$2,000 Federal Direct Deposit: Have you heard folks talking about a “$2,000 federal direct deposit” arriving this February? It’s been bouncing around Facebook, Reddit, and even barbershop conversations. Some swear it’s the next stimulus check, while others think it’s part of a hidden government program. Well, grab a cup of coffee — we’re about to sort it all out for you, plain and simple. In this article, you’ll get the full scoop on what this $2,000 talk really means, who may qualify, how it could arrive, and why this figure has folks glued to their bank apps this tax season.

Table of Contents

$2,000 Federal Direct Deposit

So here’s the truth behind the talk: there is no magical $2,000 stimulus heading to everyone in February 2026. What is happening is something far more routine (but still powerful): federal refunds and benefit payments are showing up right on time — and for many, that adds up to more than $2,000. By understanding what you qualify for, filing early, and using direct deposit, you’ll stay ahead of the game and keep your money safe from scams and confusion.

| Topic | Details |

|---|---|

| Is there a new $2,000 payment? | No — there is no authorized or universal $2,000 federal stimulus payment for Feb 2026. |

| What are people receiving? | Tax refunds, Social Security, SSI, veterans’ benefits — often totaling near or above $2,000. |

| IRS refund timeline | Refunds for early filers with direct deposit typically arrive by mid to late February 2026. |

| Who might see big deposits? | Low-to-moderate income workers, parents with dependents, Social Security and VA beneficiaries. |

| Where to check status? | IRS “Where’s My Refund?” Tool |

| Important caution | Beware of scams. The IRS will never call/email for banking info. |

What’s Really Going On with This $2,000 Federal Direct Deposit?

Let’s get real: as of February 2026, there’s no official government program issuing $2,000 direct deposits across the board.

The U.S. Congress hasn’t passed any new stimulus bill like it did during the COVID-19 pandemic. What we’re seeing instead are a combination of normal government payments — tax refunds, Social Security checks, VA benefits — landing in Americans’ bank accounts at the same time, often totaling around $2,000. That’s what’s fueling the buzz.

So, if someone you know got a $2,000 deposit, it likely came from a combo of things: maybe a refund, maybe a benefit, or both.

Why Is Everyone Talking About February?

February is when several financial streams converge:

- Tax season starts flowing: Early filers get their refunds.

- Monthly benefits like SSI and Social Security hit accounts.

- Some veterans’ and disability checks are released.

And when multiple payments hit at once? Boom — a $2,000 deposit doesn’t seem so far-fetched.

This isn’t a one-size-fits-all payout. It’s different for everyone depending on your income, benefits, tax credits, and filing status.

What Federal Payments Could Equal $2,000 Federal Direct Deposit?

Let’s break down the legit government payments that can show up this time of year and potentially add up to $2,000 or more.

1. Tax Refunds (Most Common Source)

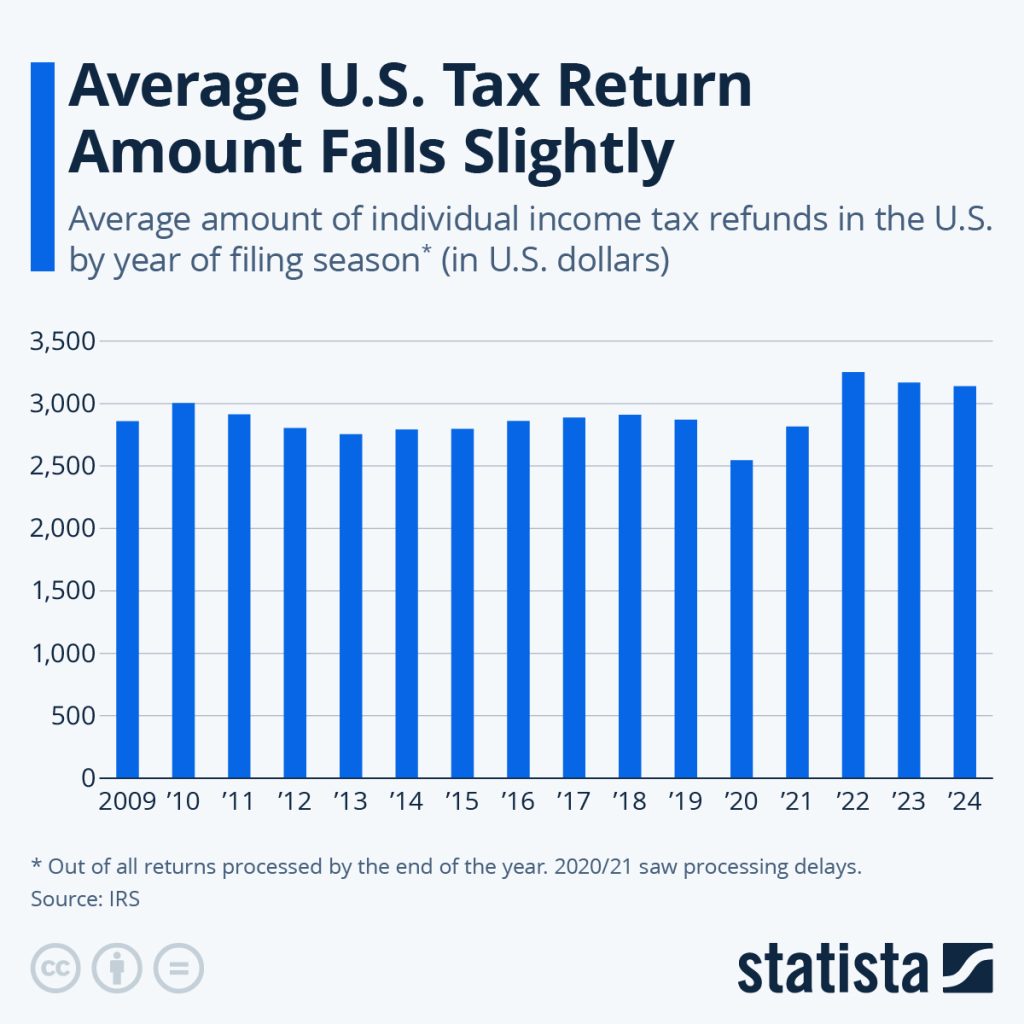

Tax season is officially in motion. If you’re one of the early birds who filed in January, you might already be in line for a refund.

According to the IRS Filing Season Statistics, the average tax refund in 2023 was $2,753 — and it’s trending similar this year.

Who qualifies for higher refunds?

- Families with kids (thanks to the Child Tax Credit)

- Low-income workers (Earned Income Tax Credit, or EITC)

- Those who had too much tax withheld

Here’s an example:

A single mom with two kids earning under $40,000 might receive over $3,000 in refunds when including the EITC and CTC.

When are refunds paid?

If you e-filed in late January and chose direct deposit:

- Expect refunds between February 15 and 28, depending on how early you filed and whether you claimed certain credits.

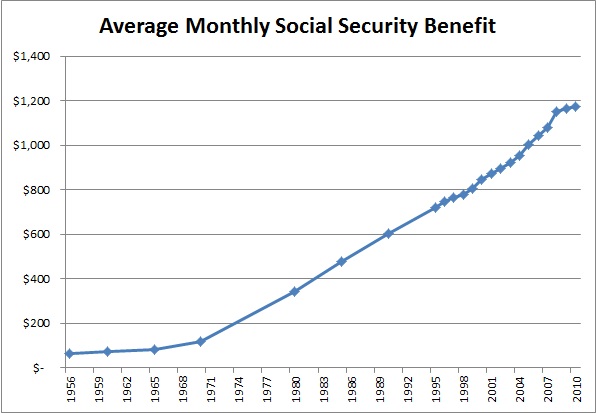

2. Social Security & SSI Payments

Monthly Social Security checks go out on a set schedule — based on your birthday or benefit type.

Here are the average payments for 2026:

- Retirement benefits: $1,907/month (after 2025 COLA increases)

- SSI for individuals: up to $943/month

- SSI for couples: up to $1,415/month

If someone gets Social Security + SSI, or benefits for multiple family members, it’s easy to hit $2,000+ per month.

3. Veterans’ Benefits (VA)

VA disability, pension, and survivor benefits also drop monthly.

Payment sizes vary:

- 10% disability: ~$171.23/month

- 100% disability (single veteran): ~$3,737/month

Many vets or surviving spouses may also qualify for additional Aid and Attendance or Dependency and Indemnity Compensation (DIC).

So yes — those deposits can land right around $2,000 as well.

4. Railroad Retirement and Other Federal Payouts

Less common, but some federal and military retirees still receive pension-style checks each month. Again, these aren’t part of some new program — just the normal benefit flow.

Examples of Combined Federal Deposits

Let’s look at a few real-life examples of how a $2,000 deposit might show up:

| Profile | Possible Deposit Breakdown | Total |

|---|---|---|

| Single father with 1 child | $1,700 (tax refund + EITC), $350 (monthly VA) | $2,050 |

| Retired couple (SSI + SS) | $1,415 (SSI), $950 (SS) | $2,365 |

| Low-income worker, no kids | $1,100 refund, $150 SNAP (on EBT card, not direct deposit) | $1,250 (cash) |

| Veteran + SSDI | $1,950 combined benefits | $1,950 |

What You Won’t See (Yet)?

Let’s shut down a few rumors making rounds on TikTok and WhatsApp groups:

- No “$2,000 Tariff Rebate” is in effect

- No “Trump Bucks” or “stimulus reactivation” has passed Congress

- No universal “Relief Check” for every adult American has been approved

While there are always proposals floating in Congress — and some candidates campaign on direct cash relief — as of now, there is no law enacting a $2,000 federal payment in February 2026.

How to Check and Maximize Your Benefits?

Wondering if you qualify for any of these payouts or refunds?

Here’s a quick checklist:

File your taxes ASAP

- Use IRS Free File if your income is below $73,000.

Claim all credits

- EITC, CTC, Recovery Rebate Credits, Education Credits.

Use direct deposit

- It’s safer, faster, and reduces IRS processing delays.

IRS February 2026 — Who May Receive a $2,000 Direct Deposit and Possible Payment Dates

Social Security February 2026 Payment Schedule – Exact Dates to Check for Your Deposit

Federal $2000 Relief Payment: Step-by-Step Timeline From Eligibility to Deposit