Social Security January 2026 Payments: Social Security January 2026 Payments are officially scheduled, and if you’re one of the millions of Americans who count on Social Security — for retirement, disability, or Supplemental Security Income (SSI) — you want the clearest, most accurate picture of when your money arrives, how much you’ll receive, and what affects your net benefit. This guide breaks it all down from the official Social Security Administration and trusted financial reporting — in plain language but with the deep insight you need for planning and budgeting. No confusion, just facts and friendly guidance.

Official SSA info shows that the Cost‑of‑Living Adjustment (COLA), payment schedule, and other key rules for 2026 are now set and coming soon. Social Security payments are more than just deposits. For millions of Americans living paycheck‑to‑paycheck, budgeting around Social Security dates and amounts is a big deal. What’s more, tax rules, Medicare premiums, and earnings limits all interact with your monthly check — and many people aren’t fully aware of how that works until they see their net payment. This article walks you through everything with clear examples, practical steps, and accurate data you can trust.

Table of Contents

Social Security January 2026 Payments

Here’s the bottom line: Social Security January 2026 payments are now officially scheduled. Most beneficiaries will see deposits on Jan 14, Jan 21, or Jan 28, depending on their birth date. SSI payments for January are paid early on Dec 31, 2025, due to the New Year’s Day holiday. A 2.8% COLA increase boosts benefits for millions in 2026, but rising Medicare premiums and deductibles mean your net income might not rise as much as expected. Planning ahead, understanding tax and earnings limits, and using your my Social Security account will give you a stronger financial footing going into the new year.

| Topic | Key Detail |

|---|---|

| January 2026 Social Security Payment Dates | Jan 14, Jan 21, Jan 28 (based on birth date group) |

| January SSI Payment Arrival | Dec 31, 2025 (due to Jan 1 federal holiday) |

| 2026 Cost‑of‑Living Adjustment (COLA) | 2.8% increase for most recipients, effective January 2026, and SSI on Dec 31, 2025 |

| Average Monthly Benefit (2026) | Around $2,071 for retirees after COLA |

| Max Monthly Benefit (2026) | Up to $5,251 for those waiting until age 70 |

| Medicare Part B Premium (2026) | $202.90/month — up from $185 |

| Medicare Part B Deductible (2026) | $283 — up $26 from 2025 |

| Earnings Limits (2026) | Under full retirement age: $24,480; If reaching full retirement age this year: $65,160 |

| Official SSA Website | https://www.ssa.gov |

When Your Social Security January 2026 Payments Will Hit Your Account?

Most people get their Social Security deposit based on their birth date grouping:

Standard Payment Schedule

- Birthdays 1–10: Wednesday, January 14, 2026

- Birthdays 11–20: Wednesday, January 21, 2026

- Birthdays 21–31: Wednesday, January 28, 2026

These dates reflect the SSA’s organized monthly payment structure. If a scheduled date falls on a holiday or weekend, benefits are often paid the business day before.

Important Holiday Rule — SSI Gets Paid Early

If you receive Supplemental Security Income (SSI), your January payment arrives on Dec 31, 2025 instead of Jan 1 because Jan 1 is a federal holiday. This ensures you aren’t waiting extra days for your check. This early deposit may look like getting two checks in December — but it’s just the January SSI payment arriving early.

Your Social Security Benefit Is Changing in 2026 — Here’s How

Cost‑of‑Living Adjustment (COLA)

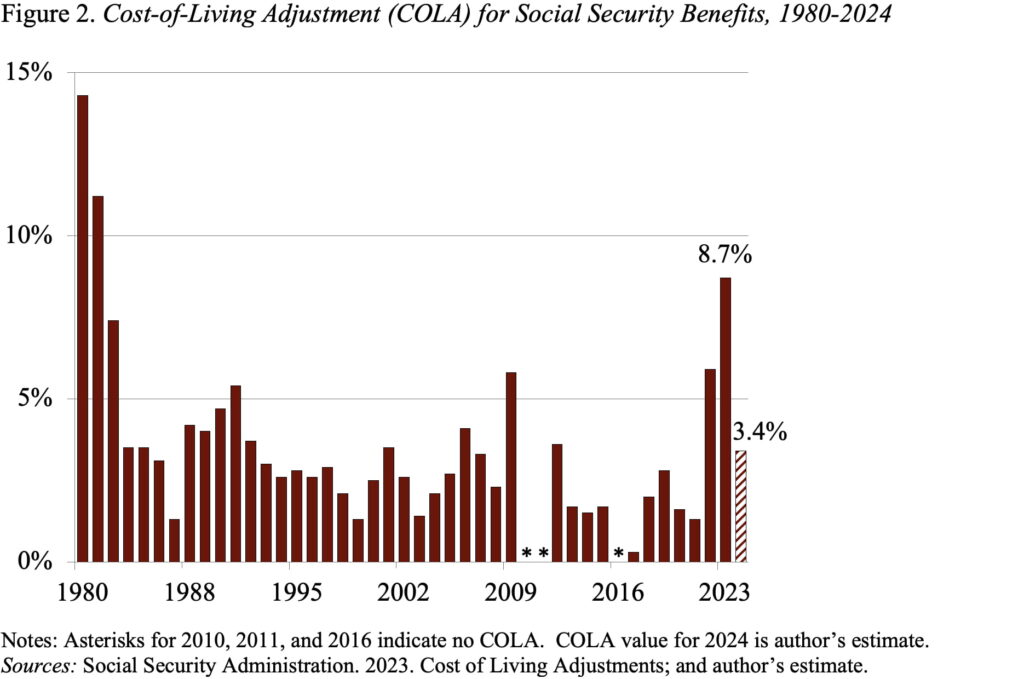

Every year the SSA adjusts benefits to help keep pace with inflation — that’s the COLA. For 2026:

- The COLA is 2.8%, a slight uptick from 2025’s 2.5% raise.

- Nearly 71 million Social Security beneficiaries and about 7.5 million SSI recipients will see this boost.

This adjustment means the average monthly retirement benefit is expected to rise to around $2,071 in January — roughly $56 more per month than before.

For individual beneficiaries who wait until age 70 to claim, the maximum monthly benefit will climb from about $5,108 in 2025 to $5,251 in 2026 — over $1,700 more per year for those top earners.

But There’s a Big “Catch” with Medicare Costs

Here’s where many people get tripped up: Medicare premiums are automatically deducted from your Social Security check if you’re enrolled in Part B (medical insurance) — and those costs are rising faster than the COLA.

- In 2026, the standard Medicare Part B premium jumps to about $202.90 per month, up roughly $17.90 from 2025.

- The Part B deductible — the amount you pay before Medicare starts covering costs — increases to $283 in 2026.

For many retirees, this means a chunk of that 2.8% COLA could be eaten up just to cover higher Medicare costs. Some analyses show the Part B hike could wipe out about one‑third of the COLA increase for average beneficiaries.

If you’re enrolled in income‑related monthly adjustment amounts (IRMAA) — meaning you have a higher income — your Part B premium could be much larger than $202.90, as high as several hundred dollars per month.

Taxes, Earnings Limits, and Working While Retired

Taxes on Your Social Security

Whether your Social Security benefits are taxable depends on your total income. Many retirees pay no federal tax on benefits — but if your income exceeds certain thresholds, up to 50% or even 85% of your benefits can be taxable.

A new tax deduction introduced for 2026 allows older taxpayers up to $6,000 (individual) or $12,000 (married filing jointly) against income — which for many could reduce or eliminate taxes on Social Security income.

Working and Collecting Social Security

If you plan to work while collecting Social Security before reaching your full retirement age (FRA), your earnings can affect your benefit:

- For those under FRA in 2026, SSA deducts $1 from benefits for every $2 earned over $24,480.

- For those reaching FRA in 2026, the limit rises to $65,160, and SSA deducts $1 for every $3 earned above that until the month you reach FRA. After FRA, there’s no earnings penalty. ([turn0search6])

Why Social Security January 2026 Payments Changes Matter — Real‑Life Examples

Let’s walk through a couple practical scenarios so you can see how it might work for you:

Scenario 1: Retiree Maria

- Maria’s monthly Social Security benefit in 2025 was around $2,000.

- In January 2026, thanks to the 2.8% COLA, Maria’s payment goes to around $2,056–$2,071.

- But her Medicare Part B premium rises to $202.90 — so if Medicare is deducted from her Social Security check, her net benefit increase may feel like only $30–$40 per month after premiums are taken out.

This is why it’s smart to plan with gross and net figures — knowing what you actually take home.

Scenario 2: SSI Beneficiary John

- John receives SSI benefits and doesn’t have Medicare premiums deducted.

- His SSI payment arrives early at Dec 31, 2025, and includes the full 2.8% COLA.

- That means John sees his first adjusted payment right before New Year’s — which helps with holiday budgeting and bills.

SSI calculations don’t usually deduct Medicare premiums, so the benefit lift feels closer to the full COLA amount.

Tips to Get the Most Out of Your Benefits

1. Register for a my Social Security Account

Visit https://www.ssa.gov to set up or access your online account. With it you can:

- See exact payment dates and dollar amounts

- Update your direct deposit info

- Track COLA notices and benefit statements

- Manage your info securely online

Going digital means you don’t have to wait on mailed letters, and you get faster updates.

2. Understand Your Budget With Net Income in Mind

Don’t just look at the headline COLA increase. Calculate:

- Your gross benefit

- Medicare Part B premiums and deductibles

- Any taxes

- Other deductions

That gives you a more realistic sense of what you’ll actually have each month.

3. Plan Around Your Payment Date

Knowing whether your payment arrives on Jan 14, 21, or 28 helps with:

- Paying bills on time

- Setting up automatic withdrawals

- Timing other income sources like pension or 401(k) distributions

4. Don’t Ignore Earnings Rules If You’re Working

If you’re still working and under FRA, those earnings limits matter. Going over the limit means SSA reduces your benefit temporarily — it’s not a tax, but a withheld benefit that can increase once you reach full retirement age.

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

What types of debts can be deducted from your Social Security checks?

Final Social Security Payments of 2025: Check Updated December Dates and Benefit Amounts