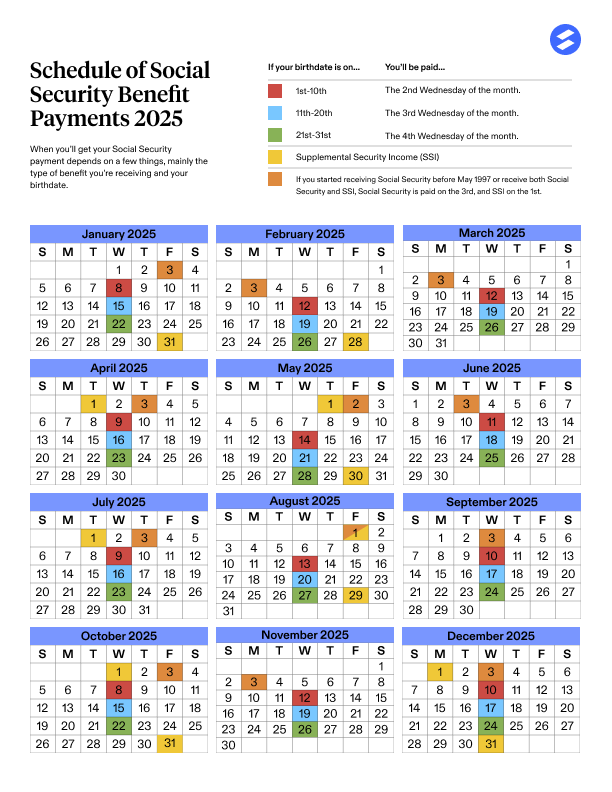

New York Social Security Schedule: If you live in New York and depend on your Social Security or SSI benefits, December 2025 is going to be an important month for your finances. Between the holiday season, early payments, and the new 2.8% Cost-of-Living Adjustment (COLA) taking effect, understanding the payment calendar is key to planning your budget wisely. This article provides the complete New York Social Security Schedule for December 2025, breaks down every payment date, and includes expert insights to help you prepare for changes, avoid delays, and make smart financial moves heading into 2026.

Table of Contents

New York Social Security Schedule

The New York Social Security Schedule for December 2025 is straightforward once you understand how your birth date and benefit type determine your payment date. By marking your calendar, setting up direct deposit, and budgeting smartly, you’ll glide through the holiday season without worrying about missed or late checks. And remember—though the dates are the same across the country, New Yorkers should stay alert for local weather and banking changes during the winter. Planning ahead ensures every benefit dollar arrives on time and works harder for you.

| Topic | Details |

|---|---|

| Social Security Payment Schedule (Dec 2025) | Dec 3 (Pre-May 1997 recipients); Dec 10 (Birth 1–10); Dec 17 (Birth 11–20); Dec 24 (Birth 21–31) |

| SSI Payments | Dec 1 (Regular Dec); Dec 31 (January 2026 payment sent early) |

| COLA 2025–2026 Increase | +2.8% adjustment effective Jan 2026 |

| Official Source | Social Security Administration |

| Average Monthly Benefit (2025) | ~$1,907 for retirees; ~$1,537 for disabled workers. |

| Tip for New Yorkers | Use direct deposit for fastest delivery—paper checks may be delayed by holiday closures or winter weather. |

Understanding Social Security and SSI

To make sense of the schedule, it’s important to understand the two main programs managed by the Social Security Administration (SSA):

- Social Security Benefits: These are earned benefits that replace part of your income when you retire, become disabled, or lose a spouse or parent. You qualify based on your work history and the taxes you paid into the system.

- Supplemental Security Income (SSI): This program supports low-income seniors, adults, and children with disabilities who have limited income and resources. Unlike regular Social Security, SSI is funded by general tax revenue—not payroll taxes.

Both programs follow the same nationwide calendar. That means if you live in Buffalo, Albany, or the Bronx, your payment dates are the same as someone living in California or Texas. The SSA determines the dates, not the state.

New York Social Security Schedule

The Social Security Administration releases an annual calendar showing exactly when payments are sent. Here’s what it looks like for December 2025.

Regular Social Security Benefits (Retirement, Disability, Survivor)

| Birth Date Range | Payment Date (December 2025) |

|---|---|

| 1st – 10th | Wednesday, December 10 |

| 11th – 20th | Wednesday, December 17 |

| 21st – 31st | Wednesday, December 24 |

Recipients who began receiving benefits before May 1997 are paid earlier—on Wednesday, December 3, 2025. This rule has been in place for years to simplify scheduling for older beneficiaries.

Supplemental Security Income (SSI)

| Month Covered | Payment Date |

|---|---|

| December 2025 SSI | Monday, December 1, 2025 |

| January 2026 SSI (early) | Wednesday, December 31, 2025 |

This means SSI recipients will receive two payments in December 2025. However, the December 31 payment actually counts as January’s check—it’s sent early because January 1 is a federal holiday.

Why December 2025 Is Unique?

December is always a tricky month for the SSA due to holidays and shortened work weeks. In 2025, Christmas Day (December 25) falls on a Thursday, and New Year’s Day (January 1) is the following Thursday. To prevent disruptions, the SSA adjusts payment dates so recipients get their money before the holidays.

This schedule ensures that everyone receives their funds before banks and mail carriers close for Christmas and New Year’s. It’s especially helpful for those who rely on benefits to pay rent or cover medical bills right before the year ends.

Another reason December 2025 stands out is the 2.8% COLA increase that takes effect in January 2026. This annual cost-of-living adjustment helps your benefits keep pace with inflation. The early SSI payment on December 31 will already include the new higher amount.

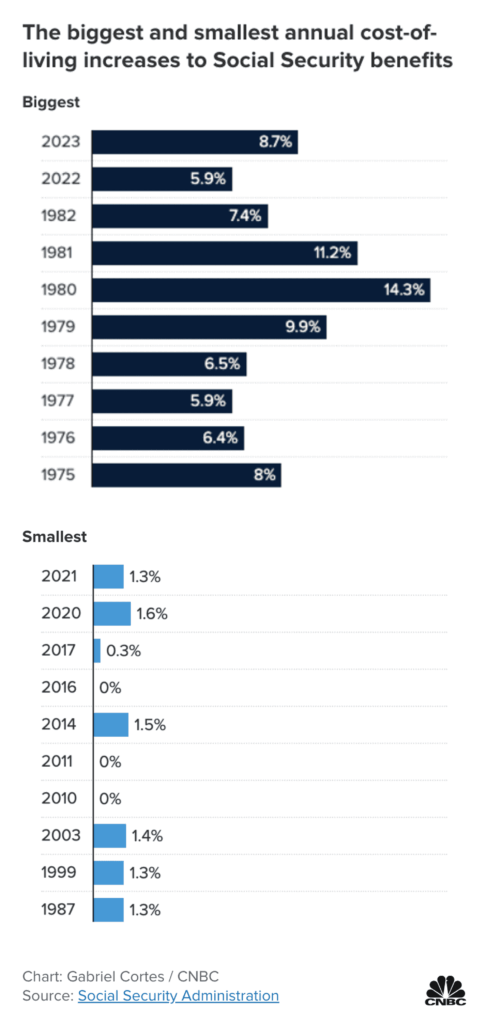

Understanding the 2025–2026 COLA Increase

The Cost-of-Living Adjustment (COLA) is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation. When the cost of living rises, Social Security benefits go up too.

For 2026, the COLA will be 2.8%, according to the Social Security Administration. Here’s how that affects you:

- If your current monthly benefit is $1,900, your new amount will be about $1,953.

- SSI individuals will see their payment rise from $943 to $969, and eligible couples will go from $1,415 to $1,454.

- Over the year, that’s nearly $636 in extra income for a retiree.

This increase helps offset inflation, especially as costs for food, housing, and healthcare continue to rise. The SSA typically announces next year’s COLA every October.

Direct Deposit vs. Paper Checks

According to SSA data, over 99% of beneficiaries now receive their payments via direct deposit. If you’re part of the 1% still getting paper checks, it’s time to make the switch.

Direct deposit delivers your funds directly to your bank or credit union account—usually before 9 a.m. on your payment date. Paper checks can take several days longer and may be delayed by holiday mail schedules or bad weather.

To set up or change your payment method:

- Visit ssa.gov/myaccount

- Log in to your My Social Security account

- Update your banking information or choose a Direct Express Debit Card if you don’t have a bank account.

This method is safer, faster, and eliminates the risk of lost or stolen checks.

What to Do If Your Payment Is Late?

Even though the SSA is highly reliable, delays can still happen. If your deposit doesn’t arrive on your scheduled day:

- Wait three business days—sometimes banks process deposits late.

- Check your online SSA account for updates or errors.

- Call SSA at 1-800-772-1213 (TTY: 1-800-325-0778).

Common causes for delays include bank account changes, holidays, and incorrect routing numbers. The SSA can track your payment and issue a replacement if necessary.

Budgeting and Tax Tips for Retirees

Your Social Security benefits may be taxable, depending on your total income. If your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits) exceeds $25,000 for singles or $32,000 for couples, you could owe federal taxes.

You can request automatic withholding using IRS Form W-4V. This helps prevent a big tax bill during filing season.

Budgeting advice:

- Follow the 50-30-20 rule (50% needs, 30% wants, 20% savings).

- Build an emergency fund with one month’s worth of benefits to cover medical or housing costs.

- Use tools from MyMoney.gov to plan your retirement budget.

Financial advisors often recommend retirees set up automatic bill payments to align with their SSA deposit dates—reducing stress and avoiding late fees.

Special Advice for New York Recipients

Living in New York comes with its own challenges and opportunities:

- Cost of living: The state’s cost of living is roughly 24% higher than the national average. That COLA increase can make a real difference.

- Winter delays: Mail and transit systems can slow down during heavy snow in December. Direct deposit avoids this risk.

- State programs: New Yorkers may qualify for Supplemental Nutrition Assistance Program (SNAP), HEAP (Home Energy Assistance Program), or Medicaid Buy-In programs.

- Senior help lines: The New York State Office for the Aging offers free counseling for Medicare, housing, and benefit questions.

Taking advantage of these programs can stretch your Social Security income and improve your quality of life.

Real-Life Example: Planning Ahead for December Payments

Let’s take Evelyn, a retired nurse from Rochester, as an example. Her birthday is December 15, which means her Social Security check arrives on Wednesday, December 17, 2025. She also receives SSI, which will come on December 1 and December 31.

Evelyn sets her bills to auto-pay right after those deposits and uses direct deposit so nothing gets delayed. Because she knows her early January payment will hit on December 31, she budgets accordingly for holiday spending and January rent.

Following this simple strategy keeps her finances stress-free—even during the busy holiday season.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?

CalFresh Recertification in December 2025: Avoid These Mistakes or Risk Losing Food Stamps