$4,983 Direct Payment: The phrase “$4,983 Direct Payment Coming Soon” has been popping up everywhere lately — from social media threads to clickbait news sites. For many Americans, the idea of receiving a payment that big in January 2026 sounds like a financial miracle. But what’s fact, and what’s fiction? Let’s set the record straight with real facts, trustworthy sources, and practical advice. We’ll explore who might see a $4,983 payment, what Social Security and SSI recipients can expect in January 2026, and how to prepare for upcoming changes to your benefits. This guide is written to be easy enough for a 10-year-old to follow but detailed enough to support professionals, retirees, caregivers, and working Americans alike.

Table of Contents

$4,983 Direct Payment

There is no federal $4,983 check headed to every American in January 2026. What is real: a standard Social Security payment schedule, a COLA increase of 2.8%, and ongoing monthly benefits for millions of retirees, disabled individuals, and SSI recipients. Stay informed. Stay protected. And always check your facts before you celebrate a windfall that might not be headed your way.

| Topic | Details |

|---|---|

| $4,983 Payment Reality | Not a stimulus check — it’s the maximum monthly Social Security benefit for top earners delaying retirement to age 70. |

| 2026 COLA Adjustment | Benefits increase by 2.8%, affecting ~71 million Americans. |

| Average Retirement Benefit | Approximately $2,071/month in 2026. |

| January 2026 Payments | Scheduled on Jan 14, 21, and 28, based on your birthday. |

| SSI Payment | Increased to $994 (individuals) and $1,491 (couples). |

| No Universal Payment | The $4,983 figure applies only to a small group of high-earning retirees. |

| Official Source | https://www.ssa.gov |

Understanding the $4,983 Direct Payment Myth

Let’s clear this up: there is no new stimulus payment of $4,983 scheduled for every American in January 2026. That amount is tied to a very specific group of Social Security retirees — namely, those who earned at the top of the income scale and delayed retirement until age 70.

To qualify for that much, you would need:

- A lifetime of high earnings (up to or above the Social Security taxable maximum each year).

- At least 35 years of work history.

- A delay in claiming your Social Security benefits until age 70.

That’s it. It’s not a gift, not a bonus, and definitely not a stimulus check for everyone.

What Is Social Security and How Does It Work?

Social Security is a federal insurance program that provides retirement, disability, and survivor benefits. It’s funded by payroll taxes through the Federal Insurance Contributions Act (FICA). If you’ve been working and paying into the system, you’re earning credits toward these benefits.

You need at least 40 credits — generally equal to 10 years of work — to qualify for retirement benefits. The amount you get depends on:

- Your 35 highest-earning years

- Your age when you begin claiming benefits

- The annual COLA adjustment to offset inflation

Social Security Benefit Types

To make sense of the payment structure, let’s break down the different benefit types:

Retirement Benefits

- For workers aged 62 and older

- Full Retirement Age (FRA) depends on your birth year (between age 66 and 67)

- Delaying retirement until age 70 gives you maximum benefits — up to $4,983/month for some

Social Security Disability Insurance (SSDI)

- For those who can no longer work due to a qualifying disability

- Requires prior work history and recent work credits

Supplemental Security Income (SSI)

- Needs-based program

- For low-income seniors and disabled individuals regardless of prior work

- 2026 monthly max: $994 (individuals) and $1,491 (couples)

Survivor Benefits

- Paid to eligible family members of deceased workers

- Amount depends on worker’s earnings and family structure

The 2026 COLA Explained

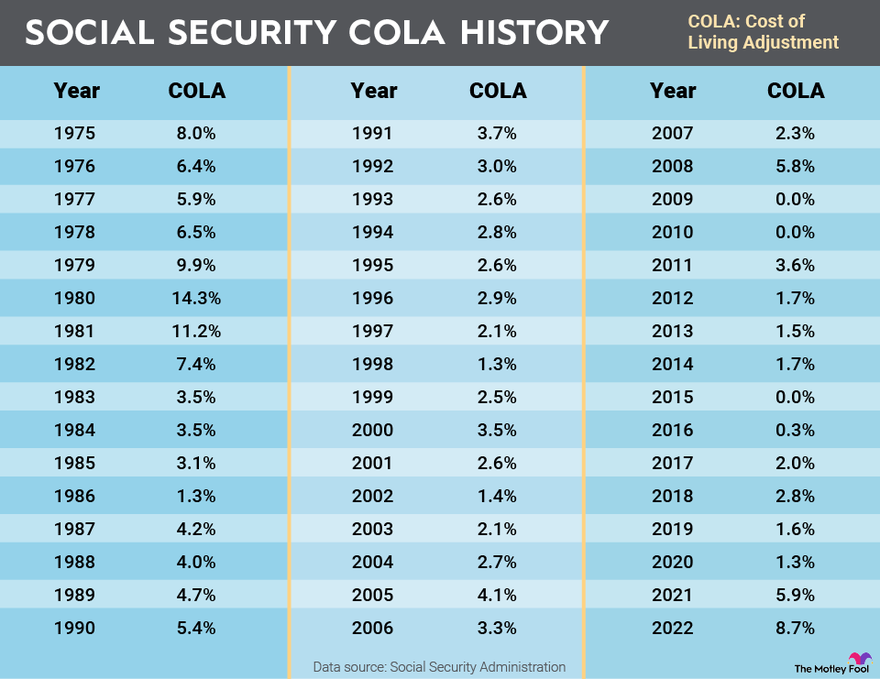

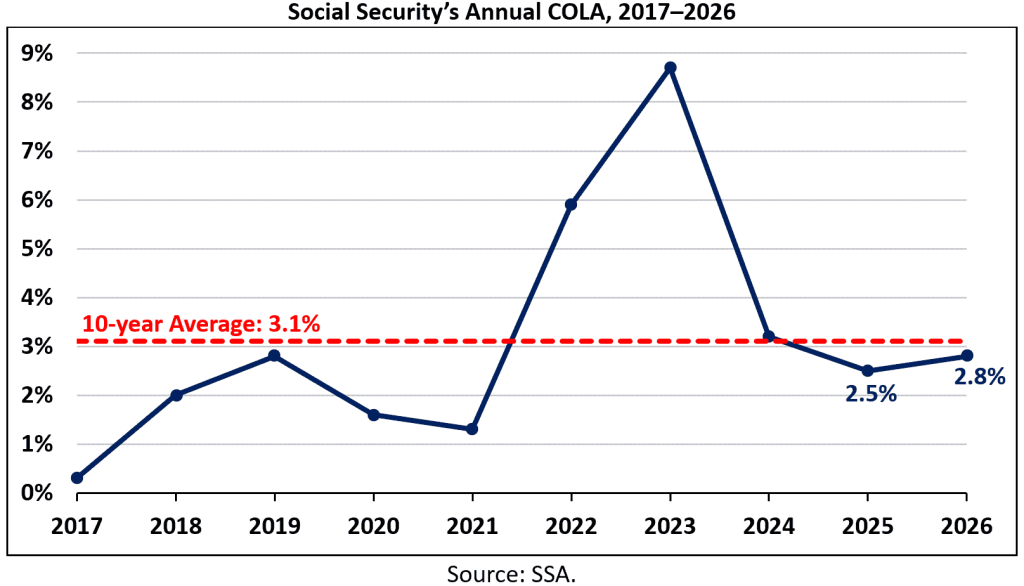

The Cost-of-Living Adjustment (COLA) ensures your benefit keeps up with inflation. For 2026, COLA is set at 2.8%, providing a modest boost across the board.

Here’s what that looks like:

| Benefit Type | 2025 Amount | 2026 Amount |

|---|---|---|

| Average Retirement | $2,015 | $2,071 |

| SSI Individual | $967 | $994 |

| SSI Couple | $1,450 | $1,491 |

| Maximum Retiree | ~$4,841 | ~$4,983 |

COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

January 2026 $4,983 Direct Payment Schedule

Social Security payments follow a consistent calendar:

| Birth Date Range | Payment Date (Jan 2026) |

|---|---|

| 1st – 10th | January 14 |

| 11th – 20th | January 21 |

| 21st – 31st | January 28 |

SSI payments are typically issued on the 1st of the month, but because January 1, 2026, is a federal holiday, SSI checks were likely distributed on December 31, 2025 instead

Who Might Actually Receive $4,983 Direct Payment in 2026?

Here’s a profile of someone who might get this top-tier benefit:

- Age: 70 (delayed retirement)

- Earnings: Maxed out Social Security taxable income (around $160,000–$180,000/year)

- Work History: 35+ years of earnings at or near the taxable cap

This is a small segment of the population — mainly high-income professionals or federal employees who waited until age 70 to retire.

How to Maximize Your Benefits?

If you want to increase your monthly Social Security payout:

- Delay Retirement

For every year you delay past FRA, your benefit increases up to age 70. - Earn More

The more you earn (up to the taxable limit), the higher your future benefit. - Work 35+ Years

SSA uses your top 35 earning years. Fewer years = lower average. - Correct Your SSA Earnings Record

Mistakes happen. Log into your My SSA Account and fix errors. - Avoid Taking Benefits Too Early

Claiming at age 62 reduces your benefit by up to 30% permanently.

Why You Should Watch Out for Scams?

Anytime money’s involved, scammers come out of the woodwork. Be wary of:

- Emails promising a $4,983 stimulus or “bonus payment”

- Calls claiming to be from SSA requesting your SSN

- Texts asking you to click a link to claim a check

SSA will never call, email, or text to ask for your personal info or banking details.

Payment Methods Are Changing

SSA now requires electronic payments. Here are your options:

- Direct Deposit to a checking or savings account

- Direct Express® Debit Mastercard® if you don’t have a bank

- Electronic Transfer Account (ETA)

Paper checks are only allowed with a hardship exemption.

Retirement Planning Tips from a Professional Perspective

If you’re preparing for retirement in the next 5–10 years, here are expert-level tips:

- Diversify Income: Don’t rely solely on Social Security. Use 401(k), IRA, pensions, and annuities.

- Watch Tax Brackets: Social Security can be taxable. Keep an eye on your total income.

- Plan for Healthcare Costs: Medicare doesn’t cover everything — plan for premiums and long-term care.

- Budget for Inflation: COLA helps, but actual inflation may outpace it over time.

- Work Part-Time: A little side income in retirement can go a long way without reducing benefits (after full retirement age).

Social Security $994 Payment for February 2026 – Check Payment Dates and Who Qualifies

Social Security January 2026 Payment Dates – Who Gets Paid First and Which Checks Arrive Early

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules