$2,000 Payments Nationwide Under Trump’s Plan: In 2025, former President Donald Trump unveiled a bold proposal: giving most Americans a $2,000 “tariff dividend” payment. The idea? Use revenue collected from tariffs on foreign imports to deliver direct financial relief to working-class and middle-income Americans. With the economy in flux, prices rising, and household budgets under stress, the proposal hit headlines like a thunderclap. But here’s the kicker: while it sounds promising, the reality is far more complex. From funding gaps and inflation risks to legal hurdles and political roadblocks, this article dives deep into what it would really take to send $2,000 checks nationwide — with plain-English explanations, solid data, and expert analysis.

Table of Contents

$2,000 Payments Nationwide Under Trump’s Plan

Trump’s proposed $2,000 tariff dividend taps into deep public frustration with inflation, economic uncertainty, and political gridlock. It offers a catchy solution — simple in words, complicated in practice. While tariff revenue exists, it’s not enough to fund this program without trade-offs. Congress would need to approve any payments, and economists warn about inflation, deficit growth, and market instability. For now, this remains an idea, not a reality. If you’re counting on that check, don’t cash it before it’s printed.

| Topic | Details |

|---|---|

| Plan Name | $2,000 Tariff Dividend |

| Proposed By | Donald J. Trump |

| Funding Source | Tariff revenue from foreign imports |

| Current Status | Proposal only; not passed or implemented |

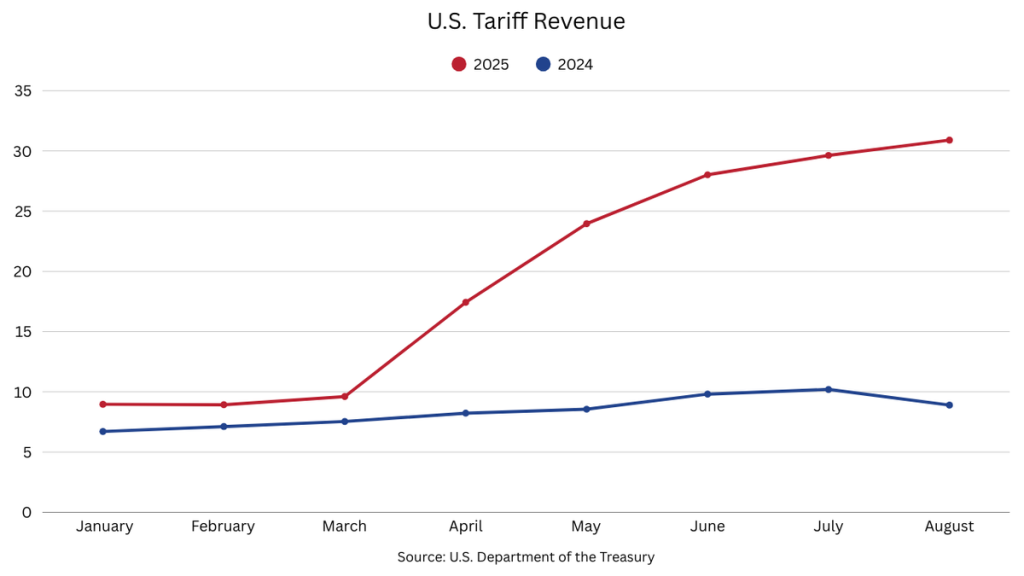

| Estimated Tariff Revenue (2025) | ~$195 billion |

| Cost of One Round of $2,000 Checks | $400–$600 billion |

| Eligibility | Likely based on income (e.g., < $100k/year) |

| Congress Approval Needed? | Yes — Constitutionally required |

| IRS Involvement? | Would administer if passed |

| Official Resource | irs.gov |

What Is Trump’s $2,000 Tariff Dividend Proposal?

Let’s start with the basics.

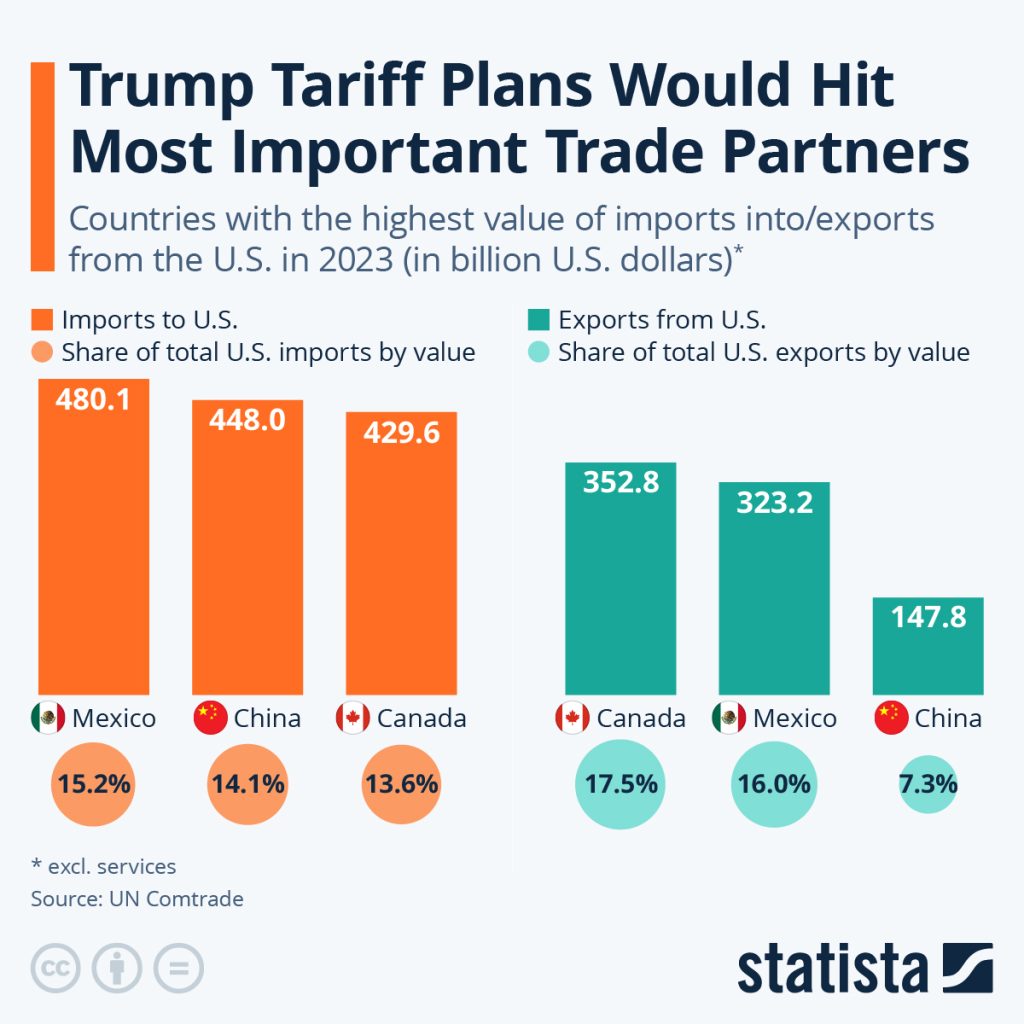

In several campaign speeches and social media posts, Trump proposed sending $2,000 per person to qualifying Americans. Unlike past stimulus checks, this money wouldn’t come from general taxes or borrowing. Instead, it would be funded using the tariff revenue generated from taxing imported goods from countries like China, Mexico, and others. He called it a “tariff dividend”, claiming it would give Americans a fair share of what foreign countries pay in tariffs.

While the concept sounds fresh, there’s no official program yet. No law has been passed, and no checks are being sent. For the plan to work, Congress would need to act, and even then, there are massive logistical and financial challenges ahead.

How Do Tariffs Work?

To understand this proposal, let’s quickly cover how tariffs function.

A tariff is a tax imposed by the U.S. government on imported goods. When the U.S. puts a tariff on Chinese steel, for instance, that cost is added to the product price. In theory, this discourages imports and boosts domestic industry. But often, American businesses and consumers end up paying more for products as a result.

So, when the government collects tariffs, it builds up revenue, which Trump proposes to redistribute as direct payments.

But here’s where it gets tricky.

Can Tariff Revenue Really Fund $2,000 Payments Nationwide Under Trump’s Plan?

Let’s do the math.

The U.S. collected about $195 billion in tariff revenue in 2025. But distributing $2,000 to roughly 160 million adults (the estimated eligible population) would cost over $320 billion — more than the total collected.

And that’s for one round of checks. If the program were to become annual or recurring, the cost would rise above $600 billion per year.

So unless tariffs are raised significantly — or other revenue sources added — the math doesn’t work.

“There’s a major shortfall between what tariffs bring in and what such a program would cost,” said Marc Goldwein, Senior Vice President at the Committee for a Responsible Federal Budget. “This would be a deficit-increasing measure unless deeply offset elsewhere.”

Legal Hurdles: Congress Must Approve Spending

According to Article I, Section 9 of the U.S. Constitution, “No money shall be drawn from the Treasury, but in consequence of appropriations made by law.”

That means only Congress can authorize federal spending. The President cannot unilaterally order the IRS or Treasury to send checks.

While Trump’s team has said they are “working on a plan,” nothing has been filed in Congress. And any such legislation would face scrutiny from both chambers, budget committees, and the Congressional Budget Office.

What About Inflation?

While the idea of $2,000 checks is popular, economists are cautious.

In 2020 and 2021, stimulus checks helped Americans survive pandemic disruptions. But they also contributed to higher consumer demand, leading to inflation spikes that continued into 2024 and 2025.

A fresh injection of $2,000 per person could stimulate spending, but also fuel inflation — especially if supply chains remain tight.

“When you put that much money into people’s pockets without matching it with output, prices rise,” said Dr. Laura Simmons, professor of economics at Georgetown University.

That means gas, groceries, and rent could all increase again, reducing the value of the very checks people receive.

Who Might Qualify for $2,000 Payments Nationwide Under Trump’s Plan?

While no official rules exist, most analysts believe eligibility would be tied to income. Likely cutoffs:

- Individuals earning less than $100,000

- Couples under $200,000

- Possibly including dependents or families with children

This mirrors previous stimulus criteria from the CARES Act and American Rescue Plan.

Still, some 40% of high-income Americans might be excluded. That leaves around 160 million Americans potentially eligible — at a cost of over $320 billion per payment cycle.

Historical Context: A Return to Hamilton?

Interestingly, the U.S. once relied entirely on tariffs to fund its government.

In the 1790s, Alexander Hamilton — yes, the Broadway guy — used tariffs to finance federal debt. Before income taxes, tariffs made up over 90% of federal revenue.

But after the 16th Amendment in 1913, the federal income tax became the primary source of government funding.

Today, tariffs represent less than 5% of federal revenue, making them an unusual — and limited — tool for direct payments.

Could This Set a New Precedent?

Some analysts suggest this “tariff dividend” idea could open the door for resource-based payouts, like Alaska’s Permanent Fund Dividend — where residents receive checks funded by oil revenue.

However, tariff revenue is more volatile and subject to global politics, trade wars, and legal challenges.

Also, some tariffs are being challenged in court, which means future revenue could be legally uncertain.

If the Supreme Court rules against certain tariffs, the U.S. may owe refunds to importers — not citizens.

What Would It Take for the Plan to Pass?

Here’s a step-by-step guide to what it would actually take:

- White House submits formal proposal

- Bill introduced in House or Senate

- Reviewed by budget and finance committees

- Scored by Congressional Budget Office (CBO)

- Debated and passed by House and Senate

- Signed into law by the President

- IRS creates systems to issue payments

- Funding mechanism confirmed by Treasury

This process could take months to years. And with a divided Congress, the politics are complicated.

Impact of $2,000 Payments Nationwide Under Trump’s Plan on National Debt

One concern is whether this plan adds to the national debt.

Unless tariff revenues exceed costs — or other spending is cut — checks could drive up deficits.

The national debt surpassed $34 trillion in 2025, and the federal budget deficit is projected at $1.6 trillion for the year.

Adding another $300–$600 billion in payments would likely deepen that hole unless offset by spending cuts or new taxes.

Real-Life Example: What Could $2,000 Do?

Let’s make this personal.

For Maria, a single mom in Georgia earning $45,000/year, a $2,000 check could:

- Cover 2 months of rent

- Pay off credit card debt

- Refill her car and fridge

For Jeff, a retiree living on Social Security, it could:

- Pay for prescriptions

- Upgrade heating in winter

- Help grandkids with school supplies

For Emily and James, a dual-income couple earning $200,000, they likely wouldn’t qualify — and if they did, the $4,000 would help, but not drastically change their financial picture.

How Trump’s Proposed $2,000 Dividend Could Affect Retirees Receiving Social Security – Check Details

Trump Wants to Bring Australia’s Retirement System to the U.S.—Could It Replace Social Security?