$3000 Social Security Spousal Benefits: When folks hear that Social Security pays up to 50% of a spouse’s benefit, they often wonder what that means in real dollars. So, let’s cut through the noise and talk about the real numbers behind $3,000 Social Security spousal benefits — and how much your wife can actually get each month. If your Social Security retirement benefit is $3,000 per month, your spouse could be eligible for up to $1,500/month in spousal benefits — but there’s a catch. That amount depends heavily on when she files, your earnings history, your marital situation, and more. This article explains how to get the most out of those spousal benefits, what to avoid, and how to plan for a financially secure retirement.

Table of Contents

$3000 Social Security Spousal Benefits

The spousal benefit in Social Security isn’t just a side perk — it’s a major part of retirement income planning for millions of couples. If your benefit is $3,000/month, your spouse can get up to $1,500/month — but only if she times it right. Spousal benefits max out at 50% of your full retirement age benefit, and they don’t grow past that. However, smart planning around when to file, how survivor benefits work, and tax planning can help maximize income over your full retirement. Don’t leave free money on the table — understand the rules, coordinate your strategy, and plan ahead.

| Topic | Details |

|---|---|

| Max Spousal Benefit | 50% of your PIA (Primary Insurance Amount) |

| If Your PIA = $3,000 | Max Spousal Benefit = $1,500 |

| Early Claim at 62 | ~32.5% of PIA → ~$975/month |

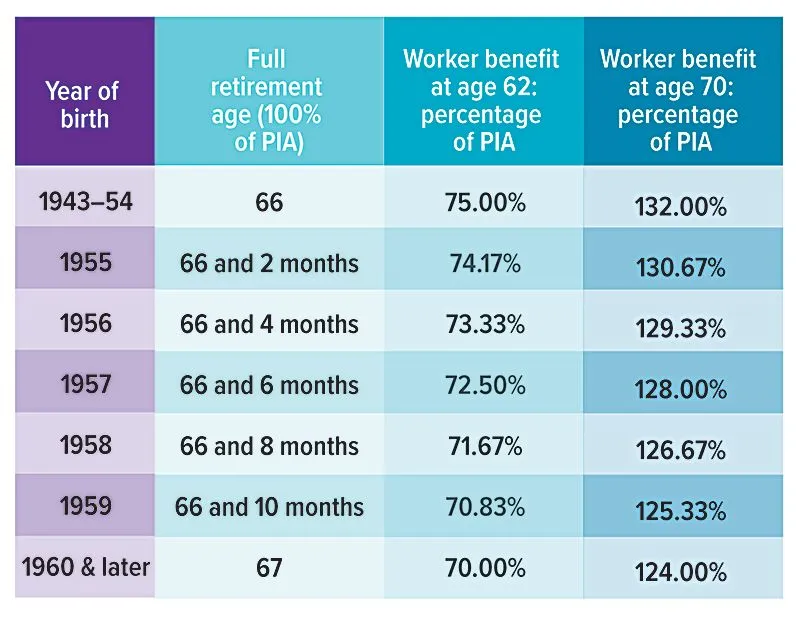

| Full Retirement Age | FRA = 66–67 depending on birth year |

| Claim After FRA | No increase beyond 50% |

| Divorce Benefit Rule | 10+ years of marriage and unmarried |

| Official SSA Spousal Tool | ssa.gov/oact/quickcalc/spouse.html |

Understanding Social Security Spousal Benefits

Spousal benefits are a key part of Social Security’s promise to support families, not just individuals. They’re especially helpful when one spouse worked fewer years, earned less, or stayed home raising kids — a scenario common in traditional households.

Here’s the gist:

- If you’re receiving $3,000/month from Social Security (at your FRA), your spouse can get up to $1,500/month at her full retirement age.

- But that’s only if she meets the eligibility rules:

- You must have already claimed your retirement benefit.

- She must be at least 62 (or caring for your child under 16 or disabled).

- She can’t receive a larger benefit based on her own work record.

This 50% rule isn’t based on the amount you’re receiving if you delay past full retirement age — it’s based on your PIA, the amount you would get at your FRA.

What Is PIA (Primary Insurance Amount)?

Your PIA is the benefit amount you’d receive if you claim at your full retirement age, which is 66 or 67 for most people today. That number is calculated based on your 35 highest-earning years. For 2025, the maximum PIA is around $3,822, but most people don’t hit that ceiling.

So, if your PIA is $3,000, your spouse can claim:

- $1,500/month at her FRA

- Less than $1,500 if she claims early

And here’s a key detail: if she has her own work history, she’ll receive whichever benefit is higher — her own or the spousal amount. Social Security doesn’t stack both together.

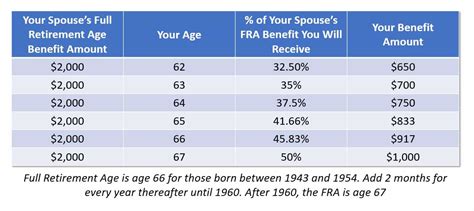

How Claiming Age Affects the Social Security Spousal Benefits?

Timing is everything. If your wife claims before reaching her Full Retirement Age, Social Security reduces the amount she receives — and it’s permanent.

Claiming at 62

- Reduction can be up to ~35%

- Instead of $1,500, she might receive just $975/month

- Reduction applies even if you wait until age 70 to file

Claiming at Full Retirement Age

- She gets the full 50% of your PIA

- That means $1,500/month on a $3,000 PIA

Claiming After FRA

- There’s no bonus for waiting

- Spousal benefits cap at 50% of your PIA

So, there’s no financial advantage for your wife to wait past her FRA for spousal benefits — unlike your own retirement benefit, which increases the longer you delay up to age 70.

Your Wife’s Own Retirement Benefit vs. Spousal Benefit

Here’s another twist: if your wife worked and qualifies for her own Social Security benefit, SSA will compare both:

- If her own benefit is less than half of yours, she’ll get spousal benefits to bring her up to the 50% level.

- If her own benefit is more, she won’t get a spousal boost — she just gets her own benefit.

Example:

- Your PIA = $3,000 → Spousal max = $1,500

- Her own benefit = $1,200

- SSA will add $300 in spousal benefits to raise her total to $1,500

This is called a dual entitlement, and the total benefit still caps at 50% of your PIA.

Special Cases: Divorce, Death, and Disability

Divorced Spouses

Your ex-spouse can qualify for spousal benefits if:

- The marriage lasted 10+ years

- She’s unmarried

- She’s 62+

- Your PIA is higher than her own benefit

And guess what? It doesn’t reduce your current spouse’s benefit either.

Survivor Benefits

If you pass away, your wife may qualify for a survivor benefit up to 100% of your benefit — not just 50%.

Survivor benefits are a different program and can kick in as early as age 60. This is why some planners recommend the higher-earning spouse delays filing until age 70 — to maximize survivor benefits down the road.

How to Apply for Spousal Benefits?

Applying is easy — here’s how it works:

- Make sure you’ve claimed your benefit first.

- Your spouse can apply online at ssa.gov/retire.

- Have key documents ready:

- Birth certificates

- Marriage certificate

- W-2s or tax returns (if applicable)

- She can apply up to 3 months before she wants the benefits to begin.

Taxation of Spousal Benefits

Social Security benefits — including spousal benefits — may be taxable, depending on your total income.

If your combined income (AGI + tax-free interest + half of SS) is:

- $25,000–34,000 (individual) → up to 50% is taxable

- $32,000–44,000 (joint) → up to 50% is taxable

- Above $34,000/$44,000 → up to 85% is taxable

Proper retirement income planning — including Roth conversions and delayed withdrawals — can help reduce the tax burden on your Social Security benefits.

How to Maximize Benefits as a Couple?

- Let the higher earner delay claiming

This increases survivor benefits down the line. - Coordinate benefits

Sometimes it’s smart for one spouse to claim early while the other delays. - Use SSA calculators

Use the SSA spousal calculator to estimate your exact numbers. - Consult a pro

Retirement income planning involves tax brackets, RMDs, Roth strategies, and more. A fee-only financial planner can help you optimize your entire picture.

Common Mistakes to Avoid

- Claiming too early without realizing the benefit is permanently reduced

- Assuming spousal benefits grow after FRA (they don’t)

- Ignoring survivor benefit planning — especially if one spouse is in poor health

- Missing the divorce benefit if you were married 10+ years

- Failing to check your Social Security record for errors

Social Security January 2026 Payments – Exact Deposit Dates Announced, Check When Your Money Arrives

Fewer Visits to Social Security Offices? Here’s How You Can Fight Back and Take Action Today

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!