3 Smart Steps to Increase Your Monthly Retirement Check: If you’re nearing retirement or already mapping out your golden years, chances are you’re wondering: How can I get the most out of Social Security? You’re not alone — this is one of the most common, and most important, financial questions Americans ask. For millions of retirees, Social Security is a lifeline — providing consistent, inflation-adjusted income when work stops. But not everyone knows that you can take a few simple, strategic steps to significantly increase your monthly retirement check. Whether you’re just starting to plan or already collecting benefits, this guide walks you through 3 proven tricks to legally and effectively boost your income.

Table of Contents

3 Smart Steps to Increase Your Monthly Retirement Check

Social Security is too important to wing it. With some strategic planning — delaying benefits, working a bit longer, coordinating with a spouse — you can turn an average check into a retirement powerhouse. Even a $100/month boost translates to $24,000 more over 20 years. That’s vacation money. Emergency cushion. Peace of mind. So don’t wait. Check your earnings, run your estimates, and build a strategy. Better yet, talk to a financial advisor who understands how Social Security fits into your full retirement picture. Because when it comes to retirement, the smarter you plan today, the better you live tomorrow.

| Topic | Details |

|---|---|

| Main Focus | 3 Smart Steps to Boost Monthly Social Security |

| Average Monthly Benefit (2024) | $1,907 |

| Max Benefit at Age 70 (2024) | $4,873/month |

| COLA Increase (2024) | 3.2% |

| Key Strategies | Delayed claiming, higher earnings, spousal optimization |

| Eligibility Age Range | 62–70 (claiming flexibility) |

| Official Website | www.ssa.gov |

Why 3 Smart Steps to Increase Your Monthly Retirement Check Matter?

With life expectancy increasing and retirement lasting 20–30 years or more, your Social Security decision isn’t just about now — it’s about stability later. According to the SSA, about 50% of elderly couples and 70% of single retirees rely on Social Security for at least half of their income.

And with inflation driving up the cost of living, that monthly benefit matters more than ever.

For context:

- A 65-year-old couple retiring today has a joint life expectancy of 85+.

- That’s two decades (or more) of checks — and a bigger check can compound into tens of thousands of extra dollars over time.

Step 1: Delay Claiming Benefits — Patience Pays Off

One of the simplest ways to boost your monthly benefit is also one of the most powerful: Wait.

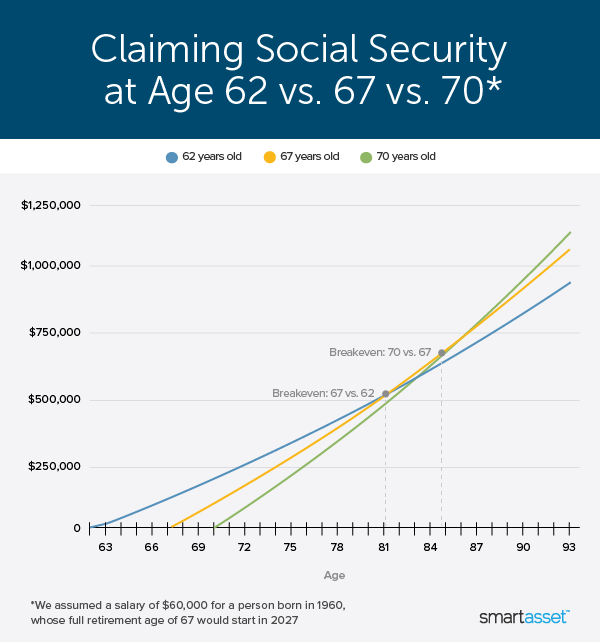

The age at which you start taking Social Security greatly affects the size of your check.

- Earliest you can claim: 62

- Full Retirement Age (FRA): 66 to 67 (depending on birth year)

- Latest to claim: 70

For every year you delay claiming past your FRA, you earn 8% more per year in Delayed Retirement Credits, maxing out at 70.

Example:

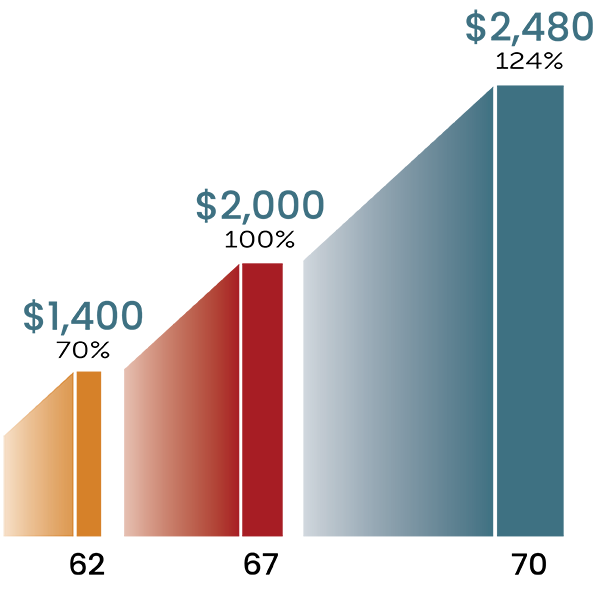

Let’s say your FRA benefit is $2,000/month at age 67:

- Claim at 62 → ~$1,400/month

- Claim at 70 → ~$2,480/month

That’s a 77% increase from age 62 to 70. Multiply that by 12 months and 20+ retirement years? We’re talking six figures in added income.

How to Delay Without Going Broke:

If you plan to retire before age 70, consider a bridge strategy — using personal savings, pensions, or retirement accounts to hold you over while your Social Security benefit grows.

Some financial advisors recommend withdrawing from tax-deferred accounts earlier (while in a lower tax bracket) and letting Social Security accrue until 70. This strategy may also reduce Required Minimum Distributions (RMDs) later on.

Step 2: Work Longer and Increase Your Earnings Record

Your Social Security benefit is based on your 35 highest-earning years, adjusted for inflation. The formula averages those years to determine your Primary Insurance Amount (PIA).

If you’ve worked fewer than 35 years? The SSA fills in the blanks with zeroes — which can significantly lower your benefit.

If you had low-income years early in your career or took time off for caregiving, now’s your chance to replace some of those years with higher-income ones.

Example:

Let’s say you worked 30 years and earned $50,000 or more in the last 5 years. Those final years will replace the $0-income placeholders in your 35-year record — and even one year of replacement can add $30–$50/month or more to your benefit.

That’s not just “a little extra.” Over a 20-year retirement, that adds up to $7,200–$12,000 more in lifetime benefits — just for working one more year.

What Counts as Income?

- Wages or salary (subject to Social Security taxes)

- Self-employment income

- Bonuses and commissions

- Even part-time work

Social Security taxes apply to earnings up to a limit ($168,600 in 2024). Earning above that doesn’t increase your benefit, but every dollar below still counts.

Step 3: Use Smart Spousal and Survivor Strategies

Social Security offers benefits for spouses, divorced spouses, and widows/widowers. These can be significant — but often go unused because people don’t know they exist.

Spousal Benefits:

You may be entitled to receive up to 50% of your spouse’s FRA benefit, even if you never worked or earned less. This can apply even if you’re divorced — as long as:

- The marriage lasted 10 years or more

- You’re unmarried

- Your ex is at least 62

You won’t reduce your ex’s benefit by claiming — and they won’t even be notified.

Survivor Benefits:

If your spouse passes away, you may qualify to receive 100% of their benefit — especially important if they delayed and had a larger check.

These benefits can start as early as age 60 (or 50 if disabled), though claiming early reduces the amount.

Coordinated Claiming:

Married couples can strategically coordinate claiming times for max value.

Example:

- Lower earner claims at 62 to bring in some income

- Higher earner delays until 70 to maximize their lifetime benefit

- Surviving spouse inherits the higher benefit later

In many cases, this setup delivers more long-term income than if both claim early.

Cost-of-Living Adjustments (COLA): The Hidden Boost

One of the great benefits of Social Security is that it adjusts automatically for inflation every year through the COLA.

- In 2023, recipients got an 8.7% increase — the highest in 40 years.

- In 2024, the COLA is 3.2%.

Delaying benefits means your future higher check gets the COLA boost too. A $2,480 check at 70 could become $2,560+ within a year — and continue rising with inflation.

Avoid These Common Mistakes

Many Americans leave thousands of dollars on the table by making common Social Security mistakes:

- Claiming at 62 without understanding the consequences

- You lock in a permanently lower benefit for life.

- Failing to check your earnings record

- Errors in your SSA earnings history can shortchange your benefit.

- Check your My Social Security Account regularly.

- Not understanding how taxes affect benefits

- Up to 85% of your Social Security may be taxable depending on your income.

- Avoid stacking Social Security on top of large IRA withdrawals or capital gains.

- Assuming SSA will advise you

- The SSA doesn’t provide financial advice — only facts. It’s up to you to ask questions or consult a financial planner.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Payment Schedule 2026 – Why Millions Will See New Dates and Larger Checks

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026