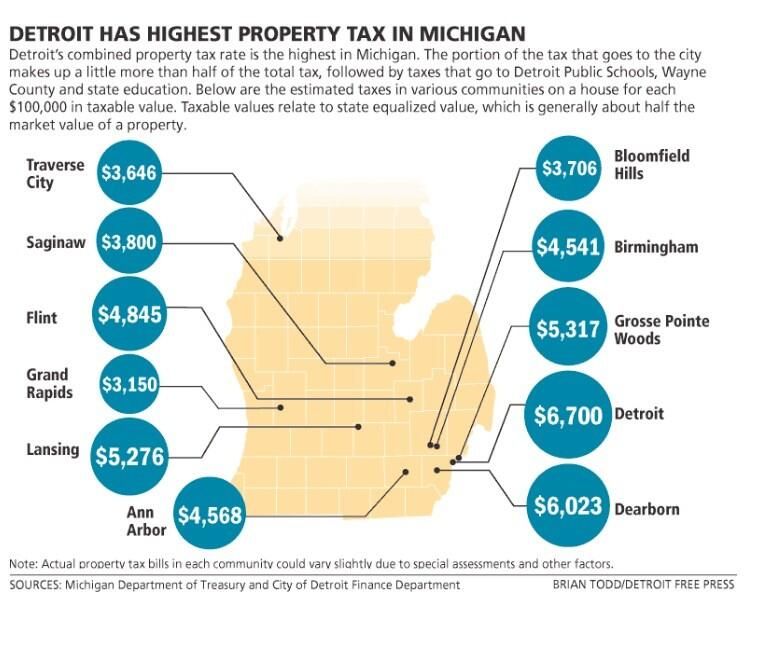

Michigan Tax Cut Proposal: The Michigan Tax Cut Proposal – Millions of Households Could Pay Less If This Bill Passes is stirring up conversation across the state. Whether you’re in Detroit, Grand Rapids, Traverse City, or the Upper Peninsula, there’s a good chance this bill could put money back in your pocket — or shift how public services are funded in your community. Lawmakers are weighing a major overhaul of property tax rules, and the move could exempt nearly 72% of Michigan households from a portion of property taxes — particularly those used to fund K–12 public education. The bill also revisits the hotly debated state income tax rate, proposing to lower or freeze it in a way that affects every working taxpayer. This article breaks it all down: what the proposal says, how it would work, who benefits, who might lose out, and what it means for the future of Michigan’s schools, economy, and local governments. Whether you’re a homeowner, business owner, or just a curious citizen, this guide is built to help you understand the facts — without political spin.

Table of Contents

Michigan Tax Cut Proposal

The Michigan Tax Cut Proposal is more than just numbers on a spreadsheet — it’s a test of the state’s values, priorities, and ability to balance relief for taxpayers with responsibility to schools and public services. If passed, it would mark one of the largest shifts in Michigan’s tax policy in decades, potentially saving households thousands while reshaping the way education is funded. But the consequences — both intended and unintended — will be long-lasting. For now, residents should pay close attention, stay informed, and voice their opinions, because what’s on the table today could define the state’s future for a generation.

| Topic | Details | More Info (Official) |

|---|---|---|

| Proposal Focus | Cut property taxes tied to school funding for households without K‑12 students | 2025 HB 5376‑5379 Proposal |

| Phase‑In Timeline | 40% cut in 2027 → full cut by 2031 | As outlined in bills |

| Households Impacted | ~72% of Michigan homes | Legislative estimates |

| School Aid Funding | ~$24 billion+ in FY 2026 | State budget documents |

| Income Tax Debate | Proposal to lock MI rate at 4.05% | HB 4170 |

| Current MI Income Tax Rate | 4.25% – 2025 default rate | MI Treasury FAQ |

| Debate Status | Under legislative review, in committees | Pending vote |

What’s Actually in the Michigan Tax Cut Proposal?

The heart of the tax proposal is to exempt certain households from the portion of their property taxes that go to public school funding. This is known as the State Education Tax (SET), which forms a significant part of every property owner’s annual bill.

Under this bill:

- Only homeowners who do not have children in Michigan public K–12 schools would qualify.

- The exemption would be phased in over five years, starting in 2027 and reaching full implementation by 2031.

- The state would still fund schools, but not through these households’ property taxes.

Supporters say it’s about fairness — why should someone pay for a service they don’t use? Opponents say it’s about community — we all benefit from an educated population and should help pay for it, even if we don’t have kids in school.

This idea may seem new, but versions of it have floated around Lansing for decades. What’s different now is the political timing, growing pressure to ease housing costs, and ongoing debates over how best to fund public education in a changing economy.

Real-World Example: How Much Could You Save?

Let’s break this down with an example that applies to many Michigan households.

Property Value: $300,000

Taxable Value: $150,000 (used for tax calculation)

State Education Tax Rate: About 6 mills (0.006)

Currently, this household pays around $900 per year just for the State Education Tax. Under the proposed plan:

- In 2027, they’d get a 40% exemption, saving about $360.

- By 2031, the full $900 would be exempt — every single year.

Over a 10-year span, that’s nearly $6,000 in potential savings for qualifying households. Multiply that by hundreds of thousands of homes, and you’re talking billions in shifted tax responsibility statewide.

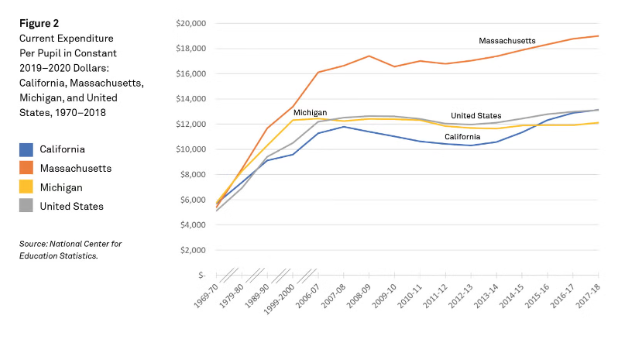

How Would Michigan Tax Cut Proposal Impact Michigan’s Schools?

That’s where the controversy kicks in.

Currently, the School Aid Fund in Michigan receives more than $24 billion annually, and property taxes contribute a large slice of that pie. Removing nearly three-quarters of households from paying the education tax would leave a large gap.

The proposal does not yet clearly define how that funding would be replaced. Possible options discussed include:

- Redirecting other state revenue (e.g., sales tax, income tax)

- Increasing “user-based” fees or targeted levies

- Trimming education budgets, a politically risky option

Educators, school boards, and some parent groups warn that this change could destabilize long-term school funding, particularly in communities already struggling with enrollment declines and outdated infrastructure.

In short, unless lawmakers backfill that lost tax revenue with new sources, schools may feel the squeeze.

Income Tax Debate: Another Piece of the Puzzle

At the same time, Michigan lawmakers are considering lowering the state income tax rate from 4.25% to 4.05%, making permanent a temporary reduction that briefly took effect in 2023.

Here’s what you need to know:

- The 4.05% rate was in place for one year, due to a 2015 trigger law tied to revenue growth.

- In 2024, the rate returned to 4.25%, but Republicans argue it should stay lower.

- The new proposal would lock in the 4.05% rate, possibly with future reductions if revenue continues to exceed spending.

On paper, this benefits everyone who earns income in Michigan — workers, retirees with pensions, small business owners, and investors.

But the income tax is a major part of Michigan’s general fund. Critics say cutting it without adjusting spending could lead to shortfalls in areas like health care, roads, and public safety.

Who Benefits — And Who Might Not?

Most Likely to Benefit:

- Homeowners with no children in public schools

- Retirees and empty nesters

- Dual-income households with strong earnings

- Business owners with commercial properties

Those Who May Not Benefit:

- Families with kids in K–12 public schools

- Renters (unless landlords pass down savings)

- School districts in high-need areas

- Communities reliant on strong state funding

That said, even renters and public school families may benefit indirectly, if lower taxes help stabilize property markets or reduce financial stress for other households. But the proposal’s benefits aren’t evenly distributed.

Historical Context: Michigan’s Tax Policy Evolution

Tax debates are nothing new in Michigan. The state has had:

- Flat income tax rates since the 1960s.

- Significant cuts to business taxes in 2011, when the Michigan Business Tax was eliminated in favor of the Corporate Income Tax.

- The Proposal A overhaul in 1994, which changed how schools were funded by increasing sales tax and reducing property tax volatility.

This new plan could be seen as the most dramatic shift since Proposal A, particularly in how it might disentangle homeowners from school funding, reversing a key principle of shared community investment in public education.

Political Landscape and Public Sentiment

Supporters of the proposal argue that it:

- Makes taxes more equitable for those not using school services.

- Lowers cost of living for middle-class families and retirees.

- Encourages housing investment and long-term property ownership.

Opponents counter that it:

- Threatens school funding stability.

- Shifts the tax burden to a smaller group of residents.

- Erodes the social contract of shared responsibility for education.

Public opinion appears mixed but intrigued. Many Michigan residents support tax relief, especially amid inflation and rising home prices, but don’t want to see schools suffer.

With elections on the horizon, some leaders have floated the idea of putting the measure on a statewide ballot in 2026, letting voters decide.

Step-by-Step Breakdown: How a Tax Law Is Made

- Bill Introduction: Lawmaker drafts the bill and files it in the House or Senate.

- Committee Hearings: Specialized committees review the bill, often holding public testimony.

- House & Senate Votes: Each chamber debates and votes. Bills may be amended or returned for changes.

- Governor’s Signature or Veto: The governor can sign the bill into law or send it back.

- Implementation: If passed, agencies like the Department of Treasury handle the rollout.

This process can take months or even years, especially for sweeping tax changes.

States Continuing Tax Rebates and Refunds Before 2025 Ends — Full Overview

Illinois expands property tax relief for seniors: Check eligibility and application

These States Are Sending Tax Refunds Before 2025 Ends; Is Yours on the List?