$2,000 Direct Deposit: As the holiday season kicks into full swing, one question is trending across social media, YouTube, and even WhatsApp family chats: “Is a $2,000 direct deposit from the IRS coming this December 2025?” You’ve probably seen headlines like:

“$2,000 Tariff Dividend Deposits Coming to Bank Accounts!”

Or maybe a friend posted a screenshot of a fake “IRS notice” claiming automatic deposits are hitting “before Christmas.” Let’s pause. Breathe. And break it all down.

This article is your complete guide — written in plain English, with expert context, facts, and some hard truth — so you’re not left guessing or falling for yet another online hoax.

Table of Contents

$2,000 Direct Deposit

Here’s the straight-up truth: There is no $2,000 direct deposit from the IRS coming this December 2025. What you’re seeing is a mixture of viral misinformation, political campaigning, and wishful thinking wrapped in a holiday bow.That doesn’t mean you won’t get any money — Social Security, state refunds, and other legitimate payments may still hit your account. But if someone promises a surprise IRS deposit “just for you,” it’s best to stay skeptical. Watch out for scams, and share this info with loved ones who might be confused.

| Topic | Details |

|---|---|

| Is there a new $2,000 payment? | No official IRS or federal stimulus payment is scheduled for December 2025. |

| Source of rumor | Viral misinformation based on Trump’s “tariff dividend” campaign idea. |

| IRS confirmation | The IRS has issued no new guidance on stimulus checks in 2025. |

| Past stimulus history | Last check was $1,400 under the American Rescue Plan in 2021. |

| Other potential payments | State rebates, delayed tax refunds, Social Security deposits. |

| Scam alert | Fraudulent texts, emails, and fake “claim portals” are spreading online. |

| Official resource | IRS Newsroom for verified payment info. |

Where $2,000 Direct Deposit Rumor Started?

The story seems to have begun in early December 2025 when former President Donald Trump proposed a new type of economic relief: the “Tariff Dividend.”

He suggested that, under his plan, the U.S. could use tariff revenue from Chinese imports to send $2,000 checks to American households earning under $100,000 a year. The statement gained traction in a televised cabinet meeting and quickly went viral on Truth Social, YouTube shorts, and TikTok.

But here’s what many people missed:

There is no official legislation, IRS infrastructure, or Treasury funding to support this payout.

Even Trump’s own Treasury Secretary, Scott Bessent, admitted in a December 8th interview that no implementation details exist and that the idea had not yet been formally presented to the Treasury Department.

A Quick History of Federal Stimulus Checks

Let’s remind ourselves how real stimulus checks work:

| Year | Amount | Legislation |

|---|---|---|

| 2020 (Mar) | $1,200 | CARES Act |

| 2020 (Dec) | $600 | COVID-Relief Bill |

| 2021 (Mar) | $1,400 | American Rescue Plan |

These weren’t surprises. They came after months of debate, passed through Congress, and were signed into law by sitting presidents. In each case:

- Eligibility rules were clearly defined.

- IRS portals were launched to track payments.

- Deposits were scheduled, predictable, and verifiable.

By contrast, no such federal infrastructure or process exists today for a $2,000 payment.

Why the “Tariff Dividend” Doesn’t Add Up?

What Is a Tariff Dividend?

A tariff is a tax on goods imported from other countries. The U.S. collects billions from these, especially from China.

Trump’s proposal would redirect these funds — currently used to support farmers or reduce deficits — directly to taxpayers as a sort of “dividend.”

The Math Problem

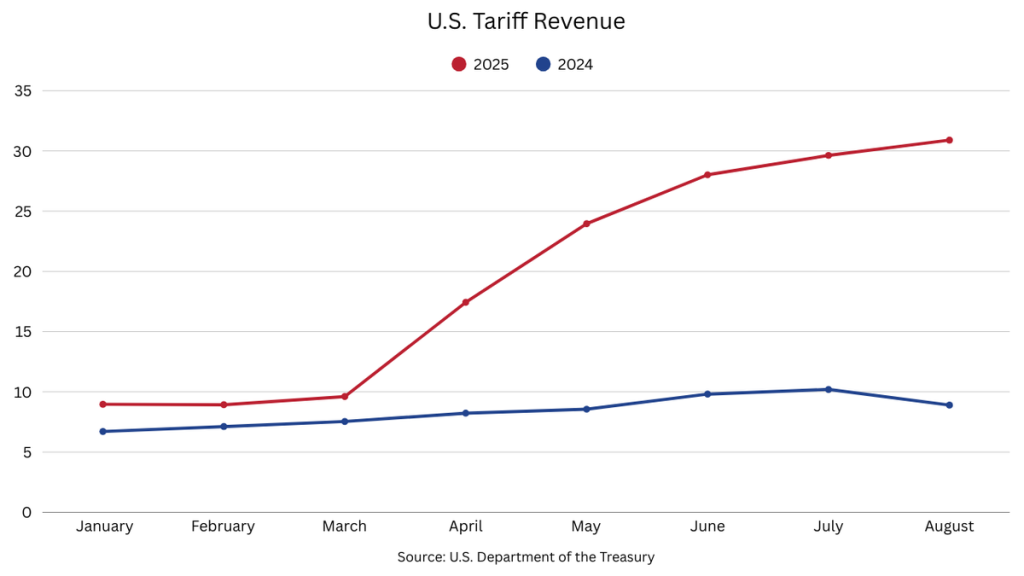

- The U.S. collected $79 billion in tariffs in FY 2023.

- There are over 250 million American adults.

- A $2,000 check would cost $500 billion.

Even if 50% of Americans qualified, the program would still need 3–4 times the annual tariff revenue to function.

“The math doesn’t support a $2,000 tariff-funded payout unless the government slashes other spending or borrows massively.”

— William Gale, Senior Fellow at the Brookings Institution

What You Might Actually See in December 2025?

While there’s no blanket $2,000 payment, some people will still get money this month — legally and rightfully.

1. Social Security and SSI Payments

If you’re receiving Social Security, Disability (SSDI), or Supplemental Security Income (SSI), you’ll see your usual monthly benefit deposit, often before Christmas depending on your birthdate.

2. State-Level Rebates

Some states are issuing property tax refunds, inflation relief, or income tax credits. These vary by location and include:

- Minnesota: Up to $1,300 in family rebates.

- California: Remaining Middle-Class Tax Refunds for late filers.

- New Mexico: Energy assistance credits.

Check your state’s Department of Revenue or Taxation page.

3. IRS Refunds or Rebate Adjustments

If you filed taxes late (for 2020 or 2021) and claimed missing stimulus payments or child tax credits, you might be receiving a final refund adjustment.

But the IRS closed most claims in April 2025, so only those with pending cases may still see a deposit.

4. Earned Income Tax Credit (EITC) Advances

Some low-income households receiving year-end advance payments via IRS-approved programs may get funds — usually under $1,000.

Why $2,000 Direct Deposit Rumors Go Viral During the Holidays?

It’s no accident that these stories explode right before Christmas. There’s a pattern to it.

Psychological Triggers:

- Holiday stress: Higher spending on food, travel, and gifts.

- Economic anxiety: Inflation, layoffs, and high interest rates put pressure on wallets.

- Hope culture: People want to believe something good is coming, especially in hard times.

And bad actors know this. That’s why scam emails, texts, and social media posts offering “stimulus signup” or “deposit trackers” spike during November and December.

Red Flags to Watch Out For

If you get a message claiming “you qualify for a $2,000 deposit,” don’t click it — especially if it asks for:

- Bank account info

- Social Security number

- IRS login credentials

Remember:

The IRS will never text, email, or call you to confirm payments.

You can always check your payment status at Get My Payment.

What the IRS Has Officially Said?

According to the IRS’s latest December 2025 bulletin:

“There are no authorized economic impact payments scheduled for release in Q4 2025. Any such claims should be verified through IRS.gov or with an authorized tax professional.”

The Political Angle: A Campaign Talking Point?

The “tariff dividend” appears to be more of a campaign talking point than a fiscal reality.

In past elections, promises of tax cuts or direct payments have swayed voters — and Trump’s latest proposal might just be a strategic headline aimed at working-class voters in swing states.

But ideas aren’t laws. Until Congress acts, this remains a “maybe someday” — not a “money’s coming now.”

What to Do If You’re Counting on That Money?

If you were banking on this check, here’s some practical advice:

- Avoid payday loans based on stimulus rumors.

- Check your actual refund status with IRS tools.

- Explore state resources for food stamps, housing help, or energy bill credits.

- Contact your local tax preparer or community service office — they may know of local or seasonal assistance programs.

December 18 Direct Deposit: One State to Send $1,000 Payments to Eligible Households

Goodbye IRS Direct File—The Free Tax Filing Program Is Ending, and Millions Must Now Adjust