$3500 a Month in Social Security: If you’ve ever wondered, “Can someone really get $3,500 a month in Social Security benefits?”, you’re not alone — and you’re asking a very smart question. With inflation rising, retirement costs ballooning, and uncertainty in the markets, many Americans are trying to figure out how much they can really count on from Uncle Sam. So let’s break it down — clearly, completely, and with real facts. We’ll explain who can qualify for a $3,500 monthly benefit, what role COLA (Cost-of-Living Adjustments) play, how timing and income affect payouts, and what you can do right now to maximize your Social Security check. Whether you’re 28 or 68, these are things you need to know.

Table of Contents

$3500 a Month in Social Security

Getting $3,500 per month in Social Security is absolutely possible — but not typical. It requires a long, high-earning career, delayed claiming, or spousal strategies. The 2026 COLA of 2.8% helps all retirees keep pace with inflation, but you’ll need to do more than wait for annual increases if you want to reach that higher income tier. Use your earnings history wisely, plan your claiming strategy carefully. Social Security can be a powerful piece of your retirement plan — when used right.

| Topic | Key Figures & Facts | Why It Matters |

|---|---|---|

| 2026 COLA Increase | 2.8% for ~71M beneficiaries | Adjusts for inflation. (ssa.gov) |

| Average Benefit for Retired Workers | ~$2,071/month in 2026 | Most retirees earn less than $3,500. |

| Married Couple Receiving Benefits | ~$3,208/month average | Many couples reach this range. |

| Maximum Possible Monthly Benefit (2025) | Up to ~$5,430/month at age 70 | Requires high earnings + delayed claiming. |

| Earnings Limit Before FRA (2026) | $24,480/year | Exceeding it can temporarily reduce benefits. |

| Official Estimator | ssa.gov | Use SSA’s tool to check your benefits. |

What Is Social Security?

Social Security is a federal program that provides monthly income to retirees, disabled workers, and surviving spouses or children of deceased workers. It’s funded by payroll taxes — meaning you’ve likely paid into it your entire working life.

But here’s the kicker: not everyone receives the same amount.

The amount you receive depends on:

- Your lifetime earnings

- The age you claim benefits

- Your work history (how many years and how much you earned)

- Inflation adjustments (COLA)

So when people talk about $3,500 monthly Social Security checks — they’re talking about a high-end scenario, not the average. But yes, it’s possible under the right conditions.

Understanding COLA (Cost-of-Living Adjustments)

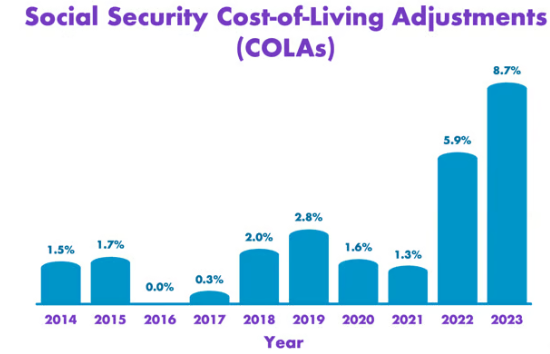

Each year, Social Security benefits are adjusted based on inflation. This is known as the COLA.

In 2026, Social Security recipients will receive a 2.8% COLA increase — that means someone earning $2,500/month in 2025 will see their check go up to about $2,570/month. While this doesn’t sound like a huge jump, over time, these small increases add up and help protect your purchasing power.

COLA is determined based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When prices for goods and services rise, your Social Security check increases — at least in theory — to help you keep up.

How Much Do People Actually Receive?

Here’s what real people are earning from Social Security:

- Average monthly benefit (2026): $2,071

- Aged couple (both collecting): $3,208

- Maximum benefit (age 70): $5,430

- Disabled worker + family: $2,937

- Widow(er) + 2 children: $3,898

Clearly, $3,500 a month is not the norm — but it’s not a fantasy either. If you’re a high earner, especially with a spouse also eligible for benefits, that number becomes realistic.

Who Can Actually Qualify for $3500 a Month in Social Security?

1. High Earners Who Delay Benefits

To get a monthly benefit of $3,500 or more on your own record, you’d need:

- Consistent high earnings (near the Social Security taxable maximum — $168,600 in 2024)

- 35 years of those high earnings

- To delay claiming benefits until age 70

By doing that, you not only max out your AIME (Average Indexed Monthly Earnings), but you also receive delayed retirement credits — about an 8% increase per year beyond your full retirement age (FRA).

2. Married Couples With Dual Benefits

Many couples can easily reach $3,500 together:

- If one spouse receives $2,000/month

- And the other spouse receives $1,500/month

- Together, they total $3,500/month

Spousal benefits also come into play. A lower-earning or non-working spouse may be entitled to up to 50% of the higher-earning spouse’s benefit.

3. Survivor or Dependent Benefits

Some families may qualify for benefits that push total household income above $3,500/month — especially in cases involving:

- A widow(er) with dependent children

- A disabled worker’s family receiving multiple payments

These scenarios aren’t common, but they’re absolutely legitimate and legally supported.

How Benefits Are Calculated?

Social Security uses a formula based on your highest 35 years of indexed earnings. Here’s how it works:

- They calculate your Average Indexed Monthly Earnings (AIME).

- They apply a progressive formula to get your Primary Insurance Amount (PIA).

- Your PIA is adjusted based on when you claim benefits.

- Early claims (before FRA) reduce your benefit.

- Delaying past FRA increases it by 8% per year up to age 70.

When Should You Claim?

Timing is everything in the Social Security game.

- Claiming at age 62: Means locking in a benefit that could be 30% less than your full amount.

- Waiting until FRA (66-67): Ensures full benefit.

- Waiting until 70: Maximizes benefit with up to 24-32% increase.

Example:

If your FRA benefit is $2,500, waiting until 70 could raise it to about $3,300–$3,500/month.

Important Policy Considerations

Social Security is facing long-term funding challenges. By 2034, if Congress doesn’t act, the trust fund may only be able to pay about 77% of promised benefits.

However, reforms are likely — including:

- Raising the retirement age

- Increasing the payroll tax cap

- Adjusting benefit formulas

For now, younger workers should view Social Security as a foundation, not a full retirement plan. Supplement with IRAs, 401(k)s, or other investments.

Avoid These Common Pitfalls

- Claiming too early – It might feel good to get checks at 62, but it permanently reduces your benefit.

- Earning too much while collecting – If you’re under FRA and still working, earning more than the limit ($24,480 in 2026) can temporarily reduce your benefit.

- Ignoring spousal/survivor benefits – These can significantly boost total family income.

- Not checking your SSA statement – Errors happen. Review your earnings record annually at ssa.gov.

Pro Tips to Maximize Your Benefit

- Work at least 35 years — fewer years drag down your average.

- Avoid zero-earning years in your record.

- Claim at age 70 if you want the largest check.

- Coordinate with your spouse for spousal/survivor benefits.

- Create a My Social Security account to track your earnings and projections.

New York Social Security Schedule: Exact December 2025 Payment Dates

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

2026 COLA Benefit Plans: Check Updated Cost-of-Living Adjustments Rules