Social Security 2026: If you’ve ever asked, “How much do I need to earn to get the maximum Social Security benefit in 2026?” — you’re not just thinking ahead, you’re planning smart. For millions of Americans, Social Security isn’t just a safety net — it’s a cornerstone of retirement. And the truth is, how much you put in — and when you take it out — makes a world of difference. This guide is your deep dive into everything you need to know about the 2026 Social Security max benefit, including what you must earn, how long you need to earn it, when to claim, and how to plan for more financial peace in retirement. Let’s break it down.

Table of Contents

Social Security 2026

To receive the highest Social Security benefit in 2026, here’s what you need to remember:

- Earn $184,500 or more per year for 35 years

- Wait until age 70 to claim

- Stay proactive about reviewing your SSA records

- Coordinate with your spouse or financial advisor

- Don’t rely on Social Security alone — but do maximize it

This isn’t just about money — it’s about freedom, security, and getting back what you worked hard for.

| Key Detail | Value/Info |

|---|---|

| Max Monthly Benefit (Age 70) | $5,251/month |

| Max Benefit at Full Retirement Age (67) | ~$4,207/month |

| Max Benefit at Early Claim (62) | ~$2,969/month |

| Max Taxable Earnings in 2026 | $184,500 |

| Required Earnings Years | 35 years at or near max |

| Earliest Claiming Age | 62 (reduced benefit) |

| Latest Claiming Age | 70 (full delayed credits) |

| Official Website | www.ssa.gov |

Understanding Social Security: The Basics

Social Security is a federal program that pays monthly retirement, disability, and survivor benefits to qualified workers and their families. What most people don’t realize is just how personalized your benefit can be. Your payout is based on:

- How much you earned

- How many years you worked

- When you choose to start collecting

In 2026, the maximum Social Security benefit you can receive at age 70 is $5,251/month. But that’s not handed out to everyone — you have to work for it.

What Is the Maximum You Can Earn Toward Social Security 2026?

Each year, the Social Security Administration (SSA) sets a cap on how much of your income is taxed for Social Security purposes. That’s called the maximum taxable earnings.

In 2026, that number is projected to be $184,500.

If you earn $184,500 or more in 2026, you’re paying Social Security taxes on all of that income — but any dollar you earn above that won’t count toward your future benefits.

So What Does That Mean for You?

If you consistently earn $184,500/year or more and do so for at least 35 years, you can position yourself to qualify for the maximum monthly benefit in retirement — assuming you also delay claiming until age 70.

This means:

- Earning less than the cap = smaller future benefit

- Earning over the cap = no added benefit after $184,500

How Social Security Benefits Are Calculated?

Let’s simplify the formula without getting too technical:

- SSA adjusts your top 35 years of earnings for inflation

- It calculates your AIME (Average Indexed Monthly Earnings)

- Then, your PIA (Primary Insurance Amount) is calculated using a progressive formula

- Your PIA is adjusted based on when you claim benefits (early = less, delayed = more)

The more you earn — consistently — the higher your AIME. The higher your AIME, the more money you’ll see in monthly Social Security checks.

Why You Need 35 Years of High Earnings?

The SSA uses your top 35 earning years to calculate your benefit. If you worked fewer than 35 years, they’ll plug in zeroes for the missing years.

This can significantly reduce your average and lower your benefit. Even if you only made $10,000 one year, it’s better than a zero.

If you’re not at 35 yet, working a few more years — even at moderate income — can improve your benefit total.

Real-Life Examples: From Main Street to Wall Street

1. Alex the High-Earner Executive

- Income: $190,000/year for 35 years

- Retirement age: 70

Result: Receives the maximum Social Security benefit of $5,251/month in 2026

2. Jenna the Public School Teacher

- Income: ~$70,000/year for 35 years

- Retirement age: 67

Result: Earns approx. $2,600–$3,000/month, based on AIME

3. Sam the Freelancer

- Income varies: $20K to $60K/year

- Retirement age: 62

Result: May only receive $1,000–$1,800/month, especially if many years are missing or under-reported

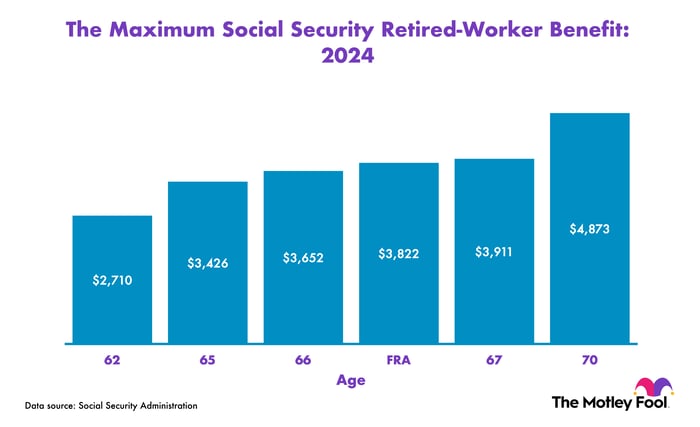

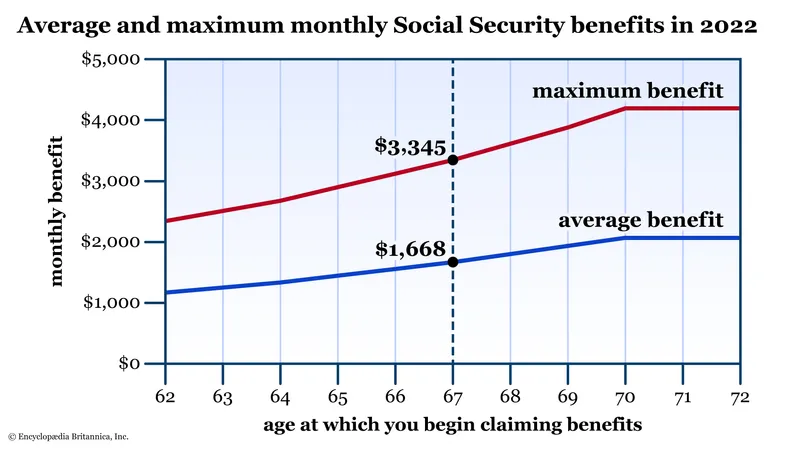

When You Claim Matters — Big Time

Even if you earned the maximum, when you choose to start your benefits can drastically change your monthly payout.

| Claiming Age | Approx. Monthly Max Benefit |

|---|---|

| 62 (Earliest) | $2,969 |

| 67 (Full Retirement Age) | $4,207 |

| 70 (Max Delayed Credit) | $5,251 |

Waiting until 70 results in a delayed retirement credit of about 8% per year past age 67.

That’s nearly a 77% increase in monthly benefits between claiming at 62 vs 70. If you’re healthy and have other income streams, waiting can pay off — literally.

Social Security 2026: What About Spousal and Survivor Benefits?

Even if you didn’t earn the max, you may still benefit through your spouse’s record.

Spousal Benefit:

You may qualify for up to 50% of your spouse’s PIA — even if you never worked.

Survivor Benefit:

Widows and widowers can receive up to 100% of their deceased spouse’s benefit, depending on age and other eligibility factors.

So if your partner earns the max, you might be eligible for a substantial payout as a spouse or survivor.

Can You Still Work and Collect Social Security?

Yes — but if you start collecting benefits before your Full Retirement Age, there’s a limit to how much you can earn without reducing your benefits.

In 2026:

- You can earn up to $24,480 before benefits are withheld.

- In the year you reach FRA, the earnings limit rises to $65,160.

- After you hit FRA? No earning limits at all.

This means you can “double dip” — work and receive full benefits — once you reach FRA.

Social Security Myths That Need Busting

Let’s clear the air:

Myth 1: Social Security is going broke.

Wrong. While the trust fund may deplete by 2035, workers will still receive ~75-80% of benefits through tax revenues.

Myth 2: You can live comfortably on Social Security alone.

Not likely. The average Social Security check in 2026 is estimated to be $2,071/month. For most people, it’s a supplement — not a full retirement plan.

Myth 3: I should claim benefits as soon as I can.

Only if you need the money. Waiting results in significantly higher monthly payments for life.

Advanced Tips for Maxing Out Social Security 2026

- Track your earnings regularly on SSA.gov — catch mistakes early

- Coordinate with a spouse — optimize combined claiming strategies

- Work past 67 if possible — delayed credits add long-term value

- File strategically — consider hiring a retirement planner or using SSA’s estimator

New York Social Security Schedule: Exact December 2025 Payment Dates

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

New Social Security payment arrives on December 24, 2025: Check eligibility and requirements