$7,500 AT&T Settlement Checks: In what’s shaping up to be one of the largest per-customer data breach settlements in U.S. history, AT&T customers may soon receive settlement checks for as much as $7,500 in 2026. This comes after two major data breaches in 2024 exposed sensitive personal information of millions of customers. AT&T, while not admitting any wrongdoing, agreed to pay $177 million to settle multiple class-action lawsuits that followed the cyber incidents. If you’re wondering whether you’re eligible, how much you might get, and when that check could land in your mailbox, this article breaks it all down. We’ll also give you tips on how to stay protected from data theft going forward and explain how this compares to other major data breach settlements.

Table of Contents

$7,500 AT&T Settlement Checks

The AT&T settlement checks represent more than just a payout — they symbolize accountability in an age where data breaches have become all too common. If you filed a valid claim, your payment could arrive in Spring or Summer 2026, with amounts reaching up to $7,500 depending on your level of exposure and documentation. But beyond the money, it’s critical to stay proactive in protecting your identity. Data breaches won’t stop, but by staying informed, using strong digital habits, and freezing your credit, you can stay one step ahead of cybercriminals.

| Topic | Details |

|---|---|

| Settlement Amount | $177 million total |

| Max Individual Payout | Up to $7,500 |

| Claims Deadline | December 18, 2025 (closed) |

| Total Affected Customers | Approx. 73 million |

| Final Settlement Hearing | January 15, 2026 |

| Expected Payment Start Date | Spring or Summer 2026 |

| Administrator | Kroll Settlement Administration |

| Official Settlement Site | attdatabreachlitigation.com |

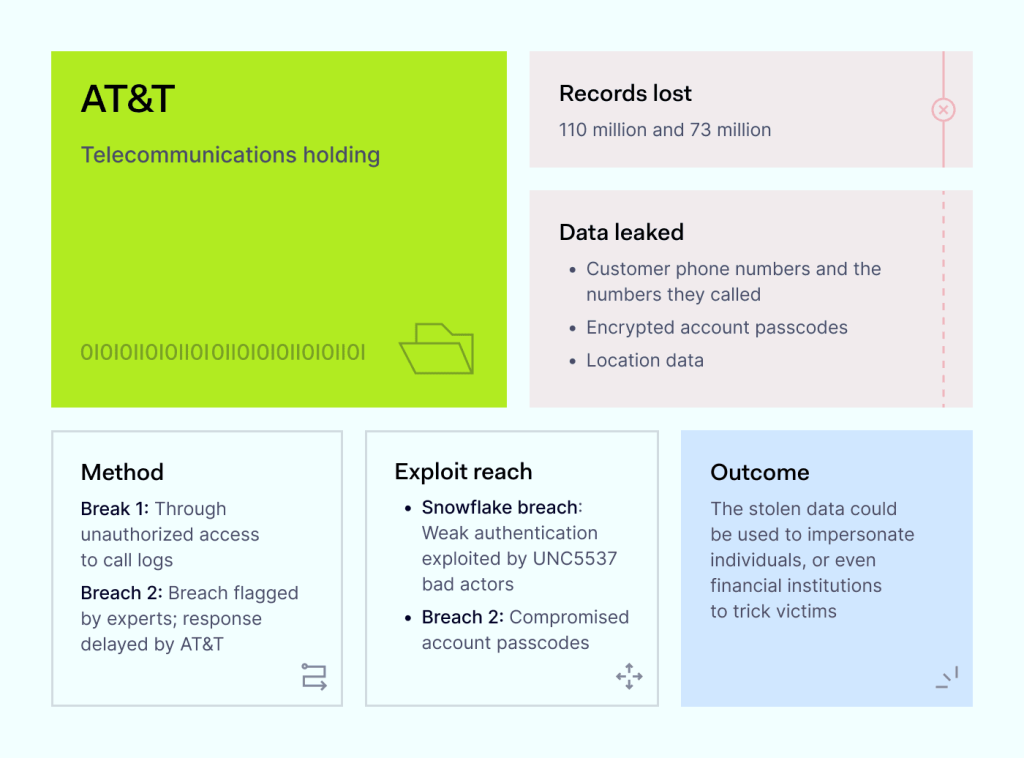

Background: What Happened with AT&T in 2024?

In 2024, AT&T experienced two separate cyberattacks that left millions of Americans vulnerable. These breaches triggered widespread concern, multiple lawsuits, and eventually the large settlement.

First Breach – March 30, 2024

Sensitive customer information was leaked on the dark web. This included:

- Full names

- Addresses

- Dates of birth

- Phone numbers

- Social Security numbers

- AT&T account passcodes

- Email addresses

According to reports, at least 7.6 million current customers had their Social Security numbers exposed, and another 65.4 million former customers were affected.

Second Breach – July 12, 2024

A separate attack involved unauthorized access to:

- Call and text metadata

- Location-based activity logs

- Account-level information

Though less sensitive on the surface, this breach still posed a significant privacy threat. Combined, both incidents affected approximately 73 million individuals.

AT&T denied liability in both cases but agreed to a class-action settlement to avoid prolonged litigation.

$7,500 AT&T Settlement Checks: Who Gets What and Why?

The maximum payout is $7,500 per eligible individual, but that doesn’t mean everyone gets that much. Here’s a breakdown of how the amounts were determined.

Tier 1 – Up to $5,000

For customers whose Social Security numbers were compromised. This tier recognizes the higher risk of identity theft when SSNs are exposed.

Tier 2 – Flat payment

For customers affected by the March breach who had sensitive information exposed but not their SSNs.

Tier 3 – Up to $2,500

For customers impacted by the July breach, where less sensitive account activity and call metadata were accessed.

Additional Reimbursement

Claimants were also allowed to request additional compensation for:

- Out-of-pocket costs related to identity theft or fraud

- Time lost dealing with breach-related issues (up to 20 hours at $25/hour)

Important Note: Final payment amounts will depend on how many valid claims were filed and how funds are distributed after legal fees and administrative costs.

$7,500 AT&T Settlement Checks Claim Process: How It Worked

The deadline to file a claim was December 18, 2025. Eligible customers could submit claims online or by mail through the official Kroll settlement website.

To file, claimants needed to:

- Verify they were affected by the breach

- Provide contact and payment info

- Submit documentation for reimbursement claims (if applicable)

As of now, the claim window is closed, and late submissions are generally not accepted unless there are exceptional circumstances approved by the court.

When Are Payments Being Sent?

This is the big question on everyone’s mind.

The final fairness hearing is scheduled for January 15, 2026. At that hearing, the court will:

- Approve or deny the settlement

- Address any remaining objections or appeals

- Finalize the payment schedule

Assuming no major delays or appeals:

- Payments are expected to begin in Spring or Summer 2026

- Kroll will send either a physical check or a digital payment (like PayPal or direct deposit), depending on what the claimant selected

Be sure to check your email (including spam folders) and your physical mailbox during that period. Digital payments can be easy to miss.

How to Check Your $7,500 AT&T Settlement Checks Claim Status?

Even though the claim period is closed, you can still check the status of your claim by visiting the official site:

www.attdatabreachlitigation.com

You’ll need your Claim ID (provided during the filing process) or other identifying information.

If your contact info has changed since you submitted your claim, notify the settlement administrator immediately to avoid missing your payment.

What to Do If You Missed the Deadline?

If you didn’t file a claim by December 18, 2025, you’re likely not eligible for a payment. However, you can still:

- Monitor the case through the official site

- Stay alert for updates or appeals

- Sign up for alerts in case future class actions emerge

Some customers might also qualify for separate legal actions if they can demonstrate damages beyond the scope of the class-action settlement.

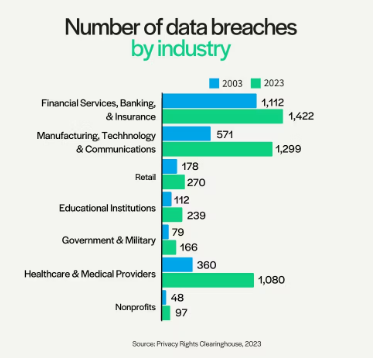

How This Settlement Compares to Others?

To better understand the scale of this case, here’s how it stacks up to other major data breach settlements:

| Company | Settlement Amount | Year | Max Payout Per Person |

|---|---|---|---|

| AT&T | $177 million | 2026 | Up to $7,500 |

| Equifax | $425 million | 2019 | Up to $20,000 (rare) |

| T-Mobile | $350 million | 2022 | ~$25–$500 (typical) |

| Facebook/Meta | $725 million | 2023 | $30–$400 |

AT&T’s per-person maximum makes it one of the most generous in recent history, especially when you consider the risk level of the leaked data.

Tax Implications of the Settlement

One common question is whether these payments are taxable.

Here’s the short answer:

- Non-taxable: Compensation for identity theft, time lost, or emotional distress

- Potentially taxable: Reimbursement for business losses or income replacement

For most consumers receiving a flat settlement payment, there will be no tax owed. However, the IRS hasn’t released formal guidance specific to this case.

If you’re receiving more than $600 or if you claimed business losses, consider consulting a tax advisor.

Staying Safe: How to Prevent Future Identity Theft

Even if you’re receiving a check, the real cost of a data breach is long-term identity protection. Here are five steps you should take immediately:

- Freeze your credit reports

This is free and can stop unauthorized accounts from being opened in your name. Do this at all three bureaus: Equifax, Experian, and TransUnion. - Use two-factor authentication (2FA)

Activate 2FA on your financial, phone, and email accounts. This creates an extra layer of protection. - Monitor your accounts daily

Check your bank, credit card, and mobile phone activity regularly. Look for small, unusual charges or changes to your account. - Use a password manager

Never reuse passwords. Use tools like LastPass, Bitwarden, or 1Password to generate and store strong passwords. - Sign up for credit monitoring

If you didn’t already, use free tools like Credit Karma or paid services for added alerts.

Real People, Real Reactions

Public sentiment on forums like Reddit, Facebook groups, and Twitter shows mixed feelings.

Some people are skeptical:

“This feels like another big promise that ends with a $38 check and a pat on the back.” – Reddit user, r/personalfinance

Others are more hopeful:

“If it actually covers my monitoring and lost time, it’s worth it. Just hope it doesn’t get delayed.” – Commenter on AT&T Support Forum

That skepticism is understandable — many settlements result in much lower payouts than advertised, especially when millions file claims. But AT&T’s tier system and documentation-based claims make this case uniquely positioned for higher individual payments, particularly for those who provided proof.

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details

Google’s $700M Settlement, Explained: Eligibility, Deadlines, and Payouts

Wells Fargo $33 Million Settlement: How Eligible Customers Can Claim Their Payout