$200 Social Security Increase: Social Security is a crucial financial safety net for millions of Americans, ensuring that retirees, disabled individuals, and survivors can maintain a basic level of income. As we look to 2026, many people are wondering about the Social Security increase and whether a $200 boost will come into play. But what’s the truth behind the headlines? Is there a guaranteed $200 increase coming your way? Let’s dig into the facts and take a closer look at what the future holds for Social Security recipients in 2026.

Table of Contents

$200 Social Security Increase

In 2026, Social Security recipients can expect a 2.8% increase in benefits, which will provide much-needed relief against inflation. While the $200 proposal is exciting, it is still in the proposal stage and has not yet been enacted into law. Regardless of the $200 proposal’s fate, the COLA increase is guaranteed and will help beneficiaries keep up with rising living costs. It’s important to stay informed and prepare for changes to your Social Security payments. If you rely on these benefits, any increase, no matter how small, can make a difference.

| Key Point | Details |

|---|---|

| 2026 Social Security COLA Increase | 2.8% cost-of-living adjustment (COLA) will boost benefits by an average of $56 per month. |

| $200 Proposal | A new Senate proposal could temporarily add $200 per month for six months in 2026. |

| Who is Affected | Retirees, disabled individuals, and survivors could see a change in their monthly benefits. |

| Inflation Impact | COLA is tied to inflation and adjusts to the rise in consumer prices. |

Social Security is more than just a retirement plan—it’s a lifeline for millions of Americans. Whether you’re a senior, disabled, or a survivor of a loved one, these monthly payments can make the difference between financial stability and hardship. In 2026, millions of Americans are waiting to see how their benefits will change. The buzz around a possible $200 Social Security increase has been growing, but what does the data really show? Are you actually going to see a massive bump in your Social Security check, or is this just another headline designed to grab your attention?

The $200 Social Security Increase: What You Can Expect

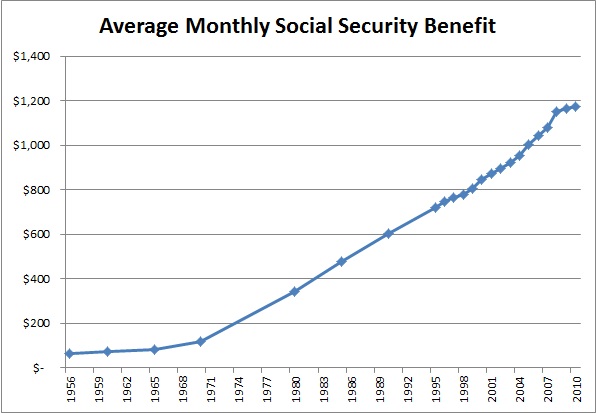

Each year, Social Security benefits are adjusted for inflation through the Cost-of-Living Adjustment (COLA). This ensures that recipients don’t lose buying power as the cost of goods and services increases. For 2026, Social Security recipients will see a 2.8% increase in their monthly payments.

How COLA is Determined?

The Social Security Administration (SSA) calculates the COLA by measuring changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the prices of goods and services like food, gas, and healthcare, which directly impact the daily lives of Social Security beneficiaries.

In 2026, the 2.8% COLA increase is being implemented due to inflation, meaning that it’s a response to rising consumer prices in recent years. While this increase may not seem huge at first glance, it’s designed to help prevent benefits from losing value over time.

How Much Will the 2.8% Increase Add to Your Monthly Benefit?

For the typical retiree who receives an average monthly Social Security benefit of about $1,900, the 2.8% COLA increase would add approximately $56 to their monthly payment. For someone already on a fixed income, an extra $56 can make a big difference, whether it’s used for groceries, utilities, or medical bills.

Here’s a breakdown of how the COLA increase will look for different types of beneficiaries:

- Retirees: Average monthly benefit of $1,900. With the 2.8% increase, they’ll get an extra $56 per month.

- Disabled individuals: Average monthly benefit of $1,200. After the COLA increase, they’ll see an extra $33.60 per month.

- Survivors: Average monthly benefit of $1,400. They’ll receive an extra $39.20 per month.

These amounts vary based on individual circumstances and the amount of benefits a person is already receiving. However, the key takeaway is that the 2.8% increase helps offset the effects of inflation, even if it doesn’t completely solve the challenges posed by rising costs.

The $200 Social Security Increase Proposal: Is It Real?

Now, let’s dive into the $200 increase that many have been talking about. You’ve probably heard that a new Senate proposal could add $200 per month to Social Security payments for six months in 2026. So, will you be seeing that extra $200 in your monthly check? Let’s take a closer look.

The Proposal Details

The proposed $200 per month would be a temporary, inflation relief measure designed to help Americans cope with rising costs. This proposal is currently in the Senate, and while it has been widely discussed, it has not yet passed into law.

If it does get passed, the $200 boost would be in addition to the 2.8% COLA increase. So, for those who qualify, they could see a $200 increase for six months. However, it’s important to note that this increase is temporary. After six months, the extra $200 would stop, and only the COLA increase would remain in place.

Who Would Benefit from the $200 Social Security Increase?

If this bill is passed, every Social Security recipient could potentially see the additional $200 per month for six months. This could be a real help to those struggling with rising inflation, especially retirees, disabled individuals, and survivors who live on fixed incomes. However, this additional money is not guaranteed, and only time will tell if the proposal will pass.

It’s important to understand that even if the $200 proposal is approved, it will only provide temporary relief. After the six-month period, the standard 2.8% COLA increase would continue to be the primary method for adjusting Social Security benefits in response to inflation.

What Happens if the Bill Fails?

If the $200 proposal doesn’t pass, there will still be the 2.8% COLA increase. While this might not be as large as the proposed $200 bump, it is still a significant help for Social Security recipients. The COLA increase is tied to inflation, which means it’s automatically adjusted every year to help recipients keep up with rising costs.

The 2.8% COLA is based on inflation data, so it’s a reliable source of increase, even if it’s not as large as some may have hoped. Even without the extra $200, the COLA increase will still provide necessary financial relief for those who rely on Social Security payments.

How Will Social Security Payments Change in 2026?

To give you a clearer picture of what to expect in 2026, here’s a deeper look at how the COLA increase will impact Social Security recipients.

2026 Social Security Payments by Category:

| Type of Beneficiary | Average Monthly Benefit | COLA Increase (2.8%) | New Monthly Payment |

|---|---|---|---|

| Retirees | $1,900 | $56 | $1,956 |

| Disabled Individuals | $1,200 | $33.60 | $1,233.60 |

| Survivors | $1,400 | $39.20 | $1,439.20 |

These figures show how the 2.8% COLA increase will be applied across different groups, helping to maintain the purchasing power of Social Security benefits in 2026. The bump may seem small, but it can make a noticeable difference, especially as prices for essentials like food, healthcare, and energy continue to rise.

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

Social Security Changes 2026 – What Beneficiaries Need to Know Before Payments Update

Social Security Maximum Benefit 2026 – Who Can Receive the $5,251 Monthly Check