DWP Confirms £910 Pre-Christmas Payment: With the cost of living continuing to bite and the cold season rolling in, the Department for Work and Pensions (DWP) has confirmed that some households across the UK could receive up to £910 in financial support ahead of Christmas 2025. Now, don’t go expecting a single cheque with “£910” stamped across it — this isn’t a lottery win. Instead, it’s a combination of scheduled benefit payments, timed perfectly to ease financial pressure during the winter months. Whether you’re a pensioner, a carer, or someone on Universal Credit trying to stretch every pound, this breakdown will guide you through who qualifies, how it all adds up, and how to make the most of this winter financial boost.

Table of Contents

DWP Confirms £910 Pre-Christmas Payment

The DWP’s £910 Pre-Christmas Payment is a much-needed financial relief during one of the most expensive seasons of the year. While it’s not a standalone payment, when you combine all available benefits — Winter Fuel Payment, Cost of Living support, Christmas Bonus, and local council aid — the total can provide a meaningful cushion for millions. Now’s the time to get informed, check your eligibility, and make sure nothing slips through the cracks.

| Topic | Details |

|---|---|

| What is it? | Up to £910 in combined winter support from DWP and local councils. |

| Type of Payment | Multiple benefits: Winter Fuel Payment, Cost of Living Payment, Christmas Bonus, and others. |

| Eligibility | Pensioners, disabled individuals, carers, and low-income households receiving certain benefits. |

| Payment Period | Between late November and December 25, 2025. |

| Automatic Payment? | Yes, most are automatic if you qualify. |

| Taxable? | No, these payments are tax-free. |

| Official Info | UK Government Benefits Portal |

Understanding the £910 Pre-Christmas Payment: What’s Really Going On?

Let’s get something straight: this £910 isn’t a single new government benefit. It’s the cumulative value of multiple seasonal and cost-of-living payments that eligible individuals may receive between late October and Christmas.

This includes:

- The Winter Fuel Payment

- The £300 Cost of Living Support Payment

- The £10 Christmas Bonus

- And potentially, extra help from the Household Support Fund, which varies by location.

This stacking effect means that some folks — especially older citizens or those on multiple benefits — could see up to £910 or more land in their bank accounts before Santa Claus arrives.

What’s Driving These Payments?

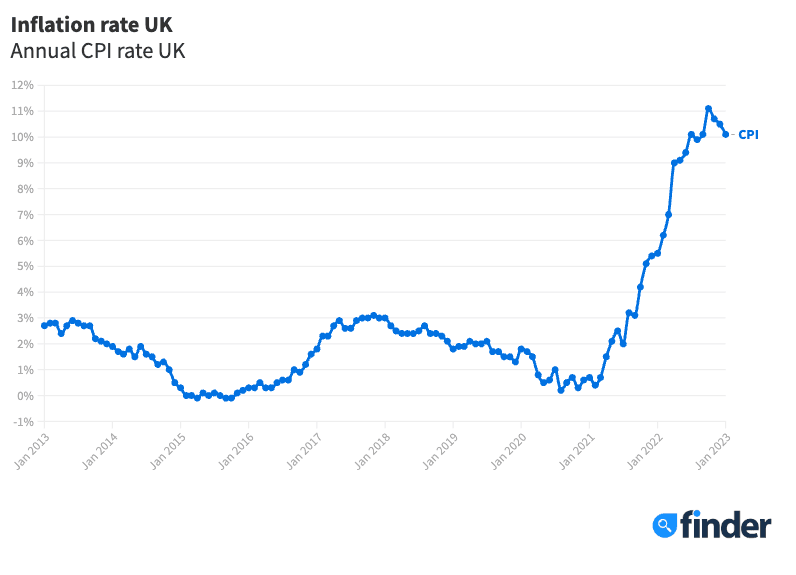

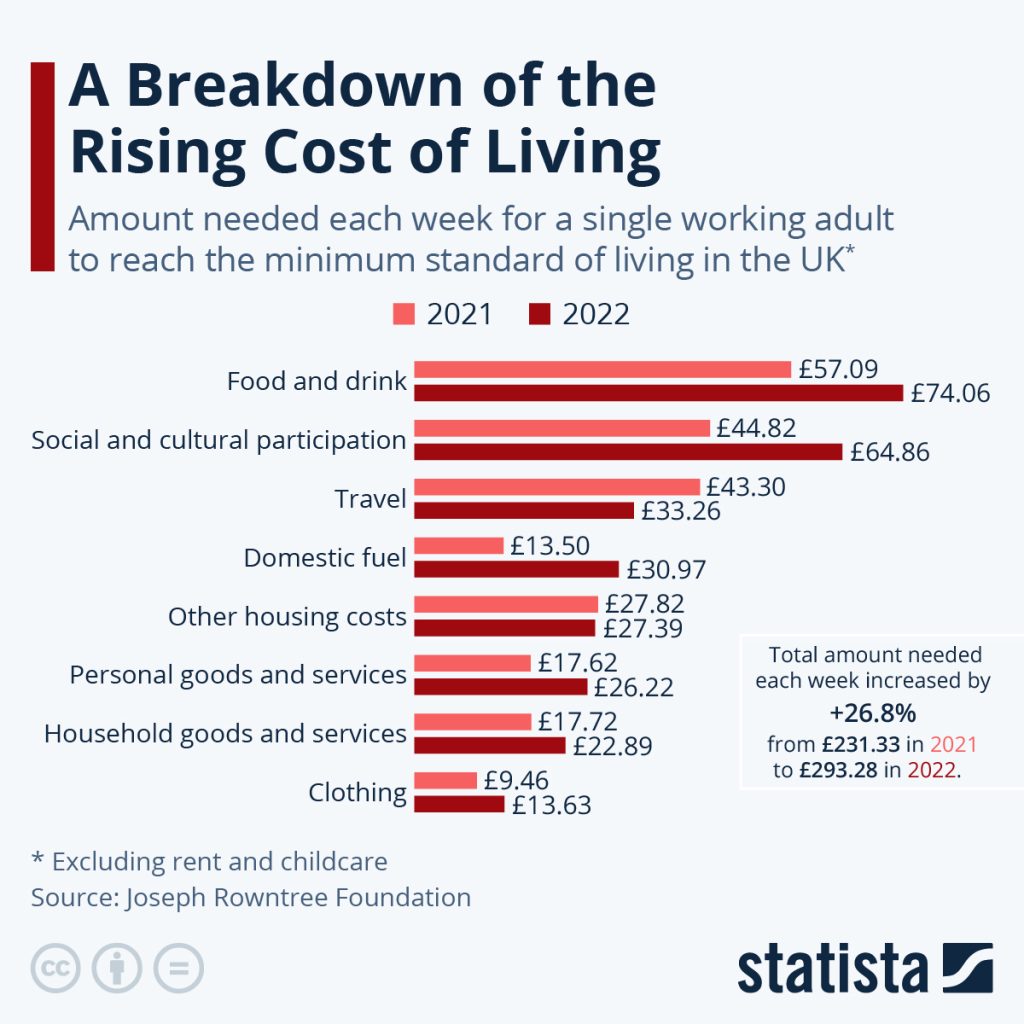

The payments are rooted in government efforts to combat economic strain, particularly for vulnerable groups. The UK is still grappling with:

- High energy prices

- Increased grocery and fuel costs

- Persistent inflation (CPI hovering around 3.9% as of late 2025)

- Rising rent and housing insecurity

According to the Office for National Statistics (ONS), nearly one in five adults reported struggling to afford basic necessities in Q3 2025. That’s why the government designed a package of targeted winter support to keep homes warm and bellies full.

Complete Breakdown of the £910 Pre-Christmas Payment: What Benefits Add Up?

Let’s dive deeper into the components.

1. Winter Fuel Payment – Up to £600

The biggest portion of the £910 figure.

What it is: A tax-free payment to help pensioners with heating bills during winter.

Eligibility:

- Born before 25 September 1957

- Lived in the UK during the qualifying week (typically in September)

Amount:

- Base amount: £250 to £300

- Additional Cost of Living top-up: £150 to £300 (added automatically in 2025/26)

Total range: £250 – £600

Payout Date: Usually in November or early December

2. Cost of Living Payment – £300

A targeted support payment to help with rising living costs.

Eligibility: You must have received a qualifying benefit during the eligibility period (late summer or autumn). Qualifying benefits include:

- Universal Credit

- Pension Credit

- Income Support

- Income-based ESA or JSA

- Tax Credits

Payment amount: £300 (for Autumn 2025 installment)

Payout Date: Between October 31 and November 19, 2025

Note: This is part of the government’s three-part Cost of Living support, totaling up to £900 for 2025/26.

3. Christmas Bonus – £10

A long-standing seasonal bonus.

What it is: A £10 one-off tax-free payment to individuals receiving certain DWP benefits during the qualifying week in early December.

Eligible Benefits Include:

- State Pension

- Carer’s Allowance

- PIP / DLA

- Attendance Allowance

- Incapacity Benefit

- Income-related ESA and others

Payment Method: Paid automatically into your bank account.

4. Household Support Fund – £100 to £200 (Varies)

This is local authority funding distributed to those most in need.

What it covers:

- Food vouchers

- Help with heating and utility bills

- Clothing for children

- Emergency cash grants

How to Apply: Check with your local council — amounts and criteria vary widely.

Typical Support: £100 to £200 in vouchers or direct aid

Who’s Eligible for £910 Pre-Christmas Payment?

To qualify for the full £910, you’ll likely need to meet multiple criteria, such as being:

- Over State Pension age

- Receiving low-income or disability benefits

- Caring for a disabled person or receiving Carer’s Allowance

- A parent of a disabled child receiving DLA

Quick Eligibility Checklist:

| Benefit | Eligible for… |

|---|---|

| State Pension | Winter Fuel + Bonus |

| Universal Credit | Cost of Living Payment |

| PIP or DLA | Christmas Bonus |

| Carer’s Allowance | Bonus + Household Support |

| Pension Credit | All three major payments |

How to Check What You’ll Get (Step-by-Step Guide)?

Step 1: Review What You Already Get

Go through your recent DWP or HMRC letters, or log in to your benefit account.

- Universal Credit: Login

- HMRC Tax Credits: Sign In

Step 2: Cross-Check Eligibility Online

Visit the Gov.uk pages listed in this article to confirm you meet all criteria.

Step 3: Contact DWP if You Think You’re Missing a Payment

If a payment doesn’t arrive when expected:

- Call DWP: 0800 169 0310

- Or use the online portal: Report a Missing Payment

Planning Tips: Making the Most of Winter Support

Here are a few practical ways to make your payments stretch further:

- Prioritize essentials — heating, food, and housing costs should come first.

- Use budgeting apps like Money Dashboard or Emma to track spending.

- Talk to your energy provider — many offer hardship grants.

- Apply for additional local grants — some councils have discretionary funds even after the Household Support Fund ends.

- Store receipts and letters — this can help in appeals or if future funding becomes available.

Real-Life Example: How It Adds Up

Take “Peter,” a 75-year-old pensioner living alone in Yorkshire:

| Payment Type | Amount |

|---|---|

| Winter Fuel Payment | £600 |

| Cost of Living Payment | £300 |

| Christmas Bonus | £10 |

| Household Support Fund (local council) | £100 |

| Total | £1,010 |

This is not a rare case — many older residents may see similar figures before Christmas.