Social Security Payment: If you’re due for a Social Security check on December 24, 2025, you might be wondering: “How much will I get this time around?” Well, that’s a mighty fine question — especially when December rolls in with those extra holiday expenses. This article breaks it all down for you: what that December payment means, how much you can expect, and what factors could raise or lower your check. Let’s walk the path together — step by step, clear as a mountain stream.

Table of Contents

Social Security Payment

That December 24, 2025 Social Security payment might seem like just another deposit, but it’s part of a system that millions of Americans rely on every month. Whether you’re a retiree, a caregiver, a surviving spouse, or someone planning ahead, understanding how much you’re owed and when it comes is crucial to living securely and confidently. Take control of your future by knowing your benefit schedule, tracking your COLA increases, and logging into your SSA account regularly. Knowledge is power, and this guide gives you the reins.

| Topic | Details |

|---|---|

| Payment Date | December 24, 2025 (Fourth Wednesday) |

| Who Gets Paid | Beneficiaries born on the 21st–31st of any month |

| Benefit Types Included | Retirement, SSDI, Survivor, Spousal |

| Average Retirement Benefit | ~$2,013.32 in 2025 |

| Max Benefit at Full Retirement Age | $5,108/month |

| 2025 COLA Increase | 3.2% |

| How to Check Your Payment | My Social Security Account |

| Taxable? | Yes, possibly at federal and/or state level |

| Official Site | https://www.ssa.gov |

What’s Special About December 24, 2025?

For folks whose birthdays fall between the 21st and 31st, the Social Security Administration (SSA) pays them on the fourth Wednesday of each month. In December 2025, that lands on Wednesday the 24th — Christmas Eve.

This payment isn’t a bonus or an advance. It’s your regular monthly benefit, and the schedule just happens to fall right before the holiday. SSA doesn’t alter amounts based on holidays, but the timing can help with year-end expenses, travel, or gift shopping.

How Social Security Payments Are Calculated?

Let’s not beat around the bush — your payment is personalized. The government isn’t just handing out flat checks. It’s all based on your earnings history, age when you claim, and total number of work credits.

Here’s how they do the math:

- They average your 35 highest-earning years of covered employment.

- The SSA applies a formula to that average to compute your Primary Insurance Amount (PIA).

- If you claim before full retirement age (which is 66–67 depending on your birth year), you get reduced benefits.

- If you delay past full retirement age up to 70, you earn delayed retirement credits — boosting your check by as much as 32%.

Example: A Quick Illustration

- Tom, age 66 in 2025, earned a decent salary most of his life.

- His PIA comes to $2,000/month.

- He delays until age 70 — his payment rises to $2,640/month thanks to delayed credits.

- His check on December 24, 2025, will include a COLA-adjusted amount of approximately $2,724.

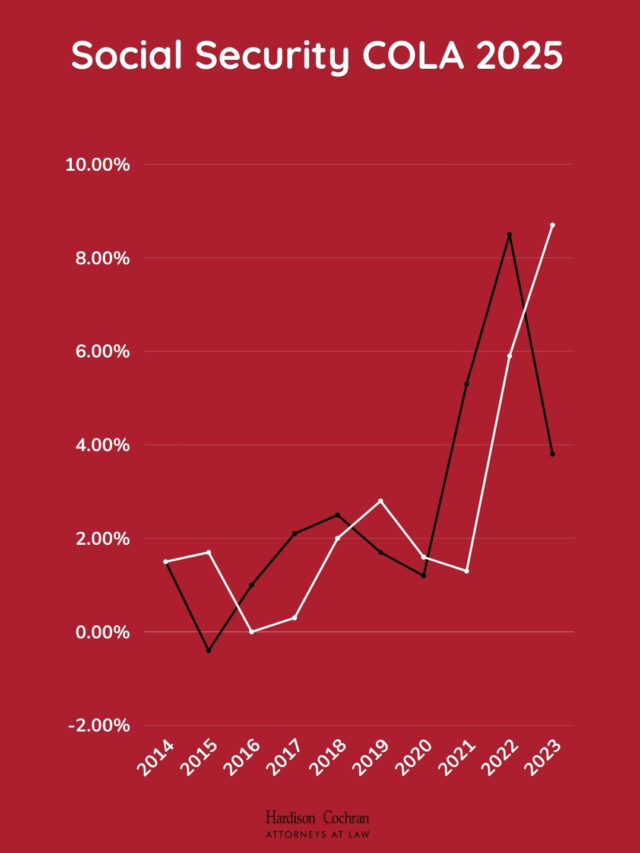

What About the 2025 COLA?

The 2025 Cost-of-Living Adjustment (COLA) is 3.2%, announced by the SSA in October 2024. This increase helps benefits keep pace with inflation, based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Let’s look at how it’s grown over time:

| Year | COLA % Increase |

|---|---|

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 3.2% |

| 10-Year Average | 2.6% |

Official Source: SSA COLA Archive

If your benefit was $1,950 in 2024, a 3.2% bump in 2025 puts it at ~$2,012.40 — that’s what you’ll receive on December 24.

Types of People Receiving This Social Security Payment

You might think Social Security is just for retirees — but it helps a wide range of Americans:

- Retired Workers

- Spouses and Ex-Spouses

- Widows and Widowers (Survivor Benefits)

- Disabled Workers (SSDI)

- Children of deceased or disabled workers

All of these folks could be receiving a check on December 24, 2025, depending on their birthdate and type of benefit.

Survivor and Spousal Benefits

- A surviving spouse (age 60+) may receive up to 100% of the deceased partner’s benefit.

- Divorced spouses married 10+ years may qualify for benefits without affecting the ex’s payments.

- Children under 18 (or 19 in high school) can get up to 75% of the parent’s benefit.

Is Your Social Security Payment Taxed?

Yep — Social Security benefits can be taxable, depending on your total income. Here’s how it breaks down:

Federal Taxes:

- If you’re single and your combined income exceeds $25,000, up to 50–85% of your benefit may be taxable.

- For married couples filing jointly, the threshold is $32,000.

State Taxes:

Some states also tax Social Security (as of 2025):

- Yes: Colorado, Kansas, Minnesota, Montana, Vermont, Utah (some exemptions apply)

- No: Florida, Texas, Tennessee, and many others

How to Check Your Social Security Payment Amount?

Knowing what’s coming in can help you budget better. Thankfully, the SSA made this super simple.

Step-by-Step:

- Visit: https://www.ssa.gov/myaccount/

- Log in or sign up.

- View your “Benefit Verification Letter” for your latest monthly amount.

- Review past payments and make sure your direct deposit info is correct.

Common Myths — Busted

Let’s clear the air on a few old tales we hear at coffee shops and senior centers.

| Myth | Truth |

|---|---|

| “Social Security is going broke!” | Not true. Even if the trust fund runs low, SSA will still pay 75%–80% of scheduled benefits from ongoing payroll taxes. |

| “I should claim benefits ASAP at 62.” | You can, but you’ll get 30% less than if you waited until full retirement age. |

| “You can’t work and collect benefits.” | False — you can, but earnings limits apply before FRA (Full Retirement Age). |

What To Do If You Don’t Get Paid on Time?

Sometimes the mail is slow, or there’s a hiccup with your bank. If your payment doesn’t show up:

- Wait 3 business days.

- Check your My Social Security account for status.

- Contact the SSA at 1-800-772-1213 (7 a.m. – 7 p.m., Mon–Fri).

- Or visit your local SSA office.

December SSA Payouts Confirmed — Here’s What You’ll Receive and Why January Checks Increase

What types of debts can be deducted from your Social Security checks?

New Social Security payment arrives on December 24, 2025: Check eligibility and requirements