2027 Social Security COLA: The 2027 Social Security COLA forecast has started rolling in — and for millions of Americans counting on monthly benefits, the early signals may come as a surprise. After several years of inflation-fueled increases, analysts now predict a smaller-than-expected Cost-of-Living Adjustment (COLA) next year. While the projected bump will still mean more money in your pocket, it may not be enough to keep up with rising costs in healthcare, rent, food, and everyday living expenses. Whether you’re already receiving Social Security, planning to retire, or helping someone navigate benefit changes, understanding how COLA works—and how to plan around it—is more important than ever.

Table of Contents

2027 Social Security COLA

The early outlook for the 2027 Social Security COLA is clear: a smaller raise is expected, likely around 2.5%. That’s still an increase—but with Medicare premiums rising and inflation lingering in some sectors, the real-world impact may be modest at best. This underscores a critical point for retirees and those approaching retirement: Social Security alone may not be enough. Understanding the system, planning around COLA forecasts, and adjusting your broader financial strategy will go a long way in protecting your financial health.

| Item | Details |

|---|---|

| Forecasted 2027 COLA | Estimated between 2.3%–2.6%, with the most common prediction around 2.5%, slightly down from 2026’s 2.8% increase. |

| Calculation Method | Based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI‑W) from Q3 (July–September 2026). |

| Official Announcement | The Social Security Administration (SSA) will release the final number in October 2026. |

| Impact on Benefits | A 2.5% COLA would add ~$52/month to the average $2,071 benefit, bringing it to around $2,123/month. |

| Medicare Premium Effects | Rising Part B premiums (estimated to exceed $202 in 2026) may offset some or all of the increase for many recipients. |

| SSA’s Official Resource | Visit the Social Security Administration: https://www.ssa.gov/cola/ |

What Is the Social Security COLA? A Quick Breakdown

Let’s start with the basics: COLA stands for Cost-of-Living Adjustment. It’s a mechanism the Social Security Administration (SSA) uses to ensure that monthly benefits keep pace with inflation. COLA was first implemented in the 1970s when rising prices started significantly eroding the purchasing power of fixed retirement benefits.

Instead of adjusting the benefit amounts manually each year, the SSA now follows a formula based on CPI-W data — an index maintained by the U.S. Bureau of Labor Statistics that tracks prices for goods and services like food, housing, transportation, and medical care.

If inflation goes up, so does COLA. But if inflation slows, COLA shrinks, even though prices may still feel high for retirees. It’s designed to mirror economic conditions, not to provide a financial cushion.

What Makes 2027’s Forecast Lower?

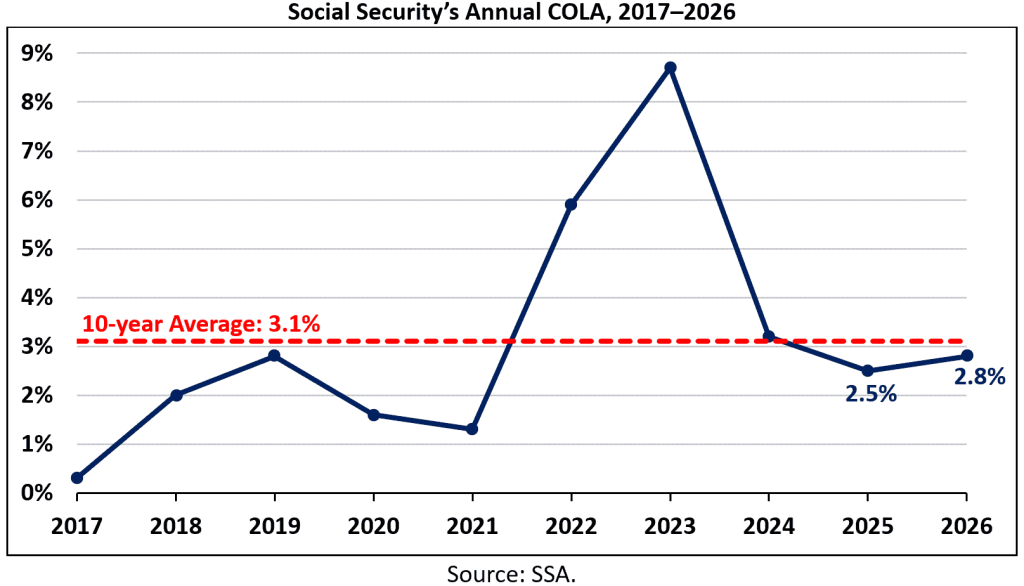

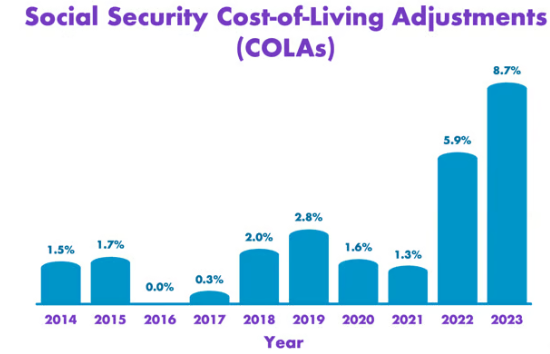

Over the past few years, COLAs have been unusually high:

- In 2022, the COLA hit a whopping 5.9%

- In 2023, it peaked at 8.7%, the highest in over 40 years

- In 2024, it dropped to 3.2%

- 2026 saw a 2.8% adjustment

- Now, 2027 is predicted to be 2.5%

This gradual cooling is largely due to slowing inflation. Although prices are still climbing, they’re doing so at a slower pace. That’s partly due to the Federal Reserve’s policy of interest rate adjustments, which aims to curb inflation without triggering a recession.

When the economy stabilizes and inflation slows, so does COLA. That’s not necessarily bad news — it means we’re not seeing runaway prices — but it does mean that benefit increases won’t stretch as far as they did during high-inflation periods.

2027 Social Security COLA: The Problem with Average Increases

Now here’s where it gets personal. Even if inflation slows, that doesn’t mean your expenses are slowing. In fact, many seniors and retirees are facing higher bills for food, rent, long-term care, and medication—even as the CPI-W flattens.

Why? Because CPI-W doesn’t track senior-specific costs very well. It focuses on wage earners, not retirees, and it underweights crucial categories like healthcare. That creates a mismatch: your actual expenses may rise faster than what COLA reflects.

This is a long-standing critique of the system. Some advocates have pushed for the adoption of a Consumer Price Index for the Elderly (CPI-E), which better reflects the real costs retirees face. But for now, CPI-W remains the official standard.

How the SSA Calculates COLA: A Step-by-Step Guide

To determine the COLA for any given year, the SSA uses the following formula:

- Collect CPI-W Data:

SSA gathers the average CPI-W index values for July, August, and September of the current year. - Compare Year-Over-Year Averages:

This average is compared to the same quarter from the previous year. If the index rose, benefits go up. - Calculate the Difference:

The percent difference becomes the COLA for the next year, rounded to the nearest tenth of a percent. - Announce the Adjustment:

The official announcement typically happens in early to mid-October. - Apply to January Payments:

The new COLA takes effect starting with the December benefit, which is paid in January.

This process is automatic. You don’t need to apply or fill out any forms. If you’re eligible, the COLA will be automatically added to your monthly check.

How Much Will a 2.5% COLA Add to Your Check?

Let’s look at a few examples of how this might play out for different beneficiaries:

- Average Retired Worker:

Current monthly benefit = $2,071

2.5% increase = ~$51.78

New monthly benefit = ~$2,123 - Retired Couple (Both Receiving Benefits):

Combined monthly benefit = $3,550

2.5% increase = ~$88.75

New combined benefit = ~$3,639 - SSI Individual:

Monthly benefit = $943

2.5% increase = ~$23.58

New benefit = ~$966.58

Keep in mind these increases are before any deductions for Medicare premiums, taxes, or withholdings.

Watch Out for Medicare Premiums

Here’s the kicker: Medicare premiums can eat up most or all of your COLA increase. Medicare Part B premiums are typically deducted directly from your Social Security check. In recent years, these premiums have risen steadily.

For instance:

- In 2023: $164.90/month

- In 2024: $174.70/month

- In 2025: $185.60/month

- In 2026: $202.90/month (projected)

So, even if you get a $50 raise from COLA, a $20 jump in Medicare premiums means you only see $30 of that increase in your pocket.

This is why many retirees report that their checks feel “about the same” even after a COLA adjustment — because rising healthcare costs eat into the gains.

Other Social Security Updates You Should Know

The COLA isn’t the only thing changing. Several other important Social Security rules and numbers are also updated each year:

1. Maximum Taxable Earnings

The amount of income subject to Social Security payroll taxes often rises annually. For those still working, this means a bit more money may be withheld from your paycheck.

2. Retirement Earnings Test Exempt Amounts

If you’re under full retirement age and still working while receiving Social Security, there’s a limit to how much you can earn before benefits are withheld. These limits are adjusted annually.

3. Work Credits

To qualify for benefits, you must earn a certain number of “credits” by working and paying into Social Security. The amount of earnings required per credit is updated yearly as well.

What Social Security Means for You: Planning Ahead

Even though a smaller COLA might feel like a letdown, the key is to plan around it, not panic about it. Here are some practical tips:

- Review your monthly budget to see how much wiggle room you have.

- Track your Medicare premiums—know how much will be deducted and what the net result of your COLA will be.

- Consider working part-time or freelancing if you’re below full retirement age and can still earn without penalty.

- Talk to a financial advisor about how COLA projections might affect your long-term income strategy.

- Plan for long-term care costs, which continue to rise faster than the rate of general inflation.

Social Security Changes 2026 – COLA Raises, Medicare Costs, and New Average Payments

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

First Social Security Stimulus Payment 2026 with COLA Adjustment: What Retirees Should Expect