$5,181 Social Security Check: When you see the headline “$5,181 Social Security check in 2026”, it sounds like a jackpot, right? But this number isn’t a guaranteed monthly payment waiting for anyone turning 65. It’s the maximum benefit the Social Security Administration (SSA) will pay out to retirees in 2026, and it takes decades of smart planning, consistent high earnings, and a bit of patience to reach it. So, let’s cut through the myths, slang, and confusion and walk you through exactly what it takes to qualify for that check. Whether you’re just starting out or already tracking your retirement plan, this is the guide you want bookmarked and shared with family and friends.

Table of Contents

$5,181 Social Security Check

The $5,181 Social Security check in 2026 is a benchmark — not a requirement. It’s the maximum monthly benefit you can receive if you play your cards right: earn consistently at high levels, work 35+ years, and delay claiming until 70. For most Americans, the real goal is to understand the system, make smart decisions about when to claim, and coordinate benefits within their household to get the most out of a lifetime of work. Don’t get lost chasing the $5K dream — get focused on making Social Security work for you.

| Topic | Details |

|---|---|

| Maximum Monthly Social Security Benefit in 2026 | $5,181 (at age 70) |

| Full Retirement Age (FRA) Benefit | ~$4,152/month |

| Claiming at Age 62 | ~$2,969/month |

| Taxable Maximum Income in 2026 | $184,500 |

| Years of Work Needed | 35 years of high income |

| Official Resource | https://www.ssa.gov |

Understanding the $5,181 Social Security Check

Let’s clear this up right away: you don’t need to earn $5,181/month or $184,500 in 2026 alone to qualify. That dollar amount is the top-end payout, and it’s based on a combination of factors, including:

- Your lifetime earnings (especially your highest 35 years)

- Your age when you start collecting benefits

- Whether you paid into Social Security consistently

This amount is only available to folks who wait until age 70 to claim benefits and who earned at or above the Social Security taxable income cap for most of their career.

How Social Security Works – The Basics

What Is Social Security?

Social Security is a federal insurance program that provides retirement, disability, and survivor benefits. It’s funded through payroll taxes under FICA (Federal Insurance Contributions Act).

Every paycheck you’ve received with Social Security tax withheld (6.2% for employees) is building your eligibility.

How Do You Qualify?

To be eligible for retirement benefits:

- You need 40 work credits, which usually equals 10 years of work

- In 2026, you’ll earn one credit for every $1,640 in wages (adjusted annually)

- You can earn up to 4 credits per year

What Income You Need to Qualify for $5,181 Social Security Check?

To reach the max monthly check, here’s the bare-bones reality:

- You need to earn at least the maximum taxable amount for 35 years.

- That amount for 2026 is $184,500, and it was $160,200 in 2023, etc.

- If you missed a few high-earning years or had gaps in employment, you’ll likely fall short of the $5,181 figure.

Cumulative Income Over 35 Years to Qualify for Max:

Even with inflation changes, we’re talking about a career total of at least $5–6 million in earnings subject to Social Security tax.

How Your Social Security Benefit Is Calculated?

Step-by-Step Breakdown

- SSA collects your annual earnings and indexes them for inflation.

- They select your top 35 years of indexed earnings.

- These are averaged into your Average Indexed Monthly Earnings (AIME).

- Then they apply a formula with bend points to determine your Primary Insurance Amount (PIA).

In 2024, for example, the PIA formula was:

- 90% of the first $1,115 of AIME

- 32% of AIME between $1,115 and $6,721

- 15% of AIME above $6,721

These figures adjust annually.

Claiming Age Makes a Huge Difference

| Age Claimed | Monthly Benefit | Percentage of FRA Benefit |

|---|---|---|

| 62 | ~$2,969 | ~70% |

| 66–67 (Full Retirement Age) | ~$4,152 | 100% |

| 70 | $5,181 | ~130%+ |

Every year you delay past your FRA (up to age 70), you earn 8% more per year in delayed retirement credits. That’s a 32% boost if you wait until age 70.

Real-World Example of $5,181 Social Security Check

Meet Nancy

Nancy is a software engineer in Chicago. She started working at 25 and has been maxing out her Social Security income base every year. She checks her statement regularly and sees that she’s on track to receive:

- ~$3,600/month if she claims at age 66

- ~$5,181/month if she delays until age 70

She plans to keep working until 70 — not just to maximize benefits, but also because she enjoys her career and wants to ease into retirement.

How to Maximize $5,181 Social Security Check?

Let’s say you’re not Nancy, but you still want to get the best benefit you can. Here’s what to do:

1. Keep Working (Especially If You’re Near Retirement)

Each additional year you work and earn more than one of your past 35 top-earning years can replace a lower one, raising your average.

2. Delay Claiming Benefits

If you’re in good health and have other sources of income, wait until 70. The 8% annual bonus is hard to beat with most investments.

3. Coordinate with Your Spouse

Married couples have special options:

- Spousal benefits

- Survivor benefits

- Timing strategies that boost household income

4. Avoid the Earnings Limit (If Claiming Early)

If you start benefits before FRA and still work, the SSA may withhold some of your checks if you earn above a certain threshold.

In 2026, that limit is around $22,320/year (subject to annual updates).

Taxes and Your Social Security Check

Here’s the catch many people don’t expect: Social Security income can be taxed if your income exceeds a certain amount.

If You File Single:

- Income between $25,000 and $34,000: up to 50% of benefits taxed

- Over $34,000: up to 85% taxed

Married Filing Jointly:

- $32,000–$44,000: up to 50% taxed

- Over $44,000: up to 85% taxed

Tip: Work with a tax advisor or use Roth accounts in retirement to reduce taxable income.

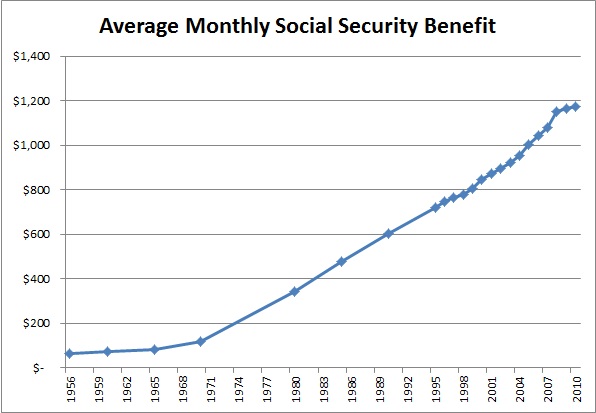

What Most People Actually Receive?

As of early 2026, the average Social Security retirement benefit is:

~$2,071/month, up from ~$1,827 in 2023 due to COLA increases.

Only about 6% of beneficiaries receive over $3,500/month. Fewer than 2% receive the max benefit. So don’t feel bad — the $5,181 figure is the exception, not the rule.

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000

Social Security Changes 2026 – What Beneficiaries Need to Know Before Payments Update

Social Security Benefits at 62, 65 & 70 – Average Monthly Checks Explained Side by Side