$1576 CPP Payment: If you’ve been scrolling through Facebook or TikTok and saw posts claiming “Everyone in Canada is getting a $1,576 CPP payment this December,” it might sound too good to be true. And in a way, it is — at least for most people. The Canada Pension Plan (CPP) is real, of course, and the maximum monthly CPP payment for December 2025 is expected to reach about $1,576. But here’s the truth: only a small number of Canadians will receive that full amount. The rest of us will get a lower payment, depending on how much we contributed throughout our working lives. So, what’s this $1,576 really about? Who qualifies? How can you boost your payout in retirement? Let’s break it all down in everyday language — no confusing jargon, just facts, examples, and a few insider tips.

Table of Contents

$1576 CPP Payment

The $1,576 CPP payment in December 2025 sounds like a windfall, but it represents the maximum benefit, not the average. Your actual payment depends on your contributions, income, and when you start claiming benefits. For many Canadians, CPP provides a steady, inflation-protected foundation for retirement — but it works best alongside OAS, GIS, and personal savings. The takeaway? Plan early, contribute consistently, and check your records. With smart choices, your CPP can help ensure a secure and comfortable retirement.

| Category | Details |

|---|---|

| Program Name | Canada Pension Plan (CPP) |

| Payment Month | December 2025 |

| Maximum Monthly Payment | $1,576 (estimated) |

| Average Monthly Payment (2024) | $758.32 |

| Eligibility Age | 60 years and older |

| Estimated Payment Date (Dec 2025) | Monday, December 22, 2025 |

| Maximum Contribution Years | Around 39 years |

| Contribution Rate (2025) | 5.95% employee / 5.95% employer |

| Official Source | Service Canada |

What Is the CPP and How Does It Work?

The Canada Pension Plan is a government-run retirement program that provides monthly income to Canadians who’ve worked and contributed during their careers. It’s a mandatory savings plan — meaning you and your employer both contribute automatically through payroll deductions. If you’re self-employed, you pay both portions (almost 12%). These contributions build over time and determine how much you’ll receive when you retire. In a nutshell: the more you earn and contribute, and the longer you work, the higher your CPP payment will be.

The Story Behind the $1576 CPP Payment?

Each year, the federal government updates CPP payments to account for inflation and average wage growth. This annual adjustment is called “indexation.” It ensures that retirees’ incomes keep pace with rising costs — like groceries, rent, and medical bills. By December 2025, those inflation adjustments will push the maximum CPP payment to about $1,576 per month, up from around $1,364 in 2024. That’s roughly a 15% increase over two years — a nice bump if you qualify. But here’s the key thing: most people won’t get the maximum. In reality, the average CPP payment is less than half that amount, because few Canadians contribute the maximum possible amount for four straight decades.

Who Qualifies for the $1576 CPP Payment?

To qualify for any CPP payment, you must meet three main conditions:

- You’ve contributed to CPP at least once during your working life.

- You’re 60 years or older.

- You’ve applied to receive it through Service Canada.

Now, to qualify for the maximum $1,576, you need to:

- Have contributed the maximum allowable amount every single year for roughly 39 years.

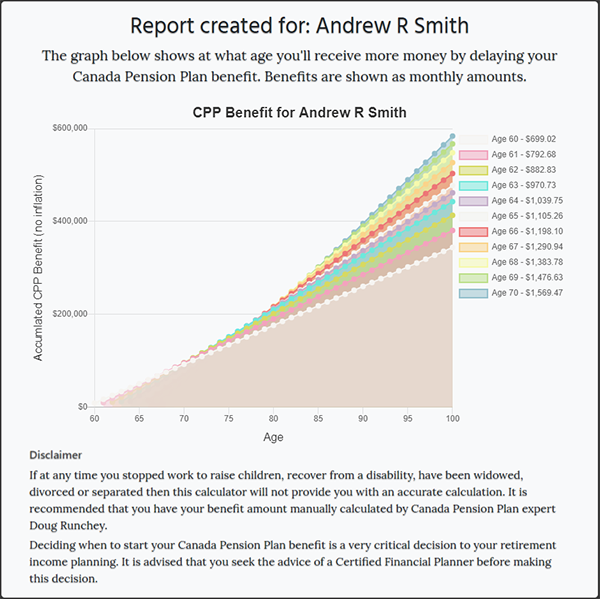

- Start your CPP at the standard age of 65 (starting earlier reduces your payment; delaying increases it).

- Have consistent, high annual earnings — close to or above the yearly maximum pensionable earnings (YMPE).

CPP Payment Dates in 2025

CPP payments are made monthly, usually during the last week of each month.

For December 2025, the estimated payment date is Monday, December 22, 2025.

Payments go straight into your bank account through direct deposit — quick, secure, and reliable.

How CPP Payments Are Calculated?

Your CPP payment isn’t random — it’s based on a detailed formula involving your:

- Total contributions over your lifetime

- Average yearly earnings

- Number of years you contributed

- Age when you start receiving CPP

- Inflation adjustment

The CPP system also includes “dropout provisions.” These allow you to exclude certain low-income years (like when you were unemployed or caring for children) to improve your benefit average. That means your low-earning periods won’t necessarily drag down your final amount.

CPP Contribution Rates and Limits for 2025

| Category | 2025 Amount |

|---|---|

| Employee Contribution Rate | 5.95% |

| Employer Contribution Rate | 5.95% |

| Self-Employed Rate | 11.9% |

| Maximum Pensionable Earnings (YMPE) | $68,500 |

| Basic Exemption | $3,500 |

This means that if you earn $68,500 or more in 2025, you and your employer will each contribute roughly $3,500 to CPP that year

Example: Real-World Scenarios

Let’s make this tangible.

- Example 1: Susan, 65, full-time nurse

Susan worked 42 years earning above the YMPE most of her life. She started CPP at 65. Her monthly payment: $1,550–$1,576. - Example 2: Mark, 62, part-time mechanic

Mark worked 30 years, earning below the average for half of them. He started CPP at 62. His monthly payment: $920. - Example 3: Priya, 60, self-employed designer

Priya contributed on and off over 25 years. She started early at 60. Her monthly payment: around $700.

As you can see, the earlier you start or the fewer years you contribute, the smaller your payout will be.

Combining CPP With Other Benefits

CPP is one piece of the retirement puzzle. To maximize your retirement income, combine it with other programs:

- Old Age Security (OAS): For Canadians 65+ who have lived in the country for at least 10 years.

- Guaranteed Income Supplement (GIS): For low-income seniors receiving OAS.

- Private Savings: RRSPs, TFSAs, or workplace pensions.

Together, CPP + OAS + GIS can cover basic needs — but to maintain your lifestyle, private savings remain essential.

The CPP Enhancement Plan

Introduced in 2019, the CPP Enhancement gradually increases contribution rates and future benefits. By 2025, these enhancements will be in full swing — meaning younger workers will earn higher benefits when they retire.

In short:

- You’ll contribute slightly more each year.

- But your eventual CPP payments will replace a larger percentage of your pre-retirement income.

Taxes and CPP: What You Need to Know

CPP payments are taxable income. Service Canada can deduct tax automatically, or you can choose to pay when filing your return.

Here are some tax tips:

- Use pension income splitting with your spouse.

- Contribute to RRSPs or TFSAs to balance taxable income.

- Claim the Age Amount and Pension Income Credit to lower taxes.

How to Apply for $1576 CPP Payment?

- Log in to your My Service Canada Account.

- Select “Apply for CPP.”

- Review and confirm your contributions.

- Submit your application about 6 months before you want payments to begin.

You’ll receive a confirmation letter or online notice with your payment start date and monthly amount.

Myths vs Facts About CPP

| Myth | Fact |

|---|---|

| Everyone gets $1,576. | Only maximum contributors do. Most receive less. |

| CPP runs out if you live long. | False. CPP is guaranteed for life. |

| You can’t work while on CPP. | You can, and even earn extra via Post-Retirement Benefits (PRB). |

| CPP isn’t adjusted for inflation. | It’s indexed every January. |

| CPP is the same as OAS. | No — CPP is contribution-based; OAS is residency-based. |

Expert Tips to Boost Your CPP

- Work longer. Every extra year adds value to your average.

- Delay your CPP start. Waiting until 70 increases your payment by up to 42%.

- Max out your income. Aim to earn at or above the YMPE each year.

- Check your records. Errors happen — verify contributions in your Service Canada account.

- Use PRB benefits. If you work after starting CPP, keep contributing to boost future payments.

Common Mistakes to Avoid

- Starting CPP too early without financial need.

- Ignoring tax implications.

- Assuming OAS will automatically cover your needs.

- Forgetting to plan for inflation beyond CPP indexing.

- Not coordinating with your spouse’s retirement plan.