Claim Social Security in January 2026: If you’re planning to claim Social Security in January 2026, now’s the time to understand exactly what’s coming. Social Security isn’t just another paycheck — it’s a lifeline, an earned benefit built through decades of work. But when you start claiming, a lot of factors affect what you’ll actually take home: your work history, age, timing, taxes, Medicare premiums, and even your birthday. This article breaks down what to expect in 2026, how your benefit is calculated, and how to make smart decisions that protect your money long term. Whether you’re a retiree, still working part-time, or advising others, this is the guide you’ll want to keep handy.

Table of Contents

Claim Social Security in January 2026

Claiming Social Security in January 2026 isn’t just about filling out paperwork — it’s about timing, planning, and understanding how the rules fit your life. Between the 2.8% COLA, higher Medicare premiums, new income thresholds, and potential tax implications, every dollar counts. Start by logging into your My Social Security account, verify your benefit estimates, and think carefully about when and how you’ll claim. The choices you make now can shape your financial security for decades to come.

| What’s Happening (2026) | Impact / Data | Why It Matters |

|---|---|---|

| 2.8% cost-of-living adjustment (COLA) | Average retired worker benefit rises by about $56/month. | Helps offset inflation but not a major raise — plan carefully. |

| Updated Medicare costs | Medicare Part B premiums and other medical expenses are rising. | Higher medical costs can absorb much of your COLA increase. |

| Earnings limits for working retirees | Under full retirement age (FRA): up to $24,480/year; reaching FRA in 2026: $65,160/year. | If you earn more than these limits, your benefits may be temporarily reduced. |

| Social Security tax base increase | Maximum taxable earnings rise to $184,500 (up from $176,100 in 2025). | Affects higher earners and payroll tax planning. |

| Benefit depends on work history | Calculated from your top 35 highest-earning years, adjusted for inflation. | More years of solid earnings = larger benefit. |

| Policy updates for spouses and survivors | Some government pension offset changes and eligibility updates. | Impacts married, divorced, or widowed retirees. |

Claim Social Security in January 2026: Understanding What Changes

1. The COLA Boost — What It Really Means

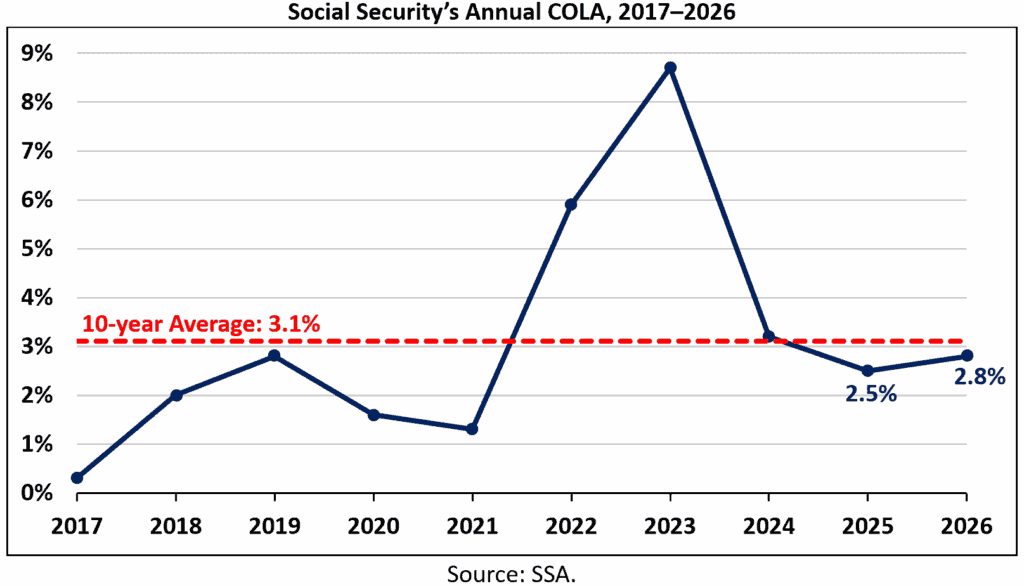

The 2.8% cost-of-living adjustment (COLA) in 2026 sounds like good news, but it’s not quite the raise most people imagine. This increase reflects inflation measured by the Consumer Price Index for Urban Wage Earners (CPI-W). In real terms, that means an average bump of about $56 per month for the typical retired worker.

While that may sound nice, consider that inflation in 2025 hovered near 3%. By the time you factor in food prices, rent increases, and higher medical bills, this adjustment mostly keeps retirees level with rising costs rather than ahead.

If you’re receiving $2,015 in 2025, you can expect about $2,071 in 2026. That’s automatic — no new forms or reapplications are needed. The SSA handles the adjustment for roughly 71 million Americans receiving benefits, including retirees, survivors, and disability recipients.

2. Medicare Costs Will Eat Into Your Raise

Here’s where things get tricky. Medicare premiums — particularly Part B — increase nearly every year, and 2026 is no different. The Centers for Medicare & Medicaid Services project higher premiums and deductibles due to rising healthcare expenses and system adjustments.

That means even though your gross benefit rises, your net take-home amount (after Medicare deductions) may only rise $30–$40 a month. For many retirees, that increase disappears into higher prescription drug costs, copays, or supplemental insurance premiums.

If you depend heavily on Social Security for monthly income, it’s essential to budget based on net benefits, not the advertised gross figure. A quick rule of thumb: check your My Social Security account each December to see exactly what your new benefit will look like after deductions.

3. Working While Receiving Social Security

A lot of Americans today aren’t retiring “cold turkey.” Maybe you enjoy working, or maybe you just want the extra income to keep things comfortable. But if you’re under your full retirement age (FRA) — which ranges from 66 to 67 depending on your birth year — your Social Security benefits are subject to income limits.

For 2026, you can earn up to $24,480 a year without penalty. Go over that, and the SSA will withhold $1 in benefits for every $2 you earn above the limit. If you reach your FRA sometime during 2026, you get a higher limit — $65,160 — and the withholding rate drops to $1 for every $3 over the threshold.

Once you hit your FRA, though, all these restrictions disappear. You can earn as much as you want, and your full benefit resumes. Any withheld benefits are later credited back through recalculation — so you don’t lose them forever.

If you plan to keep working, be strategic. For example, if you’ll cross the earnings threshold early in 2026, you could delay your claim until midyear to avoid having checks withheld unnecessarily.

4. How Your Benefit Is Calculated

Your Social Security check isn’t random — it’s based on your work history and lifetime earnings. Here’s how it works:

- The SSA looks at your 35 highest-earning years (adjusted for inflation).

- Those years are averaged to produce your Average Indexed Monthly Earnings (AIME).

- Your benefit — called your Primary Insurance Amount (PIA) — is then calculated from that AIME using a tiered formula that replaces a higher percentage of lower earnings and a smaller percentage of higher earnings.

If you’ve worked fewer than 35 years, zeros are included for missing years, lowering your benefit. So if you’ve had gaps in employment, even one or two extra years of solid earnings before retiring can make a noticeable difference.

It’s also important to understand delayed retirement credits. If you wait beyond your full retirement age to claim (up to age 70), your monthly benefit increases by roughly 8% per year delayed. Over a 10–15-year retirement, that can translate into tens of thousands of dollars in extra income.

5. Tax Implications and the Social Security Wage Base

For 2026, the maximum taxable earnings — the amount of income subject to Social Security payroll taxes — rises to $184,500, up from $176,100 in 2025. That means higher-income earners will pay Social Security taxes on a slightly larger share of their wages.

If you’re self-employed, remember that you pay both the employee and employer portions of this tax, totaling 12.4%. This increase affects your current tax bill but also contributes to your future benefit since higher contributions mean a higher eventual AIME.

While most retirees won’t notice this directly, it’s critical for those still working in their 60s — especially if they’re delaying claiming to build up benefits.

Also note that Social Security benefits themselves can be taxable. Depending on your total income, up to 85% of your benefits may be subject to federal income tax. To manage that, plan ahead by adjusting your withholding or estimated payments.

6. Spousal and Survivor Rules

Spousal and survivor benefits often get overlooked — and that’s a big mistake. If you’re married, divorced after at least 10 years, or widowed, you might qualify for benefits based on your spouse’s or ex-spouse’s record.

For 2026, the same COLA and policy changes apply. However, there have been ongoing discussions and minor adjustments related to the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) — rules that can reduce Social Security payments for those who also receive a government pension from work not covered by Social Security taxes.

If you fall into that category — teachers, firefighters, or certain public employees — it’s worth checking your updated eligibility rules at SSA.gov before filing. These offsets can significantly alter your expected benefit.

7. Long-Term Solvency and Future Expectations

Social Security remains strong, but projections still show potential funding shortfalls starting around 2035 if Congress doesn’t act. That doesn’t mean the program will vanish — it means that if no changes are made, benefits might eventually be reduced to about 80% of scheduled payments.

For those claiming in 2026, your benefits are secure for the foreseeable future, but understanding the broader picture helps when planning for long-term retirement income.

A balanced strategy — Social Security plus savings, pensions, or investment income — provides more stability than relying solely on monthly checks.

Step-by-Step Game Plan to Claim Social Security in January 2026

Step 1: Check Your My Social Security Account

Visit ssa.gov and log in or create an account. Review your latest statement, verify your earnings history, and look at your estimated monthly benefit at different claiming ages.

Step 2: Decide When to Claim

If you claim at 62, your monthly benefit may be reduced by up to 30%. Waiting until your full retirement age gives you the full amount, and delaying beyond that earns delayed credits. Use the SSA’s Retirement Estimator to compare.

Step 3: Plan for Payment Timing

Payments aren’t instant. Social Security pays one month in arrears — meaning your first check usually arrives in February 2026 if you start in January. The exact date depends on your birthday:

- 1st–10th → 2nd Wednesday of each month

- 11th–20th → 3rd Wednesday

- 21st–31st → 4th Wednesday

Mark these dates in your budget planner so you’re not caught short during that first month.

Step 4: Review Work and Income Plans

If you’ll still earn income in 2026, keep it under the appropriate threshold or budget for temporary benefit withholding. Make sure your employer reports wages accurately, and consider whether part-time work or self-employment will affect your taxes.

Step 5: Budget Based on Realistic Net Income

Factor in taxes, Medicare deductions, and inflation. Don’t build a retirement budget around “ideal” numbers — use your actual net benefit after deductions. Include emergency savings for unexpected healthcare or home costs.

Step 6: Coordinate with Spousal or Survivor Benefits

If you’re married, review both your and your spouse’s projected benefits to decide who should claim first. Sometimes the lower earner claims early while the higher earner delays, maximizing survivor benefits later.

Step 7: Reassess Each Year

COLAs, medical premiums, and tax rules shift annually. Revisit your budget and SSA account every fall when new updates are announced. Staying proactive means fewer surprises.

New York Social Security Schedule: Exact December 2025 Payment Dates

Social Security Payment Up to $4,018 Scheduled for December 10 — Who Qualifies This Cycle

How Trump’s Proposed $2,000 Dividend Could Affect Retirees Receiving Social Security – Check Details