$400 Inflation Refund: Inflation’s been running the show lately — from fast food to fuel, prices haven’t eased up much. New Yorkers, like most Americans, are tired of stretching paychecks like rubber bands. To offer a little relief, the New York State government stepped up with a $400 inflation refund aimed at helping residents offset some of that financial strain. But not everyone qualifies, and not every eligible person has received their refund yet. If you’re wondering, “Do I get it, and when’s it coming?” — this article’s your one-stop guide. We’ll break it all down: eligibility, payment status, income thresholds, real-life examples, how to avoid scams, and how you can make that refund count. Whether you’re a taxpayer, parent, student, or professional, here’s what you need to know — clearly explained and backed by reliable sources.

Table of Contents

$400 Inflation Refund

The $400 Inflation Refund isn’t a magic fix for inflation, but it’s a meaningful gesture that helps many New Yorkers stay afloat. Whether it covers a heating bill, a grocery trip, or a credit card payment, every dollar counts right now. So if you’re eligible, be patient and check your mailbox — your refund could be just around the corner. And if you’re not eligible, use this as motivation to stay informed and prepared for future relief opportunities.

| Feature | Details |

|---|---|

| Refund Amount | Up to $400, based on 2023 income and filing status |

| Eligibility | NY residents who filed a 2023 tax return (Form IT-201) and meet income guidelines |

| Distribution Timeline | Checks began mailing in September 2025 and aimed to finish by November 2025 |

| Number of Recipients | Over 8 million New Yorkers expected to benefit |

| Tax Impact | Not taxable; will not affect your 2025 tax return |

| Application Required? | No – refunds are issued automatically based on tax records |

| Official Resource | New York State Department of Taxation and Finance |

Background: Why the Refund Was Created

After years of inflation-driven economic pressure, the state of New York collected a surplus of tax revenue, largely because higher consumer prices meant higher tax collections. This wasn’t “extra” money in the typical sense — it came from you, the taxpayer, spending more than usual on necessities.

So, the state made the decision: let’s return a portion of that surplus. It’s not a stimulus check, but a targeted refund, based on your 2023 tax filings.

This initiative was designed to provide immediate, direct relief, especially for low- and middle-income households — the ones hit hardest by higher prices on food, rent, fuel, and energy.

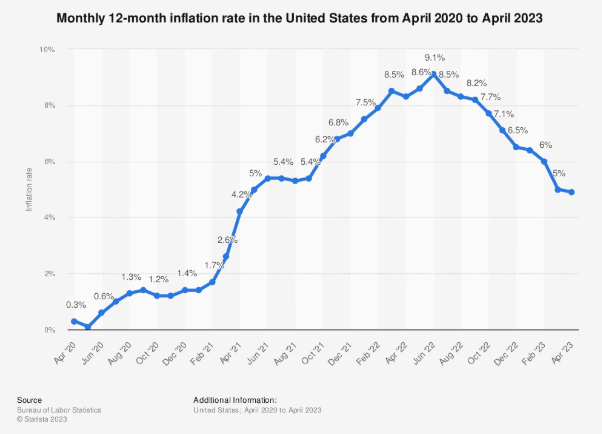

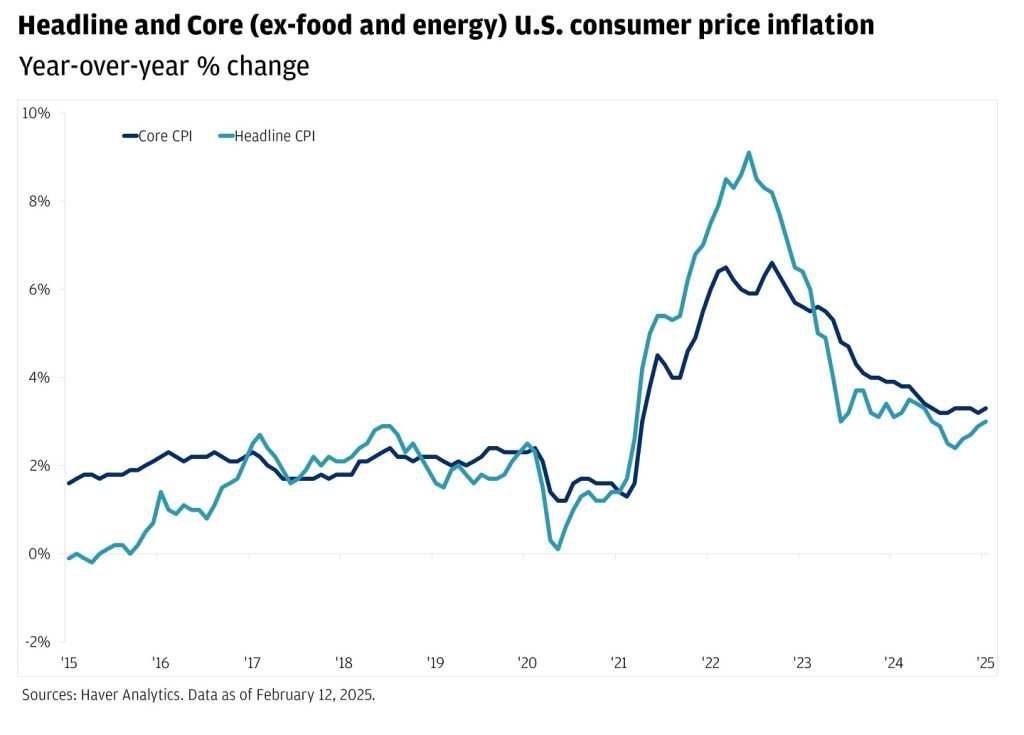

Economic Context: How Bad Is Inflation, Really?

According to the U.S. Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) rose by:

- 9.1% in June 2022 (year-over-year) — the highest in 40+ years

- 4.0% by mid-2023, signaling a slowdown but not a reversal

- Sticky inflation continued in housing, utilities, and groceries

So while inflation cooled slightly, household costs didn’t. New York’s urban areas saw above-average housing and utility price increases, while rural communities faced higher energy burdens.

The refund helps level the field, if only a little.

Who Qualifies for the $400 Inflation Refund?

To qualify, all three criteria must be met:

- You were a full-year New York State resident in 2023

- You filed a 2023 New York State personal income tax return (Form IT-201)

- You were not claimed as a dependent on anyone else’s tax return

If all that checks out, you’re likely eligible for some portion of the refund.

How Much Will I Get?

| Filing Status | NY Adjusted Gross Income (AGI) | Refund Amount |

|---|---|---|

| Married Filing Jointly / Surviving Spouse | ≤ $150,000 | $400 |

| Married Filing Jointly | $150,001 – $300,000 | $300 |

| Single / Head of Household / Separate filer | ≤ $75,000 | $200 |

| Single / Head of Household / Separate filer | $75,001 – $150,000 | $150 |

Note: Refund amounts phase out above these limits, meaning you may get a partial payment even if you’re slightly above the cap.

Distribution Timeline: When Will I Get My Check?

Mailing Schedule

The New York State Department of Taxation and Finance began mailing checks in September 2025. The rollout was phased, not all at once.

| Date | Milestone |

|---|---|

| September 2025 | First round of checks mailed |

| October 2025 | Majority of refunds sent |

| November 2025 | Final batches mailed |

| December 2025+ | Reissued checks, address updates, follow-ups |

How Refunds Are Sent

- No direct deposits

- Paper checks mailed via USPS

- Sent to your last known address on file

If you’ve moved recently and didn’t update your information with the NY Tax Department, your check may be delayed or returned.

How to Update Your Mailing Address?

If your address has changed since filing your 2023 return, here’s what to do:

- Complete Form DTF-96 (Address Change Form)

- Submit it online or mail it to the Tax Department

- Confirm update by calling 518-457-5181

Real-World Examples of $400 Inflation Refund

- Miguel and Vanessa, married with two kids in Albany, filed jointly with $130,000 AGI. → Eligible for full $400

- Priya, a single mom in Syracuse earning $73,000. → Eligible for $200

- Tom, single and earned $160,000. → No refund based on income

Communities Most Impacted

Urban Households

Many city dwellers — especially renters — are feeling cost pressure from inflation. Refunds can help with:

- Rent hikes

- Food insecurity

- Transit cost increases

Rural Residents

Rural New Yorkers face higher energy bills and food transport costs. The refund provides relief for:

- Heating oil costs

- Gasoline for longer commutes

- Limited grocery access

Elders & Retirees

Fixed-income seniors qualify if income falls below the threshold, helping cover:

- Prescription costs

- Property taxes

- Utility bills

What to Do With the Money: Smart Financial Planning

Getting a refund is great, but how you use it matters. Here’s how to make the most of it:

- Emergency Savings: Park it in a high-yield savings account for rainy days

- Debt Reduction: Pay down credit cards or high-interest loans

- Grocery Stock-Up: Bulk-buy essentials to hedge future price hikes

- Energy Bills: Offset heating costs during the winter months

- Professional Development: Use it to pay for online courses or certifications

How to Know If You’ve Been Scammed?

Let’s be real — anytime there’s money involved, fraud follows. Here’s what to know:

Red Flags:

- You get a text/email asking to “claim your refund”

- Someone asks for your Social Security Number

- They demand a “processing fee” to receive your check

What’s Legit:

- You don’t need to apply

- You won’t be contacted by phone

- No bank info is required

How This Refund Differs From Federal Stimulus Checks?

| Feature | $400 NY Inflation Refund | Federal Stimulus Checks |

|---|---|---|

| Administered By | New York State | U.S. Federal Government |

| Based On | 2023 State Tax Return (Form IT-201) | IRS Federal Returns (2020/2021) |

| Max Amount | $400 | $1,200 to $1,400+ |

| Application Required | No | No |

| Sent As | Paper Check | Direct Deposit or Check |

$400 Inflation Refund Checks Announced for Everyone, Payment Disbursement Started

Stimulus Check Update 2026: What the Latest Payment News Really Says

Will there be $2,000 checks in 2026? The latest on the tariff payments