$6,000 Settlement Paycheck: The buzz about the $6,000 settlement paycheck is picking up steam across the country, especially online. If you’re wondering whether you’re eligible, how much you can actually get, and how to file your claim, you’re not alone. We’re seeing a wave of class action settlements tied to recent data breaches, and some of them offer payouts up to $6,000 — if you know where to look and act in time. But let’s keep it real: this ain’t no free government check or stimulus. These payments come from legal settlements after companies got caught slipping with your personal information. Whether you’re a busy parent, a college student, or a seasoned professional, this guide is designed to help you understand the what, why, and how behind these settlements.

Table of Contents

$6,000 Settlement Paycheck

The $6,000 settlement paycheck isn’t some gimmick — it’s a real opportunity to get compensated if your personal data was exposed. Whether you lost money, spent time fixing your credit, or simply want free monitoring, these settlements are here to help you recover. But here’s the deal: you’ve got to act fast. Deadlines like January 12 and January 28, 2026, are creeping up, and if you wait too long, your shot at the money is gone. Don’t leave cash or protection on the table. Take five minutes, check your eligibility, and get what’s rightfully yours.

| Topic | Details |

|---|---|

| Type of Payment | Class Action Settlement (Data Breach) |

| Max Payout | Up to $6,000 with documented proof |

| Average Payout | $45 – $300 for basic claims |

| Other Benefits | 2–3 years of credit monitoring |

| Who’s Eligible | U.S. residents whose data was exposed |

| Deadline Examples | Jan 12, 2026 (Dakota Eye Institute) |

| Proof Needed? | Yes, for larger payout |

| Official Resource Example | Dakota Eye Settlement |

What’s This $6,000 Settlement Paycheck Really About?

To put it simply, this is about justice for people whose sensitive personal data got exposed — sometimes by accident, other times through cyberattacks. In recent years, thousands of folks have had their Social Security numbers, medical records, and financial info leaked because companies failed to keep their systems secure.

When that happens, the company usually faces a class action lawsuit. Instead of dragging it through court for years, they often settle and agree to pay out money to the affected people — like you. These aren’t scams. They’re legal, court-approved settlements.

One big example? The Dakota Eye Institute had a data breach and agreed to a $1 million settlement where affected individuals can claim up to $6,000 if they can show proof of damages. (claimdepot.com)

Where’s the Money Coming From?

Let’s be clear — this is not a government handout or federal benefit. The money comes from the company’s insurance or settlement fund. It’s compensation for:

- Time spent dealing with identity theft

- Money lost due to fraud

- Emotional distress (yes, that can count)

- Costs for credit repair or monitoring

- Missed work or professional services

That’s why the amount varies based on your experience. If you suffered real losses, you could be in for a larger payout.

Who Actually Qualifies for the $6,000 Settlement Paycheck?

Not everyone is eligible — and that’s key. Here’s how you know if you make the cut:

1. Your Personal Info Was Exposed

If a company had a breach and your name, Social Security number, or medical records were leaked, you’re likely part of the settlement. You’ll usually receive a notice by mail or email. It contains a Claim ID and PIN.

2. You’re in the U.S.

Almost all current class actions apply only to U.S. residents, though some may include U.S. territories.

3. You File Before the Deadline

No matter how severe your damages, missing the deadline means no payout. Mark your calendar and set a reminder.

4. You Submit the Proper Documentation

For the full $6,000, you’ll need to submit proof of loss (we’ll cover this below).

What Kind of Proof Do You Need for the Max $6,000 Settlement Paycheck?

If you want to aim for the full amount, here’s what typically qualifies as “documented loss”:

- Bank statements showing fraudulent withdrawals

- Police reports or identity theft claims

- Letters from your bank or credit bureau

- Receipts for credit monitoring services

- Paid invoices for legal or credit repair support

It’s not enough to say, “Hey, my data got hacked.” The court needs paper (or digital) proof that the breach cost you time, money, or peace of mind.

Even If You Don’t Have Proof, You May Still Get Paid

Don’t count yourself out if you didn’t lose thousands to identity theft. Many settlements offer a flat cash payment to anyone affected — no paperwork needed. That’s usually $45 to $300, depending on the number of people who file.

For example, the First Choice Dental data breach settlement offers a $50 flat rate, plus free credit monitoring, to claimants without documentation.

How to File a $6,000 Settlement Paycheck Claim (Step-by-Step Guide)

Filing a claim is easier than filing your taxes — promise.

Step 1: Locate the Official Settlement Website

Example: https://dakotaeyesecurityincident.com

Never trust third-party ads. Use the official link found in your notice or reliable news sources.

Step 2: Enter Your Claim Info

Use the Claim ID or contact the administrator to verify your eligibility.

Step 3: Select Your Claim Type

You’ll choose between:

- Documented losses (upload receipts and reports)

- Flat-rate no-proof claim

- Credit monitoring option

Step 4: Review and Submit

Double-check all entries, upload files if needed, and hit submit.

Step 5: Keep a Copy

Take screenshots or save confirmation emails for your records.

Which Settlements Are Currently Active?

Here are some examples of ongoing class action settlements where you could qualify:

Dakota Eye Institute

- Max payout: $6,000

- Free credit monitoring

- Deadline: January 12, 2026

First Choice Dental

- Up to $6,000 with proof

- $50 no-proof payment

- Deadline: January 28, 2026

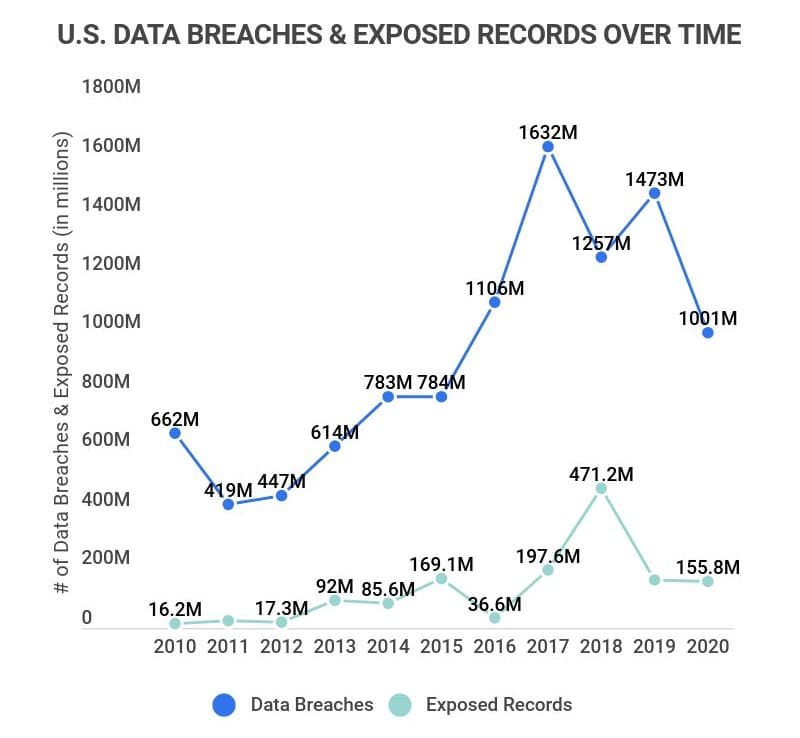

The Bigger Picture: Class Actions Are on the Rise

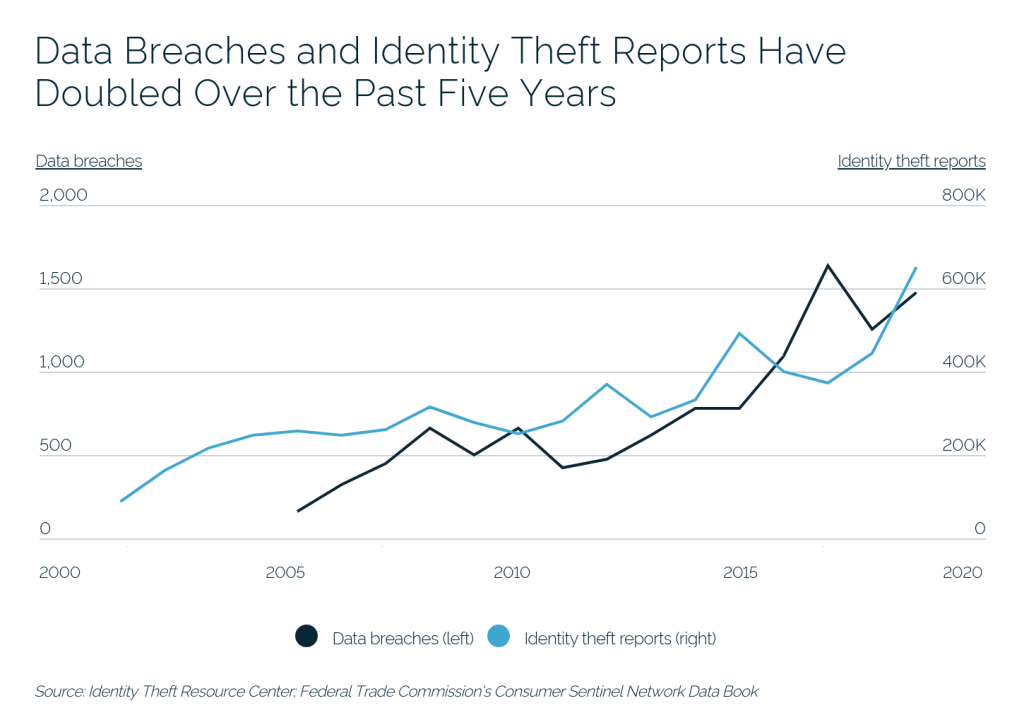

With more companies collecting sensitive data, class actions are becoming more common. According to the Identity Theft Resource Center, data breaches reached a record high in 2023, affecting over 422 million individuals across the U.S.

That means more opportunities — and more responsibilities — to protect yourself and claim your rights.

How to Stay Safe After a Data Breach?

Even if you cash in now, it’s smart to stay vigilant. Here’s how:

1. Check Your Credit Regularly

Use AnnualCreditReport.com — it’s free.

2. Freeze Your Credit

This stops new accounts from being opened in your name. Go to:

- Experian

- TransUnion

- Equifax

3. Enable Two-Factor Authentication

For your bank, email, and any accounts tied to money.

4. Use a Password Manager

Don’t reuse passwords. Use secure, encrypted managers like 1Password or Bitwarden.

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details

Class Action Settlements 2026 – The Biggest Payouts This Year and What They Mean for Consumers

$7,500 AT&T Settlement Checks 2026 – Check Payments Dates, Amounts, and Eligibility Criteria