New York Announces 2026 Minimum Wage Hike: The New York 2026 minimum wage increase is official, and it’s stirring conversation from Albany to Brooklyn. Beginning January 1, 2026, New York’s lowest-paid workers will see their paychecks rise again, marking another big step toward fairer wages and economic balance in one of the most expensive states in America. This isn’t just a bureaucratic policy change. It’s real money that affects how people pay rent, buy groceries, or afford childcare. For employers, it’s a reminder to adapt payrolls, budgets, and compliance systems ahead of time. Let’s break down everything you need to know about this upcoming change, who gains the most, and how both workers and business owners can prepare smartly.

Table of Contents

New York Announces 2026 Minimum Wage Hike

The 2026 New York minimum wage increase is a major step toward a more equitable economy. With rates climbing to $17/hour in NYC, Long Island, and Westchester, and $16/hour across the rest of the state, millions of workers will see tangible improvements in their paychecks. This wage hike helps families manage higher costs, strengthens the middle class, and empowers workers to live with dignity in an expensive state. For employers, it’s a reminder to plan ahead, update systems, and invest in retention. As New York transitions to inflation-based increases in 2027, it sets an example for the nation — balancing economic growth with fairness and human dignity.

| Topic | Details |

|---|---|

| Effective Date | January 1, 2026 |

| NYC, Long Island, Westchester | $17.00/hour |

| Rest of New York State | $16.00/hour |

| 2025 Rate (for comparison) | NYC/Downstate: $16.50 |

| Future Adjustments | Indexed to Inflation (CPI-W) starting 2027 (ny.gov) |

| Main Industries Affected | Retail, hospitality, healthcare, construction, education, gig work |

| Overtime Pay Rule | 1.5× hourly rate after 40 hours/week |

| Official Source | New York State Department of Labor (DOL) |

What’s Changing in 2026?

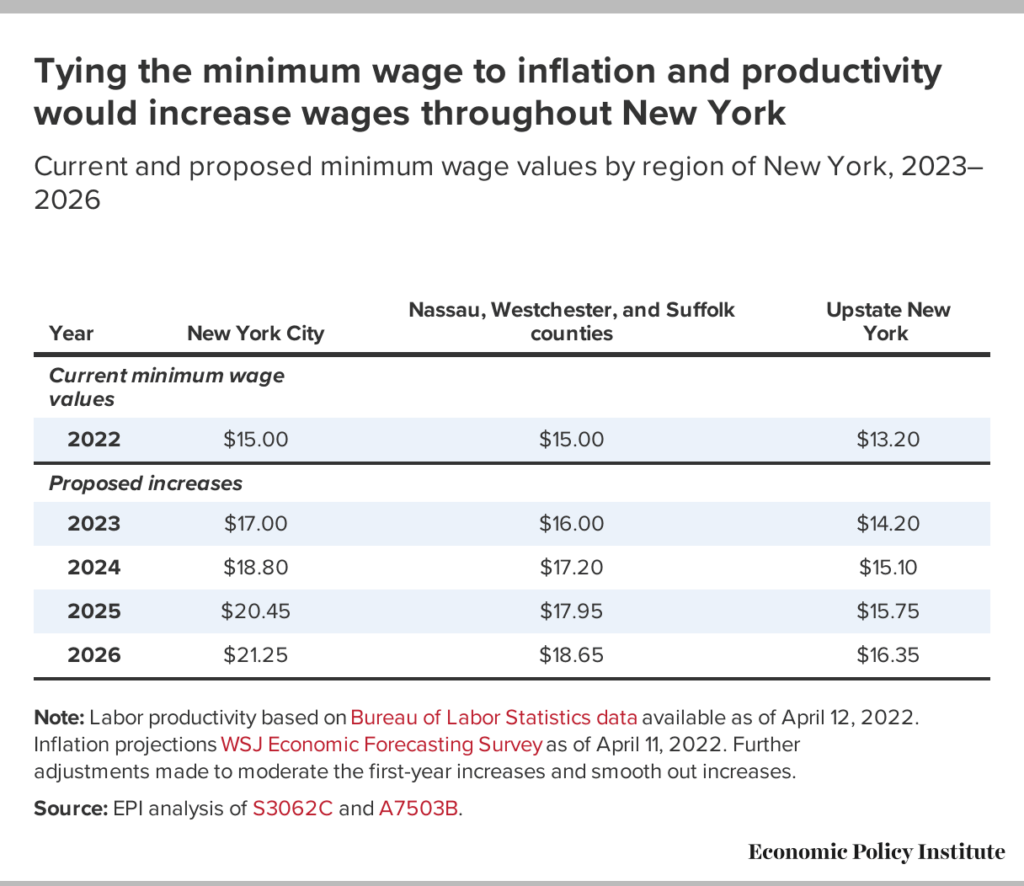

Starting January 1, 2026, the New York minimum wage will increase by 50 cents per hour statewide.

- In New York City, Long Island, and Westchester County, the minimum wage will be $17 per hour.

- In the rest of the state, it will rise to $16 per hour.

This is part of a multi-year wage plan first announced in 2023, designed to gradually align pay levels with the actual cost of living across different parts of New York. These wage floors are mandatory for most hourly, non-exempt workers — meaning you’re entitled to these rates unless you’re in a very specific exemption category defined by law.

And beginning January 2027, things get even more interesting: future raises will automatically adjust each year based on inflation — measured using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the Northeast. This means wages will finally keep up with rising prices, instead of falling behind as inflation erodes real purchasing power.

A Look Back: New York’s Wage Journey

To understand why this increase matters, it helps to look back at where we started.

In 2016, New York introduced a tiered minimum wage system for the first time, acknowledging that living in Manhattan isn’t the same as living in Binghamton. Back then, the wage was $9 per hour statewide — and $15/hour in NYC was just a dream on the horizon.

Fast forward a decade, and the wage has nearly doubled. But as living costs and rent soared, many working-class families still struggle. According to the MIT Living Wage Calculator, a single adult in New York City now needs $24.66/hour to meet basic living expenses. The new $17/hour rate is progress, but there’s still ground to cover.

Why the New York Announces 2026 Minimum Wage Hike Matters?

For Workers

This wage hike means more stability, especially for those living paycheck to paycheck.

Let’s put this in perspective:

A full-time worker (40 hours/week) at $17/hour earns $680 weekly, compared to $660 at $16.50/hour. Over a year (50 working weeks), that’s an additional $1,000 — money that can cover bills, transportation, or savings.

And for those working overtime, the pay increases too. At $17/hour, overtime pay becomes $25.50/hour after 40 hours per week, according to the New York City Comptroller’s Office.

For Families

For a family of two full-time minimum wage earners, that’s roughly $2,000 more household income per year. It can cover rising utility costs, school supplies, or medical expenses — essentials that have jumped in price across New York since the pandemic.

For the Economy

More money in workers’ pockets also means more spending at local businesses. Economists call this the “multiplier effect” — every extra dollar earned by a low-wage worker tends to circulate quickly in the local economy, boosting restaurants, grocery stores, and small shops.

Who Benefits Most From New York Announces 2026 Minimum Wage Hike?

- Low-Wage Hourly Workers

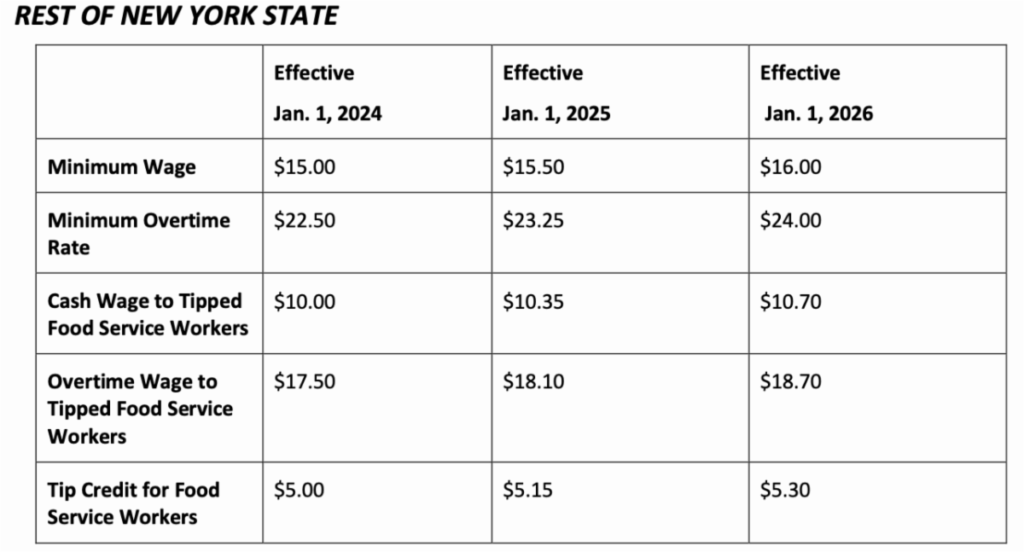

Retail cashiers, cleaners, caregivers, and fast-food workers will see a direct, guaranteed raise. These employees form the backbone of the service economy, and many of them have seen stagnant wages despite rising rent and inflation. - Tipped Workers

Tipped employees, such as servers and bartenders, will see an increase in their cash wage minimum and an adjustment in tip credits. This ensures they receive a stable income even during slow business periods. Employers must ensure tips plus cash wage always equal at least the new minimum wage. - Part-Time and Young Workers

Teenagers, college students, and part-timers — who often earn close to minimum wage — benefit significantly. A few extra dollars an hour means a stronger financial foundation and more independence. - Upstate Workers

While the rate outside NYC is lower ($16/hour), it remains competitive relative to regional living costs. In areas like Rochester or Albany, where housing and transportation are cheaper, this raise provides meaningful improvement in real purchasing power.

How to Prepare for the 2026 Minimum Wage Hike?

For Workers

Step 1: Confirm your new wage rate based on your region using the official NYS DOL wage map.

Step 2: Review your January 2026 paystub to verify your employer applied the new rate.

Step 3: Track overtime hours and ensure they’re calculated at time-and-a-half.

Step 4: If underpaid, contact the New York Department of Labor’s Division of Labor Standards or file a complaint online.

Step 5: Keep learning about wage rights through community organizations and DOL workshops.

For Employers

Employers should take this as an opportunity to modernize payroll and compliance systems.

Here’s a quick checklist:

- Update payroll software and accounting tools by December 2025.

- Adjust salaried exemption thresholds (these are expected to rise as well).

- Post the new minimum wage notice prominently at all workplaces.

- Train HR teams on overtime calculations and employee classification.

- Review pricing strategies to offset higher labor costs responsibly.

- Consult legal or HR professionals to avoid compliance penalties.

Non-compliance isn’t worth the risk — penalties can include back pay, interest, and fines under New York’s Labor Law Section 652.

Broader Impact and Economic Outlook

Economists and labor experts view this as a measured and balanced increase. The New York State Department of Labor projected minimal job loss impacts due to the gradual rollout. In fact, many small businesses are already paying above minimum wage to retain staff amid labor shortages.

Dr. Ethan Miller, a labor economist at SUNY Albany, explains:

“This isn’t about pricing employers out — it’s about catching up. Wages haven’t kept pace with inflation or productivity. When the floor rises moderately and predictably, businesses can plan ahead, and workers gain stability.”

According to Moody’s Analytics, similar moderate wage hikes tend to boost local spending without driving major price hikes. The extra income circulates into local economies through groceries, transportation, and rent — generating more sales tax and economic activity.

How New York Compares Nationally?

New York joins a small group of states leading the charge for higher wage standards:

- Washington: $17.25/hour (2025) — the highest in the nation.

- California: $16/hour statewide in 2024.

- Massachusetts: $15/hour statewide.

- Federal Minimum Wage: $7.25/hour (unchanged since 2009).

This puts New York in the top tier nationally, reinforcing its leadership in wage equity and cost-of-living alignment. It also keeps New York competitive in retaining workers who might otherwise migrate to states with higher pay floors.

Real-World Example

Let’s take a look at Maria, a 29-year-old single mom working 35 hours a week at a Brooklyn diner.

In 2025, she earns $16.50/hour — about $577/week.

In 2026, she’ll make $17/hour — $595/week.

That’s nearly $936 more a year before taxes. It might not sound like much, but for Maria, it covers her MetroCard, phone bill, and a portion of childcare — everyday costs that directly affect her quality of life.

New York Social Security Schedule: Exact December 2025 Payment Dates

$4018 SSDI Payment in December 2025: How to get it? Check Eligibility, Schedule

Ranking the 15 Least Friendly Cities for Retirement — Check Which Surprised the List