$2,000 Trump Stimulus Checks: Talk is heating up about the $2,000 Trump stimulus checks for 2026. Americans across all walks of life are asking: “Is this legit? Am I really going to get paid?” The short answer? Not yet. The longer answer is a bit more complex — involving government budgets, tariffs, Congress, constitutional law, and political promises. This article explains the full picture clearly and simply so you can understand what’s actually happening, why it matters, and what to watch for next.

Table of Contents

$2,000 Trump Stimulus Checks

At the end of the day, the $2,000 Trump stimulus checks remain an unapproved political proposal. While the idea is bold — and clearly appealing to many — no money is being sent out yet, and there are major legal, financial, and political hurdles ahead.

| Topic | Details |

|---|---|

| Program Name | $2,000 Tariff Dividend |

| Proposed By | Donald Trump |

| Status | Proposal only — not yet law |

| Funding Mechanism | Revenue from import tariffs |

| Revenue Generated in FY2025 | ~$287 billion |

| Projected Cost | ~$410–$450 billion |

| Congress Approval Needed? | Yes — required by U.S. Constitution |

| Supreme Court Tariff Case Pending? | Yes |

| Expected Payment Date? | No official timeline — speculation only |

| IRS Involvement? | None yet. Official IRS announcements would appear at irs.gov |

What Are the $2,000 Trump Stimulus Checks?

The buzz around $2,000 checks began after former President Donald Trump publicly floated the idea of giving a “tariff dividend” to most Americans. The plan? Take money collected from tariffs (taxes on imported goods) and send it back to Americans in the form of direct payments — $2,000 per eligible citizen.

He first mentioned this idea in late 2025 and reinforced it on Truth Social and in campaign speeches. Many Americans immediately assumed another round of federal stimulus checks was on the way — like the ones distributed during the COVID-19 pandemic.

However, unlike the 2020–2021 stimulus packages, this proposal hasn’t been passed into law, and no federal checks are currently being issued.

What Is a Tariff Dividend?

Think of tariffs as taxes the U.S. government charges on goods brought in from other countries. For example, if a Chinese company sells furniture to the U.S., the government might add a tax (say 25%) to that product, making it more expensive. The U.S. Treasury collects that tax money.

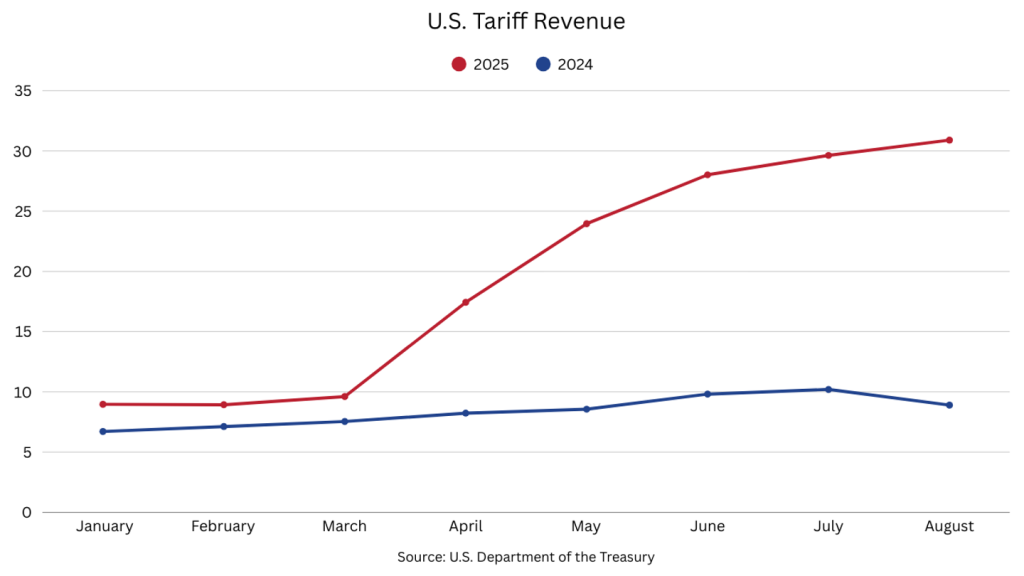

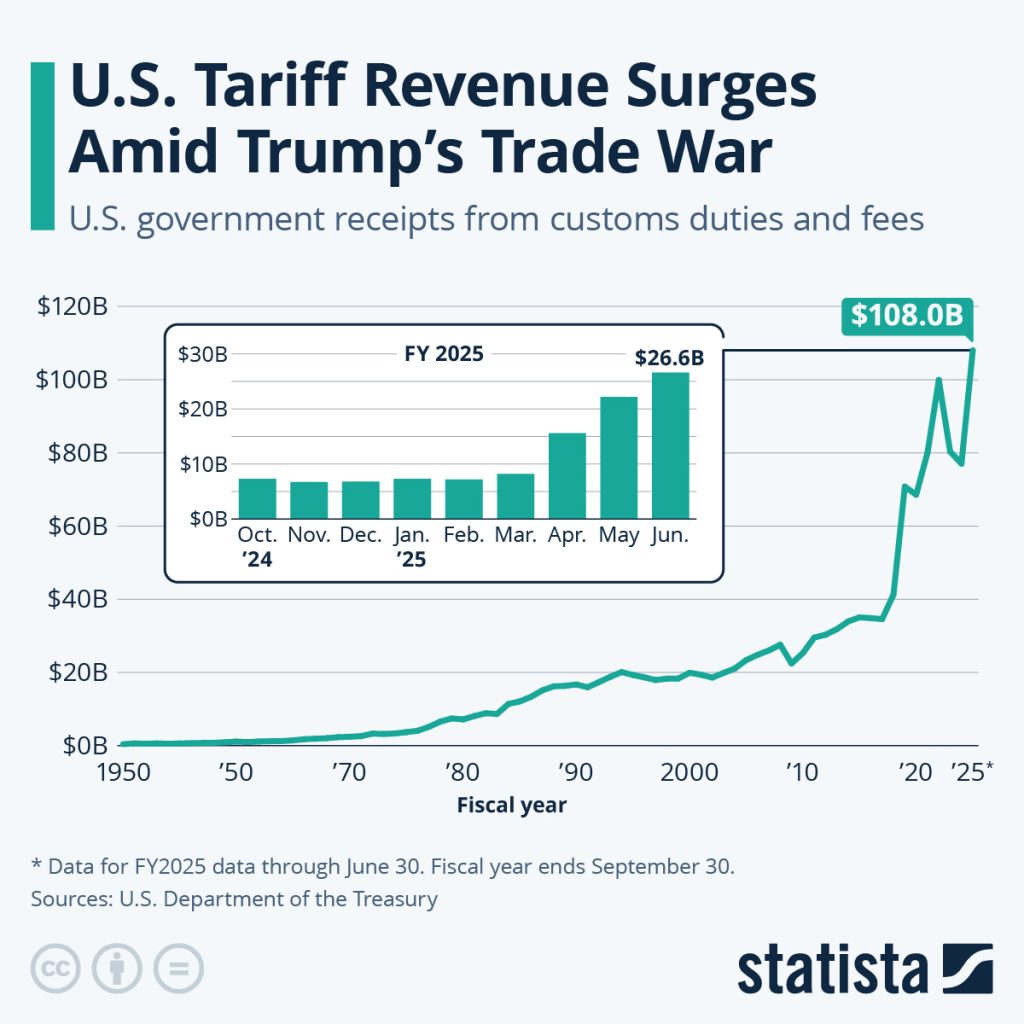

President Trump argues that this money — over $287 billion in 2025 alone — could be redistributed to working Americans, especially those earning under $100,000/year. He calls this a “tariff dividend” and estimates that $2,000 per person could be paid from this pool.

But here’s the tricky part: who actually pays these tariffs? Most economists say it’s not foreign companies, but U.S. consumers and businesses, who end up paying higher prices. So the idea that “China is paying for your stimulus check” isn’t really accurate.

Is This Legal?

This is where things get serious. According to the U.S. Constitution (Article I, Section 9), Congress controls all federal spending — not the President. That means Trump cannot unilaterally hand out checks without lawmakers authorizing the move.

Many legal scholars have stressed that tariff revenue — even if technically collected — cannot be spent without Congressional approval.

Even if the executive branch wanted to repurpose tariff funds, it would likely trigger a constitutional challenge, and may face scrutiny in the courts.

$2,000 Trump Stimulus Checks: Supreme Court Challenges Looming

Adding to the uncertainty is an ongoing Supreme Court case about Trump-era tariff powers. Critics argue the president abused “national security” loopholes to expand tariffs across unrelated sectors — from steel and aluminum to baby formula and kitchen appliances.

If the Court rules that these tariffs were illegal or excessive, it could:

- Invalidate future tariffs,

- Reduce revenue,

- And eliminate the very pool of funds Trump wants to use for the checks.

A ruling is expected later in 2026, which could determine whether the “tariff dividend” ever becomes possible.

How Much Would This Cost?

Here’s where numbers really matter. According to economists at Yale’s Budget Lab, giving $2,000 to Americans earning under $100,000 would cost about $410–$450 billion.

That’s nearly double what tariffs are currently generating. In FY2025, the U.S. collected about $287 billion from tariffs — which still wouldn’t be enough to cover all proposed payments.

That leaves a major budget gap, and no clear plan to make up the difference — unless Congress raises taxes, increases tariffs, or borrows more money.

How This Compares to Past Stimulus Programs

Let’s compare:

| Program | Year | Amount | Funding Source |

|---|---|---|---|

| CARES Act | 2020 | $1,200/adult | Borrowed funds |

| ARP Act | 2021 | $1,400/adult | Borrowed funds |

| Proposed Tariff Dividend | 2026 | $2,000/person | Tariff revenue |

Unlike COVID-era relief programs, which were funded via federal borrowing (increasing the deficit), the tariff dividend is being marketed as self-funded — using money “already collected.”

However, experts warn this is a political framing, and not how budgeting really works.

What Are the Economic Impacts?

According to research by Yale Budget Lab and other think tanks:

- GDP could grow by about 0.2–0.5% temporarily.

- Inflation could tick up slightly, as higher tariffs push prices upward.

- Employment may improve short-term, but long-term effects are unclear.

Ultimately, the proposal may stimulate spending, but at a relatively high fiscal cost — with limited long-term economic payoff.

Public Opinion and Political Context

This isn’t just a policy proposal — it’s also a campaign talking point. As Trump seeks a return to the White House, the promise of $2,000 checks may boost support among working-class and middle-income voters.

Polls show that 66% of Americans support direct payments, especially when funded by taxes on foreign goods. However, support drops below 45% once respondents learn that:

- Tariffs raise consumer prices, and

- The payments might increase the deficit or inflation.

It’s also worth noting that many Republican lawmakers are skeptical of cash handouts, even if Trump supports them.

Who Would Qualify for $2,000 Trump Stimulus Checks?

At this stage, no official eligibility criteria have been finalized, but proposals suggest:

- Income cap around $100,000 for individuals

- Possibly $200,000 for couples

- Could exclude non-taxpayers, high earners, or dependents

- Would likely be based on recent tax returns (2025)

The IRS would likely manage the program — if it ever becomes law — using data from previous tax filings, like it did with pandemic-era checks.

How Would the $2,000 Trump Stimulus Checks Be Distributed?

If the program becomes law, here’s the likely rollout path:

- Congress passes a bill

- IRS creates infrastructure for payment

- Taxpayers receive direct deposit or mailed checks

- Eligibility disputes resolved via appeal process

- Deadline for issuing payments likely within 12 months

But again — as of January 2026, no such legislation has passed.

Watch Out for Scams

This part is crucial. Fake websites and scammers are already sending texts and emails saying “Claim your $2,000 now!”

Let’s be clear: No official application exists. No checks are being mailed. No forms are needed.

- Don’t click shady links.

- Don’t give out your Social Security number.

- Always verify info through irs.gov or major news sources.

If a check program starts, it’ll be all over the news — and the IRS will tell you how to safely claim it.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

$2,000 Stimulus Check 2026: Approval Status and Official IRS Updates

$1,000 Stimulus Payment Confirmed for January 2026 — Check Eligibility and Deposit Dates Now