$400 New York Inflation Check: If you’re still waiting on your $400 New York inflation check, you’re definitely not alone. Across the Empire State, millions of folks are wondering the same thing — where’s my money? The state promised to send out checks of up to $400 to help ease the sting of inflation, but as of December 2025, many mailboxes remain empty. So, what gives? Let’s break down the real reasons behind the delay, who’s eligible, and how you can make sure your check doesn’t get lost in the shuffle.

Table of Contents

$400 New York Inflation Check

If you’re still waiting on your $400 New York inflation refund check, hang in there. The delay isn’t about neglect — it’s about logistics, verification, and the sheer scale of the operation. By late December 2025, all eligible checks are expected to be mailed out, and most residents should see theirs by mid-January 2026. If yours doesn’t arrive, check your address, contact the NYS Tax Department, and stay informed through official sources. At the end of the day, the state’s goal is to get this money into your hands — it just might take a little longer than expected. And in times like these, even a few hundred dollars can make a world of difference.

| Topic | Details & Key Info |

|---|---|

| Program Name | New York Inflation Relief Refund (2025) |

| Payment Amount | Up to $400 for eligible taxpayers |

| Eligibility | Based on 2023 New York State income tax filings |

| Payment Type | Paper check only, mailed automatically |

| Issuing Authority | New York State Department of Taxation and Finance |

| Mailing Period | October – December 2025 (sent in batches) |

| Official Website | Visit NYS Tax Department |

| Estimated Recipients | Over 8 million New Yorkers |

| Final Delivery Deadline | End of December 2025 |

What Is $400 New York Inflation Check?

The New York Inflation Refund Check is a one-time tax rebate designed to help residents tackle rising living costs caused by ongoing inflation. It’s part of Governor Kathy Hochul’s state budget relief plan, which aims to provide financial breathing room to working families, retirees, and middle-income taxpayers. In plain terms, this refund acts like a mini stimulus. While $400 won’t make anyone rich, it can help cover groceries, utilities, gas, or that never-ending grocery bill at Trader Joe’s.

The program’s funds are drawn from New York’s 2025 surplus budget, which included billions in excess revenue due to higher-than-expected tax collections. Instead of holding on to the funds, the state decided to distribute a portion directly to residents — a move aimed at stimulating local spending.

Why You Haven’t Gotten Your Check Yet?

Now, let’s get to the question on everyone’s mind: Why is this taking so long?

While frustration is understandable, there are a few practical, not sinister reasons behind the delay.

1. Checks Are Being Mailed in Phases

Unlike digital stimulus payments or tax refunds that hit your bank account overnight, these inflation relief payments are sent by physical mail only. That means each check must be printed, processed, and physically delivered — a massive operation when you’re talking about 8 million checks.

The New York State Department of Taxation and Finance confirmed that mailing began in early October 2025, but it’s happening in regional batches. Residents in some counties received theirs by Halloween, while others in rural areas or downstate are still waiting.

There’s no ZIP-code schedule and no online tracker, so patience is key. The state expects all checks to be mailed no later than December 31, 2025.

2. Mailing & Postal Delays

The U.S. Postal Service (USPS) has been dealing with staff shortages and mail slowdowns throughout the fall, especially after the holiday shipping rush began in November. Combined with winter weather, mail delivery times can vary widely.

So if you’re upstate in Buffalo or Rochester, your check might take a bit longer than someone in Manhattan.

3. Address or Residency Issues

Your check will go to the address on your 2023 tax return, not your current one. If you’ve moved recently or didn’t file a change of address with the state, your check might be stuck in limbo — possibly even mailed to your old apartment or landlord.

4. Late or Amended Tax Filings

If you filed your 2023 state tax return late or made changes (like an amended return), your information might still be under review. Those cases go into a separate processing batch, often delaying checks by several weeks.

5. Administrative Backlogs

According to a report from Hudson Valley Post, the Department of Taxation and Finance has been managing a massive workload. Processing millions of taxpayer records, verifying eligibility, printing secure checks, and handling mailing logistics have stretched the department’s resources.

Even small technical hiccups — like printing errors or mismatched data — can cause cascading delays.

Who Qualifies for the $400 New York Inflation Check?

Eligibility depends on your income level, filing status, and residency for the 2023 tax year. Here’s a breakdown:

| Filing Status | Adjusted Gross Income (AGI) | Maximum Payment |

|---|---|---|

| Married Filing Jointly | Up to $150,000 | $400 |

| Head of Household | Up to $112,500 | $300 |

| Single | Up to $75,000 | $250 |

To qualify, you must have:

- Filed a 2023 resident income tax return for New York State.

- Been a New York resident for the entire year.

- Had an income within the limits shown above.

No application is needed — the state determines eligibility automatically. If you qualified for last year’s Middle-Class Tax Refund, you’ll likely qualify for this one too.

How to Check If You’re Eligible for $400 New York Inflation Check?

Even though there’s no tracking tool for this check, you can confirm eligibility in three ways:

- Visit the official NYS Inflation Refund page – tax.ny.gov/pit/inflation-refund-checks.htm

- Log into your NYS Online Services Account – check that your 2023 filing is marked as “processed.”

- Contact the NYS Tax Department at 518-457-5149 if you filed correctly but haven’t received your check by mid-January 2026.

The Bigger Picture: Inflation and Relief Programs

To understand why this program exists, it helps to look at the broader economic landscape.

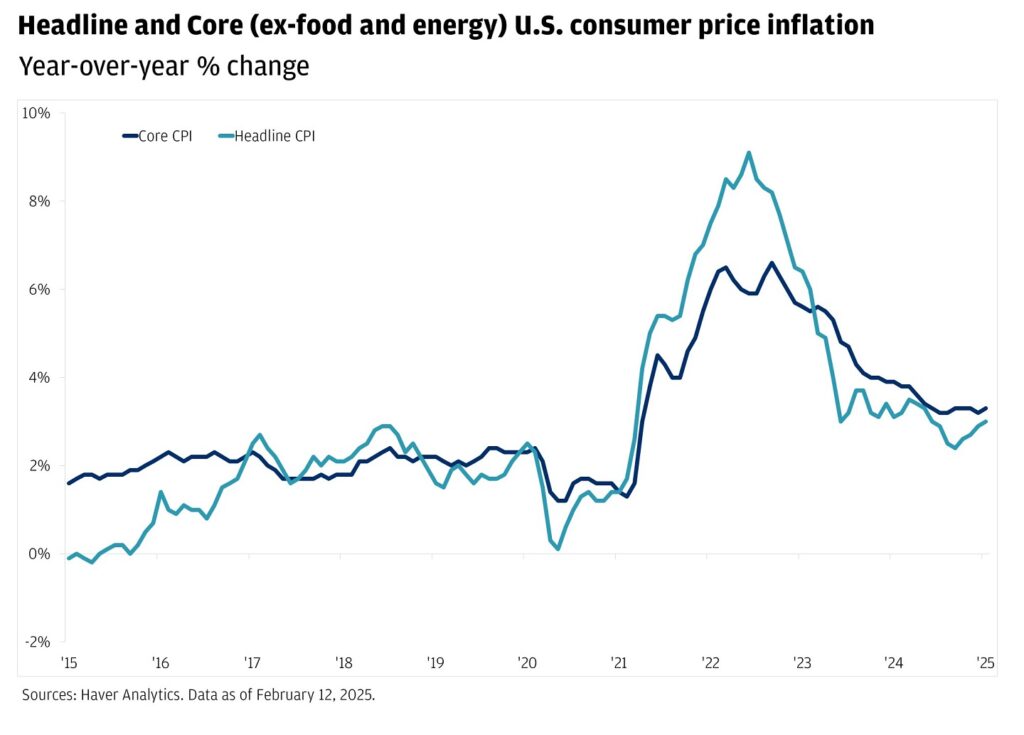

After years of price spikes, the U.S. inflation rate peaked at 9.1% in 2022, then gradually dropped to around 3.4% in 2025 according to the U.S. Bureau of Labor Statistics. However, many essentials — groceries, gas, housing — remain stubbornly high.

New York households, especially in high-cost areas like NYC, Long Island, and Westchester, are spending on average $1,200 more annually on everyday goods compared to 2020, based on USDA Food Price Outlook data.

Governor Hochul’s administration launched this refund program to soften inflation’s impact on working families, targeting relief at middle-income earners rather than the ultra-wealthy.

Common Reasons Your Check May Be Delayed

Let’s spell it out clearly — here are the top six reasons for delay:

- Mail delivery backlog from USPS.

- Outdated mailing address on file.

- Late or amended 2023 return.

- Eligibility verification issues.

- System errors or name mismatches (especially for joint filers).

- Returned or undeliverable checks being reprocessed.

If your check was returned to the state, it can take 4–6 weeks for it to be reissued after you update your address.

What To Do If Your Check Still Hasn’t Arrived?

Follow this checklist:

- Wait until mid-January 2026 — most late checks arrive by then.

- Verify your address via your NYS Online Services account.

- Contact the NYS Department of Taxation and Finance if it’s still missing.

- Request a replacement if the state confirms it was mailed but lost.

It’s also smart to sign up for USPS Informed Delivery, a free tool that lets you preview your mail online so you’ll know if your check is on the way.

Practical Advice to Avoid Future Issues

Here’s what tax experts recommend to make sure you don’t miss out next time:

- File your taxes early. Early filers are always first in the queue for relief programs.

- Use direct deposit for future refunds and credits.

- Keep copies of your tax returns and W-2s — they help resolve verification problems quickly.

- Never share personal info with anyone promising to “speed up” your check. That’s a red flag for scams.

- Bookmark official websites, like www.tax.ny.gov, and ignore unofficial links shared on social media.

Expert Insight: Why Paper Checks Instead of Direct Deposit?

You might be wondering why the state didn’t just deposit this refund directly into your account like the federal stimulus payments.

According to state officials, this was intentional. Many taxpayers’ banking information changes yearly, and verifying it across millions of records could lead to errors or fraud. Mailing physical checks ensures each recipient’s identity is verified via postal delivery — slower, yes, but safer.

That said, policymakers have hinted that future relief programs may include digital delivery options if data security can be guaranteed.

$2000 Stimulus Check in December 2025: Check Payment Date & Eligibility Criteria

US $4873 December 2025 Direct Deposit: Check Eligibility Criteria & Payment Schedule

$967 SSI Payment December 2025: Will you get it? Check Eligibility