$2,000 Trump Tariff Checks: In recent months, there has been a lot of buzz surrounding the idea of $2,000 tariff checks—often referred to as the Trump Tariff Dividend—that some say could be sent to residents of California and beyond. But what’s the reality behind these checks? Are they actually happening, or is it all just talk? In this article, we’ll break down the details, address the mixed signals, and give you a clear, authoritative look at what’s really going on. Whether you’re a Californian hoping for a payout or just curious about the future of government handouts, we’ve got you covered.

Before diving into the specifics, let’s set the stage. The idea of $2,000 checks coming from tariff revenues—the taxes on imported goods—has been a hot topic. Former President Donald Trump, throughout his tenure and beyond, has proposed giving back some of the funds collected from tariffs, especially those imposed on Chinese goods. The thought process here is that if tariffs are generating a lot of revenue, why not return some of it to the American people, as a sort of rebate or dividend? Sounds simple, right? But, as you’ll see, there are plenty of complexities.

Table of Contents

$2,000 Trump Tariff Checks

The idea of $2,000 tariff checks is an intriguing concept, especially for those in California and other high-cost areas, but it’s important to understand that it’s still in the realm of speculation. While former President Trump’s proposals and ideas have stirred up conversation, there are significant legal and logistical obstacles that must be cleared before any checks are sent out. As of now, the tariff checks remain a potential idea rather than a definitive reality.

| Key Topic | Details |

|---|---|

| Proposed Check Amount | $2,000 per person |

| Source of Funds | Tariff revenues collected from taxes on imports, particularly on goods from China. |

| Legal and Constitutional Concerns | Only Congress has authority over federal spending, including payments like rebates or dividends. |

| Status of Payments | As of now, no $2,000 checks have been approved or issued. |

| Possible Timeline for Implementation | Experts disagree on if these checks can be issued without Congress; potential timelines remain unclear. |

| Confusion and Mixed Signals | Trump’s statements have been inconsistent, raising questions about the feasibility of this proposal. |

What Are Trump Tariff Checks?

Simply put, the Trump Tariff Checks are proposed payments to Americans, funded by the revenue collected from tariffs. In this case, tariffs are the taxes placed on foreign goods entering the U.S. One of the most prominent examples was the trade war with China, where the U.S. imposed taxes on billions of dollars worth of Chinese products. According to Trump and some of his supporters, this money could be used to give American citizens direct financial assistance.

In theory, each eligible person could receive $2,000—which, in this case, is referred to as a tariff dividend. The idea is to take money collected from tariffs and redistribute it to U.S. citizens to help alleviate the financial strain caused by the trade war or other economic pressures.

The Mixed Signals On $2,000 Trump Tariff Checks: What’s Really Happening?

While the concept of $2,000 checks sounds like a nice surprise, there’s been a fair share of confusion about whether or not it’s actually going to happen. Here’s why:

- Inconsistent Statements from Trump

Former President Donald Trump has made a number of statements regarding the tariff checks, but they have not been consistent. In some interviews, Trump has strongly suggested that the checks are coming soon, saying that the government has “so much money coming in” from tariffs that payments would soon be possible. However, in other instances, he has expressed doubts about whether the payments will go through, especially given legal and logistical challenges. - Legal Hurdles and Congressional Approval

One of the biggest questions surrounding the tariff checks is whether the Trump administration has the legal authority to distribute them without Congressional approval. As much as Trump has touted the idea of distributing the funds from tariffs directly to Americans, only Congress has the power to allocate federal funds for such programs. That means that even if tariffs generate large amounts of revenue, they cannot legally be used for checks without Congress passing legislation to authorize it. - The Numbers Don’t Quite Add Up

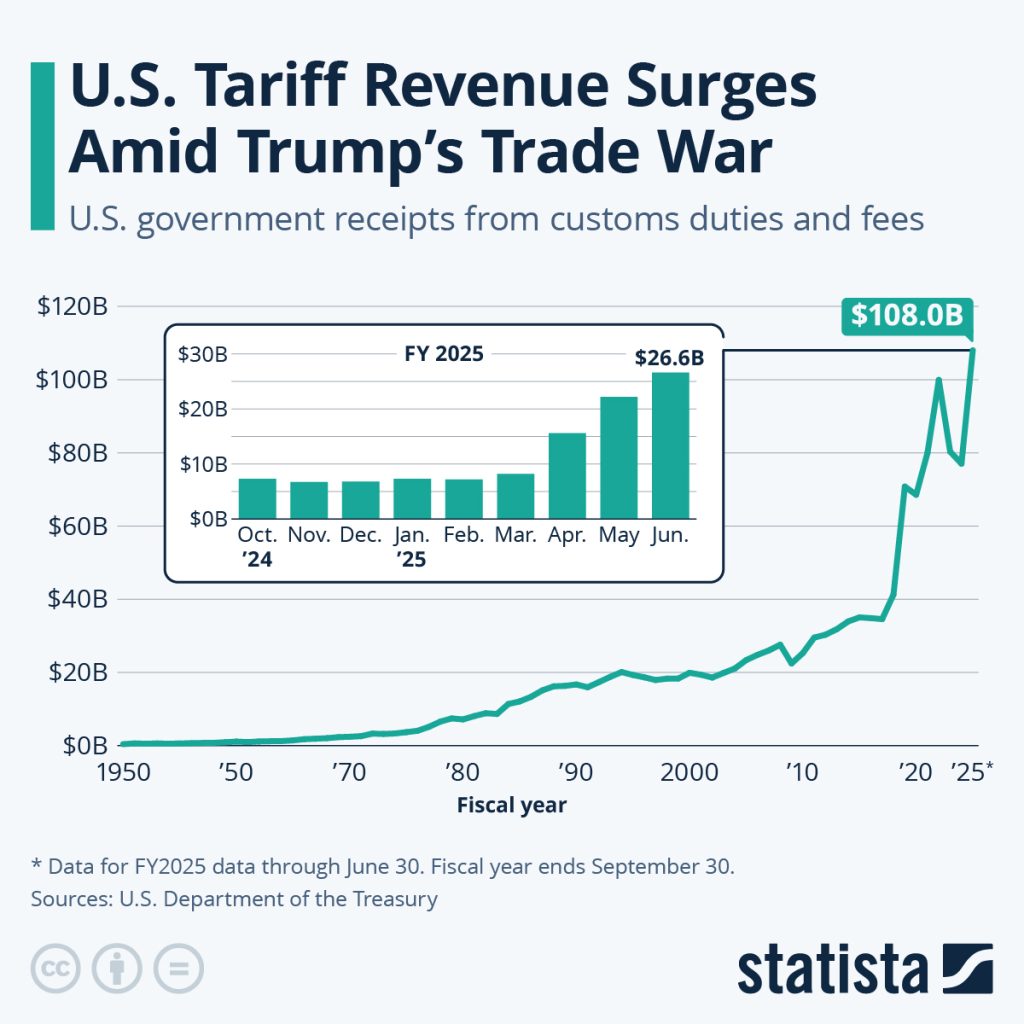

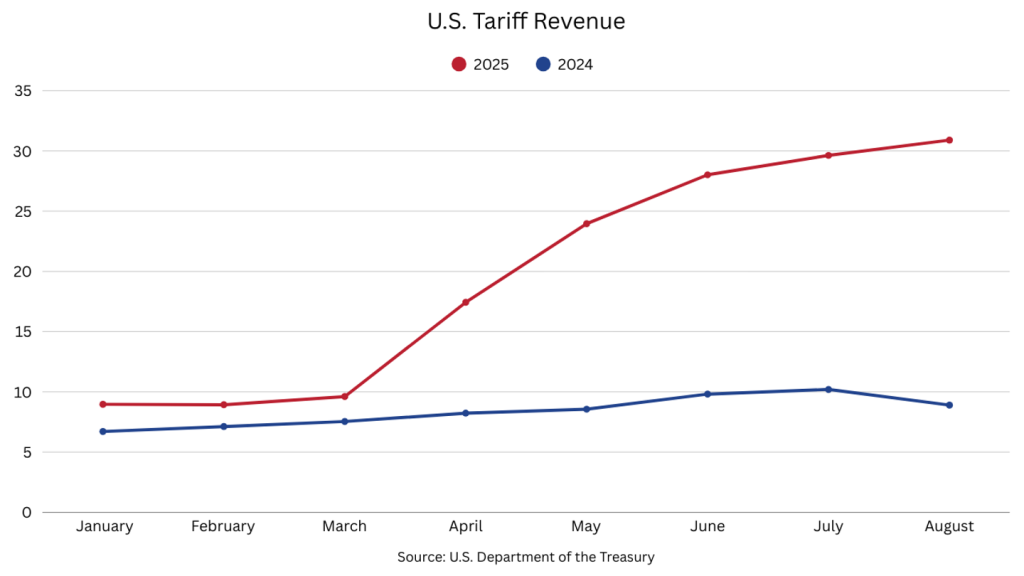

When you dig into the numbers, it becomes clear that there might not be enough tariff revenue to support such a widespread program. For example, in fiscal year 2025, the U.S. collected approximately $216 billion in tariffs, but that revenue has to be divided among many different government needs. It’s unclear if there’s enough money to send $2,000 checks to every American—especially considering other priorities, such as infrastructure, national security, and social programs.

How Tariffs and Tariff Checks Work?

To better understand what’s at play, let’s break down how tariffs and the proposed checks would work:

1. What Are Tariffs?

Tariffs are essentially taxes that a government places on goods that are imported from other countries. These tariffs are typically used to protect domestic industries by making foreign goods more expensive. In the case of the trade war with China, President Trump imposed tariffs on hundreds of billions of dollars’ worth of Chinese goods. The idea was to raise revenue and make American-made products more competitive.

2. How Are Tariffs Collected?

Tariffs are collected at the U.S. border when goods enter the country. Businesses that import goods from abroad pay these taxes, and the funds are deposited into the U.S. Treasury. This money is then used for general government spending, including defense, education, and social programs.

3. Could Tariff Money Be Used for Checks?

The proposal is that the U.S. government could use the revenue generated from tariffs to give back to American citizens through direct payments. This concept of a “tariff dividend” is somewhat similar to ideas used in countries like Alaska, where oil revenues are shared with citizens. However, as mentioned, there are serious legal obstacles, as the U.S. Constitution gives Congress sole authority over how federal money is spent.

Legal and Constitutional Issues

One of the most significant barriers to implementing the $2,000 tariff checks is that only Congress has the power to approve spending of federal funds. Trump’s comments about using tariff revenue for direct payments have raised concerns about the separation of powers. While the executive branch can negotiate tariffs and collect revenues, the distribution of funds to individuals must be authorized through legislation.

If these checks were to be issued, it would likely require Congressional approval to pass a law that allocates funds for the checks. Until that happens, the checks are just a proposed idea and not an actionable program.

The Pros and Cons of Tariff Dividend Checks

Let’s take a moment to consider the potential benefits and drawbacks of this proposal:

Pros:

- Immediate Financial Relief: For individuals struggling with the cost of living, a $2,000 check could offer immediate financial relief, particularly in areas affected by high costs, like California.

- Favorable to Middle-Class Families: This proposal could benefit middle-class families, especially those who may not qualify for other government assistance programs.

- Stimulating the Economy: By putting money directly into the hands of consumers, this could boost spending, which in turn could stimulate the economy.

Cons:

- Legal and Constitutional Issues: As mentioned earlier, there are serious questions about whether the government has the authority to distribute these funds without Congressional approval.

- Limited Funds: Tariff revenues fluctuate, and it’s unclear if there will be enough consistent revenue to fund large-scale checks.

- Potential for Market Distortion: Some argue that depending on tariffs for government revenue could create market distortions or lead to trade imbalances.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts