Latest Retirement Age in the World: Retirement — for many Americans, it’s the light at the end of the long work tunnel. Whether you’re fresh out of college, in the thick of your career, or approaching your 60s, one thing’s certain: understanding retirement age is essential to planning your financial future. But here’s something most people don’t realize — retirement age isn’t the same everywhere. In fact, one country stands out for having the latest official retirement age in the world. And while the United States is close to the top of the list, it doesn’t take first place. This comprehensive guide breaks down global retirement ages, where the U.S. stands, how the system works, and what it all means for your financial future. Whether you’re a working professional, financial advisor, or curious student, this article will give you a full, accurate, and easy-to-understand picture.

Table of Contents

Latest Retirement Age in the World

Retirement age is more than a number — it’s a roadmap for your future. While Libya sets the global high mark at 70, the U.S. ranks among the top with a retirement age approaching 67. Understanding how retirement works — from early options to delayed benefits — empowers you to make the best financial decision for your life. No matter where you are in your career, the time to start planning is now. Because when retirement finally comes, you’ll want to be ready — financially, emotionally, and practically.

| Topic | Details |

|---|---|

| Highest Retirement Age in the World | Libya — 70 years (men and women) |

| U.S. Retirement Age (Full Benefits) | 66.8 years (2025), rising to 67 for those born in 1960 or later |

| Average Global Retirement Age | 64.2 for men, 63.5 for women |

| Early Retirement in the U.S. | Allowed from age 62, with reduced Social Security |

| Other Countries at 67 | Australia, Italy, Greece, Iceland, Netherlands, Denmark |

| Legal vs. Effective Retirement Age | Legal is when you’re eligible for benefits; Effective is when people actually retire |

| Sources | SSA.gov, World Population Review |

Which Country Has the Latest Retirement Age in the World?

As of 2025, Libya holds the global record for the highest official retirement age — a striking 70 years old for both men and women. This sets Libya apart from other countries, many of which hover between 65 and 67.

Why so high? Several reasons:

- Libya’s public sector is large and dominant, often requiring older employees to remain active longer.

- Pension systems are under financial stress, encouraging later retirement to reduce pressure.

- There may be limited economic opportunities for younger workers, pushing older adults to stay in the workforce longer.

This policy choice may surprise those who expect higher-income countries to demand longer working years. But as we’ll see, economic stability, workforce demographics, and government pension strategies all play a part.

Where Does the U.S. Rank?

The United States is among the top countries with a high retirement age, but it’s not quite at the top. In 2025, the full retirement age for most Americans is approximately 66.8 years and is on track to rise to 67 for anyone born in 1960 or later.

This ranks the U.S. just below Libya and places it in the same category as countries like:

- Italy

- Greece

- Australia

- Iceland

- Denmark

- The Netherlands

All of these countries have legal retirement ages set at 67, though actual retirement behavior can differ widely.

Unlike many other nations, the U.S. provides flexibility:

- You can retire as early as 62, though your monthly Social Security benefits will be permanently reduced (by as much as 30%).

- Or, you can delay retirement up to age 70, which maximizes your benefits.

This flexibility allows Americans to make retirement decisions based on their personal health, financial situation, and career trajectory.

Historical Context: How the U.S. Retirement Age Evolved

In 1935, when President Franklin D. Roosevelt signed the Social Security Act into law, the full retirement age was set at 65. Back then, life expectancy was around 61 years, meaning many people never lived long enough to collect benefits.

Today, the average American lives well into their late 70s or beyond. As a result:

- Congress passed the Social Security Amendments of 1983, gradually increasing the retirement age from 65 to 67.

- This shift was designed to protect the long-term sustainability of Social Security as the population aged and lived longer.

The increase has been phased in over decades, and by 2027, nearly all new retirees will face a full retirement age of 67.

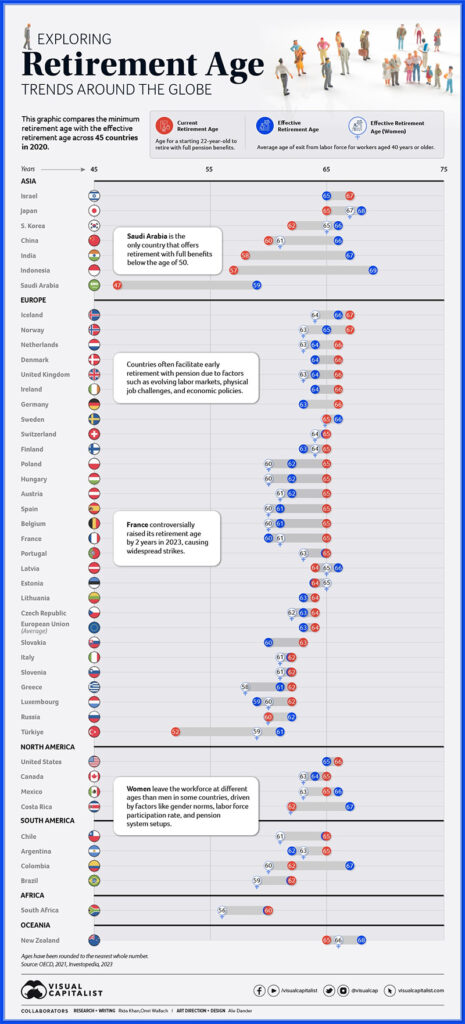

Global Comparison: Retirement Ages Around the World

Here’s a comparison of legal retirement ages in major countries as of 2025:

| Country | Legal Retirement Age |

|---|---|

| Libya | 70 |

| Italy | 67 |

| Australia | 67 |

| Greece | 67 |

| Netherlands | 67 |

| Denmark | 67 |

| Iceland | 67 |

| United States | 66.8 |

| Spain | 66.7 |

| Portugal | 66.6 |

| Germany | 66.3 |

| Japan | 65 |

| Canada | 65 |

| France | 64 (recently increased from 62) |

Note: Countries like France have faced massive public protests over raising retirement age, highlighting the political sensitivity of these reforms.

Legal vs. Effective Retirement Age

Many people confuse legal retirement age with the actual age at which people retire. Let’s clear that up.

- Legal Retirement Age: The age at which individuals are eligible for full pension or public retirement benefits.

- Effective Retirement Age: The average age when people actually leave the workforce.

In the U.S., for example:

- The legal retirement age is approaching 67.

- The effective retirement age (when people actually retire) is about 64 for men and 62 for women, depending on occupation, income, and health.

Factors that affect early or delayed retirement include:

- Access to savings or employer pensions

- Physical demands of the job

- Healthcare needs

- Family responsibilities

Why Are Retirement Ages Rising Globally?

Many countries are pushing back retirement ages. This is driven by several realities:

- Longer Life Expectancy

People are living longer and drawing pensions for more years. To keep retirement systems financially viable, retirement ages are increasing. - Aging Populations

Countries like Japan, Italy, and Germany have shrinking workforces. Fewer young workers are available to support retirees through payroll taxes. - Rising Healthcare Costs

As people live longer, their medical costs increase. Delaying retirement helps ensure they remain covered by employer-provided insurance. - Sustainability of Public Pension Systems

Governments must find ways to keep pension systems funded. Raising the retirement age is one of the least politically complicated levers. - Changing Nature of Work

With more jobs shifting to remote or digital formats, many professionals can continue working into their 60s and 70s.

Real-Life Examples: Retirement Scenarios in the U.S.

Understanding retirement age on paper is one thing. Let’s see how it plays out in real life.

Barbara (Age 59): Public School Teacher

Barbara is eligible for her state pension at 62. However, she also wants full Social Security benefits, so she plans to continue working part-time until 67.

Tom (Age 53): Construction Worker

Tom’s job is physically demanding. He’s planning to retire at 62 and accept reduced benefits because he doesn’t think he’ll be able to work full-time beyond that age.

Leah (Age 34): Tech Startup Founder

Leah contributes to a solo 401(k) and Roth IRA. She doesn’t plan to retire traditionally. She may continue working into her 70s — not because she has to, but because she enjoys building businesses.

Social Security: Early vs. Full vs. Delayed Retirement

You have three options for claiming Social Security:

- Early Retirement (Age 62)

You can claim benefits early, but receive only 70–75% of your full amount. - Full Retirement Age (66–67)

You receive 100% of your benefit, based on your birth year. - Delayed Retirement (up to Age 70)

Your benefits increase by 8% per year for every year you wait past full retirement age, up to age 70.

Delaying retirement can result in significantly larger monthly payments — but it also means you’ll have to work longer or rely on other savings in the meantime.

Legislation Watch: Will U.S. Retirement Age Go Higher?

There’s growing debate in Congress about increasing the retirement age again. Some proposals include:

- Raising the age to 68 or 70

- Gradually increasing the age based on future life expectancy

- Reducing benefits for high-income earners to improve fairness

One example is the Social Security 2100 Act, which proposes tax increases on higher earners while maintaining the retirement age at 67. These decisions will impact millions of future retirees.

Planning for Retirement: Tools and Tips

You can’t control the national retirement age, but you can take steps now to build a secure retirement plan.

- Know Your Full Retirement Age

Visit SSA.gov to confirm your FRA. - Use Calculators

- Social Security Retirement Estimator

- AARP’s Social Security Benefits Calculator

- Diversify Savings

Use a mix of IRAs, 401(k)s, Roth accounts, and brokerage investments. - Track Expenses

Know what you spend monthly. That’s key to knowing how much income you’ll need in retirement. - Consider Healthcare

Medicare begins at 65, but it doesn’t cover everything. Look into supplemental plans or HSAs.

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Ranking the 15 Least Friendly Cities for Retirement — Check Which Surprised the List