Review Tip Reporting Procedures

Use time tracking and digital payroll systems that can handle tip allocation and employer top-ups automatically. - Audit Exempt Employee Classifications

Ensure salaried workers earn at least $871.16/week and pass the duties test. - Post Updated Labor Law Posters

Maine requires wage posters be visible in employee areas. Digital posting is allowed for remote teams. - Communicate Early

Notify employees of the change ahead of time — it builds trust and transparency.

Rural vs. Urban Impact

Not all parts of Maine look like Portland. In northern and rural areas, the cost of living is lower, but so is job density. For businesses in rural Maine, absorbing wage increases can be harder — but they’re still required to comply.

On the worker side, it means better earnings where wages have traditionally lagged. For low-income communities, even a $0.45/hour raise can help cover bills, gas, and heating costs — especially during the long Maine winters.

New Montana Law Means Bigger Paychecks: Minimum Wage Hike Kicks In January 1, 2026

It’s Official: New York Announces 2026 Minimum Wage Hike; Here’s Who Benefits Most