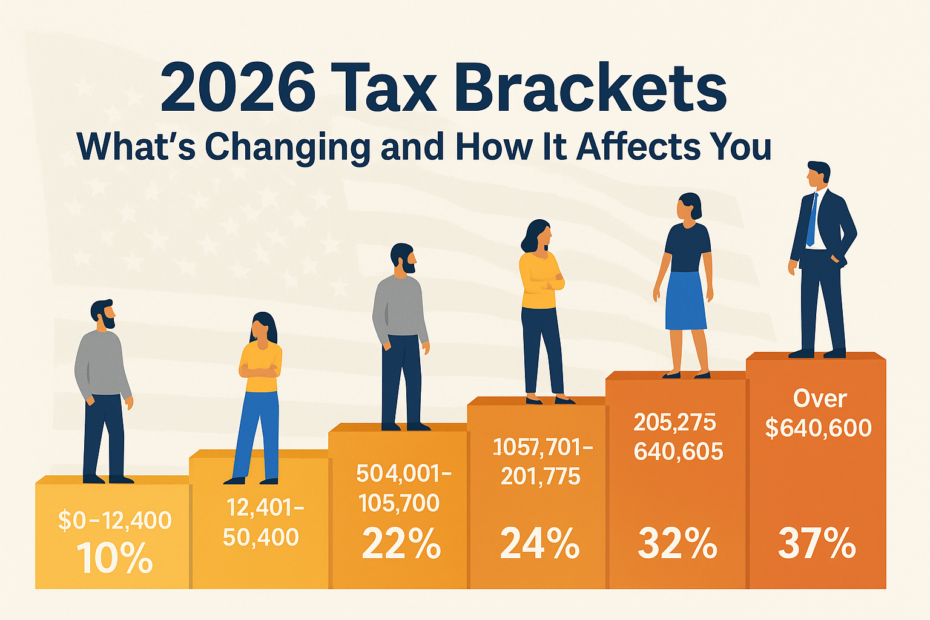

2026 Tax Refund Expectations and Updates: 2026 tax refund expectations are shaping up to be a financial bright spot for many Americans. Thanks to mid-year tax law changes, delayed IRS withholding adjustments, and a series of new deductions and credits, millions of taxpayers are expected to see significantly larger refunds when they file their 2025 tax returns in early 2026. In this guide, we’ll break down exactly what’s going on, why it matters, and how you can plan ahead to get the most out of your refund. Whether you’re a parent juggling expenses, a gig worker, or a seasoned CPA advising clients, this article offers clear, expert-driven advice — all explained in everyday English.

Table of Contents

2026 Tax Refund Expectations and Updates

2026 tax refund expectations are high — and for good reason. With the One Big Beautiful Bill Act lowering tax liabilities, and IRS withholding not catching up until late in the year, millions of Americans have overpaid and will get that money back in 2026. This once-in-a-decade convergence of tax law change and withholding lag creates a unique opportunity — but also demands preparation. Don’t leave money on the table. Use the tools available, stay organized, and consider getting expert advice if your situation is complex. Plan now. File early. Maximize your refund.

| Topic | Data / Insight | Why It Matters |

|---|---|---|

| Average Refund Increase | ~$1,000 to $2,000 more than usual | Driven by over-withholding and new credits |

| Total Refund Volume | Projected $120–$150 billion in 2026 | May be the largest in U.S. history |

| Key Tax Law | One Big Beautiful Bill Act (July 2025) | Lowered rates, expanded deductions, credits |

| Delayed IRS Withholding Update | Employers used outdated tax rates for most of 2025 | Led to excess withholding for millions |

| Expanded Tax Relief Areas | Tips, overtime, senior care, child care | New write-offs cut tax owed or raise refunds |

What’s Fueling the 2026 Tax Refund Expectations and Updates Surge?

Let’s get to the heart of it. The buzz around bigger 2026 tax refunds comes down to three things:

1. The One Big Beautiful Bill Act (OBBBA)

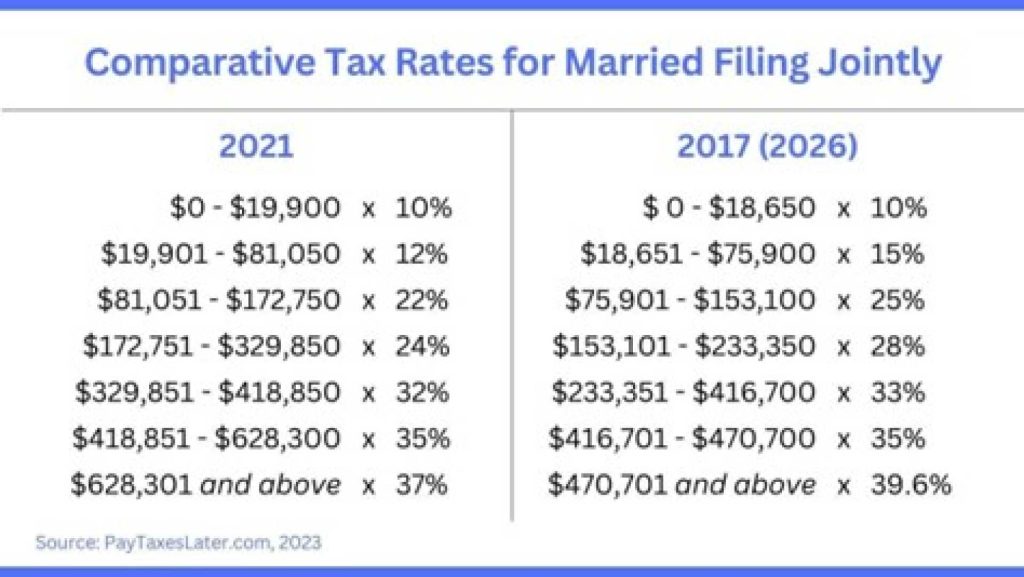

Passed in July 2025, the One Big Beautiful Bill Act was a comprehensive economic and tax reform bill. It included sweeping tax relief for middle-income families, small business owners, seniors, and hourly workers. Crucially, it made its changes retroactive to January 1, 2025 — meaning all income you earned that year is subject to the new, more favorable rules.

However, because it passed mid-year, most employers continued using old IRS withholding tables until late 2025. That led to overwithholding — and now, many taxpayers are owed money back.

OBBBA included:

- Permanent extension of Trump-era tax cuts

- Increase in standard deductions across all filing statuses

- Expanded child and dependent tax credits

- New deductions for tip income, overtime, and caregiving

- Boosts to the Earned Income Tax Credit (EITC)

2. IRS Withholding Delay = Overpayment

Tax withholding is the amount your employer takes out of each paycheck for federal taxes. It’s based on IRS-provided tables and forms (like the W-4). But in 2025, because the OBBBA passed after the year started, withholding continued as if the older, higher tax rules still applied.

So if you earned $60,000 in 2025, the government may have withheld taxes as if your standard deduction was $13,850 — when it was actually $15,000 under the new law. That’s money that will come back to you in 2026 as a refund.

3. Refundable Credits Add to the Boost

Refundable tax credits — like the Child Tax Credit and Earned Income Credit — can increase your refund beyond what you overpaid. OBBBA temporarily increased both of these, meaning:

- You may qualify for more money even if your tax bill was already zero.

- Low- to middle-income families stand to benefit the most.

Refund Examples That Show the Difference

Case 1: The Restaurant Worker

Amanda works in a downtown diner, earning $35,000 a year — half in wages, half in tips. Her employer withheld based on outdated 2024 rules.

Because the OBBBA allows her to deduct a portion of tip income and raises the standard deduction, Amanda’s actual tax liability drops. She overpaid by $1,100 and qualifies for a $2,200 refund — up 40% from 2024.

Case 2: The Married Parents

David and Lisa, married with two children, earned a combined $95,000 in 2025. The expanded Child Tax Credit and higher standard deduction under OBBBA reduces their taxable income by nearly $10,000.

Even though they had similar income to 2024, their 2026 refund grows from $3,200 to $4,400.

Additional Deductions and Credits to Watch

Under the new law, several new or expanded tax breaks could impact your refund:

- Senior Caregiver Deduction: Up to $2,500 for those caring for elderly parents.

- Overtime Premium Deduction: Partial deduction of overtime pay for qualified workers.

- Tip Income Write-Off: Up to $1,200 of qualified tip income now deductible.

- Expanded EITC Eligibility: Income ceilings raised to include more working-class households.

- Student Loan Interest Deduction Cap Increase: From $2,500 to $4,000.

Note: These apply to tax year 2025 (filed in 2026).

When Will You Get Your 2026 Tax Refund Expectations and Updates?

The IRS typically starts accepting returns in late January, with most e-filers receiving refunds in under 21 days.

Factors that can delay your refund include:

- Paper filing instead of e-filing

- Manual review or audit flags

- Refund offsets due to back taxes or child support

- Identity verification delays

The IRS recommends using direct deposit for the fastest refund.

Smart Strategies to Maximize Your 2026 Refund

1. Use the IRS Withholding Estimator

Check whether you’re withholding too much or too little

2. Organize Your Tax Documents Early

Ensure you gather:

- W-2s

- 1099s (for gig work, dividends, or bank interest)

- Receipts for deductions

- Childcare and education expense documentation

3. Don’t Leave Credits on the Table

Many people miss out on credits like:

- Child and Dependent Care Credit

- Saver’s Credit (for retirement contributions)

- Premium Tax Credit (for ACA health insurance)

4. File Electronically and Early

The earlier you file, the faster your refund comes — and the lower the chance of tax fraud or identity theft.

What Tax Professionals Should Know?

For CPAs, EAs, and preparers, this is expected to be one of the busiest seasons in years. Here’s what to prepare for:

- Return Complexity Spike: Multiple new deduction lines, credit eligibility rules, and updated 1040 schedules.

- Client Confusion: Many taxpayers will ask why their refund is so high, or assume it’s a mistake.

- Software Updates: Ensure all tax software incorporates OBBBA changes — especially for deductions like tip income and caregiver support.

- Audit Readiness: Bigger refunds may lead to more scrutiny. Educate clients on substantiating claims.

These States Are Sending Tax Refunds Before 2025 Ends; Is Yours on the List?

States Continuing Tax Rebates and Refunds Before 2025 Ends — Full Overview

Two Energy Tax Credits Expire December 31; Claim Up to $3,200, Check Eligibility