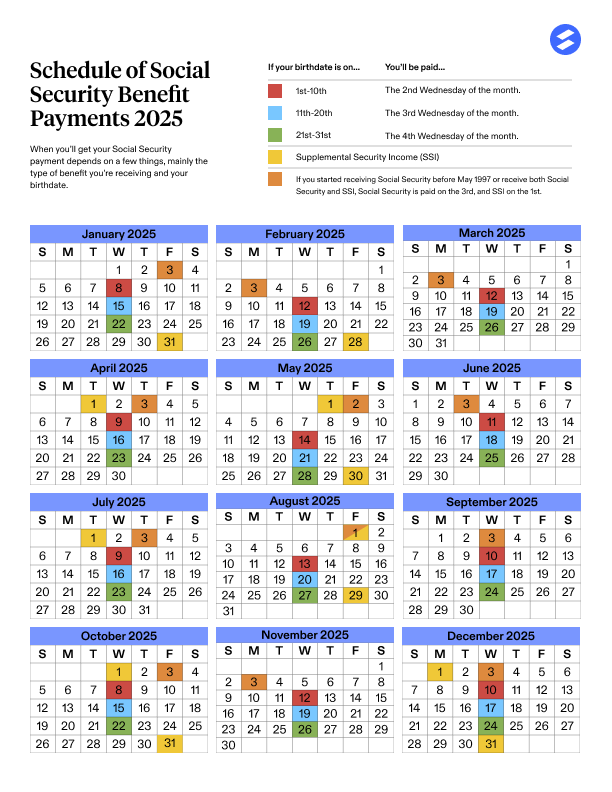

December 10, 2025 — if you’re drawing benefits from Social Security Administration (SSA) for retirement, disability (SSDI), or as a survivor — and the worker on whose earnings record your benefits are based was born between the 1st and 10th of a month — then this date matters for you: that’s when your December check will hit your account. This article takes you under the hood: who gets paid when, why the schedule exists, what’s new in 2026 (like benefit bumps), and smart planning tips to make the most of your benefits. We’ll walk through it step by step, plain-talk style, but with the facts and trustworthiness you’d expect from a savvy adviser.

Table of Contents

December 10 Social Security Payments

Look — I know Social Security rules aren’t exactly light reading. They can be confusing. But here’s the deal: if you take a few minutes to figure out when you get paid, how much, and what might change (COLA, earnings, retirement age, bank info), you give yourself a much better shot at making every dollar work. Sure — the 2.8% raise isn’t a jackpot. Inflation, medical costs, housing, and everyday expenses keep climbing. But when you combine steady monthly support with good planning, transparency, and realistic expectations — Social Security can still be the bedrock many retirees and families rely on. So if you’re expecting a deposit December 10 — or watching for a double-payment December 31 — now you know exactly why that date matters. Keep an eye on your account, plan ahead, and treat that benefit as part of a bigger financial story, not just a check.

| What You Get Paid | When You Get Paid (Dec 2025) | Exceptions / Notes |

|---|---|---|

| Retirement, SSDI, Survivor Benefits (post-May 1997) | 2nd Wed (Dec 10) if birthdate 1–10; 3rd Wed (Dec 17) if 11–20; 4th Wed (Dec 24) if 21–31 | None, unless you’re a legacy beneficiary or receive SSI as well |

| Legacy beneficiaries (pre-May 1997) or dual-benefit recipients (SS + SSI) | 3rd of month | Part of older scheduling system |

| SSI-only recipients | SSI payment Dec 1, plus Jan 2026 payment on Dec 31 (calendar holiday shift) | December may feel like “double pay month” for SSI |

| COLA increase for 2026 | ~ +2.8% bump on Jan 2026 checks (SSI bump reflected Dec 31) | Helps offset inflation / cost increases |

What’s the Deal with December 10 Social Security Payments?

Some folks read “Social Security payments hitting everyone on December 10” and think — “Sweet, payday!” — but the truth is a little more nuanced. In reality, only a portion of SSA beneficiaries get paid on December 10. That’s because SSA uses a birth-date based payment schedule (for most beneficiaries) rather than a one-size-fits-all payday.

Here’s how it works for December 2025:

- If the worker whose record you draw benefits from was born between 1st–10th of any month → you get paid Wednesday, December 10.

- If born 11th–20th → payment lands Wednesday, December 17.

- If born 21st–31st → payment lands Wednesday, December 24.

- If you began receiving Social Security (or related benefits) before May 1997 — or you receive both Social Security and a need-based benefit like Supplemental Security Income (SSI) — you might be on a different, older schedule, often receiving payments on the 3rd of each month.

So — December 10 is a “real payday” for many, but definitely not a blanket payout for all.

Why SSA Uses This Staggered Payment Schedule — And What It Means

Spreading Out to Avoid Overload

If everyone got paid on the same day each month, banks, retailers, and payment systems would be hammered. By spreading payment dates across the second, third, and fourth Wednesdays (or fixed date for legacy/SSI cases), SSA helps reduce “rush hour” stress on financial systems and ensures smoother processing.

That’s a big deal — especially for older folks or people living on fixed income: it helps avoid delays, ensures funds don’t bounce, and gives banks room to process deposits.

Predictability Helps with Planning & Budgeting

For retirees or survivors living on monthly checks, knowing exactly when your money lands each month helps you plan bills, rent, groceries, meds, utilities — the works. Transparency in scheduling helps you avoid surprises.

Holiday & Weekend Adjustments

If a scheduled payday falls on a federal holiday or weekend, SSA typically adjusts the deposit to the preceding business day.

And for December 2025 — that creates one of those quirks where some SSI beneficiaries get two payments (Dec 1 + Dec 31) because Jan 1 is a holiday.

Legacy / Dual-Benefit Cases Still on Old Rules

If you started benefits before May 1997 — or if you get both Social Security and SSI — you might still follow the “3rd of the month” schedule instead of the Wednesday-based system. That means December 3 in 2025 for many such beneficiaries.

What’s Changing in 2026: Benefit Bumps and Why They Matter

2.8% Cost-of-Living Adjustment (COLA)

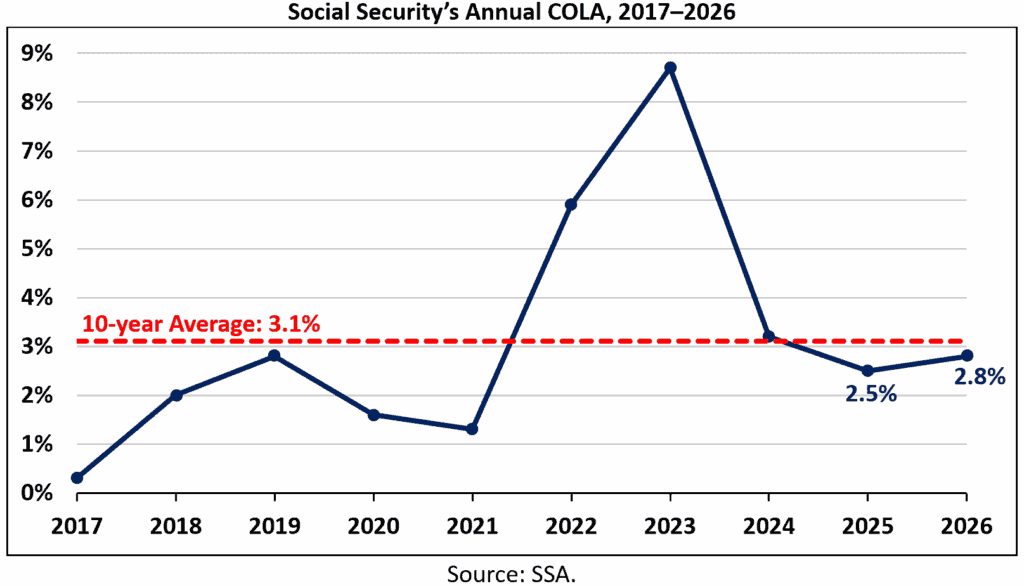

On October 24, 2025, SSA announced a 2.8% COLA increase for 2026. This bump applies to most Social Security retirement, disability, and survivor benefits — and also to SSI for eligible recipients.

That means, on average, retired workers will see roughly $56 more per month starting with their January 2026 payment. For nearly 71 million beneficiaries — that’s real money when prices are high.

Why COLA Matters — But Also Its Limits

COLA is determined by the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from Q3 of the prior year to Q3 of the current year.

But some financial-planning experts warn that CPI-W doesn’t always reflect the real costs many retirees face (like healthcare, housing, meds). Over time, this has meant that benefit increases can lag behind actual living-cost rises.

Thus — while a 2.8% bump helps, many seniors feel it’s not always enough. Even a small misalignment between COLA and actual inflation can eat into living standards over long retirement years.

Earnings Limits & Working While Receiving Benefits

If you’re under “full retirement age” (FRA) and still working, there are earnings limits. For 2026, these thresholds have been adjusted upward.

If you earn above the limit, SSA deducts from benefits (e.g., $1 for every $2 you earn over the limit).

That’s good to know if you plan to keep working — especially part-time. It may affect when and how much benefit you get.

How Much Are Typical Checks? (And What Affects the Amount)

It’s good to know the “when.” But “how much” matters more to most folks. Here’s what we know:

- Before the 2025 COLA bump, the average monthly benefit for retired workers was about US$ 1,927. After the 2.5% bump, that went to around US$ 1,976.

- With the 2026 2.8% bump, many retirees will see about $56 extra per month, on average.

- SSI — for low-income seniors or disabled individuals with limited resources — also gets adjusted. SSI beneficiaries will see the new amount begin with the payment on December 31, 2025 (reflecting January’s raise).

- Actual benefit amounts vary widely, depending on work history, earnings record, retirement age, type of benefit (retirement, disability, survivor, SSI), and any deductions (like Medicare premiums or earnings-related reductions).

So if someone says “I get $2,100/month from Social Security,” that might be after a long career or delayed retirement; someone else who started earlier could be getting less. It’s not one-size-fits-all.

A Practical Guide: How to Know Exactly When and What You’ll Get — Step by Step

Here’s what I’d tell a friend or client if they asked — in plain language, no fluff:

Step 1 — Know What Kind of Benefits You Get

Are you getting:

- Retirement benefits?

- Disability (SSDI)?

- Survivor benefits?

- SSI (needs-based)?

- A combination (Social Security + SSI)?

Step 2 — Check the Birthdate Rule (for Retirement/SSDI/Survivor)

If your benefit is based on a worker’s earnings record (and you started after May 1997), check their birthdate:

- 1st–10th → 2nd Wednesday of month

- 11th–20th → 3rd Wednesday

- 21st–31st → 4th Wednesday

Step 3 — Account for Legacy or Dual-Benefit Situations

If you started before May 1997 — or get both Social Security & SSI — your payment likely arrives on the 3rd of each month (or preceding business day if 3rd is a weekend/holiday).

Step 4 — Watch for Holiday or Weekend Adjustments

If your expected payment day falls on a holiday or weekend — SSA typically shifts the deposit to the prior business day.

Step 5 — Set Up (or Confirm) Direct Deposit / Electronic Payment

As of late 2025, nearly all SSA and SSI benefits are paid via direct deposit or prepaid-debit-card (for those without bank accounts). Paper checks are largely phased out.

Step 6 — Factor in COLA and Possible Reductions (Earnings, Medicare, etc.)

- Remember the 2026 2.8% COLA bump — expect larger checks starting Jan 2026 (SSI on Dec 31 2025).

- If you earn money, and you’re under full retirement age, SSA might reduce your benefit depending on how much you earn.

- Other deductions (like Medicare premiums, taxes, or other withholdings) may affect your net deposit.

Step 7 — Monitor Your Statements / “My Social Security” Account

Check regularly — especially after COLA announcements — so you’re on top of how much you should get. If a payment doesn’t show up by the expected date, give it a few business days (banks sometimes delay posting), then contact SSA or your bank.

Why December 10 Social Security Payments Matters — Especially for Seniors, Caregivers & Financial Planners

If you’re living on a fixed income — like many retirees, disabled individuals, or survivors — Social Security is often the main income stream. Getting the timing and amount wrong can mean missed rent, delayed meds, or trouble with bills.

Financial planners and caregivers should pay close attention because:

- Cash-flow timing matters — especially around holidays, end-of-month expenses, rent cycles.

- COLA and inflation: With rising cost of living (housing, healthcare, food), even a small bump helps — but might not be enough. That means budgeting carefully and possibly supplementing Social Security with other income sources (savings, part-time work, pensions, investments).

- Working while receiving benefits: If someone plans to keep earning, especially in part-time or freelance gigs — it can affect benefit amounts, so you need to coordinate.

For many, Social Security isn’t just a “nice to have.” It’s survival. Knowing exactly when checks drop and how much to expect — especially with holiday quirks and yearly adjustments — can make the difference between “comfortable” and “tight.”

New York Social Security Schedule: Exact December 2025 Payment Dates

December SSI and Social Security Deposits: Updated Dates, Extra Payments, and 2026 Adjustments

Discussion Continues Around Potential $2,000 Federal Payments — What’s Currently Known