December’s Social Security Payments: If you’re someone who depends on Social Security payments, you’ve probably heard some buzz about December’s checks coming on a “different schedule.” And it’s true — December 2025 isn’t business as usual. The Social Security Administration (SSA) has made adjustments to the payment calendar because of how the holidays fall this year. Before you worry, take a breath. No one’s missing a payment. In fact, some people are actually getting two payments in December — it just takes a little understanding of the system to know why. This article breaks it all down in plain English — why this happens, who it affects, how to plan for it, and what changes are coming in 2026. Whether you’re a retiree, a disabled worker, or a family member managing benefits for a loved one, this guide explains everything you need to know.

Table of Contents

December’s Social Security Payments

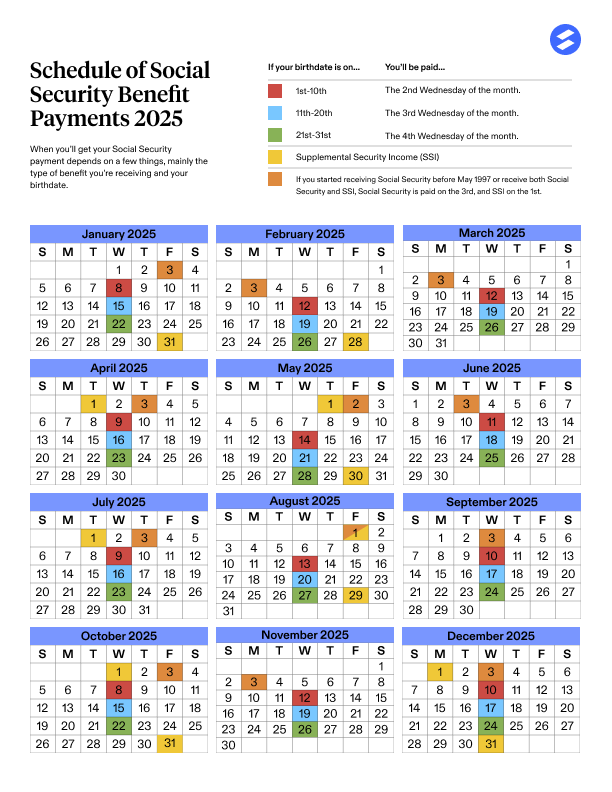

So, why will December’s Social Security payments follow a modified schedule this year? It all comes down to timing and federal holidays. Because New Year’s Day 2026 lands on a Thursday, the Social Security Administration is moving some payments up to ensure nobody waits longer than necessary for their money. If you receive SSI, you’ll get two checks in December — on December 1 and December 31 — but none in January. For everyone else, payments still follow the regular Wednesday schedule tied to birthdays. And don’t forget — your COLA increase starts with the January payment, giving your 2026 benefits a slight boost. The best thing you can do? Stay informed, plan your budget early, and remember that your December 31 payment is for January expenses — not extra holiday cash.

| Topic | Details |

|---|---|

| Main Reason for Schedule Change | Federal holidays (especially New Year’s Day) cause payment shifts |

| Who’s Affected | Recipients of SSI, SSDI, and Social Security retirement benefits |

| Key Dates | Dec 1, Dec 3, Dec 10, Dec 17, Dec 24, and Dec 31, 2025 |

| Double Payment? | Yes, some SSI recipients get two checks in December |

| January 2026 | No SSI check that month (already paid early) |

| COLA Adjustment | 2.8% Cost-of-Living Adjustment starts with January 2026 payments |

| Official Source | Social Security Administration |

Understanding Social Security: A Quick Refresher

Before diving into the December shuffle, let’s clear up what these payments actually are.

The Social Security program is made up of a few different parts:

- Retirement Benefits: These are the monthly checks older Americans receive after paying into the system during their working years.

- SSDI (Social Security Disability Insurance): These benefits go to individuals who can no longer work because of a medical condition or disability.

- SSI (Supplemental Security Income): This is for people with limited income and resources, including many seniors and people with disabilities who don’t qualify for standard Social Security.

Each of these programs has its own schedule. And while the Social Security Administration does a good job keeping things consistent month to month, holidays sometimes force a temporary reshuffle.

The Reason for the Modified December’s Social Security Payments Schedule

Here’s the core issue: The SSA doesn’t process payments on weekends or federal holidays. When a scheduled payment date lands on one of those, it automatically moves to the nearest business day before the holiday.

In December 2025, the culprit is New Year’s Day 2026, which falls on Thursday, January 1. Since that’s a federal holiday, January’s SSI payments can’t go out on that date. Instead, those payments are sent out a day early — on Wednesday, December 31, 2025.

Combine that with the regular December SSI payment (scheduled for Monday, December 1), and you end up with two SSI payments in the same month.

For people who only receive Social Security retirement or disability benefits, the pattern is a bit different — their payments are tied to their birth date and are distributed on Wednesdays:

- If your birthday is 1st–10th, you’ll be paid on Wednesday, December 10.

- If your birthday is 11th–20th, you’ll be paid on Wednesday, December 17.

- If your birthday is 21st–31st, your payment arrives Wednesday, December 24.

- And if you began receiving benefits before May 1997, your payment hits Wednesday, December 3.

These changes don’t mean anyone gets extra money — the SSA is simply adjusting so everyone gets paid on time, even during the holiday season.

How the COLA Increase Factors In?

There’s another reason December’s payments are getting extra attention this year — the upcoming Cost-of-Living Adjustment (COLA).

Every year, the SSA reviews inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Based on that, the agency adjusts benefits to keep up with the rising cost of living.

For 2026, the COLA increase is 2.8%, meaning your benefit will be a bit larger starting in January. But here’s where it gets interesting: the December 31 SSI payment technically counts as January’s payment, so it will already reflect that new higher amount.

For example, if your current SSI benefit is $943 per month, you’ll start receiving around $969 instead — roughly $26 more per month or $312 more per year.

It’s not a windfall, but it’s meaningful for millions of seniors and disabled Americans trying to keep pace with everyday costs like groceries, rent, and medical care.

Real-World Example: How It Affects Everyday Americans

Let’s say Maria, a 68-year-old retiree in Ohio, receives both SSI and SSDI. Normally, she gets one SSI payment at the start of the month and her SSDI mid-month.

In December 2025, her schedule looks like this:

- December 1: Regular SSI payment for December

- December 17: SSDI payment (birthday between 11th–20th)

- December 31: Early SSI payment for January

Maria gets three deposits in one month. While that might seem like a bonus, it’s not extra money — it’s just her January SSI payment arriving early. She’ll need to budget carefully because she won’t receive another SSI deposit in January 2026.

Financial planners often warn clients about this: treat that last December check as next month’s money, not a holiday windfall.

The Broader Impact on Retirees and Disabled Beneficiaries

This adjusted schedule can create challenges — especially for those living paycheck to paycheck.

Retirees on fixed incomes often time their bill payments and grocery runs around their deposit dates. An early payment can cause confusion or, worse, lead to overspending during the holidays.

For those receiving both SSI and SSDI, the effect is even more pronounced. They may receive up to three separate payments in December, then face a long wait until February for their next SSI check.

To avoid problems, financial experts recommend tracking payments closely, setting alerts through your bank, and writing out a simple budget plan that stretches those December funds well into January.

Practical Tips for Managing the Schedule Shift

If you or someone you care for receives Social Security benefits, these steps can help you stay organized:

- Write down all December payment dates on a physical calendar or your phone.

- Plan January’s expenses early — remember, you won’t receive another SSI payment until February.

- Avoid spending the Dec 31 payment during the holidays; treat it as next month’s income.

- Check your My Social Security account on SSA.gov to confirm your deposit schedule.

- Use direct deposit to ensure payments arrive securely and on time.

- Ignore scam calls or texts — the SSA never asks for money, gift cards, or personal details.

Following these steps keeps your finances steady through the transition and helps avoid unnecessary stress.

Common Myths and Misunderstandings

Myth 1: December’s double check is a holiday bonus.

Nope. It’s your January SSI payment being delivered early because of the holiday schedule.

Myth 2: The SSA is cutting a payment next year.

Not at all. You’ll still receive 12 SSI payments in total — just not one in January because you already received it December 31.

Myth 3: Everyone gets two checks.

Only SSI recipients do. Regular Social Security retirement or SSDI beneficiaries stick to their usual Wednesday schedule.

Myth 4: The SSA might miss my deposit because of the holidays.

The SSA has decades of experience handling these shifts. If your direct deposit information is current, your payment will always arrive on time — sometimes even earlier.

Expert Insights

According to Mary Johnson, a policy analyst with The Senior Citizens League, “The timing changes can be confusing for people who rely on every check to cover essentials, especially during the holidays. But once beneficiaries realize they’re not losing anything — just receiving it early — it’s easier to plan ahead.”

She adds that the COLA increase will help offset some of the cost pressures Americans have been facing with higher food and energy prices over the past year.

How to Double-Check Your December’s Social Security Payments?

To make sure you’re on track, it’s smart to log in to your My Social Security account before mid-December. There, you can:

- View your benefit amount and payment schedule.

- Confirm your direct deposit details.

- Download an official benefits verification letter.

- Track your COLA updates and past deposits.

For those without internet access, the SSA also provides printed calendars and payment notices through the mail.

How to Plan Ahead Financially?

The key takeaway is simple: treat early payments as if they arrived on time. Financial counselors often recommend these strategies:

- Split your December 31 check in two: Use half for January bills and keep the rest in savings for emergencies.

- Set up automatic transfers: Move a portion of your Social Security deposit into a separate savings account so you don’t spend it unintentionally.

- Stay organized with a budget app: Tools like Mint or EveryDollar make it easy to label SSI or SSDI payments and track expenses by month.

Taking small steps like these ensures that the modified schedule doesn’t throw off your financial rhythm.

New York Social Security Schedule: Exact December 2025 Payment Dates

December Social Security & SSI Guide: Payment Dates, Double Checks, and Next Year’s COLA

Up to $4,018 in Social Security Arrives December 10 — Who Qualifies for This Payment