$400 Inflation Refund Checks: If you’ve been feeling like your paycheck just doesn’t stretch the way it used to, you’re not alone. With inflation ramping up prices on everything from gas to groceries, Americans have been left asking, “Where’s the help?” Finally, there’s an answer: the federal government has officially launched the $400 Inflation Refund Checks program. This one-time payment aims to relieve the financial burden caused by skyrocketing costs in 2025. Whether you’re a parent, a retiree, a student, or someone grinding through two jobs, this initiative is designed to help everyday Americans make ends meet.

Table of Contents

$400 Inflation Refund Checks

The $400 Inflation Refund Check isn’t just a political gesture — it’s a real, tangible effort to put money back into American hands during one of the most expensive years in recent memory. Whether you’re a college student, a single parent, or someone nearing retirement, this payment could be the buffer you need to regain some financial peace of mind. Check your eligibility, stay alert for updates, and above all — use this relief wisely. It’s not just free money. It’s a lifeline for millions of families trying to get back on solid ground.

| Details | Information |

|---|---|

| Program Name | $400 Inflation Refund Checks |

| Announcement Date | October 2025 |

| Payment Amount | Up to $400 per eligible person |

| Disbursement Method | Direct deposit, mailed checks, or debit cards |

| Eligibility | Based on 2024 federal tax return, income thresholds, valid SSN/ITIN, and residency |

| Official Info | IRS Economic Impact Payments |

| IRS Hotline | 1-800-919-9835 |

| Estimated Reach | Over 85 million Americans |

| Use of Funds | Essentials, debt payments, savings, or emergency expenses |

What’s Behind the $400 Inflation Refund Checks?

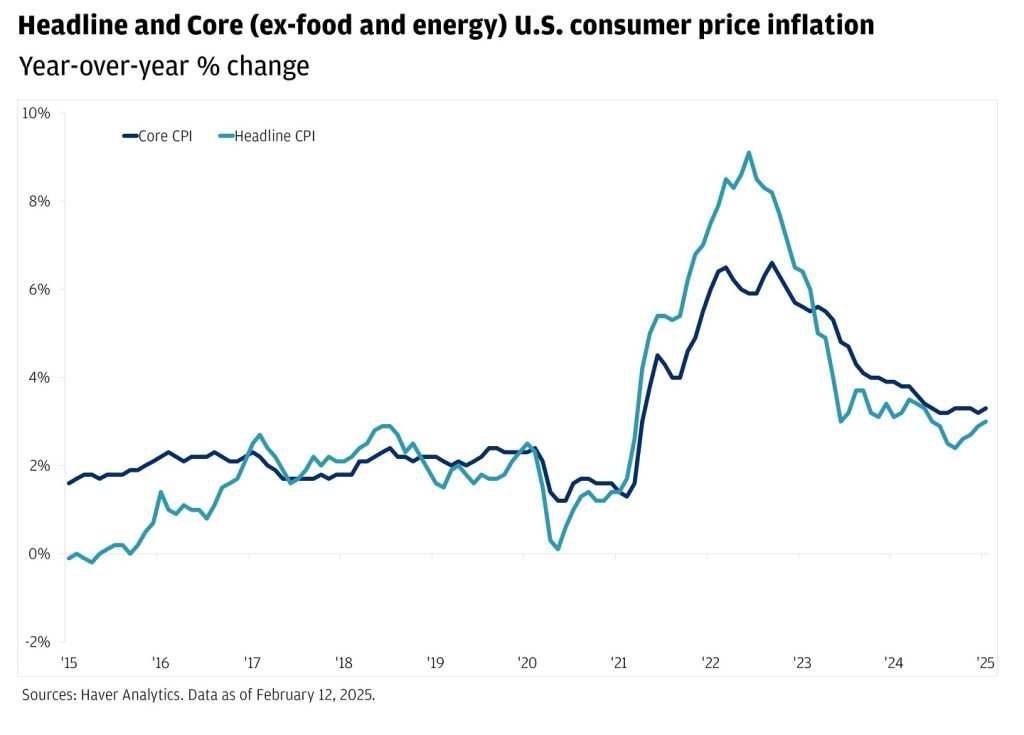

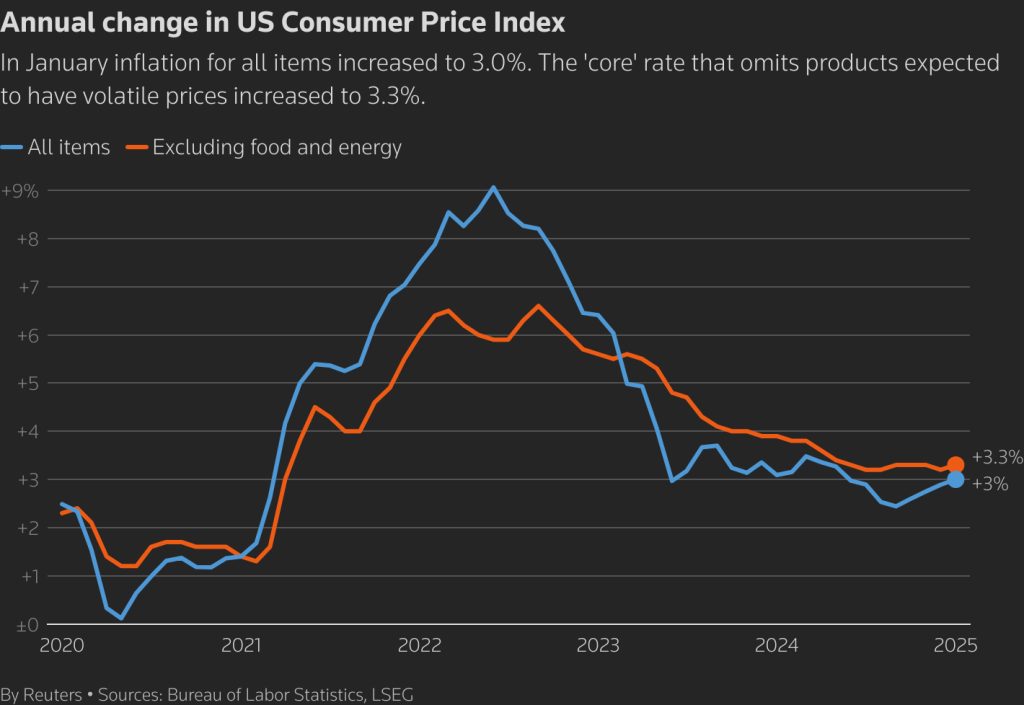

Let’s rewind a bit. In 2025, inflation hit a 15-year high, with the Consumer Price Index (CPI) showing an annual increase of 5.4%, as reported by the U.S. Bureau of Labor Statistics. Prices on food, rent, fuel, and utilities have jumped, putting low- and middle-income families under serious strain.

This refund is not part of the typical stimulus check package. Instead, it is a targeted anti-inflation relief effort aimed at offsetting these increased living costs. It complements existing state programs, but with nationwide eligibility, it’s broader and more inclusive.

Eligibility Criteria: Who Gets It and Why

The refund isn’t just for low-income Americans. It covers a broad middle-income base, ensuring that people with stable but modest incomes also benefit.

You’re likely eligible if:

- You filed a 2024 federal income tax return.

- You earned less than $100,000 (individual) or $200,000 (married filing jointly).

- You have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- You weren’t claimed as a dependent on another taxpayer’s return.

You’re likely not eligible if:

- You didn’t file a tax return.

- Your income was above the threshold.

- You received equivalent direct assistance from other 2025 federal programs.

Note: Individuals on Social Security, Veterans benefits, or SSI may still qualify if they filed taxes or used the IRS’s non-filer portal in 2024.

How Are the $400 Inflation Refund Checks Sent?

The U.S. Treasury is using existing tax return data to streamline payment distribution. Here’s how most people are receiving the refund:

1. Direct Deposit

Payments are automatically deposited into the bank account listed on your last tax return. These deposits have already started for many eligible taxpayers.

2. Paper Checks

If you didn’t include bank info on your return, expect a physical check via mail. Processing may take 4–8 weeks depending on your state and postal service conditions.

3. Prepaid Debit Cards

For taxpayers without bank accounts, the IRS is issuing Visa or Mastercard-branded debit cards that can be used anywhere. These are especially helpful for unbanked and underbanked individuals.

State-Level Variations and Add-Ons

Some states have additional programs that supplement the federal refund:

- New York: Offers up to $400 in inflation aid through the Department of Taxation and Finance to residents who claimed the Empire State Child Credit.

- California: Rolled out Middle Class Tax Refunds in 2023 and may offer more support pending budget review.

- Illinois and Colorado have also initiated rebates up to $500 based on local cost-of-living assessments.

How to Make the Most of Your Refund?

Let’s get real — $400 won’t make you rich, but it can be a powerful financial tool when used wisely.

Here are strategic ways to spend or save your check:

Pay Off Debt

Paying off high-interest debt like credit cards first can save you hundreds in interest long-term.

Cover Essentials

Use it for groceries, rent, utility bills, school supplies, or healthcare — wherever you feel the squeeze most.

Build an Emergency Fund

Set aside $100–$200 in a high-yield savings account. It’s a safety net that many Americans still don’t have.

Invest in Yourself

Enroll in a short course, get certified, or purchase tools to boost your freelance business or side hustle.

Impact by Demographic Groups

The check affects communities differently based on economic status and age:

Seniors

With fixed incomes and rising prescription costs, seniors are disproportionately affected by inflation. This refund can help with utility bills or medical co-pays.

Parents

Many parents are juggling childcare, rising school costs, and reduced SNAP benefits. This $400 can be used for food, clothing, or educational tools.

College Students

If not claimed as a dependent, students can use the money to cover textbooks, transportation, or dorm expenses.

Veterans

Eligible veterans with fixed military pensions or VA benefits can allocate the refund toward medical costs or housing needs.

Common Myths and Misconceptions

Let’s bust a few myths that have been floating around social media:

“It’s just another stimulus check.”

Nope. It’s specifically structured as an inflation-focused relief credit, separate from pandemic-era stimulus.

“I have to apply to get it.”

Wrong. If you filed taxes, you’re automatically considered. No extra paperwork is needed unless you’re a non-filer.

“It’s taxable income.”

Absolutely not. This refund is not taxable, and you don’t need to report it as income on next year’s return.

“This is a scam.”

There are scams out there — but the legit refund will only come from the IRS. They won’t call or email asking for your info.

What to Do If You Haven’t Received $400 Inflation Refund Checks?

If you haven’t received your refund yet and believe you qualify:

- Visit Get My Payment.

- Confirm your tax return filing was accepted.

- Call the IRS at 1-800-919-9835.

- File Form 3911 to initiate a refund trace if it’s been over 8 weeks.

Also, double-check that your mailing address and bank account info are current with the IRS.

2026 Tax Refund Expectations and Updates– Why Officials Expect Larger Refunds Next Year

$1702 Stimulus Payment 2026: Is It Really Confirmed?

Will there be $2,000 checks in 2026? The latest on the tariff payments