$4018 SSDI Payment: If you’ve been hearing about the $4,018 SSDI payment in December 2025, you’re not alone. Across the United States, millions of Americans are asking the same questions: Who qualifies for this payment? When will it arrive? And why is everyone talking about $4,018? In this detailed guide, we’ll walk you through everything — the Social Security Disability Insurance (SSDI) payment schedule, eligibility requirements, maximum benefit details, and the new 2025 changes. Written in clear language, this article is designed to help both beginners and professionals understand the system and make confident, informed decisions.

Table of Contents

$4018 SSDI Payment

The $4,018 SSDI payment in December 2025 represents the highest monthly benefit available under current Social Security guidelines. While only top earners reach that amount, every qualifying American deserves to understand how these benefits work and how to secure them. Staying informed, organizing your paperwork, and using tools can make the difference between a delayed application and timely approval. SSDI is more than just financial aid — it’s a safety net built from years of your contributions, designed to protect your dignity and independence when life takes an unexpected turn.

| Topic | Details |

|---|---|

| SSDI Maximum Payment 2025 | Up to $4,018/month for top earners |

| Average SSDI Benefit | Around $1,580/month |

| December 2025 Payment Dates | Dec 3, 10, 17, 24 depending on date of birth |

| COLA Increase 2025 | 2.5% raise from 2024 |

| SSI Double Payments | Dec 1 and Dec 31, 2025 due to Jan 1 holiday |

| Eligibility Requirements | Work credits and disability standards |

What Is SSDI?

Social Security Disability Insurance (SSDI) is a program run by the U.S. government that pays monthly benefits to individuals who can’t work because of a severe disability. Unlike welfare or public assistance, SSDI is earned through the Social Security taxes you’ve paid while working. Think of it as an insurance plan — you’ve contributed to it during your career, and now, when you need it, it pays back. These benefits aren’t random. They’re based on your average lifetime earnings and how long you’ve worked, ensuring that the amount you receive reflects your work history.

Who Qualifies for $4018 SSDI Payment?

Getting SSDI isn’t automatic. You need to meet two main requirements: sufficient work credits and a qualifying disability.

1. Work Credits

You earn Social Security work credits when you work and pay Social Security taxes. In 2025, you get one credit for every $1,730 in wages or self-employment income. You can earn up to four credits per year.

Typically:

- Most adults need 40 credits to qualify.

- 20 of those must have been earned within the last 10 years before your disability began.

- Younger workers (under age 31) may qualify with fewer credits.

For instance, someone who’s 27 may qualify with as few as 12 credits. The SSA has an official chart to determine exact requirements.

2. Medical Disability

The Social Security Administration (SSA) defines disability strictly. Your condition must:

- Prevent you from performing “Substantial Gainful Activity (SGA)” — meaning you can’t earn above a certain amount, set at $1,620 per month in 2025.

- Be expected to last at least 12 months or result in death.

The SSA maintains a detailed “Blue Book” listing recognized disabilities. Conditions not listed can still qualify if you can prove they’re equally severe.

SSDI Payment Schedule for December 2025

The SSA sends SSDI payments based on your date of birth and the date you first started receiving benefits. Here’s the breakdown for December 2025:

| Birth Date Range | Payment Date |

|---|---|

| 1st – 10th | December 10, 2025 |

| 11th – 20th | December 17, 2025 |

| 21st – 31st | December 24, 2025 |

| Began Benefits Before May 1997 | December 3, 2025 |

If your payment date falls on a weekend or federal holiday, you’ll receive it the business day before. Payments typically arrive via direct deposit, which is faster and more secure than checks.

How Much Will You Receive?

The headline figure — $4,018 — is the maximum SSDI payment for 2025. This doesn’t mean everyone receives that amount. The average payment is closer to $1,580 per month, and your benefit depends on your past income and work history.

To calculate your payment, the SSA uses your Average Indexed Monthly Earnings (AIME) and applies a formula called Primary Insurance Amount (PIA). The more you earned while working and paying Social Security taxes, the higher your SSDI check.

Example:

Let’s take John, a construction manager from Illinois. Before his injury, he earned $75,000 per year. His SSDI benefit for 2025 is about $2,100 per month, based on his work credits and earnings. He doesn’t get the max, but it’s enough to support his basic expenses.

SSDI vs. SSI: What’s the Difference?

Many people confuse SSDI with SSI (Supplemental Security Income), but they’re not the same program.

| Feature | SSDI | SSI |

|---|---|---|

| Funded By | Payroll taxes (FICA) | General tax revenue |

| Based On | Work history and earnings | Financial need |

| Maximum Benefit 2025 | $4,018/month | About $943/month |

| Medical Rules | Same for both | Same |

| Payment Dates | 2nd, 3rd, or Wednesday | 1st of the month |

| Double Payment in December 2025 | No | Yes (Dec 1 and 31) |

In short, SSDI is an earned benefit; SSI is a needs-based program for people with low income or limited assets.

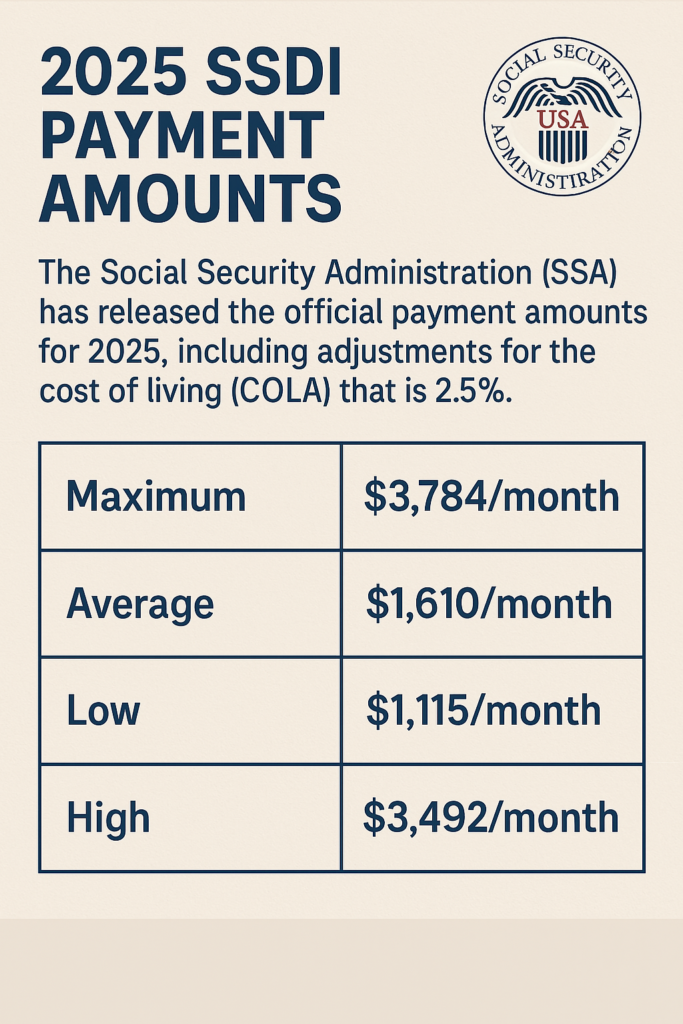

2025 Changes: COLA and Inflation Impact

Every year, the SSA adjusts benefits through a Cost-of-Living Adjustment (COLA) to keep up with inflation. For 2025, SSDI payments increased by 2.5% compared to 2024.

For example:

- A person receiving $1,600 in 2024 will receive about $1,640 in 2025.

- The maximum benefit rose from $3,822 to $4,018.

This adjustment helps offset rising costs for essentials like rent, healthcare, and food. In 2026, analysts expect another small increase of around 2.8%, depending on inflation rates.

Step-by-Step: How to Apply for $4018 SSDI Payment

Applying for SSDI can seem complicated, but breaking it into steps makes it easier:

Step 1. Check Your Eligibility

Use the SSA’s Disability Eligibility Tool to confirm your work credits and condition qualify.

Step 2. Gather Documentation

Collect:

- Medical reports, treatment notes, and test results

- Proof of income (W-2s, tax returns)

- Identification and Social Security number

- A list of medications and doctors

Step 3. Submit Your Application

Apply online at SSA.gov, call 1-800-772-1213, or visit your local SSA office.

Step 4. Wait for a Decision

Most applications take 3–6 months. Around 65% of first-time applications are denied, often due to incomplete paperwork.

Step 5. Appeal if Denied

If denied, file an appeal within 60 days. Many applicants are approved after a review or hearing, especially with legal representation.

Common Mistakes That Delay SSDI Payments

- Submitting incomplete or unclear medical records

- Ignoring SSA mail or missing deadlines

- Applying for SSI instead of SSDI (or vice versa)

- Failing to report changes in work status or income

- Not setting up direct deposit, leading to check delays

Tips to Maximize Your SSDI Benefits

- Stay in touch with SSA. Keep your contact information updated.

- Set up direct deposit to avoid lost checks and delays.

- Track your benefit changes through your My Social Security account.

- Use a trial work period if you plan to return to work. You can test your ability to work for up to nine months without losing benefits.

- Consider tax planning. Part of your SSDI may be taxable if your income exceeds IRS limits.

Real-Life Example

Sarah, a 52-year-old from Michigan, worked as a nurse for 20 years before chronic arthritis forced her to stop working. She applied for SSDI in May 2024, was approved in January 2025, and started receiving $1,950 per month. With the 2025 COLA increase, her check rose to $1,999 by December. Her case shows that while the process takes time, SSDI can provide critical stability when health issues arise.

Additional Financial Support

If SSDI doesn’t cover all your expenses, you may qualify for:

- SNAP benefits (food assistance)

- Medicaid (in some states, automatically included with SSI)

- State disability programs

- Housing subsidies through HUD or local agencies

New York Social Security Schedule: Exact December 2025 Payment Dates

Final Social Security Payments of 2025: Check Updated December Dates and Benefit Amounts

December SSI and Social Security Deposits: Updated Dates, Extra Payments, and 2026 Adjustments