Illinois expands property tax relief: Property taxes can be a real pain—especially for seniors trying to stay in their homes on a fixed income. And let’s face it: Illinois isn’t known for being cheap when it comes to taxes. That’s why the state’s move to expand property tax relief for seniors is such a big deal. If you’re a senior citizen, a family member helping one, or a financial advisor looking out for your clients, this guide is your one-stop shop for understanding the new 2025 rules, how to qualify, what forms you need, and how to avoid common pitfalls. We’ll also share some real stories, expert advice, and practical tips.

Table of Contents

Illinois expands property tax relief

The Illinois expansion of property tax relief for seniors is more than just a policy shift—it’s a real opportunity for thousands of older residents to stay in their homes, maintain independence, and ease their financial load. By raising the income cap and streamlining the process, Illinois is making it easier than ever for seniors to benefit. Whether you’re applying for yourself or helping a loved one, don’t wait—start gathering those documents and get your application in before March 1. With the right knowledge, preparation, and support, you can take full advantage of this powerful program and secure a more stable future.

| Feature | Details |

|---|---|

| What’s New | Expanded eligibility for the Senior Citizens Real Estate Tax Deferral Program |

| New Income Limits | $75,000 (2025), $77,000 (2027), $79,000 (2028+) |

| Age Requirement | Must be 65 years old or older |

| Maximum Annual Deferral | $7,500 per year or 80% of home equity |

| Program Type | State-backed tax deferral (not a grant) |

| Repayment Time | When the home is sold, transferred, or upon death |

| Application Deadline | March 1 following the tax year (e.g., March 1, 2026 for 2025 taxes) |

| Official Website | Illinois Department of Revenue |

What Is the Illinois Senior Property Tax Relief Program?

Let’s break it down simply: The Senior Citizens Real Estate Tax Deferral Program is a state-sponsored program that helps eligible seniors delay paying their property taxes. It’s designed to ease the financial burden of homeownership for older adults.

This isn’t free money—it’s more like a loan that you don’t have to pay back right away. The state pays your property taxes to the county on your behalf, and the amount gets paid back only when:

- You sell your home

- Transfer the property

- Or pass away

The deferral limit is $7,500 per year, including interest and fees, or up to 80% of your home’s equity, whichever is lower. This program allows seniors to stay in their homes longer, avoid falling behind on taxes, and maintain financial independence.

What’s New in 2025?

Illinois lawmakers passed a bill in 2025 to raise the income limits for this program—something advocates had been pushing for due to inflation and rising living costs.

Here’s how the new income thresholds work:

- Tax Year 2025: $75,000 max household income

- Tax Year 2027: $77,000 max

- Tax Year 2028 and onward: $79,000

Previously, the cap was $65,000, meaning thousands of seniors just above that mark were disqualified. Now, with the higher limits, more middle-income seniors can access this vital resource.

The change aims to make life easier for seniors who are “house rich but cash poor”—owning valuable homes but with limited monthly income.

Why Illinois Expands Property Tax Relief Matters: A Real Financial Lifeline

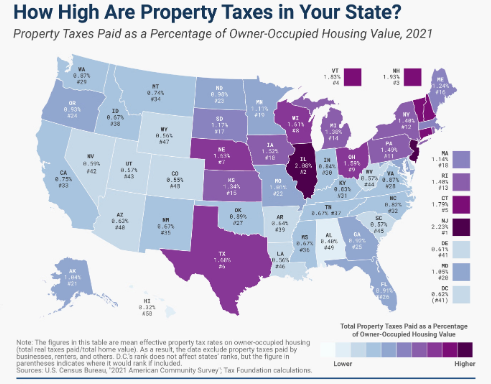

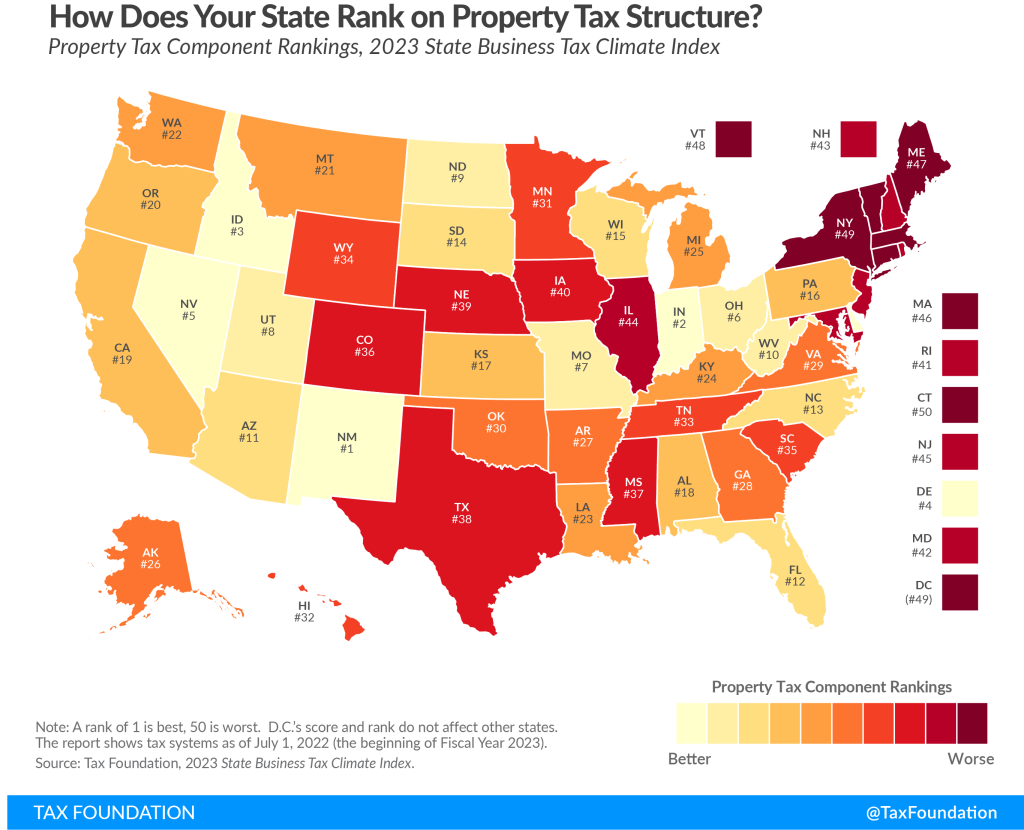

The Tax Foundation ranks Illinois as having the second-highest property tax rates in the U.S., averaging 2.07%. For a $200,000 home, that’s over $4,000 per year in taxes—often unaffordable for seniors living on Social Security or small pensions.

This expanded program gives seniors an option to protect their home equity, avoid tax delinquency, and keep up with rising living costs.

Who’s Eligible for Property Tax Relief?

To qualify for this newly expanded tax relief, you need to check several boxes:

1. Age Requirement

You must be 65 years old or older by June 1 of the year you’re applying for.

2. Residency

You must:

- Own and live in the home as your primary residence

- Have occupied the property for at least 3 consecutive years

3. Income

Your total household income (including Social Security, pensions, annuities, etc.) must not exceed:

- $75,000 for tax year 2025

- $77,000 in 2027

- $79,000 from 2028 onward

4. Property Taxes and Assessments

All prior-year taxes must be paid in full. You can’t use this program if you’re already behind.

5. Insurance

You must have fire and casualty insurance on the property.

How to Apply for Property Tax Relief: Step-by-Step Guide

This isn’t just about filling out forms. It’s about understanding the process so you don’t miss out due to a technicality.

Step 1: Get the Right Forms

Download or request:

- IL-1017: Application for Real Estate Tax Deferral

- IL-1018: Tax Deferral and Recovery Agreement

Get them from:

- Illinois Department of Revenue

- Your County Treasurer or Assessor’s Office

Step 2: Gather Documents

You’ll need:

- Proof of age (Driver’s License, State ID)

- Income documents (Social Security statements, pension statements, tax returns)

- Homeownership documents (property deed or tax bill)

- Insurance certificate showing fire/casualty coverage

Step 3: Submit the Application

Send your application and documents to your County Collector’s Office. Many counties also accept in-person drop-offs or mail-in applications.

Deadline:

- For tax year 2025: Submit by March 1, 2026

Step 4: Wait for Approval

Once submitted, your application will be reviewed. If approved, the state will pay your taxes and place a lien on your property for repayment in the future.

Other Illinois Property Tax Relief Programs for Seniors

This isn’t the only game in town. There are other senior-focused tax exemptions in Illinois that can stack with the deferral program.

1. Senior Citizens Homestead Exemption

- Lowers your home’s assessed value by $5,000 or more

- Reduces the amount you’re taxed on directly

- No repayment required

2. Senior Assessment Freeze (Senior Freeze)

- Freezes the assessed value of your home

- Protects against rising property values and tax hikes

- Income limits apply (currently $65,000)

3. General Homestead Exemption

- Available to all homeowners

- Reduces the EAV (Equalized Assessed Value) of your home

You can apply for these through your County Assessor’s Office.

Real-Life Example: Why This Matters

Martha Johnson, a retired school librarian in Springfield, had lived in her bungalow since 1975.

“I didn’t think I’d qualify,” she said. “But once the income cap increased, my daughter helped me apply. Now I don’t stress every time the tax bill comes.”

She deferred $6,300 in taxes in 2025, money she used for medical bills and fixing her roof.

Pros and Cons of the Program

Pros:

- Delays big tax payments

- Keeps seniors in their homes longer

- Interest rates are lower than market rates

- Frees up monthly income for essentials

Cons:

- It’s not a grant—it’s a loan

- Heirs must settle the debt from the estate

- Requires solid paperwork and deadlines

Common Mistakes to Avoid

- Missing the deadline (March 1)

- Assuming you qualify without calculating income

- Forgetting to attach insurance proof

- Applying while behind on taxes

How Illinois Compares to Other States?

Unlike Florida or Texas, which offer property tax exemptions, Illinois offers deferrals, which require repayment. But Illinois is more flexible in stacking programs, meaning a senior can benefit from both exemptions and deferrals for a bigger total savings.

Some Midwestern states like Indiana offer fixed credits, but Illinois’ model is based on income and home value, making it fairer for varied income brackets.

States Continuing Tax Rebates and Refunds Before 2025 Ends — Full Overview

Could Texas End School Property Taxes? Inside Greg Abbott’s Big, Controversial Proposal

NJ ANCHOR Program: Check Whether You’ll Receive the $1,750 Rebate in December