$1,776 Warrior Dividend: The $1,776 Warrior Dividend is more than just a one-time cash payment — it’s a symbol of appreciation from the United States to its active-duty service members. Announced in December 2025 and confirmed in January 2026 as completely tax-free, this benefit has brought financial relief, morale boosts, and national recognition to over 1.45 million U.S. military personnel. If you’re wondering what it is, who qualified, and how it affects taxes, you’re in the right place. This article will break everything down in clear terms, mixing expert advice, historical context, and practical tips, whether you’re in uniform, working in finance, or simply trying to make sense of it all.

Table of Contents

$1,776 Warrior Dividend

The $1,776 Warrior Dividend is one of the rare government programs that checks every box: timely, meaningful, tax-free, and efficient. It recognized the service of active-duty and qualifying reserve members with both symbolism and substance. Thanks to the IRS confirmation, there’s no gray area — the money stays in your pocket. As America looked back on 250 years of history, it made sure to show gratitude to the people defending its future.

| Topic | Details |

|---|---|

| Payment Name | $1,776 Warrior Dividend |

| Type | One‑time bonus for U.S. military personnel |

| Amount | $1,776 |

| IRS Tax Status | Non-taxable under IRC Section 134 |

| Eligibility Date | Must be active-duty/reserve as of November 30, 2025 |

| Who Qualifies | Active military O-6 and below, reservists with 31+ days of active orders |

| Who’s Not Eligible | Retirees, veterans not in service, civilians |

| Number of Recipients | ~1.45 million |

| Official IRS Guidance | irs.gov |

What Is the $1,776 Warrior Dividend?

Introduced in late 2025, the $1,776 Warrior Dividend was a federally authorized one-time bonus for qualifying military members. It came just ahead of the 250th anniversary of the United States’ founding and was designed to celebrate American independence while offering real, tangible support to the military community.

The dividend was not just symbolic. It was a real check, deposited into service members’ accounts via Defense Finance and Accounting Service (DFAS) channels like MyPay. For many families, it was a holiday miracle — a much-needed boost amid rising costs and inflation.

Why $1,776? Historical and Cultural Significance

The number 1776 represents a turning point in American history — the signing of the Declaration of Independence, the official birth of the United States. It’s also the year when the first seeds of the U.S. military were planted, starting with the Continental Army.

Fast-forward 250 years, and the government chose that same number — $1,776 — to send a message: We haven’t forgotten. The Warrior Dividend ties the legacy of service from 1776 to today’s troops.

This isn’t the first time the military has used historical symbolism to connect generations of warriors. Commemorative medals, anniversary coins, and unit patches often carry dates, Latin mottos, or founding symbols. But this time, the message came with a dollar amount — a direct deposit of gratitude.

Who Authorized $1,776 Warrior Dividend?

The dividend was part of a broader military spending package passed in the “One, Big, Beautiful Bill”, a colloquial nickname given by media and government spokespeople for a comprehensive military appropriations law passed in 2025.

The plan was announced publicly by former President Donald J. Trump in mid-December 2025 during a televised holiday address, framing the dividend as a patriotic “Christmas gift” for service members and a gesture of national pride. According to press briefings and budget records, over $2.9 billion was allocated to cover the payments.

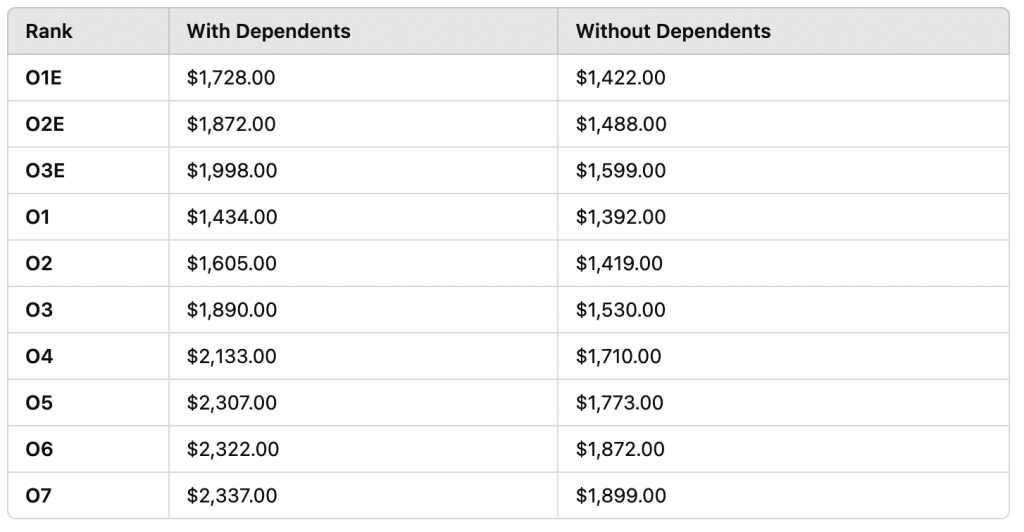

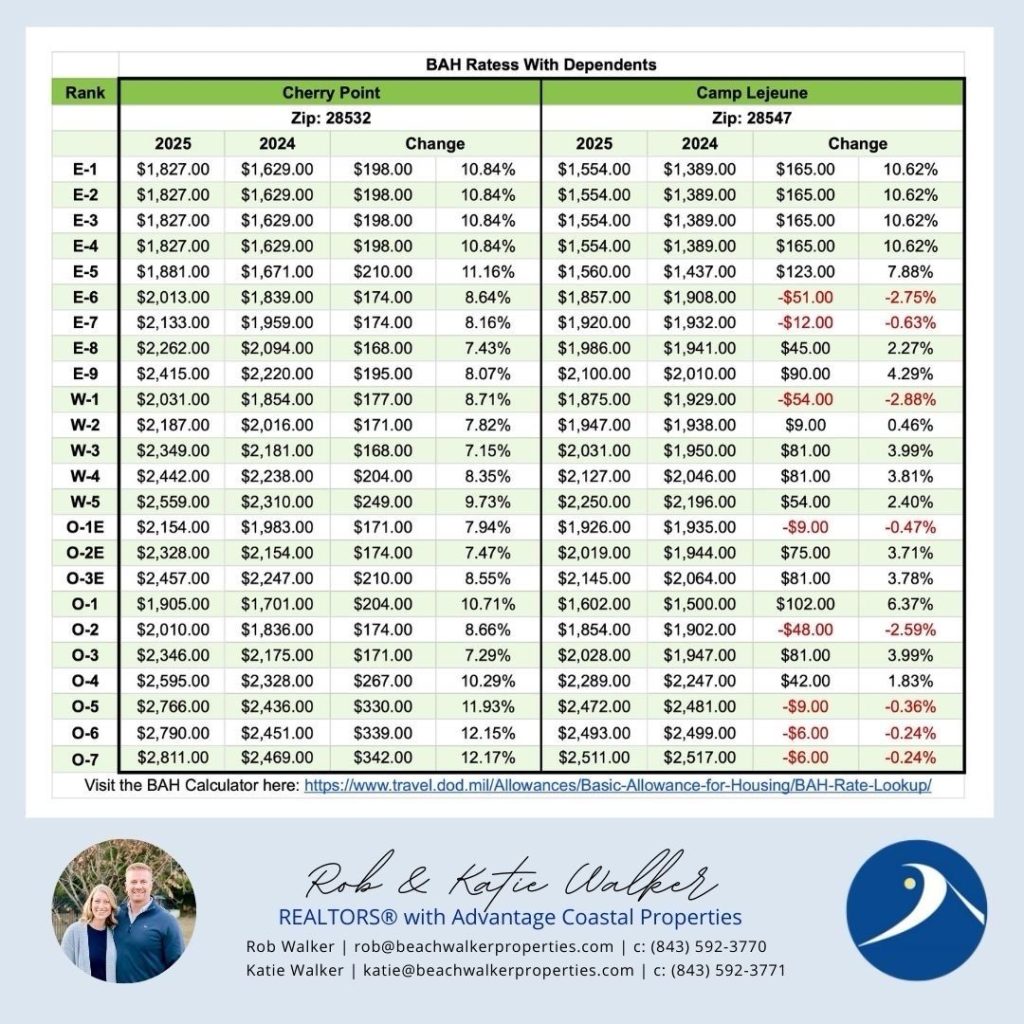

Who Was Eligible for $1,776 Warrior Dividend?

Let’s get into the nitty-gritty of the eligibility requirements. To receive the dividend, individuals had to meet the following:

Eligible

- Active-duty military members (Army, Navy, Marine Corps, Air Force, Space Force, and Coast Guard) in pay grades O-6 and below

- Must have been serving as of November 30, 2025

- Reserve and National Guard members must have had 31 or more consecutive days of active-duty orders on or before that same date

Not Eligible

- Military retirees no longer serving as of November 30, 2025

- Veterans not on qualifying reserve duty

- Civilian employees, even those working with the military

- Contractors and federal workers outside of DoD active duty

No action was required to receive the payment. If you were eligible, it was automatically deposited — no application, no approval process, no paperwork. That made it easy and inclusive.

The IRS Ruling: Tax-Free and Clear

A few weeks after the dividend was issued, the big question emerged:

“Do I have to pay taxes on this?”

The IRS quickly addressed the confusion. In an official statement dated January 16, 2026, the agency confirmed that the Warrior Dividend is:

- Classified as a qualified military benefit

- Not considered taxable income

- Not reportable on IRS Form 1040

- Exempt under IRC Section 134

That’s a big deal. It means service members get to keep every single dollar of that $1,776, without worrying about taxes in April. This kind of clarity is rare — and welcome.

Impact on Real Families: More Than Just Money

Let’s put this into perspective. For a junior enlisted service member (say, an E-3), monthly base pay might hover around $2,200–$2,400. A $1,776 bonus is like getting three-quarters of a month’s salary, unexpectedly.

That’s huge for young families living paycheck to paycheck. Here are some real (anonymized) examples:

“I was about to take out a loan to cover our Christmas trip to see family. That dividend changed everything. We flew home and bought gifts without putting a dime on a credit card.”

“I used the money to fix our car’s alternator and register for online college classes. That one payment got me closer to a degree and back on the road.”

For others, it covered utility bills, rent, or overdue credit card payments. The emotional and financial boost couldn’t have come at a better time.

Military Financial Experts Weigh In

We reached out to Jared Simmons, a former Navy officer and current Certified Financial Planner (CFP®) who works with military families:

“Tax-free payments like this are rare. What’s important is that service members see it not just as free cash, but as an opportunity — to save, to pay off debt, or invest in something meaningful. The tax-free nature makes it even more powerful.”

Jared recommends that service members treat this kind of windfall with intention:

- Use 50% for immediate needs or debt

- Save 25% in an emergency fund

- Spend 25% on something meaningful — family, education, or personal development

Red Flags: Beware of Scams and Misinformation

As with any government-issued payout, scammers quickly began taking advantage of the buzz. The Department of Defense and IRS both issued warnings about:

- Fake websites asking for personal info to “claim” the dividend

- Text messages or calls pretending to be from DFAS

- Social media scams offering to “boost” or “unlock” dividend payments for a fee

Key reminder: No one needs to apply for the Warrior Dividend. If you’re eligible, you’ve already received it. If anyone asks for your SSN, banking info, or CAC card login, report them.

How $1,776 Warrior Dividend Affects Taxes, FAFSA, and Benefits?

Let’s talk ripple effects. Since the dividend is excluded from gross income, it does not affect:

- Your federal income tax bracket

- Earned Income Tax Credit (EITC) eligibility

- Child Tax Credit amounts

- Student loan income-driven repayment plans

- FAFSA applications for dependents in college

In other words, there’s no financial downside — and no surprises.

Suggested Action Plan

For Service Members:

- Log into MyPay and download your LES showing the dividend

- Save documentation for future reference

- Check your state’s tax treatment (most follow federal rules, but verify)

- Talk to your base’s financial readiness counselor if you need guidance

For Tax Professionals:

- Confirm the payment is not included in Form W-2

- Do not report it on Line 1 of Form 1040

- If your client is audited, reference IRS Publication 3 and IRC §134

- Educate clients about military-specific tax rules

$1702 Stimulus Payment 2026: Is It Really Confirmed?

Stimulus Check Update 2026: Is the $2,000 Payment Actually Coming?

$1000 Alaska PFD Payment 2026: Full Schedule, Amount and Who’s Eligible