$167.5 Million Settlement Over ATM Fee Charges: If you’ve swiped your debit card at a gas station ATM, hotel lobby, or neighborhood corner store anytime since October 2007, you may be owed some money. That’s right—thanks to a massive $167.5 million settlement, Visa and Mastercard are being held accountable for allegedly conspiring to keep ATM fees unfairly high for nearly two decades. This legal case has been brewing for over 14 years. And now, millions of everyday consumers and small business owners could benefit from the outcome. But the big question is: Are you eligible? Let’s break it all down so you know exactly what’s going on and what to do next.

Table of Contents

$167.5 Million Settlement Over ATM Fee Charges

The Visa and Mastercard $167.5 million settlement is more than just a refund—it’s a win for fairness in finance. For far too long, hidden ATM fees have been quietly eating into Americans’ wallets. This legal action proves that corporate accountability still exists, and your voice matters. Whether you’re a professional tracking every penny or just a regular consumer tired of fee overload, this is a moment to cash in—literally. Don’t ignore that claim email when it comes. It could be your money waiting to be claimed.

| Key Info | Details |

|---|---|

| Total Settlement | $167.5 million |

| Companies Involved | Visa Inc. and Mastercard Inc. |

| Case Filed | 2011 (Washington D.C. federal court) |

| Date of Settlement Filing | December 19, 2025 |

| Type of ATMs Affected | Independent (non-bank) ATMs |

| Allegation | Conspiracy to fix ATM access fees |

| Visa’s Share | $88.8 million |

| Mastercard’s Share | $78.7 million |

| Covered Time Period | October 2007 – Present |

| Who Can Claim | U.S. consumers & businesses who paid unreimbursed fees at non-bank ATMs |

| Next Steps | Await court approval, file claim after notification |

| Official Sources | FTC Refund Site, Reuters Coverage |

Why This Lawsuit Happened (And Why It Matters)?

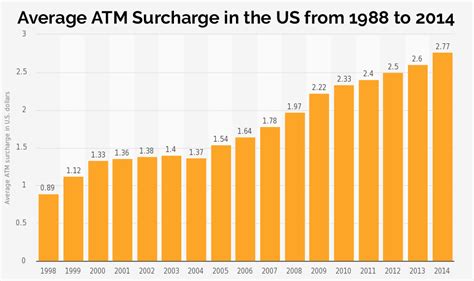

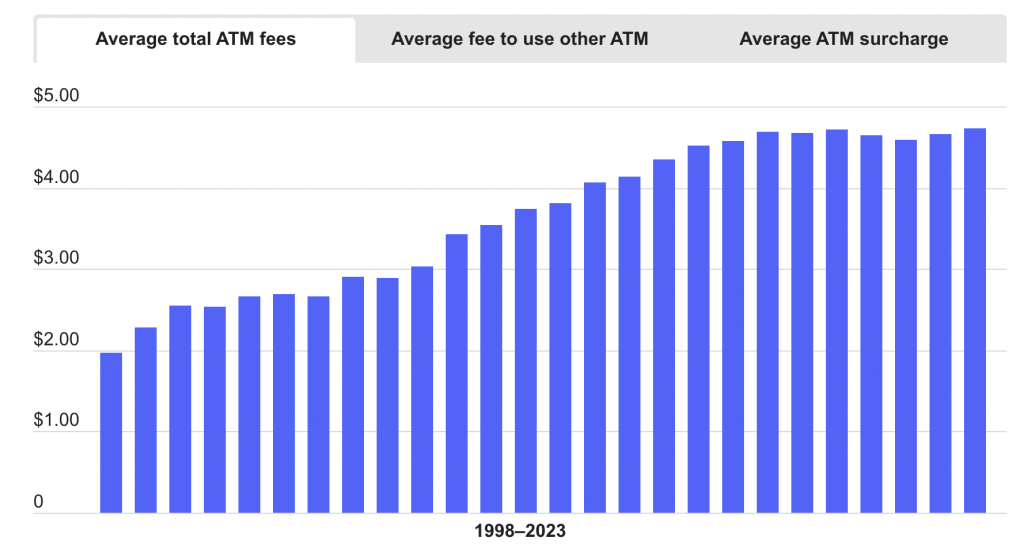

Let’s get one thing straight: ATM fees are annoying, but they’ve also quietly drained billions from consumers’ pockets over the years. When you use an out-of-network ATM—especially one not owned by a bank—you typically pay an extra $2 to $5 per transaction.

The lawsuit claimed that Visa and Mastercard used their market power to prevent competition among ATM operators. Instead of letting operators offer lower fees, these two financial giants allegedly implemented rules that kept ATM surcharges artificially high across the board.

This blocked smaller ATM networks from cutting costs for consumers and violated U.S. antitrust laws, according to plaintiffs.

Even though Visa and Mastercard deny any wrongdoing, they’ve agreed to pay up—big time.

Legal Background: The Case in a Nutshell

This lawsuit isn’t some overnight TikTok scandal. It dates back to 2011, when a group of consumers filed a federal case in Washington, D.C., accusing Visa and Mastercard of fixing ATM access fees in violation of the Sherman Antitrust Act.

This case is part of a trilogy of lawsuits targeting unfair ATM practices:

- Bank-Owned ATM Case – Settled in 2024 for $197.5 million

- Bank Defendants Case – Settled in 2021 for $66 million

- Independent ATM Fee Case – The current $167.5 million settlement

A fourth case, led by independent ATM operators, is still pending.

So, what’s the issue here? The plaintiffs claim that Visa and Mastercard’s rules required ATM operators to charge the same access fee across all card networks, killing price competition. If true, that means consumers were paying more than necessary at countless ATMs nationwide.

What ATMs Are We Talking About?

This case specifically targets independent or non-bank ATMs—the kind you see at:

- 7-Eleven and convenience stores

- Bars, clubs, and casinos

- Gas stations

- Airport kiosks

- Local businesses

If the ATM didn’t have a big bank name on it—like Wells Fargo, Bank of America, or Chase—it probably qualifies under this case.

So if you paid out-of-network fees at one of these locations and didn’t get reimbursed by your bank, you might be eligible for a piece of the settlement.

Who Is Eligible to File a $167.5 Million Settlement Over ATM Fee Charges Claim?

Pretty much any U.S. consumer or small business that:

- Used a non-bank ATM

- Paid surcharge fees between October 2007 and now

- Did not get reimbursed by their bank for those fees

You don’t need to have a fancy title or financial degree—just proof you were charged.

And yes, businesses are included too! If your company card was used at an out-of-network ATM to pull cash, you may qualify.

What Kind of Proof Do You Need?

Here’s what can help you:

- Bank statements showing “ATM surcharge” or “access fee”

- Receipts from the ATM (if you still have them)

- Digital banking history (most banks let you download records going back 10+ years)

- Sworn declarations may be allowed for small claims if you don’t have full records

Pro Tip: Contact your bank and ask for archived statements if you need help finding older charges.

What Happens Next: Timeline & Steps

As of now, the settlement is proposed but not yet final. Here’s how it’ll play out:

Step 1: Court Approval

A judge will review the settlement terms in early or mid-2026.

Step 2: Notification Period

If approved, eligible consumers will be notified via email or mail. A dedicated website will go live where you can file your claim.

Step 3: File Your Claim

Submit your claim online with supporting documentation. The deadline will be clearly stated (usually 3–6 months).

Step 4: Disbursement of Funds

Once all claims are reviewed, the money will be paid—likely via check or direct deposit.

Expect a timeline of 9 to 12 months from approval to payment.

How Much Could You Get?

Exact amounts depend on:

- How often you used non-bank ATMs

- How much you were charged

- How many people file claims

Estimates range from:

- $25–$200 for casual users

- $300+ for frequent users or businesses

- Larger amounts possible if you can show extensive usage

The court will also deduct up to 30% (~$50 million) for attorney fees and court costs, a common practice in class action settlements.

Real-World Impact of $167.5 Million Settlement Over ATM Fee Charges

Here’s who this matters to most:

- Low-income Americans who rely on cash-based transactions

- Gig workers like DoorDashers and Uber drivers who often pull cash from nearby ATMs

- Students away from their home bank

- Small businesses that run cash floats or use debit cards to access operational funds

According to the FDIC, about 13% of Americans are unbanked or underbanked, and many depend on these ATMs for daily financial access.

This case helps close the gap between those who can easily avoid ATM fees and those who can’t.

What This Means for the Financial Industry?

Beyond the payout, this case could reshape how payment networks operate:

- Encourages transparent fee disclosure

- Sets a legal precedent against network rules that restrict competition

- Could lead to regulatory changes from agencies like the Consumer Financial Protection Bureau (CFPB)

Legal analysts also expect more lawsuits challenging payment networks over similar anticompetitive practices in other financial services.

Expert Insights On $167.5 Million Settlement Over ATM Fee Charges

According to Professor Laura Jenkins, a financial law expert at the University of Michigan:

“This case is a watershed moment for ATM regulation. Consumers have tolerated outrageous ATM surcharges for years, often without knowing they were the result of anti-competitive tactics.”

Meanwhile, James Lopez, an analyst at NerdWallet, says:

“Even if you only used an ATM once or twice, this case shows that no fee is too small to fight back against.”

Google’s $700M Settlement, Explained: Eligibility, Deadlines, and Payouts

Lawyers Seek $300 Million in Fees From the $1.5 Billion Anthropic Copyright Settlement

AT&T Settlement Deadline Extended; Here’s How to File Your Claim Before Time Runs Out