December 2025 Direct Deposit: If you’ve been scrolling through social media lately, chances are you’ve seen posts claiming a “US $4,873 December 2025 Direct Deposit” is being issued to all Americans. From viral TikTok videos to Facebook shares, these posts have left many people wondering — is this a new stimulus check, or just another online hoax? Let’s cut through the noise and get the truth out there. The short answer? No, there’s no special $4,873 government direct deposit in December 2025. But there are real payments scheduled for millions of Social Security and SSI beneficiaries this month. The confusion comes from a mix of misleading social posts, outdated data, and a misunderstanding of what that number really represents.

Table of Contents

December 2025 Direct Deposit

The “US $4,873 December 2025 Direct Deposit” rumor sounds exciting, but it’s not an extra stimulus or special bonus. That figure represents the maximum possible Social Security payment, not a universal benefit. Still, millions of Americans will receive official Social Security and SSI payments this December — on time and through direct deposit. By understanding the payment schedule, knowing your eligibility, and avoiding scams, you can ensure your financial peace of mind this holiday season. When in doubt, always double-check or call 1-800-772-1213. Staying informed is your best defense against misinformation.

| Topic | Details |

|---|---|

| Claimed Amount | $4,873 (misinterpreted — refers to maximum Social Security benefit) |

| Actual Programs | Social Security Retirement, SSDI, and SSI |

| December 2025 Payment Dates | Dec 1 (SSI), Dec 3 (Early SS), Dec 10 / 17 / 24 (Regular SS), Dec 31 (January 2026 SSI Early Payment) |

| Average Social Security Benefit (2025) | $1,913/month |

| Average SSI Benefit (2025) | $967/month |

| Eligibility | Based on income, work history, disability, or age |

| Official Source | www.ssa.gov |

| Rumor Status | False — no new federal stimulus |

| Payment Method | Direct Deposit via SSA/Treasury |

The Origin of the $4,873 December 2025 Direct Deposit Claim

The figure making the rounds online — $4,873 — didn’t come from a secret government memo or a new White House policy. It actually comes from Social Security’s 2025 benefit chart, where it represents the maximum possible monthly Social Security retirement payment.

To receive that much, a person must:

- Have worked at least 35 years.

- Earned the maximum taxable income each of those years.

- Waited until age 70 to claim Social Security benefits.

Most Americans don’t meet those criteria. According to SSA data, the average retiree receives around $1,913 per month, while people on SSI (Supplemental Security Income) get an average of $967.

So, while $4,873 is a real number, it applies to a small group of long-time, high-income earners — not everyone.

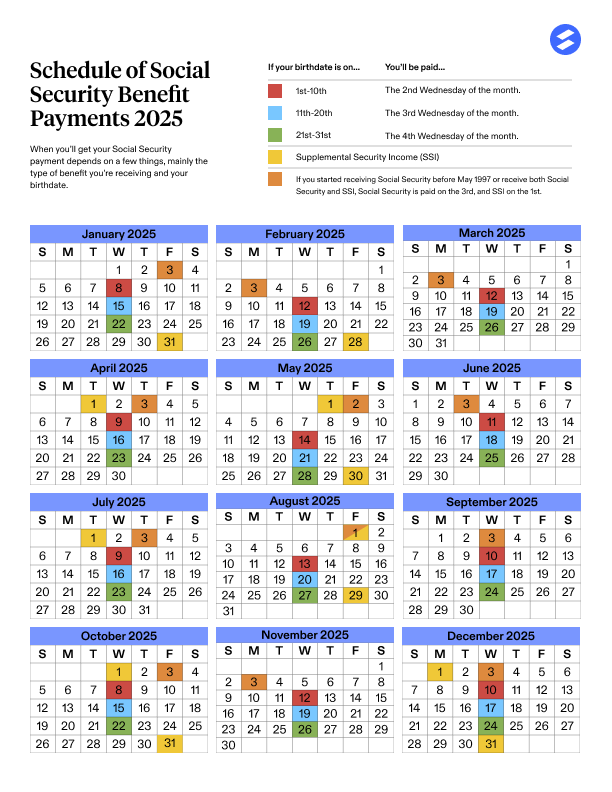

The Official December 2025 Direct Deposit Payment Schedule

The Social Security Administration (SSA) has a consistent payment schedule that determines when benefits are sent out. Here’s what you need to know for December 2025:

Supplemental Security Income (SSI)

- December 1, 2025: Regular monthly SSI payment for December.

- December 31, 2025: Early payment for January 2026, since January 1 is a federal holiday.

That means SSI recipients receive two payments in December, but the second one counts for January. It’s not a bonus — just a scheduling adjustment.

Social Security Retirement, SSDI, and Survivors Benefits

Payments for retirees, disabled workers, and survivors are issued on Wednesdays, based on the beneficiary’s date of birth:

| Birth Date Range | Payment Date (2025) |

|---|---|

| 1st–10th | December 10 |

| 11th–20th | December 17 |

| 21st–31st | December 24 |

If you’ve been receiving benefits since before May 1997, your payment will arrive on December 3, 2025.

Direct deposit is automatic for most recipients, hitting accounts early in the morning of the payment date. Paper checks may arrive later, depending on mail delivery times.

Who Qualifies for December 2025 Direct Deposit?

Social Security Retirement

You’re eligible if:

- You’ve worked for at least 10 years (40 work credits).

- You’re at least 62 years old.

- You’ve paid into Social Security through payroll taxes.

Your monthly amount depends on your average earnings, when you start collecting, and whether you delay benefits to increase the payout.

Social Security Disability Insurance (SSDI)

You may qualify if:

- You’re under full retirement age.

- You have a severe, long-term medical condition that prevents you from working.

- You’ve paid enough Social Security taxes during your working years.

Supplemental Security Income (SSI)

SSI is designed for people who:

- Have limited income and resources.

- Are 65 or older, or have a disability.

- Meet residency and citizenship requirements.

Eligibility for SSI can also open doors to Medicaid and SNAP (food assistance) in most states.

How Much Will You Receive?

The exact payment amount varies depending on your situation, but here’s what most Americans can expect in 2025:

- Average Social Security Retirement: $1,913 per month

- Average SSDI: $1,537 per month

- Average SSI: $967 per month

- Maximum Possible Social Security (at 70): $4,873 per month

In addition, Social Security payments in 2025 include a 3.2% cost-of-living adjustment (COLA), designed to help beneficiaries keep up with inflation.

How to Check Your Eligibility and Payment Status?

If you’re unsure about your eligibility or benefit amount, here’s a step-by-step guide to verify your status safely:

- Create a “my Social Security” Account:

Visit ssa.gov/myaccount. You’ll be able to view your benefit amount, earnings record, and payment dates. - Set Up Direct Deposit:

Log into your SSA account, go to “Benefits & Payments,” and ensure your bank details are correct. Direct deposit is faster, safer, and more reliable than paper checks. - Use SSA’s Benefit Estimator:

The SSA’s online calculator at ssa.gov/benefits/retirement/estimator.html provides an instant estimate of your expected monthly benefit. - Monitor Your COLA Notice:

Every fall, SSA mails out COLA notices that detail benefit increases for the following year. Keep an eye on your mailbox or SSA account. - Check Your Payment Status:

If your deposit doesn’t arrive on time, wait three business days, then contact SSA at 1-800-772-1213 or visit your local office.

Understanding the Rumors and Scams

The rise of misinformation about government payments isn’t new. Each year, fake “stimulus” rumors resurface, often spreading faster around the holidays.

Some of these posts claim you can “apply” for the $4,873 deposit or that it’s a “holiday relief” bonus. In reality, no such program has been approved by Congress or the Treasury Department as of December 2025.

The Federal Trade Commission (FTC) warns that scammers frequently pose as government agencies, asking for personal information, Social Security numbers, or small “processing fees” to claim fake payments. In 2024, Americans lost over $160 million to Social Security and IRS impostor scams.

Expert Tips to Maximize Your Benefits

Financial experts suggest that small adjustments can help you get the most out of your Social Security or SSI payments:

- Delay claiming benefits if possible. Each year you delay past full retirement age increases your benefit by roughly 8% up to age 70.

- Check your earnings record annually. Mistakes can happen, and missing income could lower your monthly payout.

- Budget around your payment date. Plan bills and expenses for the day your deposit arrives to avoid overdrafts.

- Avoid sharing sensitive information online. Scammers target seniors with fake “payment verification” forms that look official.

- Consider setting up automatic savings. Even a small portion saved from your monthly check can build an emergency fund.

A Real-Life Example

Take Linda, a 68-year-old retired nurse from Ohio. She worked for 40 years, paid into Social Security consistently, and decided to claim at 67. Her current monthly benefit is about $2,150.

Her husband receives disability benefits, and together they rely on their direct deposits to cover essentials. Linda says she sets reminders on her phone for her payment dates, and if she doesn’t see it by noon, she checks her SSA account before calling her bank.

Stories like Linda’s are common — and they show how staying organized and informed makes a big difference, especially around the holidays when scams and rumors spread fast.

Why Staying Informed Matters?

Understanding your Social Security and SSI payments isn’t just about tracking money — it’s about protecting your financial security.

Many Americans live on fixed incomes, and even a small disruption in payment timing can cause stress. By knowing your exact payment dates, keeping direct deposit active, and using official resources, you can stay in control.

Also, staying updated helps you plan for COLA increases, tax implications, and even future benefit adjustments if Congress updates Social Security law in the coming years.

December 18 Direct Deposit: One State to Send $1,000 Payments to Eligible Households

$2000 Stimulus Check in December 2025: Check Payment Date & Eligibility Criteria